The Pros and Cons of Conventional and FHA Loans

Pros and Cons of Conventional and FHA Loans in 2025 When planning to buy a home, one of the first…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Pros and Cons of Conventional and FHA Loans in 2025 When planning to buy a home, one of the first…

HUD FHA 203h Mortgage Guidelines for Disaster Victims in 2025: Helping Families Rebuild After Natural Disasters with Zero Down Payment…

The mortgage industry has gone through dramatic shifts over the past few years. From rising interest rates to new loan…

FHA Loan Denied for Low Credit Scores in Ohio: Why It Happens and How to Get Approved If your FHA…

This blog will discuss and cover HUD guidelines on student loans vs other mortgage programs. HUD, the Department of Housing…

If you are thinking about buying a home or refinancing your current mortgage, you may have heard about FHA loans….

Your All-Inclusive Manual to Getting an Illinois Mortgage with Bad Credit Mortgage Options. Do you fear poor credit could dash…

This guide covers the FHA loan guidelines Alabama for homebuyers and homeowners. Due to the lenient FHA loan guidelines Alabama,…

FHA Loans With Low Credit Scores in Nebraska: Your Guide to Homeownership in 2025 Are you concerned your low credit…

In this blog, we will cover and discuss the best bad credit mortgage lenders in Alaska for FHA loans. The…

Buying a home is exciting, but it also comes with new responsibilities. Property taxes, homeowners’ insurance, and mortgage payments can…

In this blog, we will cover and discuss government mortgages for owner-occupant homebuyers. We will go in-depth about what government…

In this article, we will cover and discuss FHA streamline refinance Utah mortgage guidelines. Gustan Cho Associates, Empowered by NEXA…

Refinancing Your California Mortgage Loan in 2025: A Complete Guide If you’re a California homeowner, you’ve probably heard friends or…

This guide covers what are the FHA loan limits for one-to-four unit properties in Illinois. FHA loan limits for one-to-four…

Mortgage Approval with 580 FICO Credit Score in 2025: Your Complete Guide If you’ve been told you can’t get a…

Manual Underwriting With Extenuating Circumstances: 2025 Guide to Mortgage Approval Buying a home can feel impossible when you’ve had tough…

In this blog, we will cover and discuss FHA guidelines on late payments after bankruptcy. Borrowers are often confused with…

Debt-to-Income Ratio Overlays: What Homebuyers Need to Know Your debt-to-income ratio (DTI) matters to lenders when getting a mortgage. But…

In this guide, we will cover getting 15-year vs 30-year FHA loans. We will compare and contrast 15-year vs 30-year…

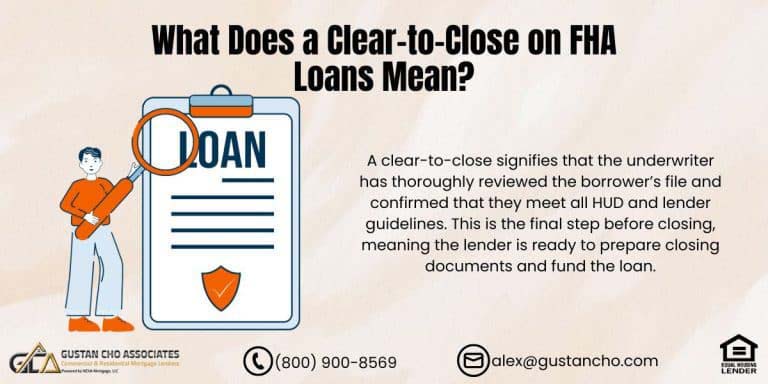

This guide covers what a clear-to-close on FHA loans means. What does a clear-to-close on FHA loans mean for borrowers?…

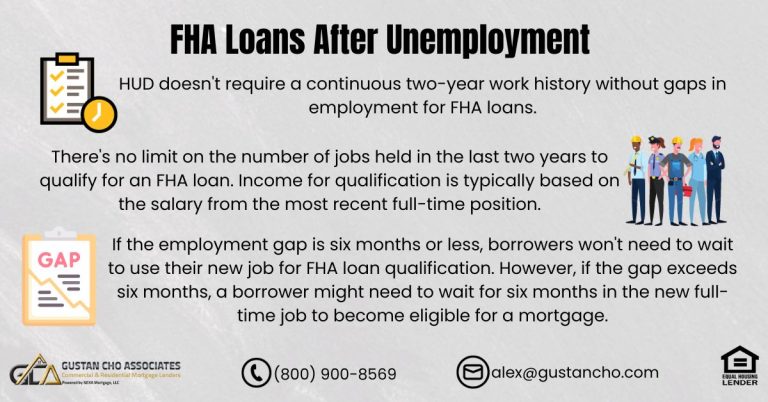

This blog examines the eligibility requirements for FHA loans after unemployment or employment gaps. Prospective FHA loan applicants now have…