In this blog, we will discuss and cover FHA streamline refinance Connecticut with no appraisal and no income docs required. FHA Streamline Refinance Connecticut is when a homeowner with a current FHA home loan refinances with a new FHA loan. HUD, the parent of FHA, does not require homeowners with an FHA loan to get another home appraisal or provide income documentation. The only requirement is for homeowners to have been timely on their current FHA loan for the past 12 months.

The Booming Housing Market in Connecticut Despite Skyrocketing Mortgage Rates

The housing market in Connecticut is booming. Home prices in Connecticut have been skyrocketing for the past several years. Mortgage rates earlier this year hit a historic low of 2.75% on a 30-year fixed-rate mortgage. In less than six months, mortgage rates have peaked at a three-year high of over 5.0%. It is not IF rates is going to plummet, but WHEN. The Dow Jones Industrial Average, 10-year treasuries, and mortgage rates are expected to tank. If rates drop, many homeowners can take advantage of FHA streamline refinance at substantial lower mortgage rates.

FHA Streamline Refinance Connecticut Eligibility Requirements

Under FHA Streamline Refinance Connecticut, for a homeowner to be eligible for Streamline Refinance, the following requirements must be met:

- The homeowner needs to currently have an FHA Loan

- The FHA Loan needs to be current and in good standings

- The homeowner needs to have been timely with their FHA Loan monthly payments for the past 12 months

- All original borrowers and co-borrowers on the current FHA Loan needs to be on the new Streamline Refinance Loan

- There is no cash-out refinances allowed with streamline refinances

- Not all FHA Loan to FHA Refinances are always streamline refinances

In this article, we will discuss and cover in qualifying for an FHA Streamline Mortgage.

FHA Streamline Refinance Guidelines And Mortgage Rates Waiting Period From Original Home Purchase

Credit Scores have a big impact on mortgage interest rates on FHA loans. It is very common for homebuyers to purchase a home with an FHA loan when they have lower credit scores. With lower credit scores, borrowers get a higher mortgage interest rate. After the close they work on their credit so they can refinance with an FHA Streamline Refinance Connecticut at a much lower mortgage rate. Many homeowners wonder what the waiting period is to refinance their original home purchase loan to an FHA Streamline Refinance Connecticut at a much lower mortgage rate.

HUD Guidelines On Waiting Period For FHA Streamline Refinance Connecticut

Here are HUD Guidelines On Waiting Period To Do A FHA Streamline Refinance:

- FHA Loans do not come with pre-payment penalties

- HUD requires homeowners with FHA loans to wait 211 days from the original FHA loan on their home purchase before homeowners are eligible for FHA Streamline Refinance Connecticut (To Lower FHA Mortgage Interest Rates)

- There is no home appraisal required with an FHA Streamline Refinance Connecticut

The Loan To Value on the streamline is based on the calculation on the previous appraisal when the homeowner purchased their home and got their original home purchase FHA loan.

Net Tangible Benefit To Be Able To Do A FHA Streamline Refinance Connecticut

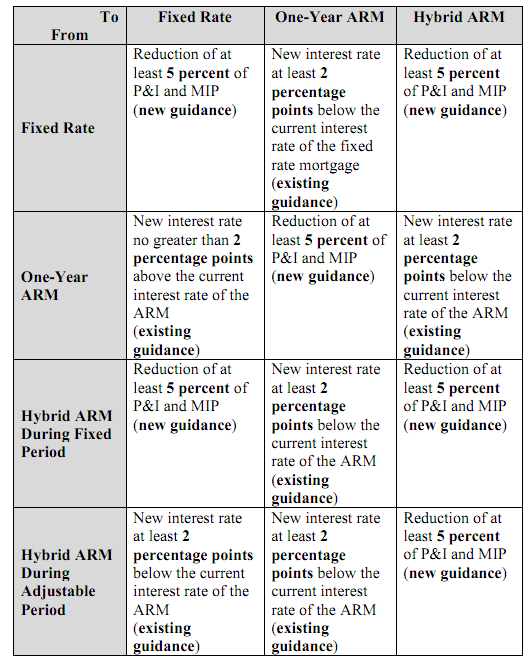

Homeowners cannot do an FHA Streamline Refinance Mortgage for just the sake of doing it. They need to meet the net tangible benefit requirement from HUD in order to qualify for streamline refinancing or need to have other benefiting factors to the homeowner such as going from an adjustable-rate mortgage to a fixed-rate mortgage. Look at the table below on how going from an ARM to a FIXED-RATE MORTGAGE (FRM) can benefit FHA mortgage borrowers:

Homeowners Not Meeting The 5% Net Tangible Benefit Requirement

Homeowners who cannot meet the 5% net tangible benefit requirement are still eligible to refinance their current FHA loan to another FHA loan if there are other benefits for them. Homeowners may be eligible for an upfront mortgage insurance premium refund. A new home appraisal may be required. The LTV cannot exceed the maximum LTV of 97.75% on refinancing mortgages based on a new appraisal.

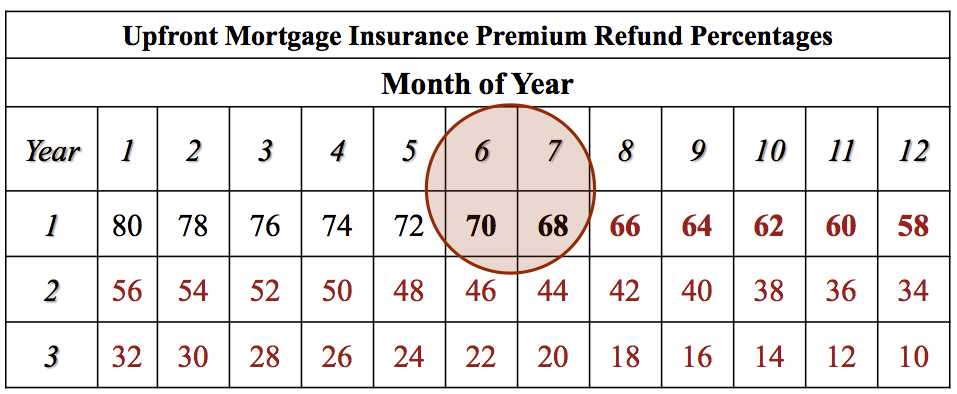

Refund of Costs When Refinancing FHA Loan to Streamline Refinance

When a homeowner was to refinance from one FHA-insured loan to another new FHA loan within a 36-month window time frame, they are entitled to a partial FHA Upfront Mortgage Insurance Premium refund. The refund from FHA is a percent of the initial FHA Upfront Mortgage Insurance Premium the home buyer originally paid at the time of home purchase. The percentage of the FHA UPMIP reduces every month as time passes and finally is zero as month 36 approaches. Below are the FHA Upfront Mortgage Insurance Premium Refund Percentages due to homeowners when they do an FHA Streamline: Refinance:

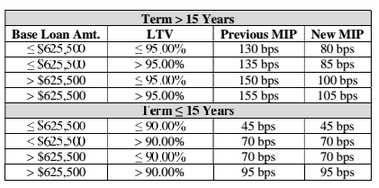

FHA Mortgage Insurance Premium Rate On Streamline Refinance Mortgages

There are two different types of FHA Mortgage Insurance Premiums:

- Upfront Mortgage Insurance Premium or known as FHA UPMIP is a one time upfront fee of 1.75% which can be rolled into the FHA loan balance

- Annual Mortgage Insurance Premium also is known as FHA MIP or 0.85% for a 30 year fixed rate mortgage and is charged for the life of the FHA loan

- The Annual Mortgage Insurance Premium depends on the term of the FHA loan, the amount of the FHA loan balance, and the Loan To Value

For borrowers who had their FHA Loan prior to May 31, 2009, they are eligible for a reduction of their Upfront Mortgage Insurance Premium of 0.01% and an annual MIP of 0.55%.

FHA Streamline Refinance And Mortgage Rates And Closing Costs

There are closing costs on all mortgage loans. However, Gustan Cho Associates offers no closing costs on all Streamline Refinance mortgages. We will cover borrowers closing costs with lender credit and offer the best terms and lowest mortgage interest rates on FHA Streamline Refinances. Here are the benefits of FHA Streamline Refinances with Gustan Cho Associates:

- Low mortgage interest rates where homeowners will save tens of thousands of dollars over the term of the FHA loan with an FHA Streamline Refinance Connecticut

- Homeowners get to skip two monthly mortgage payments right after the FHA Streamline Refinance Connecticut

No closing costs because we offer lender credit to cover all closing costs.

How To Get Started With FHA STREAMLINE REFINANCE?

Start by completing our online secured mortgage loan application on our secure site APPLY NOW!!! Borrowers can also contact us at (262) 716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates is a one-stop lending shop and has a national reputation for not having any lender overlays on government and conventional loans.