This guide covers HARP for underwater mortgages. This guide is an update of a previous guide that was published in 2018, the last year of HARP. HARP stands for the Home Affordable Refinance Program and is no longer available. We have updated this guide because, in the event another real estate market and financial crisis happens, the government may come up with a similar streamline refinance program for conventional loans. HARP stands for HOME AFFORDABLE REFINANCE PROGRAM: It was created by the Obama Administration to assist homeowners who were victims of the 2008 real estate and mortgage collapse. The purpose was to help homeowners with a mortgage balance that was higher than the actual value of their homes. Marga Jurilla, the executive assistant at Gustan Cho Associates says the following about HARP for underwater mortgages:

Millions of homeowners turned in their keys to their homes to their lenders and walked due to being upside down on their mortgages. This was because their loan balance was substantially higher than the value of their homes.

To reward homeowners who planned on sticking it out and remaining in their homes even though the mortgage balance was higher than the value of their homes, the federal government implemented the HARP for underwater mortgages in 2009. HARP for underwater mortgages is offered by the FHFA, the Federal Housing Finance Agency. To qualify for the HARP for underwater mortgages program, the loan must be owned and/or guaranteed by Fannie Mae or Freddie Mac. Mortgage loans that are not owned or guaranteed by Fannie Mae or Freddie Mac will not qualify for the Home Affordable Refinance Program. In this article, we will discuss and cover HARP for underwater mortgages lending guidelines.

Qualification Requirements For HARP For Underwater Mortgages

Many homeowners who went through the real estate market crash of 2008 got so discouraged about having underwater mortgages. The shock of losing most or all of the equity in their homes devasted countless homeowners who had not participated in the Home Affordable Refinance Program. The Home Affordable Refinance Program is for conventional loans only. Does not apply to FHA loans. To participate in HARP for underwater mortgages, a home does not have to be an owner-occupant home. Home can be the following:

- second home

- investment home

- multi-unit 2 to 4 unit primary

- investment home

- Condominium

- PUDS ( Which are Planned Unit Development )

- manufactured homes

Start Your Process Towards Buying A Home

Apply Online And Get recommendations From Loan Experts

HARP for Underwater Mortgages Eligibility Requirements

I’m combining and bolding headings that make sense to keep this post to the point and concise. Here’s how I would format this new combination. I’m sure you understand that the HARP (Home Affordable Refinance Program) ended in 2018, so right after this section, I’ll dive into the options available post-HARP.

Frequently Asked Questions on HARP for Underwriter Mortgages

Here’s an updated FAQ on HARP for Underwater Mortgages Lending Guidelines with fresh insights and a modern take for 2025. Fret not. I will keep your blog relevant for today’s readers.

- From 2009 to 2018, the Home Affordable Refinance Program, or HARP, sought to aid homeowners’ underwater’ on their mortgages (owing more than their homes were worth) by allowing those with affordable loans and lower interest rates.

- The end goal was to help them stabilize their finances.

Can Homeowners Still Use HARP for Underwater Mortgages in 2025?

- Mortgage applications for the Home Affordable Refinance Program (HARP) in 2009.

- After accepting, processing, and closing thousands of HARP for underwriter mortgage applications, it ended in 2018.

- Hence, skipping forward, no, you cannot use HARP as of today.

- Rest assured, just because the program ended doesn’t mean you won’t be able to find a different solution.

- Homeowners looking for a HARP mortgage today have far more options.

- You not only have the second HARP option available, but you have proprietary options from lenders as well.

What Replaced HARP for Underwater Mortgages After It Ended?

After HARP’s expiration, two major programs were introduced:

- Fannie Mae’s High LTV Refinance Option (HIRO).

- This option allows borrowers with Fannie Mae-owned loans to refinance their loans even if the loan-to-value (LTV) ratio exceeds traditional limits.

Enhanced Relief Refinance (FMERR) by Freddie Mac:

- Anyone can benefit from this program if they have existing Freddie Mac loans.

- It is ideal for homeowners with high LTVs, enabling them to refinance at superior rates.

All these programs are designed to help homeowners who are unable to refinance their ever-increasing LTV ratio.

What Are the Current Guidelines for Refinancing Underwater Mortgages?

- Broadly defined, here are some guidelines that apply regardless of the program in question (e.g., HIRO, FMERR):

Eligibility Requirements:

- The borrower must have a loan with Freddie Mac or Fannie Mae.

- The mortgage was issued 15 or more months before the refinancing application.

- A borrower must have a good repayment track record, including no missed payments for the last six months and no more than one missed payment in the last year.

Loan-to-Value (LTV) Ratio:

- This program’s target market includes borrowers with LTV ratios above 97% to over 100%.

- Standard fixed-rate mortgages tend to have no maximum LTV set.

Loan Types:

- Most programs cover primary homes, secondary homes, and rental properties.

Credit Score Requirements:

- HIRO or FMERR has no minimum credit score requirements, but the lender might decide.

Is It Possible To Qualify With A Mortgage That Fannie Mae Or Freddie Mac Do Not Own?

HIRO and FMERR are not available for your loan. These products are only available for Fannie Mae or Freddie Mac-owned loans. Either entity does not back ours, so you will have to consider other alternatives like these:

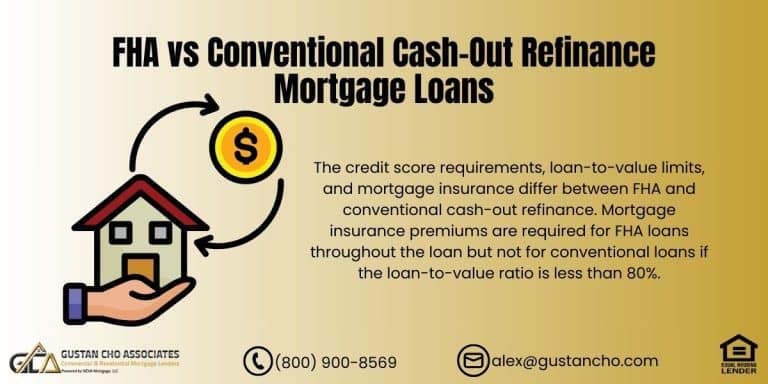

FHA Streamline Refinance:

- Most FHA loans usually require no appraisal or income verification.

VA IRRRL (interest rate reduction refinance loan):

- This loan allows streamlined refinancing with reduced documentation for VA loans.

Portfolio Loans:

- Private lenders provide them to help borrowers refinance their home loans in unique circumstances.

Are There Some Fees On Refinancing The Loan?

- Yes, refinance does include some fees for closing costs that cover the following items:

Loan origination fees.

- Title insurance and standard costs for a mortgage.

- However, many lenders will not penalize you for paying closing costs, where all penalties are merged into the loan balance or paid back at a higher interest rate.

Your Dream Home Is Just A Few Steps Away

Apply Online And Get recommendations From Loan Experts

What Benefits Can Underwater Homeowners Get From Refinancing A Mortgage?

Refinancing has the following benefits for most property owners:

- Offering lower monthly payments with lower mortgage interest rates.

- Changing the type of loan: from an adjustable-rate mortgage (ARM) to a fixed rate for a longer period.

- Eliminating a risk of foreclosure: making life more manageable during cash-strapped situations.

What If I Don’t Qualify for a Refinance Program?

- Consider these options if the type of loan you have and your current financial condition make it impossible for you to refinance:

Loan Modification:

- You may be able to negotiate with the lender to change some aspects of the original agreement, such as the rate of interest charged and the payment duration.

Forbearance:

- During temporary financial hardship, one can apply to pay less or cancel payments for a limited timeframe.

Short Sale or Deed instead of Foreclosure:

- These methods should only be implemented as a last resort, but they provide an option to exit a mortgage with considerably fewer losses.

How Do I Find Out If Fannie Mae or Freddie Mac Owns My Loan and I am Eligible for HARP for Underwater Mortgages?

To see this information, Fanny Mae and Freddy Mac have online tools that provide this service. Here are the tools they provide:

- Fannie Mae Loan Lookup: www.fanniemae.com/loanlookup

- Freddie Mac Loan Lookup: www.freddiemac.com/mymortgage

What Are Some Tips for Navigating the Refinancing Process in 2025?

- Check If You Are Eligible: Use Fannie Mae and Freddie Mac’s tools for owning lookups to determine who owns the loan.

- Shop Around: It is worthwhile to contact several lenders because they frequently have competitive rates and terms.

- Prepare Your Documents: Tax returns, proof of income, and other documents should be organized in advance.

Tip 10: Consider refinancing options like HIRO, FMERR, FHA Streamline, and VA IRL for better rates.

Where Can I Get More Information About Refinancing Options?

GCA Forums are a fantastic source of information for borrowers and industry experts. Here, they can get answers to questions in real-time. You can also read articles and guides to mortgage programs within the community.

- The HIRO program enables people to refinance on better terms, even if they have underwater mortgages. If you want personalized help and the most up-to-date information about refinancing guidelines, join GCA Forums. It’s the perfect place to talk with professionals and get the best solutions for your financial situation.

- Also, spend time boosting your credit wherever you can to help you qualify for better terms.

- If you haven’t bought into HARP, don’t worry. Many resources are out there to suit today’s borrowers’ needs.

Other requirements to qualify for HARP for underwater mortgages are as follows:

- The homeowner must be in good standing with their current mortgage loan with timely payments in the past twelve months.

- One 30-day late payment is permitted in most circumstances.

- To participate in the HARP loan program, the current loan-to-value (LTV) MUST be greater than 80%.

- The mortgage loan must have been sold to Freddie or Fannie on or before May 31st, 2009.

- The homeowner needs to be able to afford the new mortgage loan housing payment.

- The Home Affordable Refinance Program got extensions after extensions

The deadline for HARP for underwater mortgages is set for December 31st, 2018. Homeowners considering refinancing through the HARP for underwater mortgages can contact Gustan Cho Associates at gcho@gustancho.com or call us at 800-900-8569. Text us for a faster response.

This guide on HARP for underwater mortgages was updated on January 23rd, 2025.

Clarify Your Doubts With Our Loan Officers And Finalize Your Mortgage Loans

Apply Online And Get recommendations From Loan Experts