Your All-Inclusive Manual to Getting a Mortgage with Poor Credit in Illinois.

Do you fear poor credit could dash your hopes of homeownership in Illinois? Worry no more! This manual will provide a step-by-step approach to securing an Illinois mortgage, even if you have bad credit. We shall review your alternatives, ways to enhance your credit score, and how to handle the mortgage application process. Whether you reside in Chicago or any suburban or rural area, this guide will enable you to achieve stability and invest in your future, even with prior financial hardships.

Comprehending Your Mortgage Options in Illinois with Bad Credit

Various options are available for people seeking an Illinois mortgage with bad credit. Below is an overview of some common types of mortgage loans that may be within your reach:

FHA Loans—Federal Housing Administration (FHA) loans are widely used by individuals with low credit scores. Normally, a minimum score of 580 is required, but if you can make a larger down payment, then some lenders might approve an Illinois mortgage with bad credit even when the score is as low as 500.

VA Loans—Veterans or active duty service members should consider VA Loans because they do not require a specific level of creditworthiness, although individual lenders may set their own rules.

Subprime Mortgages—Designed for borrowers with less-than-perfect histories, these loans usually bear higher rates. Still, they can become viable options for securing an Illinois mortgage with bad credit when other financing options become unavailable.

Non-QM Loans: These types of mortgages work well for people with unconventional financial profiles. Rather than only looking at your credit rating, non-QM mortgages also consider things like income and assets, among others, before deciding whether you qualify.

Worried About Bad Credit? We Can Help You Secure an Illinois Mortgage!

Contact us today to explore flexible financing options and get pre-approved for your home loan.

Tips to Improve Your Credit Score

Working on boosting your credit score before applying for a mortgage is a smart move, especially if you’re considering an Illinois mortgage with bad credit. Here are some actions you can take:

Check your credit report: Begin by obtaining complimentary copies of your credit report from the three main credit bureaus. Look it over for errors and dispute any inaccuracies, which could improve your score, making it easier to secure an Illinois mortgage with bad credit.

Pay off debt: Reducing your outstanding balances, especially on credit cards, can significantly increase your credit score by reducing your credit utilization ratio. This is a critical step in improving your chances of being approved for an Illinois mortgage with bad credit.

Pay on time: One of the best ways to build — or rebuild — credit is by consistently paying bills when they’re due. Even a few months of timely payments can bump up your score.

Don’t take on more debt: Try not to apply for new lines of credit or loans before shopping for a house. Too many applications in a short period can temporarily lower your score.

Try secured cards if needed: If you’ve been struggling with establishing or rebuilding credit, consider getting a secured credit card that requires an upfront security deposit and works like a regular one otherwise.

Quick Fixes to Boost Your Credit Score

Sometimes, you need fast relief. Here are three things that could give your scores a lift in the next 30 days:

- Ask for higher limits: Requesting an increase in the amount of credit extended to you could reduce the percentage of available funds currently being used.

- Become an authorized user: Obtain permission to become an authorized user of an account belonging to a parent or partner with a strong credit history. Their payment record will positively impact your credit score.

- Pay small balances: Reduce or eliminate what you owe on one or more cards using cash from savings, then let them report as paid (but don’t close them).

The Payoff of Higher Credit Score

Better-than-average numbers can save you big bucks over time, either through lower interest rates or less spent in fees (or both). Here’s how much:

On loans: If you are considering borrowing $200,000 through a 30-year fixed-rate mortgage, a half-point variance in your interest rate could cost you or save you up to $20,000 throughout the loan’s duration.

In insurance: You might pay hundreds more each year for coverage on your car or home if your credit score is lower than fair (669-580) versus very good (740-799).

What is the moral of the story? Work hard to boost those scores and keep them high.

Finding the Best Mortgage Lenders in Illinois for Bad Credit

Not all mortgage lenders have the same requirements for bad credit mortgages. It’s important to find lenders specializing in working with borrowers with poor credit, especially when looking for an Illinois mortgage with bad credit. Here’s what to look for:

Lender Overlays

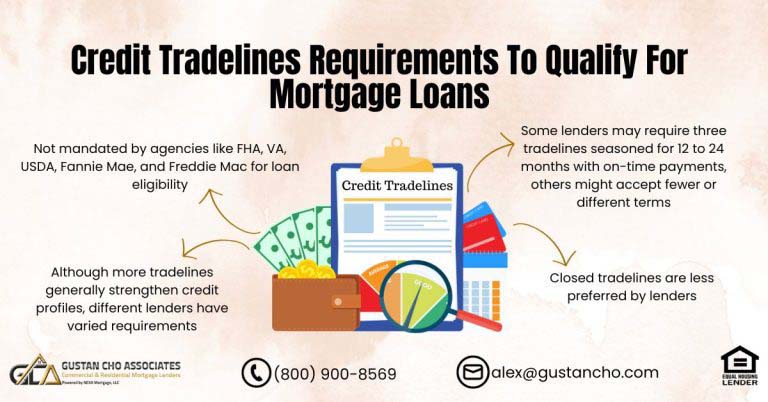

Some lenders have additional requirements, known as overlays, beyond standard FHA or VA guidelines. Look for lenders like Gustan Cho Associates, which has zero lender overlays. This can be critical when seeking an Illinois mortgage with bad credit.

Specialized Programs

Seek out lenders offering specialized programs for bad credit borrowers, such as Non-QM loans or bank statement loans for the self-employed. These programs are often essential for those looking into Illinois mortgages with bad credit.

How to Build a Relationship with Your Loan Officer

A strong relationship with your loan officer can make the mortgage process smoother and more successful. Here’s how to build that relationship:

- Communicate Openly: Be honest about your financial situation and credit history. This helps your loan officer find the best solutions for you.

- Ask Questions: Feel free to ask questions if you’re uncertain about any part of the process. A knowledgeable loan officer will gladly provide explanations.

- Stay Involved: Stay in regular contact with your loan officer throughout the process to stay informed and promptly address any issues.

Bad Credit in Illinois? Don’t Let It Stop You from Owning a Home!

Reach out now to learn about your mortgage options and how we can help you get approved.

Can I Get Pre-Approved for a Mortgage with Bad Credit?

It’s possible to secure pre-approval for a mortgage, even with bad credit! Finding the perfect lender is very important, especially when seeking an Illinois mortgage with bad credit. Here’s a guide to help you get started:

- Consult Multiple Loan Officers: Speak with several loan officers to understand your options and find one you feel comfortable with. This step is vital in navigating the complexities of acquiring an Illinois mortgage with bad credit.

- Gather Documentation: Be prepared with all necessary documents, such as income statements, tax returns, and credit reports. Adequate preparation can significantly influence your ability to secure an Illinois mortgage with bad credit.

- Understand the Process: Familiarize yourself with the pre-approval and application process to avoid surprises. Knowing what to expect can make applying for an Illinois mortgage with bad credit easier and less hassle.

Understanding the Pre-Approval Process for an Illinois Mortgage with Bad Credit

Getting pre-approved is an important step in the home buying process, especially when finding your way through the challenges of securing an Illinois mortgage with bad credit. Here’s what you need to know:

Initial Consultation: Talk with a loan officer about your financial status, aspirations for purchasing a home, and any concerns regarding bad credit. This conversation is an essential starting point, particularly in Illinois, where mortgage considerations can vary.

Document Submission: For a smooth process, be prepared to provide necessary documents, such as income statements, tax returns, and credit reports. These documents are important for assessing your financial situation, especially when dealing with bad credit.

Credit Check: The lender will conduct a rigorous credit assessment to evaluate your creditworthiness. Understanding how bad credit affects your mortgage options in Illinois is a crucial step.

Pre-Approval Letter: If approved, you’ll receive a pre-approval letter stating the loan amount for which you qualify. This document is particularly valuable for those with bad credit, as it helps you understand your budget when house hunting in Illinois, factoring in the unique challenges bad credit presents.

Looking for a Home Loan in Illinois with Bad Credit? We’ve Got Solutions for You!

Contact us now to discuss the best mortgage options for your situation and get started with your application.

How to Apply for an FHA Loan with Bad Credit in Illinois

Trust and communication with your loan officer are key. Here’s how to ensure a smooth process:

- Vet Your Loan Officer: Check online reviews and seek referrals from trusted sources like family and friends.

- Build a Strong Relationship: Establish a good rapport with your loan officer to navigate the homebuying and mortgage process effectively.

- Follow Their Guidance: Your loan officer will guide you through each step, from application to pre-approval.

Non-QM Loans with No-Income Docs

At Gustan Cho Associates, we offer a variety of Non-QM loans, which are great for those with unconventional financial situations:

- Bank Statement Mortgages: Perfect for self-employed borrowers who don’t want to provide tax returns.

- Jumbo Loans: For high-value properties with flexible credit requirements.

- No-Waiting Period Loans: Available for those just out of foreclosure or bankruptcy.

Monitoring and Correcting Your Credit

Regularly monitoring your credit is crucial. Here’s how to stay on top of it:

- Annual Credit Report: Take advantage of your free annual credit report to check your credit health.

- Rapid Rescore: If needed, consider a rapid rescore to update your credit report and improve your score quickly.

Benefits of Working with Gustan Cho Associates

At Gustan Cho Associates, we specialize in helping borrowers with bad credit. Here’s what we offer:

- No Lender Overlays: We have no additional requirements beyond standard FHA, VA, USDA, and conventional loan guidelines.

- Extensive Loan Options: We offer various loan programs, including FHA, VA, USDA, conventional, and non-QM loans.

- Expert Guidance: Our group of seasoned experts is here to assist you at each process stage, starting from pre-approval and concluding at closing.

Final Thoughts

Achieving homeownership with bad credit in Illinois is challenging but entirely possible. You can find a home loan that suits your needs with the right guidance, preparation, and persistence. Remember, improving your credit score, understanding your options, and working with the right professionals are key steps in this journey.

FAQs: Illinois Mortgage With Bad Credit Mortgage Options

- 1. What does “Illinois mortgage with bad credit” mean? An Illinois mortgage with bad credit refers to home loans available to individuals in Illinois who have low credit scores. Despite past financial mistakes, high debt levels, or unexpected financial hardships, it’s still possible to secure a mortgage.

- 2. Can I get an Illinois mortgage with bad credit? Yes, you can. Different types of loans are offered such as FHA loans, VA loans, subprime mortgages, and Non-QM loans, all aimed at assisting individuals trying to obtain Illinois mortgage with bad credit.

- 3. What are FHA loans? FHA loans are government-backed loans by the Federal Housing Administration. They are popular for people with low credit scores. Typically, a minimum score of 580 is required, but some lenders might approve you with a score as low as 500 if you can make a larger down payment.

- 4. What are VA loans? VA loans are for veterans and active-duty service members. They don’t require a specific credit score, although individual lenders may set their own requirements. They are a great option for securing an Illinois mortgage with bad credit.

- 5. What are subprime mortgages? Subprime loans target individuals with imperfect credit records. Typically, they carry elevated interest rates. Nevertheless, they can serve as a feasible choice for obtaining a mortgage if other financing avenues are not accessible.

- 6. What are Non-QM loans? Non-QM (Non-Qualified Mortgage) loans are designed for people with unconventional financial profiles. Lenders take into account more than just your credit score, considering your income and assets when you apply for these loans. They are a flexible option for an Illinois mortgage with bad credit.

- 7. How can I improve my credit score before applying for a mortgage? Before you apply for a mortgage, you can take various practical steps to enhance your credit score.Start by checking your credit report and dispute any inaccuracies you find. It’s also beneficial to pay down debt, as reducing your outstanding balances can significantly boost your score. Making payments on time consistently is crucial, as is limiting new credit applications before you start shopping for a mortgage.

- 8. Are there quick fixes to boost my credit score? Yes, consider increasing your credit limits, becoming an authorized user on a family member’s account, and paying off small credit card balances.

- 9. What are the benefits of a higher credit score? Having a higher credit score may result in receiving lower mortgage rates, which can help you save significant amounts of money throughout the duration of your loan.

- 10. How do I find the best mortgage lenders in Illinois for bad credit? When looking for the best mortgage lenders in Illinois for bad credit, seek out lenders who specialize in bad credit mortgages and have no additional requirements (overlays). Additionally, consider lenders offering specialized programs such as Non-QM loans or bank statement loans for self-employed individuals.

- 11. Can I get pre-approved for a mortgage with bad credit? Yes, you can get pre-approved for a mortgage with bad credit. To start, consult with multiple loan officers to find the best fit, gather necessary documentation (like income statements and credit reports), and ensure you understand the entire pre-approval process.

- 12. How do I apply for an FHA loan with bad credit in Illinois? Establishing trust and maintaining open communication with your loan officer is crucial when applying for an FHA loan with poor credit in Illinois. Vet your loan officer by checking reviews and seeking referrals. Build a strong relationship with them and follow their guidance closely.

- 13. What are Non-QM loans with no-income docs? Non-QM loans at Gustan Cho Associates cover a diverse range including bank statement mortgages, which are perfect for self-employed borrowers, jumbo loans that cater to high-value properties, and no-waiting period loans designed for individuals who have recently emerged from foreclosure or bankruptcy.

- 14. How do I monitor and correct my credit? To monitor and correct your credit, you can use your free annual credit report to keep an eye on your credit health. If needed, consider a rapid rescore to quickly update and improve your score.

- 15. What are the benefits of working with Gustan Cho Associates? When working with Gustan Cho Associates, you’ll benefit from their extensive loan options, including FHA, VA, USDA, conventional, and Non-QM loans, as well as expert guidance from experienced professionals with no additional lender overlays.

- 16. Can I really buy a home with bad credit? Absolutely! With the right guidance and preparation, you can achieve homeownership even with bad credit. Improving your credit score, understanding your options, and working with knowledgeable professionals are essential steps.

For more information about Illinois mortgage with bad credit and personalized assistance, contact us at Gustan Cho Associates. Call or text us at 800-900-8569 for faster response, or email us at alex@gustancho.com. We’re here to help you achieve your dream of homeownership. The right preparation and guidance can achieve an Illinois mortgage with bad credit.

The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about Illinois Mortgage With Bad Credit Mortgage Options was updated on July 8th,2024.

Need a Mortgage in Illinois but Have Bad Credit? We Can Help You Get Approved!

Reach out now to learn how we can work with you to secure the financing you need.