Fix-and-Flip Mortgage Guidelines For Real Estate Investors

Fix-and-Flip Mortgage: The Ultimate Guide for 2024 If you’re a real estate investor or thinking about diving into the world…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Fix-and-Flip Mortgage: The Ultimate Guide for 2024 If you’re a real estate investor or thinking about diving into the world…

Mortgage for Self-Employed Versus W-2 Borrowers: 2024 Guide to Getting Approved Are you a self-employed worker or a W-2 employee…

Home Loans of Over 5 Million: Your Ultimate Guide to Jumbo and Super Jumbo Mortgages in 2024 If you’re in…

Can You Get Denied for a Mortgage With Good Credit? If you’re asking yourself, “Can you get denied for a…

Manatee County Florida: Is It a Good Place to Buy a House in 2024? Are you thinking about buying a…

Everything You Need to Know About 85% LTV Jumbo Loans: Your Guide to Financing a High-End Home in 2024 Are…

California Gas Prices in 2024: Why They’re So High and How to Save Money at the Pump California gas prices…

The Best Mortgage Lenders After Bankruptcy: Your Path to Homeownership in 2024 Buying a home might feel like a far-off…

Buying a House in Nevada: The Ultimate 2024 Guide to Making Your Dream Home a Reality Buying a house in…

The Feds Announce Future Rate Cuts: What It Means for Mortgage Rates in 2024 In 2024, homeowners and buyers will…

Common VA Overlays: What You Need to Know for 2024 When it comes to VA loans, borrowers often need more…

Surety Bond: Everything Mortgage Brokers Need to Know in 2024 Understanding surety bond requirements is important if you’re a mortgage…

Debt Settlement Versus Bankruptcy: A Guide for Mortgage Borrowers in 2024 If you’re juggling debt and trying to figure out…

Homebuyers do not need great credit and high credit scores to qualify for a mortgage. You can have outstanding collections and charged-off accounts and qualify for a mortgage as long

97 LTV Conventional Versus FHA Loans: Which One Is Right for You? If you’re like most first-time homebuyers, one of…

How Do I Know If I Qualify For A Mortgage? All loan programs have different lending guidelines. However, you normally need timely payments in the past twelve months and need qualified income and have the ability to repay your new mortgage.

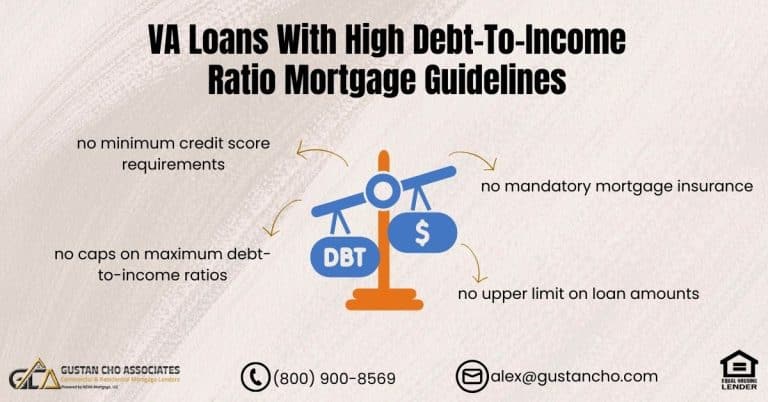

VA Loans with High Debt-to-Income Ratio: A 2024 Guide for Veterans Are you a Veteran worried about your high debt-to-income…

Guide to Freddie Mac Mortgage Guidelines for 2024: Your Path to Homeownership or Refinancing Are you ready to own a…

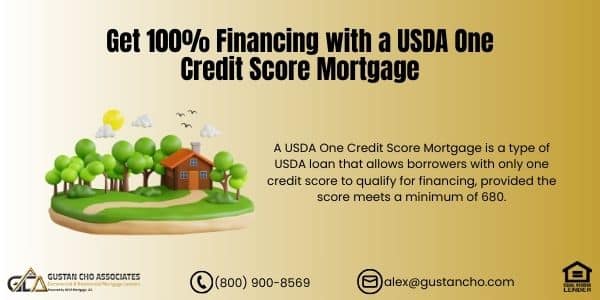

USDA One Credit Score Mortgage: What You Need to Know to Qualify in 2024 If you’ve been told you can’t…

2024 Guide to Low Credit Score Pricing Adjustments: Understanding Your Options to Save on Your Mortgage Ready to buy or…

Cash to Close and Seasoned Funds for Closing: Your 2024 Guide to a Smooth Home Purchase When you’re ready to…

Updated FHA Loan Requirements for 2024: What You Need to Know Are you considering an FHA loan to buy a…