Get Recent Update Credit Report Fast With a Rapid Rescore

In this blog post, we’ll delve into the most recent methods to update credit report fast using rapid rescore to…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog post, we’ll delve into the most recent methods to update credit report fast using rapid rescore to…

This guide covers how to close on home loan after losing job during mortgage process. We will show you qualifying…

This guide covers mortgage underwriter errors causing borrowers a loan denial. Mortgage underwriter errors do happen. Underwriters are human and…

Dozens of non-QM loan programs have been created and launched in recent years. A large percentage of homebuyers who cannot qualify for traditional loans gravitate towards non-QM loans.

Homebuyers and homeowners can secure Chapter 13 Trustee Mortgage Approval under the Chapter 13 Bankruptcy repayment plan. FHA and/or VA…

This blog post will discuss VA loans with no credit scores in detail and examine the DTI (Debt-to-Income) requirements. VA…

This guide covers using realtor commission for home purchase down payment. This article delves into using realtor commission for a…

This article delves into the lending prerequisites and regulations concerning mortgage with new job. It addresses the misconception that one…

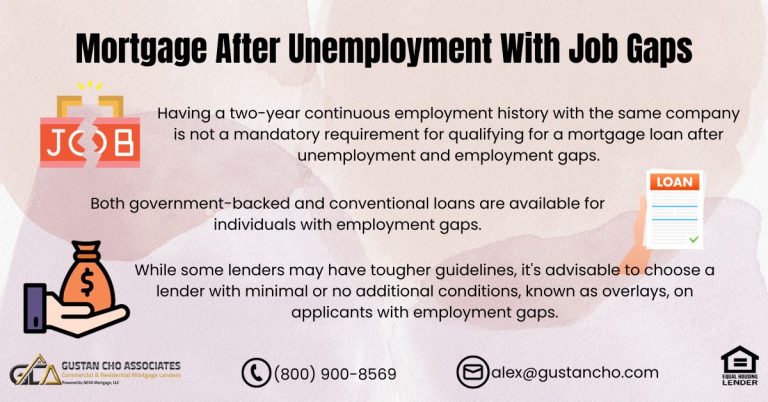

This blog addresses the eligibility criteria for obtaining a mortgage and securing approval despite having experienced employment gaps within the…

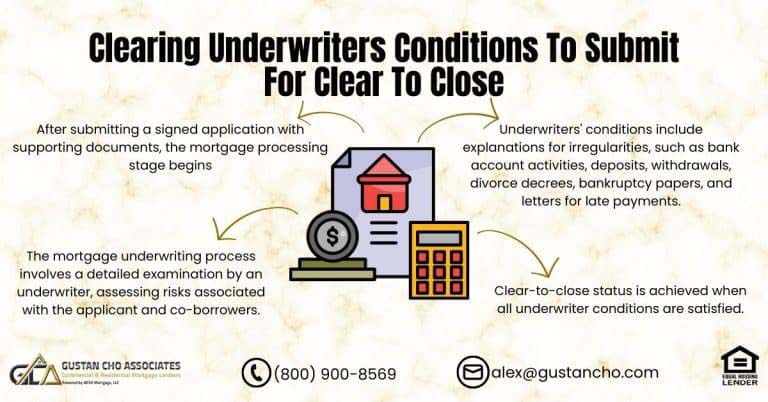

In this guide, we address underwriters conditions to pave the way for a clear-to-close submission. Whether individuals seek approval for…

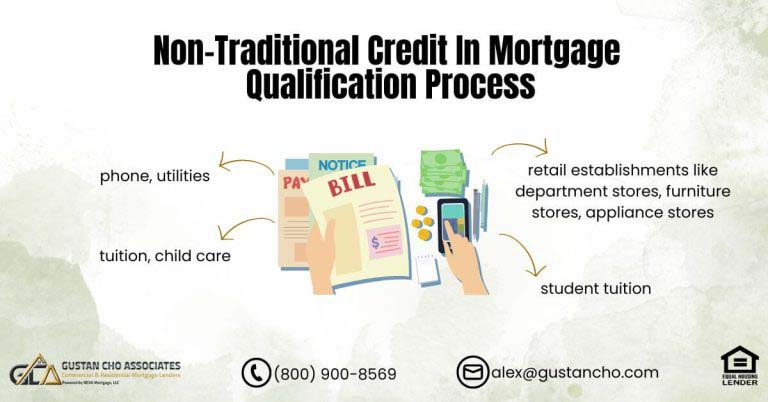

This blog delves into the significance of non-traditional credit in mortgage qualification process, particularly focusing on scenarios where borrowers lack…

Gustan Cho Associates are experts when analyzing consumer credit reports. Since we do not have lender overlays, we see all…

This guide covers low appraisal on home purchase and solutions for mortgage borrowers. We will discuss solutions to low appraisal…

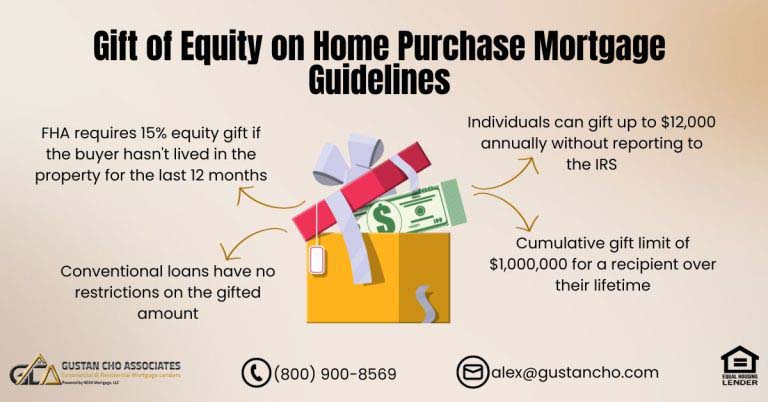

In this blog, we will cover and discuss the gift of equity on home purchase mortgage guidelines. Many people want…

How To Get Refer To Approve-Eligible Per AUS To Qualify For Mortgage: There are ways of trying to get a refer/eligible findings to an approve/eligible per automated underwriting system.

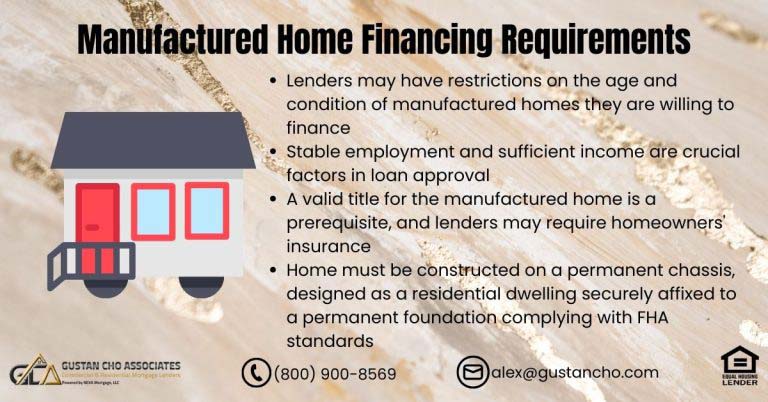

This guide covers manufactured home financing requirements. Many home buyers of manufactured home financing have a difficult time getting it….

In this article, we will cover and discuss how credit disputes affect mortgage process and cause loan denial. The pre-approval…

Every mortgage borrower is different. Your income, debts, credit rating, savings, and goals are unlike anyone else’s. The best mortgage for your neighbor might be the worst home loan for you.

This guide covers VA credit agency guidelines versus lender overlays on VA loans. Understanding VA Credit Score Agency Guidelines is…

This guide covers the benefits of paying mortgage balance early before end of loan term. Paying mortgage balance early before…

This guide explains Fannie Mae second home guidelines, especially vacation properties. As of 2025, a minimum down payment of 10%…

This article will discuss and cover qualifying for a mortgage after unemployment. Homebuyers do not need a two-year employment history…