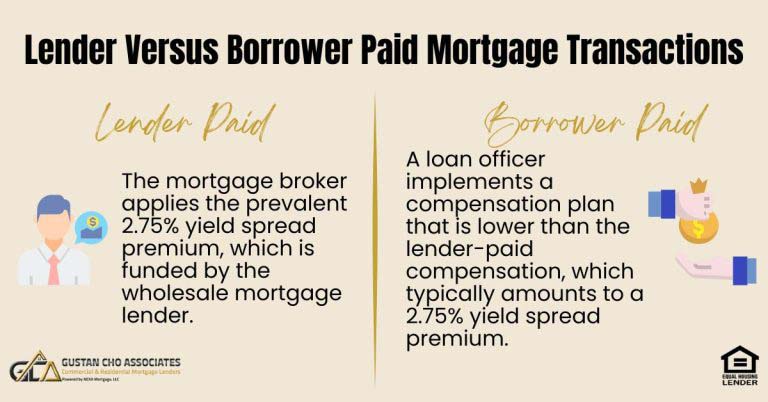

Lender Versus Borrower Paid Mortgage Transactions

In this blog, we will discuss lender versus borrower paid mortgage transactions. Mortgage brokers can often opt to go with…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will discuss lender versus borrower paid mortgage transactions. Mortgage brokers can often opt to go with…

This guide covers the importance of mortgage qualification and pre-approval. A pre-approval is when a home buyer or homeowner has…

In this article, we will cover and discuss new mortgage programs for homebuyers and real estate investors. We have over…

This guide covers things to avoid when repairing your credit for a mortgage approval. There are things to avoid when…

This guide covers the five C’s of mortgage underwriting leading to clear-to-close. With mortgage loans, the risk analysis is critically…

This guide covers how to fix bad credit to qualify for a mortgage. How to fix bad credit to qualify…

This guide covers the frequently asked question can I get denied for FHA loan with good credit on home purchase….

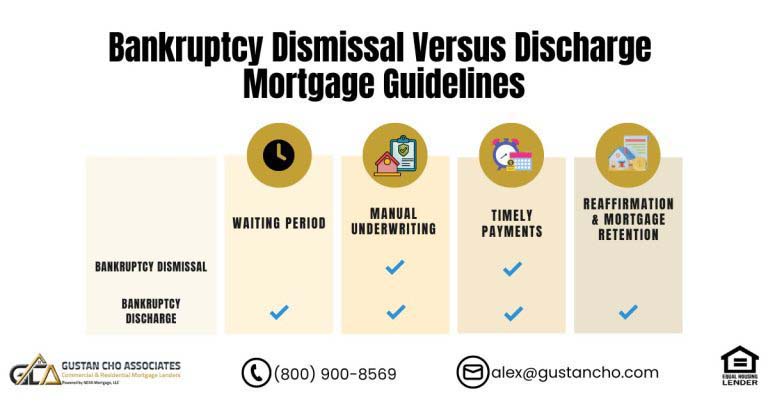

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy…

This guide covers how solid is your pre-approval for a home purchase mortgage. A mortgage pre-approval letter means that a…

This guide covers government and conventional loans after bankruptcy and foreclosure. There are mandatory waiting period requirements on government and…

This guide covers qualifying and getting approved for a home mortgage moving to new home. Moving to new home is…

This guide covers mortgage for second primary residence lending guidelines. Many Americans have a current primary residence and are looking…

This guide cover FHA versus conventional mortgage after bankruptcy. There are differences in when and how you can qualify for…

This guide cover how long is a pre-approval valid when shopping for a home. A pre-approval letter is a ticket…

This guide covers paying down credit card balances to boost credit scores and lower high debt-to-income ratios to qualify for…

This guide covers the differences between FICO and VantageScore Credit Scores. We will explain the differences between FICO and VantageScore…

This guide covers what is the lowest credit score allowed for mortgage approvals. The team at Gustan Cho Associates gets…