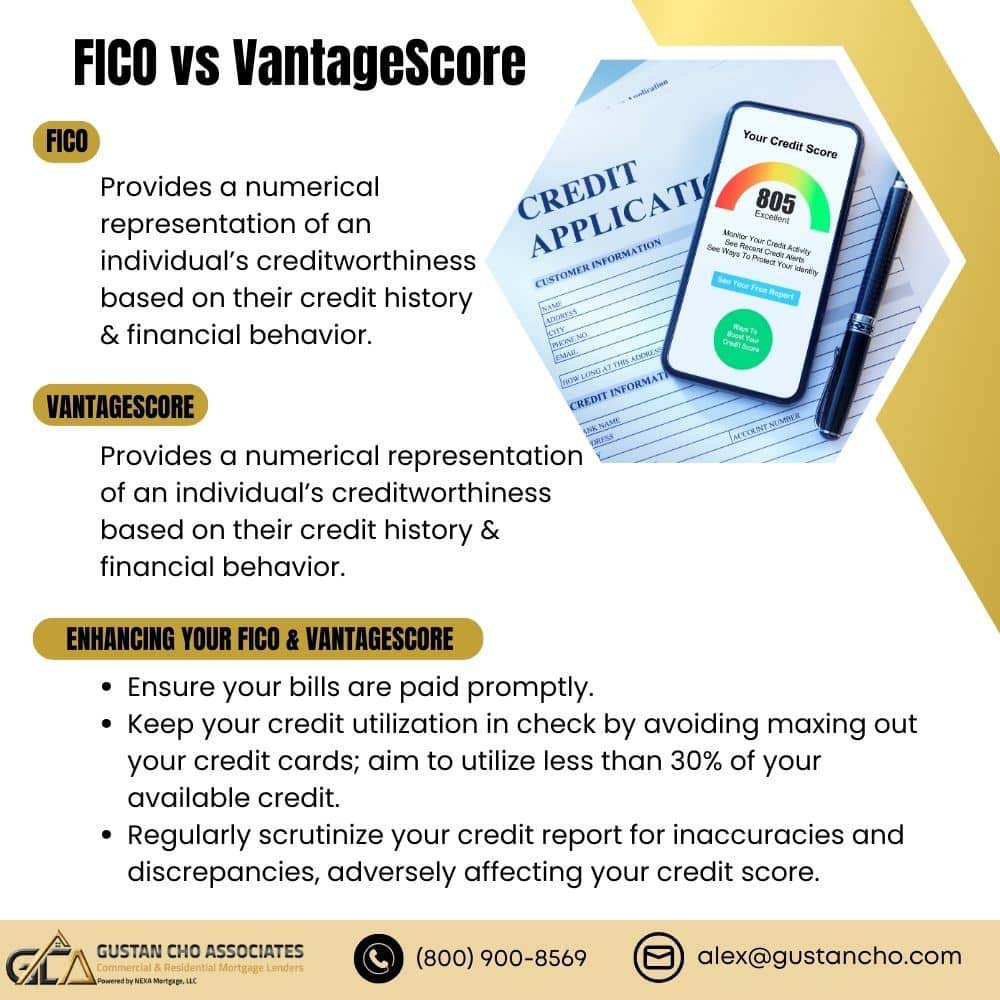

This guide covers the differences between FICO and VantageScore Credit Scores. We will explain the differences between FICO and VantageScore credit scores in mortgage lending and rebuilding credit. Understanding the differences Between FICO and VantageScore is important when rebuilding credit and applying for a mortgage.

FICO and VantageScore are the two most widely recognized scoring models for measuring creditworthiness.

While they aim to achieve a similar goal, understanding the nuances and variations between them is crucial for anyone seeking to make informed financial decisions. Today, we will explore the differences between FICO and VantageScore, their impact on mortgage applications, and actionable tips for improving your scores.

Credit Bureaus and Scoring Models

Credit bureaus, such as Experian, TransUnion, and Equifax, collect and report individual credit information to generate credit reports. These credit reports are then used by credit scoring models, such as FICO and VantageScore, to calculate credit scores. Credit bureaus are responsible for providing accurate credit information to credit scoring models that calculate credit scores based on algorithms.

FICO and VantageScore are the two most common credit scoring models lenders use to determine an individual’s creditworthiness. FICO scores typically use credit data from all three major credit bureaus, while VantageScore typically uses data from two of the three bureaus.

While FICO and VantageScore may use different algorithms, they both rely on data provided by the credit bureaus to generate credit scores. Therefore, the information included in credit reports from credit bureaus plays a crucial role in determining one’s credit scores and overall creditworthiness.

Credit Scoring Models Used By Mortgage Lenders

Mortgage lenders typically use a variety of credit scoring models to assess the creditworthiness of borrowers. While FICO (Fair Isaac Corporation) scores are the most commonly used credit scores in the United States for mortgage lending, lenders may also consider other credit scoring models and factors.

The key credit scoring models and factors mortgage lenders use are FICO and VantageScore. FICO Scores: FICO scores are the mortgage industry’s most widely used credit scores.

There are several versions of FICO scores, but the FICO Score 2, FICO Score 4, and FICO Score 5 are commonly used by mortgage lenders. These scores are based on information from the three major credit bureaus: Equifax, Experian, and TransUnion.

Comparing FICO and VantageScore Credit Scores: The FICO Scoring Model

The Fair Isaac Corporation established FICO as the first credit scoring model to revolutionize the lending landscape. It was devised to offer lenders a standardized method of evaluating credit risk, providing a numerical representation of an individual’s creditworthiness based on their credit history and financial behavior.

With higher scores indicating stronger creditworthiness, the FICO Score ranges from 300 to 850. Over the years, FICO has evolved, with the most widely used version being FICO Score 8.

The FICO scoring model considers factors such as payment history, credit utilization, length of credit history, types of credit, and new credit applications. Lenders often consider multiple credit scores, including FICO and VantageScore, to obtain a holistic view of an individual’s creditworthiness. This flexibility allows lenders to make well-informed decisions, enhancing the fairness and accuracy of lending practices.

VantageScore

VantageScore: VantageScore is another credit scoring model that is gaining popularity among mortgage lenders. VantageScore 3.0 and VantageScore 4.0 are two commonly used versions. Like FICO scores, VantageScores are based on data from the major credit bureaus.

VantageScore is a newer credit scoring model developed collaboratively by the three major credit bureaus: Experian, TransUnion, and Equifax.

VantageScore aimed to provide an alternative to the dominance of FICO in the market. It sought to incorporate variables that could widen credit access to consumers with limited credit histories. Like FICO, the VantageScore also ranges from 300 to 850.

The latest version, VantageScore 4.0, considers similar credit factors as FICO, including payment history, credit utilization, age and mix, and recent credit behavior.

FICO and VantageScore have gained significant popularity among lenders due to their ability to predict credit risk effectively. While FICO remains the most widely used model, VantageScore has established a formidable presence as an alternative scoring option.

The Crucial Role of Credit Scores in Securing a Mortgage

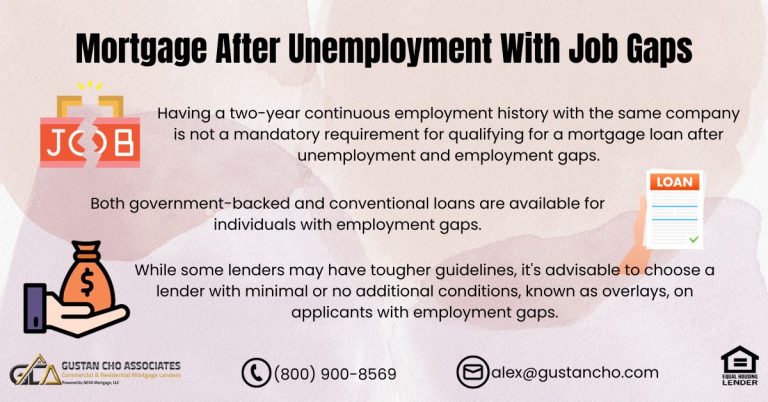

The dream of homeownership often hinges on obtaining a mortgage. However, many individuals may need to fully comprehend the critical influence of credit scores in this process. Mortgage credit scores are different than other types of credit scores. The FHFA now requires lenders to use the VantageScore 3 versus the FICO scoring model.

Credit scores, the lifeline of mortgage applications, provide lenders with an assessment of an individual’s creditworthiness and ability to repay the loan. Mortgage scores are generally lower than scores of consumer loans.

A good credit score opens the door to competitive interest rates, flexible loan terms, and higher borrowing limits. In contrast, a poor credit score can hinder loan approval or result in higher interest rates and unfavorable terms. According to a study by Freddie Mac, borrowers with credit scores above 760 received interest rates over 0.60% lower than those below 620.. The Federal Reserve reports that borrowers with credit scores below 620 are considered subprime and are subject to higher interest rates.

Sources:

The Role of Lenders in Choosing a Scoring Model

Lenders play a crucial role in selecting the credit scoring model they use to evaluate mortgage applicants. While FICO (Fair Isaac Corporation) has historically been the dominant model used in mortgage lending, alternative models such as VantageScore have gained traction in recent years. Lenders can choose the scoring model that aligns with their risk tolerance, business strategies, and regulatory requirements.

Which Credit Scoring Model Will Lenders Use Between FICO and VantageScore

Some lenders may exclusively rely on FICO scores due to its long-standing presence and extensive industry use, emphasizing its familiarity and consistency. Others may opt for VantageScore as an alternative to expand credit access by considering a wider range of consumers’ credit histories and behaviors.

It’s important to note that mortgage lenders often have underwriting guidelines and credit score requirements varying from one lender to another.

While FICO scores are widely used, the specific FICO score version and the minimum score required can vary depending on the lender and the type of mortgage loan sought (e.g., conventional, FHA, VA, USDA). Non-traditional Credit Scoring: Some lenders may consider non-traditional sources of credit information, such as rental payment history, utility bill payments, and other alternative data sources, especially for borrowers with limited or no traditional credit history.

The Impact of FICO and VantageScore on Borrowers

Mortgage applicants should know the lender’s chosen scoring model, as different models may generate varying scores based on their respective algorithms. Borrowers must monitor their credit reports from all three major credit bureaus (Experian, TransUnion, and Equifax) since lenders may use information from one or more bureaus to calculate credit scores.

Enhancing Your FICO and VantageScore

Maintaining robust credit health ensures financial stability and unlocks future opportunities. To achieve this, it is imperative to adhere to a set of vital principles consistently. Above all, ensure that your bills are paid promptly. Timely settlement of credit card balances, loans, and other financial obligations forms the bedrock of a positive credit history. Additionally, it’s wise to keep your credit utilization in check by avoiding maxing out your credit cards; aim to utilize less than 30% of your available credit.

Similarities of FICO and VantageScore

Furthermore, regularly scrutinize your credit report for inaccuracies and discrepancies, adversely affecting your credit score. Refrain from opening multiple new credit accounts simultaneously, which could raise concerns about your financial stability. Lastly, cultivating patience and maintaining a lengthy credit history showcases your ability to handle credit responsibly. By diligently following these guidelines, you can safeguard and enhance your credit health.

Understanding The Differences Between FICO and VantageScore

Navigating today’s credit-driven society effectively can be tough, so it is important to comprehend the differences between FICO and VantageScore credit scoring models. While both strive to assess creditworthiness, understanding the nuances specific to each model can provide valuable insights for building a strong financial foundation.

By applying the knowledge and tips shared in this blog, you can take proactive measures to improve your credit scores and secure better financial opportunities in the future. Sometimes, mortgage lenders may use manual underwriting instead of relying solely on automated credit scoring models. Manual underwriting involves a more detailed review of a borrower’s financial history, income, assets, and liabilities.

Customized Scoring Models

Some larger mortgage lenders develop customized credit scoring models or use proprietary algorithms to assess borrower risk. These models may take into account additional factors that are specific to their lending criteria. To improve your chances of securing a mortgage with favorable terms, it’s essential to maintain a good credit history, pay bills on time, keep credit card balances low, and review your credit reports for accuracy regularly. Working with a mortgage professional can help you navigate the specific requirements of different lenders and mortgage programs.