Low Credit Score Pricing Adjustments on Mortgage Loans

2024 Guide to Low Credit Score Pricing Adjustments: Understanding Your Options to Save on Your Mortgage Ready to buy or…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

2024 Guide to Low Credit Score Pricing Adjustments: Understanding Your Options to Save on Your Mortgage Ready to buy or…

Understanding Discount Points: Your Key to Big Savings on Your Mortgage When exploring your mortgage options, “discount points” often pop…

Issues With Condominium Financing And Mortgage Options in 2024 Financing a condominium can be a smart choice for many buyers….

Changing Lenders After Locking Rates: What You Need to Know in 2024 Locking in a mortgage rate is a critical…

This guide guide covers how home prices are increasing despite higher mortgage rates. All indicators point to a housing bubble….

In this article on the difference between a direct versus correspondent lender, we will explore the advantages and disadvantages of…

This guide covers FHA versus conventional mortgage rates on purchase and refinances transactions. One of the most common questions the…

This article covers the mortgage rate lock process and how to decide when to lock in a mortgage. You cannot…

This Article Is About How Credit Scores Affect Mortgage Rates When Locking Loan Mortgage Rates have dropped 0.25% after the…

Non-QM mortgage rates are determined by the down payment, credit scores, credit history of the borrower, and type of property. The higher the credit score and the higher the down payment, the lower the mortgage rates.

In general, borrowers buy down mortgage rates to get a lower rate on their home loans. However, there are instances where borrowers need to buy down rates due to loan level pricing adjustments due to lower credit scores

This guide covers comparison of mortgage rates on purchase and refinance loans. Mortgage rates have been steadily going up to…

This guide covers buying an investment property using a conventional loan. Buying an investment property using a conventional loan with…

This guide covers credit scores and mortgage rates versus pricing adjustments. Credit scores and mortgage rates go side by side….

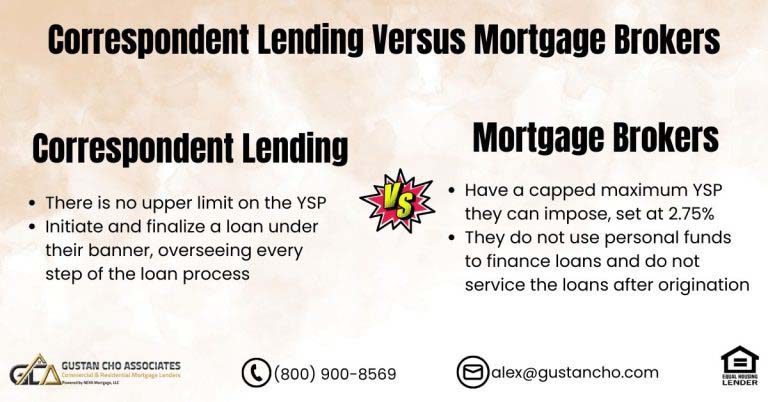

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains…

This guide covers qualifying for the lowest FHA mortgage rates on FHA loans. Qualifying for the lowest FHA mortgage rates…

In this blog, we will cover ARM versus fixed-rate mortgages. ARM stands for an adjustable-rate mortgage. Adjustable-Rate Mortgage is when…

Lenders base each borrower’s credit scores as well as other risk factors when determining mortgage rates. The higher the risk of a borrower, the higher the rate. It is best for each borrower to maximize their credit scores and other layered risks to get the best mortgage rates.

Rumors are flying about a possible housing bubble in the US. Are they based in fact, or is this wishful thinking on the part of frustrated would-be buyers?

This guide covers understanding FHA mortgage rates on purchase and refinance transactions. FHA loans are the most popular mortgage program…

In this blog, we will discuss and cover shopping for mortgage with poor credit and low credit scores. Shopping for…

Homeowners should explore how much money they can save with today’s historic low mortgage rates to refinance their home loans.