Mortgage Process Can Be Stressful If Not Properly Qualified

This Article Is About How The Mortgage Process Can Be Stressful If Borrowers Not Properly Qualified The mortgage process does…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This Article Is About How The Mortgage Process Can Be Stressful If Borrowers Not Properly Qualified The mortgage process does…

This guide covers the VA credit dispute guidelines on VA mortgage loans. VA loans are the best loan program in…

This guide covers paying down credit cards during mortgage process due to high debt-to-income ratios. Debt-to-income ratios are one of…

This guide covers the minimum credit score mortgage guidelines on home loans. Income, credit, credit history, and credit scores are…

Can I Qualify For A VA Loan With A Lender With No Lender Overlays In Mississippi? Absolutely, Gustan Cho Associates is a lender with no lender overlays on VA loans and is licensed in Mississippi.

This guide covers the process of qualifying borrowers for mortgage on home purchases and refinances. From the application stage to…

This guide covers realtors marketing package for home buyers, real estate agents and referral partners. Home buyers rely on their…

This guide covers how does mortgage process work after being pre-approved. Most folks consult with a loan officer when they…

This guide covers the home appraisal process timeline during the mortgage process. Gustan Cho Associates will update you on the…

This guide covers how mortgage brokers get paid on closed home loans. Mortgage brokers, loan originators, or loan officers are…

In this article, we will cover and discuss the role of mortgage processor during the mortgage process. The mortgage processor…

This guide covers clearing mortgage conditions of conditional loan approval. After borrower’s mortgage application has been processed and underwritten, the…

When And Why Do Mortgage Lenders Ask For Reserves? On VA and FHA manual underwriting, one month’s reserves are required. Multi-family units require reserves by homebuyers.

This blog will cover closing on your new home in 21 days from application to CTC. Closing on your new…

In this blog, we’ll explain the qualifying credit score that lenders use for mortgages. Mortgage underwriters determine this score by…

Choosing the right lender with no lender overlays is the key on how to avoid mortgage denial

This guide covers how underwriters view unsourced funds while analyzing and reviewing a borrower. Unsourced funds have no paper trail,…

This guide covers home inspection before proceeding with the mortgage process. A home inspection is an inspection of a home…

Many people have no credit score. This can make getting a mortgage to buy a home harder. However, it’s not impossible. You can re-establish credit after bankruptcy or other serious credit problems. And if you have no credit score at all, lenders can approve you with a non-traditional credit report.

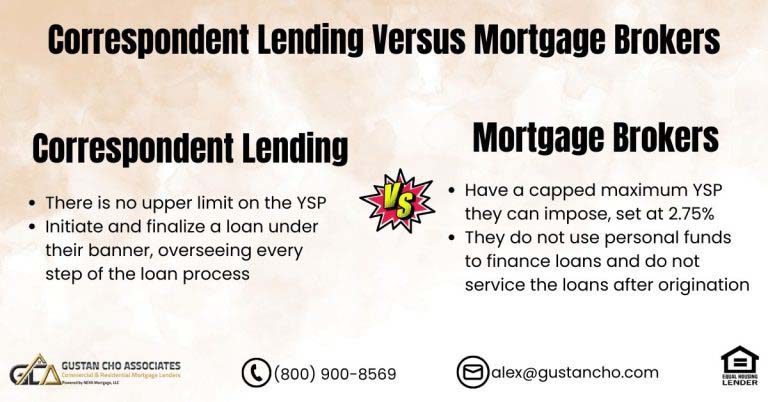

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains…

This article explores the Factors Affect Pre-Approval And Stress During Mortgage Process. Once individuals decide to purchase a home, the…

This guide covers 580 score VA financing for eligible veteran homebuyers and homeowners. The team at Gustan Cho Associates are…