FHA Waiting Period After Bankruptcy and Foreclosure

This article will discuss the FHA Waiting Period After Bankruptcy and Foreclosure. The FHA mandates waiting periods after bankruptcy, foreclosure,…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This article will discuss the FHA Waiting Period After Bankruptcy and Foreclosure. The FHA mandates waiting periods after bankruptcy, foreclosure,…

This guide covers late payments after Chapter 13 bankruptcy mortgage guidelines. Mortgage lenders do not want to see any late…

This guide covers how bankruptcy affects mortgage approval and the waiting period after discharge date. Bankruptcy is a great tool…

In this article, we’ll explore the process of Qualifying For FHA Loan During Chapter 13 Bankruptcy. Homebuyers can secure an…

In this blog, we will discuss and cover mortgage after foreclosure with no waiting period with non-QM loans. Non-QM loans…

This guide cover the FHA guidelines during vs after Chapter 13 Bankruptcy on FHA loans. VA and FHA guidelines during…

This guide covers approved mortgage after short sale in Chicago FAQ and answers. Sonny Walton covers getting approved for a…

This article will discuss HUD bankruptcy guidelines following Chapter 7 and Chapter 13 bankruptcy, particularly about FHA loans. HUD Bankruptcy…

In this blog, we will cover and discuss how to buy and sella house while in Chapter 13 Bankruptcy. Borrowers…

In this article, we will discuss and cover the FHA credit guidelines on how to get qualified for an FHA…

In this article, we will cover and discuss qualifying for a mortgage with recent derogatory credit with our non-QM loan…

This guide cover the waiting period to qualify for a mortgage loan after foreclosure. Homeowners who had a prior foreclosure…

This guide cover the things to know before filing bankruptcy for future homebuyers. There are things to know before filing…

This blog post will explore Buying House While In Chapter 13 Bankruptcy. Chapter 13 Bankruptcy involves a structured five-year repayment…

This article cover no waiting period on short sale mortgage guidelines. For those who were homeowners during the economic meltdown…

In this blog, we will cover the Fannie Mae Chapter 13 dismissal guidelines on conventional loans. One of the most…

Homebuyers and homeowners can secure Chapter 13 Trustee Mortgage Approval under the Chapter 13 Bankruptcy repayment plan. FHA and/or VA…

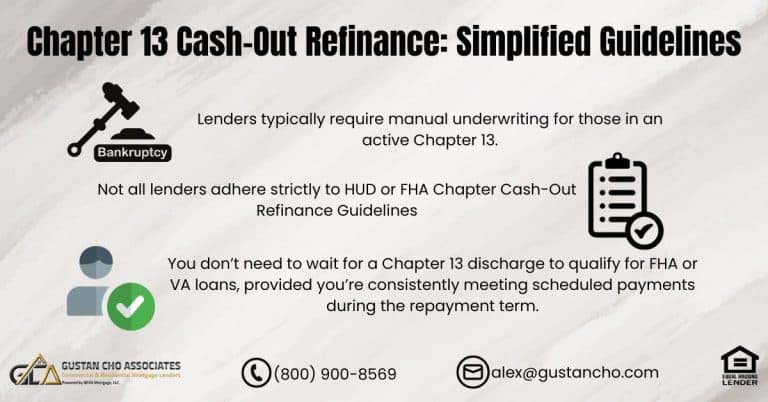

According to VA and HUD Chapter 13 cash-out refinance guidelines, homeowners may be eligible for a cash-out refinance on an…

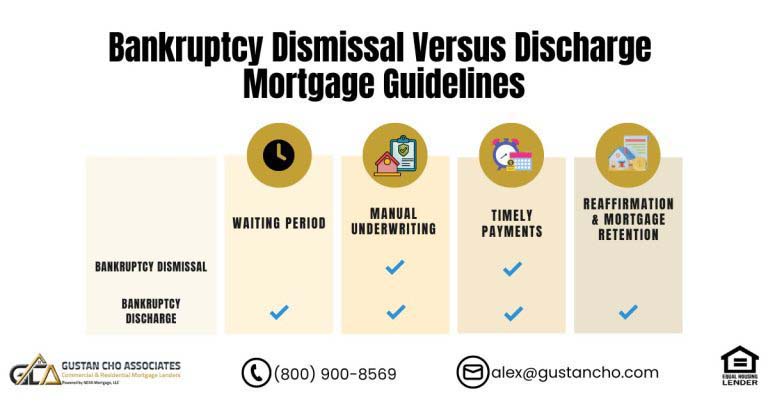

In this article, we will cover and discuss when you can get a mortgage approval after bankruptcy dismissal. There are…

In this blog, we will cover and discuss the mortgage guidelines after bankruptcy on home purchases and refinance transactions. There…

In this blog, we will discuss and cover VA refer-eligible findings versus AUS approval guidelines. The United States Department of…

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy…