Buying a Home in Florida: Simple Guide for First-Time Buyers

Buying a home in Florida is a dream for many people. Sunshine, beaches, no state income tax, and year-round outdoor…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Buying a home in Florida is a dream for many people. Sunshine, beaches, no state income tax, and year-round outdoor…

Gustan Cho Associates is a mortgage broker licensed in 48 states (Not licensed in NY, MA) with a wholesale lending…

The latest data of the top 10 most expensive states to buy a house in 2026 has been released and…

In this blog, we will cover and discuss the down payment guidelines on home purchase mortgage loans. The down payment…

In this blog, we will cover and discuss the steps in buying and selling a home and closing on time….

Boise Idaho Housing Market Update (October 2025): Prices, Inventory & 6–12 Month Outlook If you’re watching the Boise Idaho housing…

Why the Mortgage Process Feels So Stressful Buying a home should be one of the most exciting times in your…

Preparing for a Mortgage in Illinois: Step-by-Step Guide for Homebuyers Buying a home is one of the biggest financial decisions…

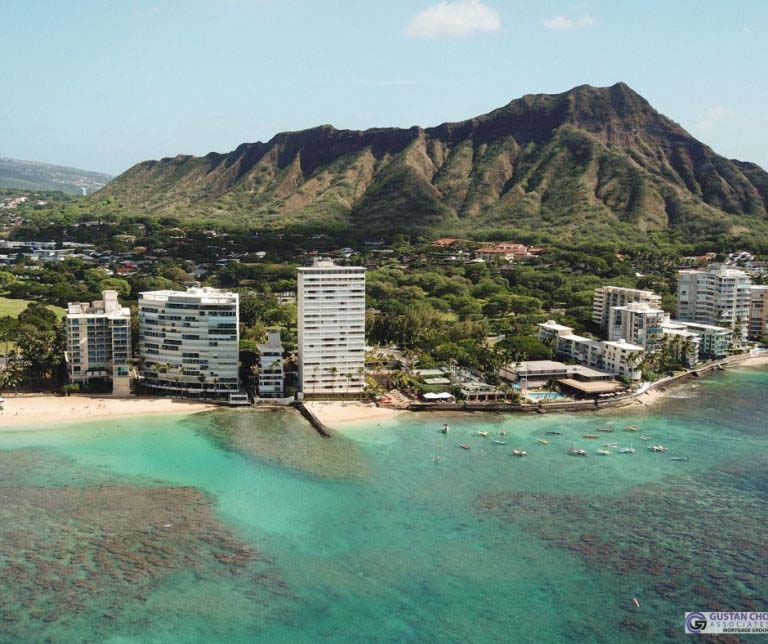

Buying a Beachfront Property in Florida: Everything You Need to Know Florida’s sunshine, sandy beaches, and breathtaking views have made…

Why Buyers and Sellers Need to Understand Canceling a Real Estate Purchase Contract Buying or selling a home is exciting,…

Primary Home Mortgage Guide: Rules, Loan Options, and How to Qualify Buying your first home can feel confusing. One of…

In this article, we will cover and discuss how do mortgage underwriters view assets for down payment on home purchases….

Buying a House in Savannah, Georgia: Your 2025 Guide to Homeownership If you’ve been considering buying a house in Savannah…

In this blog, we will discuss and cover choosing the right neighborhood when buying a home. Choosing The Right Neighborhood:…

In this article, I provide a step-by-step guide for first-time buyers and answer common questions concerning a home purchase in the Chicago area.

In this blog, we will discuss and cover buying home near schools for first-time homebuyers. There are pros and cons…

This blog covers things to keep in mind when looking at buying an older home. There are many reasons why…

One of the most frequently asked questions is how much income do I need to buy a house in 2025….

This guide covers how much money do I need to buy a house. One of the most common first time…

Buying a Home in States With Exceptional Campgrounds: Your Guide to Outdoor Living Are you dreaming of a home where…

Waiting Period After Loan Modification: What You Need to Know Before You Apply for a Mortgage If you’ve gone through…

This guide covers primary home status when qualifying for a mortgage. When a mortgage loan borrower applies for a residential…