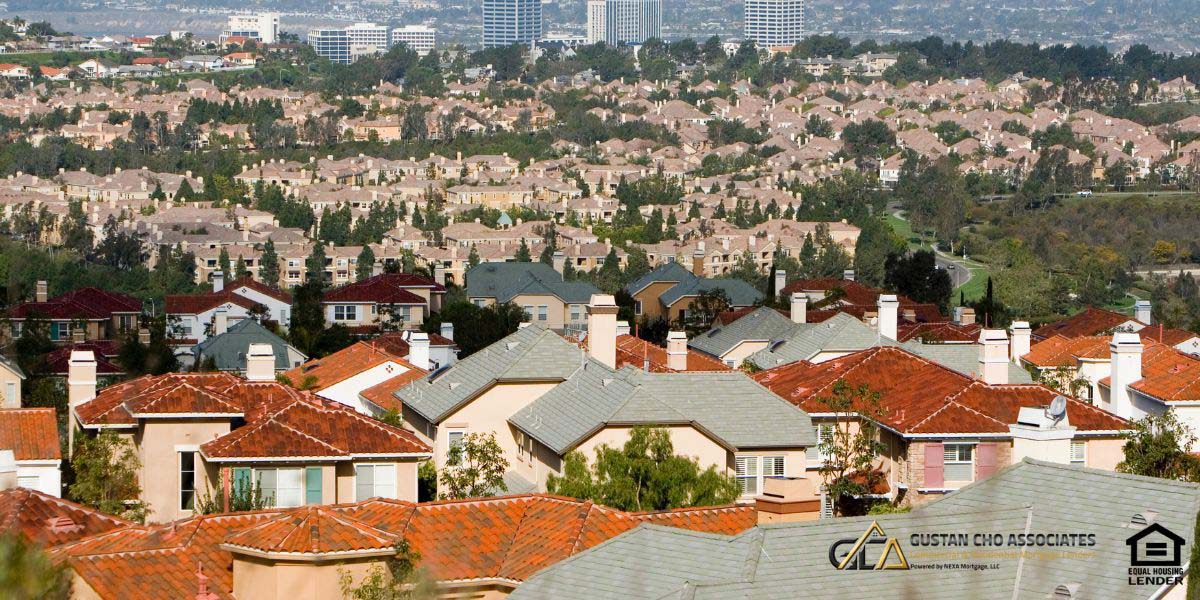

This article will discuss the California Housing Market Forecast for homebuyers of primary owner-occupant homes, second homes, investment homes, and commercial properties. California is the third-largest state in the United States. The state has the largest population of any state. With a population of 39.5 million, the area comprises 163,696 square miles (423,970 km2).

Los Angeles County and its surrounding areas have the largest area in the state. Los Angeles County is the most populous area in the state and has the nation’s second-largest population, with 19 million residents.

The California housing market for 2025 is expected to experience moderate growth and continued challenges related to inventory and affordability. Here are key forecasts and insights. California housing market forecast is expected for continued growth through 2025. The median home price in California is projected to increase by about 6.2% in 2024, reaching approximately $860,300, and further increases are expected into 2025 due to persistent demand and limited supply.

California Housing Market Forecast on Sales Activity:

Increase in Sales: Existing single-family home sales are forecasted to rebound significantly, with a 22.9% increase in 2024, setting the stage for continued strong performance in 2025 as market conditions stabilize (California Association of Realtors).

Influencing Factors of California Housing Market Forecast

Interest Rates: Impact of Rates: While mortgage rates are expected to decline slightly to around 6.0% in 2024, they remain a crucial factor influencing affordability and buyer demand. Stable or slightly decreasing rates could stimulate more buying activity (Construct Element, Norada Real Estate).

Supply and Demand of California Housing Market Forecast

Low Inventory: The housing shortage will likely continue to drive up prices. New construction must meet demand, especially in desirable areas, contributing to higher home prices and competitive market conditions (Norada Real Estate, Gord Collins).

Regional Variations of California Housing Market Forecast

Coastal vs. Inland: Coastal areas like San Francisco and Los Angeles are expected to see higher appreciation rates than inland regions. For instance, home values in the Bay Area are predicted to rise by about 7% by mid-2024, while Los Angeles might see a 5.3% increase (Construct Element).

Economic Conditions

Job Market and Wages: A strong job market will support housing demand, especially in tech hubs. However, economic factors such as job growth, wages, and broader economic health will influence the housing market dynamics (Norada Real Estate).

Challenges on Affordability

High Cost of Living: High home prices continue to make affordability a significant issue for many Californians. The high cost of living and rising mortgage rates pose challenges for first-time buyers (Norada Real Estate).

Regulatory Environment

Zoning and Land Use: Strict zoning laws and lengthy permitting processes hinder new construction, exacerbating the supply shortage and increasing prices. Overall, the California housing market 2025 will see continued price growth driven by high demand and low inventory. Lower mortgage rates might relieve some, but affordability issues and regulatory challenges remain significant hurdles. Regional variations will persist, with coastal areas experiencing higher price increases than inland regions.

Ready to Buy Your First Home in California? CalHFA Mortgage Programs Are Here for You!

Reach out now to learn about CalHFA’s mortgage programs and how they can benefit you

Will Real Estate Prices in California Keep Increasing

Economists expect a 10% drop in home prices in California over 2024. The downward trend in California home prices is expected to continue into 2025. San Francisco and the surrounding Bay Area have the fifth largest population in the United States, with 9.7 residents. The state capital of California is Sacramento. California has over 14 million homes. California also has the highest home prices in the country. The average home prices in California have skyrocketed since 2012 throughout the state. The median home prices in the state have gone up over 85.5% from 2012 through the end of 2024 on middle-level single-family housing. Excluded from the data were higher-end luxury homes and oceanfront estates.

Surging Home Prices of High-End Homes in California

The median home price in 2012 was $305,000. The median California home price at the end of 2019 was $598,500. Today’s median home price in California (As of the end of April 2024) was $990,500. Despite the coronavirus outbreak and the economic recovery from the pandemic, housing values rose 7.0% over the past year.

The coronavirus outbreak shook the whole country. Over 50 million Americans filed for unemployment. Unemployment rates are still under 10%. Many Californians were hoping for a huge housing market correction. However, the housing market is stronger today than when the coronavirus broke out.

The 2024 California Housing Market Forecast is expected to be stronger than ever despite the historic record-high mortgage rates. Compare the median home prices in California to the average median home prices for the rest of the nation, which is $545,700 for single-family homes. California home prices are double the average for the rest of the nation.

California Housing Market Forecast Remains Strong Despite The State’s Economy

The state of California has 40 million people. The state’s gross state product of $3.0 trillion makes the state the largest sub-national economy in the world. If the state were separated from the United States, the state would rank as the world’s fifth-largest economy and the 37th-most populous as of 2024. California will always have in-migration due to its powerful economic engine. Many national news networks keep on reporting that many. Californians are fleeing the state due to high taxes and the high cost of living to other low-taxed states.

Is It a Good Time To Buy a House in California

Tens of thousands of people are moving to California, not just from other parts of the nation but from foreign countries. California has been experiencing a shortage of housing for many years. Dale Elenteny, a senior mortgage advisor and expert in California Housing Market, says the following:

Due to the strong housing demand and limited inventory, California Housing Market Forecast for 2024 remains strong. Dale

Home prices in California have skyrocketed for almost ten years, and there is no sign of any housing market correction. With 30-year fixed-rate mortgages over 7.0%, homebuyer demand for homes remains stronger than ever. It is a seller’s market despite high rates and soaring inflation. The California housing market forecast is expected to keep on strengthening.

California Housing Market After Coronavirus Outbreak

California’s Housing Market Forecast and the economic outlook after the coronavirus outbreak were bleak. Like other states in the nation, the government shut it down. Most economic experts predicted another housing crash worse than the 2008 Great Recession. National unemployment numbers topped close to 20%. Over 50 million Americans filed for unemployment. California, a heavily Democratic state, joined other blue states in politicizing the coronavirus pandemic hurting millions of small business owners and taxpayers. Governor Gavin Newsom extended business and work shutdown when other states reopened.

High Home Prices Making Home Buying Unaffordable in California

Los Angeles Mayor Eric Garcetti, one of the worst mayors in the nation and probably the most incompetent, issued unconstitutional executive orders, such as shutting down utilities for those who defied his illegal and unconstitutional executive to stay-at-home order. It seems blue states with incompetent governors and mayors are struggling and in a financial crisis. This holds in Illinois. With the combination of the heavy-set obese incompetent governor J.B. Pritzker and Chicago Mayor Lori Lightfoot, the city of Chicago and Illinois are on the verge of financial collapse and meltdown.

Politics Economic Impact on Small Businesses in California

Due to incompetent Democrat politicians, the California economy got crippled. Over two-thirds of California, workers are employed by small businesses. Democrat politicians, from the governor down to city mayors, did everything possible to restrict the entire state from reopening and Californians returning to work.

The coronavirus outbreak and politicians politicizing and fear mongering Californians did not make a dent in the California real estate market. Values of real estate kept on surging up with no signs of correction.

Homebuyers were at a standstill until the chaos in the state stabilized. Homebuyers were hoping housing prices would fall due to the California economy deteriorating. Landlords were worried about vacancies and tenants under the CARES ACT not paying rent. Cities and counties throughout the state were implementing moratoriums on evictions hurting landlords and the commercial real estate market.

Looking to Buy a Home in California? CalHFA Mortgage Programs Can Help!

Reach out now to find out how you can benefit from CalHFA’s mortgage programs and take the first step toward homeownership.

Strong Housing Market Forecast In California

However, real estate investors of rental properties were concerned about the California housing market collapse, mainly due to the Federal Reserve Board lowering interest rates to zero. Mortgage rates plummeted with the Central Bank lowering interest rates to zero. Never in history were mortgage rates this low. Due to the Trump Administration acting quickly with the CARES ACT and other economic stimulus packages, the housing market is stronger now in California than it was before the outbreak of the coronavirus pandemic.

in February 2020. With thousands of homebuyers who suspended their home purchase before the coronavirus pandemic, you now have a flood of homebuyers looking for homes in a market with limited inventory.

The housing market is booming in all parts of California. Even with one of the highest tax rates in the nation, California is attracting thousands of new taxpayers and businesses. A good economy means a stronger housing market.

Housing Crash Predictions Went The Opposite Way

The U.S. economy was booming before the coronavirus outbreak in February 2020. Then the coronavirus pandemic hit the U.S. Most state governors ordered executive stay-at-home orders and shut down their states. Many homebuyers with pre-approval letters stopped shopping for a home because the housing market would crash.

Many homebuyers were convinced the housing market would collapse and be worse than the 2008 housing and credit meltdown.

This notion of another Great Housing Crashing in 2020 backfired. Instead of housing prices collapsing, it went in the other direction. The California housing market is stronger today than it was before the outbreak of the coronavirus. The U.S. economy had quickly recovered from the damage the coronavirus impact did when it first broke out. The unemployment numbers went as high as 20% but quickly recovered to under 10%.

California Housing Market Remains Strong Despite Inflation and High Rates

The Trump Administration was proactive with any negative impact that would hurt the U.S. economy. Many thought it was no rocket science that President Donald Trump would win reelection for his second term on November 3rd, 2020. Unfortunately, the world was shocked by how Joe Biden won the election.

Under the next Trump Administration, the economy and the housing market are expected to boom to historic growth levels.

Due to the strong demand for homes versus inventory, the housing market forecast in California remains strong not just for 2024 but for the next five years. Under Biden’s administration, the country seems to be a disaster. Gas prices are double, inflation is the highest in 40 years, the cost of living is skyrocketing, and a major shortage of goods is affecting everything, including the kitchen sink.

Historical Inflation Rate Adding To Surging California Home Prices

California’s housing market forecast remains strong despite the highest inflation rate in 40 years and surging mortgage rates. Construction materials, labor costs, and rising land prices fuel the fire on rising housing prices for 2024 and years to come. Due to the strong tech sector in California, more and more people are locating in the state and will no doubt look for housing. Many homebuyers who have suspended their home shopping due to the coronavirus outbreak in February 2020 are now looking for homes. Many home buyers who had plans to purchase a home in a year or two have changed their plans and want to purchase a home now to take advantage of the historically low mortgage rates.

Getting a Mortgage In California in a Booming Housing Market

Mortgage rates are at historic lows. Median home prices in California are double the national average and are expected to rise more due to the demand for housing. Everything is expensive in California. However, people make more money in California. Dale Elenteny of Gustan Cho Associates shows his take on the job market and economy of California versus the rest of the nation.

California’s housing market is stronger than ever. Home prices in California are double the price than the rest of the country.

People in California earn double the wages than people of other states. Homeowners selling their homes in California and moving to a different state is making a lot of money. The median home price of an average 2,000-square-foot home is just under $980,000. Due to high home prices, many counties in California are considered high-cost areas. The maximum FHA loan limit on FHA loans is capped at $498,257 for most areas in the United States. However, FHA and Conventional loan limits in high-cost areas in California are capped at $1,149,825 on FHA and Conventional loans for single-family homes.

California HIgh-Balance VA Jumbo Loans

homes. As of January 1st, 2020, there is no longer a maximum VA loan limit. Gustan Cho Associates is a national mortgage company licensed in multiple states, including California has no lender overlays on government and conventional loans. Gustan Cho Associates are also experts on non-QM loans. Non-QM loans are very popular in California.

Self-employed borrowers can qualify for non-QM bank statement loans with no income tax returns required and no maximum loan limit. Borrowers can qualify for non-QM jumbo mortgages with credit scores down to 620 FICO.

For more information about the California housing market forecast or to qualify for a home mortgage with no lender overlays on government or conventional loans, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 24 hours a day to answer your questions on the California housing market forecast or any other mortgage questions. Please contact us seven days a week, evenings, weekends, and weekends.

FAQs: California Housing Market Forecast For 2025

- 1. What is the current population and size of California? California has a population of 39.5 million and covers an area of 163,696 square miles (423,970 km²).

- 2. What is the projected growth for the California housing market in 2025? The California housing market is expected to experience moderate growth through 2025. The median home price is projected to increase by about 6.2% in 2024, reaching approximately $860,300, with further increases anticipated into 2025.

- 3. How will sales activity change in the California housing market? Existing single-family home sales are forecasted to rebound significantly with a 22.9% increase in 2024, setting the stage for continued strong performance in 2025 as market conditions stabilize.

- 4. What factors influence the California housing market forecast? Key factors include interest rates, supply and demand, regional variations, economic conditions, and regulatory environment.

- 5. How will interest rates impact the housing market? Mortgage rates are expected to decline slightly to around 6.0% in 2024. Stable or slightly decreasing rates could stimulate more buying activity.

- 6. What is the impact of low inventory on the market? The housing shortage is likely to continue driving up prices. New construction must meet demand, especially in desirable areas, contributing to higher home prices and competitive market conditions.

- 7. Are there regional variations in the housing market forecast? Yes, coastal areas like San Francisco and Los Angeles are expected to see higher appreciation rates than inland regions. For example, home values in the Bay Area are predicted to rise by about 7% by mid-2024, while Los Angeles might see a 5.3% increase.

- 8. How do economic conditions affect the housing market? A strong job market will support housing demand, particularly in tech hubs. However, housing market dynamics will influence job growth, wages, and broader economic health.

- 9. What are the challenges related to affordability in California? High home prices continue to make affordability a significant issue for many Californians. The high cost of living and rising mortgage rates pose challenges for first-time buyers.

- 10. How do zoning and land use regulations affect the housing market? Strict zoning laws and lengthy permitting processes hinder new construction, exacerbating the supply shortage and increasing prices.

- 11. Will real estate prices in California keep increasing? While economists expect a 10% drop in home prices over 2024, the trend indicates continued price growth due to persistent demand and limited supply.

- 12. How has the coronavirus outbreak impacted the housing market? Despite the initial economic recovery challenges, housing values have continued to rise. The market has proven resilient, with a strong demand for homes persisting.

- 13. Is it a good time to buy a house in California? Due to strong housing demand and limited inventory, the California housing market forecast for 2024 remains strong. Despite high mortgage rates and soaring inflation, it is still considered a seller’s market.

- 14. How has the historical inflation rate affected home prices in California? California’s housing market remains strong despite the highest inflation rate in 40 years. Rising construction material costs, labor costs, and land prices contribute to the continued increase in home prices.

- 15. What are the mortgage options available in California’s booming housing market? Mortgage rates are at historic lows. High-cost areas in California have higher loan limits, and various loan options, including non-QM loans, are available for different borrower profiles.

- 16. Who can I contact for more information about the California housing market forecast or mortgage options? For more information, you can contact Chad Bush at Gustan Cho Associates at 623-399-0402. Text for a faster response, or email at chad@gustancho.com. Chad Bush and his team of mortgage loan originators is available 24/7 to answer questions related to the California housing market forecast or mortgage queries.

This California housing market forecast article was updated on July 25th, 2024 by Chad Bush, a dually licensed realtor and mortgage loan officer.

Ready to Own a Home in California? Explore CalHFA Mortgage Programs Today!

Contact us today to learn more about CalHFA mortgage programs and how you can qualify.