BREAKING NEWS: How The Coronavirus Pandemic Affects Qualifying For FHA Mortgages For Borrowers With Lower Credit Scores

With an additional roughly 5 million Americans filing unemployment last week, this pushes a total of 26 million Americans off work due to COVID-19 coronavirus.

- This is an alarming rate that we hope changes quickly

- Unemployment was at an all-time low

- African-American unemployment was at an all-time low

- Hispanic American unemployment was at an all-time low

- Asian American unemployment was near an all-time low, and then the COVID-19 coronavirus outbreak terrorized the people of the world and the global economy

- In this blog, we will detail how to get an FHA loan if your credit score is below 660

In this breaking news article, we will discuss and cover How The Coronavirus Pandemic Affects Qualifying For FHA Mortgages.

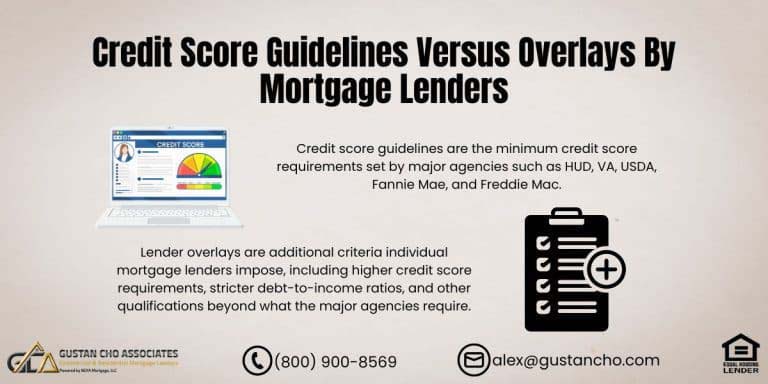

How The Coronavirus Pandemic Affects Qualifying For FHA Mortgages Versus Lender Overlays

Many lenders have added additional lender restrictions for FHA mortgage lending.

- After many major announcements and talking to numerous colleagues in the industry, most lenders have raised their minimum credit score requirements to 660 for FHA lending

- Others have raised them to 640

- The good news is, Gustan Cho Associates have not raised their credit score requirements

We still offer all of our FHA products without any additional LENDER OVERLAYS.

How The Coronavirus Pandemic Affects Qualifying For FHA Mortgages And Loan Programs That Have Been Suspended

Below are details on our FHA products that most lenders no longer offer:

Low credit score FHA options:

- We offer FHA mortgage loans with credit scores all the way down to 500

- If your credit score is between 500 and 579, you will be required to put down a minimum of a 10% down payment

- There is no way around this, this is an FHA guideline

- Besides the 10% down payment requirement, there is a more strict debt to income and documentation requirements for credit scores below 580

We are the experts in FHA lending with scores below 580.

Borrowers With Under 620 Credit Scores

For all credit scores above 580, only a 3.5% down payment is required.

- This is the most common FHA mortgage transaction

- Thousands of Americans utilize FHA mortgages to purchase homes every single year

- They are an amazing loan program and allow lower credit scores and higher debt to income ratios compared to conventional mortgage lending

- Since most mortgage lenders have raised their minimum credit score requirements, we have seen an increase in FHA applications over the past few weeks

Once again, we can go down to credit scores of 580 with just a 3.5% down payment.

HUD Manual Underwriting Guidelines Versus Lender Overlays During The Pandemic Crisis

FHA manual underwriting:

- This has always been a staple of Gustan Cho Associates

- We are experts in mortgage manual underwriting

- While the bulk majority of lenders do not participate in manual underwriting, we know the ins and outs like the back of our hand

- Many lenders will tell you do not qualify because you do not get an automated approval on the automated underwriting system (AUS)

- That does not mean you can’t qualify for a manual underwrite

- There are very specific requirements that must be met to pass a manual underwrite

- Most of those requirements are based on your credit report

- Your payment history is incredibly important

- Also, your debt to income ratios is slightly more strict compared to automated approval

- Most of the time, we do not suggest maxing out your debt to income ratio whether you require a manual underwrite or have an automated approval

- We want to make sure you stay within your budget

For more information, please click our FHA MANUAL UNDERWRITING BLOG.

How The Coronavirus Pandemic Affects Qualifying For FHA Mortgages: FHA 203k Loans

FHA 203k lending:

- FHA 203K renovation mortgage lending can be a difficult process

- Even without a global pandemic, many lenders do not participate in this space

- A renovation loan is a great way to increase the value of your property

- During the COVID-19 coronavirus outbreak, we still offer 203K standard and 203K Limited mortgage products

- These products can be a little tough to complete as not every contractor is still accepting new jobs

- It may also be difficult to obtain necessary permits from your local municipality

Please see our blog on FHA 203K LENDING for more information on the loan program itself.

Future Mortgage Market Forecast Due To Pandemic And Economic Crisis

Gustan Cho Associates do anticipate the mortgage market stabilizing in the next few months.

- However, until this happens, interest rates and discount points will be all over the map

- Even with higher credit score borrowers, we are seeing discount points required to obtain an interest rate for a mortgage transaction

- This has to do with the chaos throughout the U.S. and the global economy

- Wall Street temporarily has slowed down the purchase of mortgage-back securities, creating a ripple effect through the mortgage market place

For more information on discount points and how they may apply to your FHA mortgage transaction, please check out this blog on DISCOUNT POINTS DURING COVID- CORONAVIRUS.

Qualifying For A Mortgage With No Lender Overlays At Gustan Cho Associates

Gustan Cho Associates are excited to continue to offer FHA mortgage products without lender overlays. Even before this pandemic, numerous Americans were affected by mortgage lender overlays. About 75% of my clients have been turned down by the current lender or are not receiving the communication they deserve. For our clients, even if you do not qualify today, we will set up a custom financial plan to have you qualify to buy a home as soon as possible.

For questions surrounding FHA mortgage qualifications, please call Mike Gracz on (800) 900-8569. Mike Gracz is also available via email at gcho@gustancho.com. There is a lot of uncertainty throughout the entire world in moments like this. It is important to take a step back and understand what is important. We hope everyone is safe and keeping their friends and family as safe as possible. We are available seven days a week to answer your mortgage questions. We hope to hear from you soon. Subscribe to our YouTube CHANNEL to stay current on the everchanging mortgage market.