This Breaking News Article Is About ECB Cuts Rates To Negative Interest Rates To Avoid Recession : BREAKING NEWS: ECB Cuts Rates To Negative Interest Rates: Breaking News the European Central Bank has cut rates into negative territory hit the World Financial Markets. The breaking news came in just minutes ago. In this article, we will discuss the breaking news of the ECB Cuts Rates To Negative Interest Rates To Avoid Recession.

Terms of The News of ECU Cut Rates Into Negative Interest Rates

The European Central Bank announced the ECU plans on restarting purchasing government bonds. This initiative was placed to fuel-start the sluggish eurozone economy. The European Central Bank also announced that it will be cutting the deposit rate on by 10 basis points.

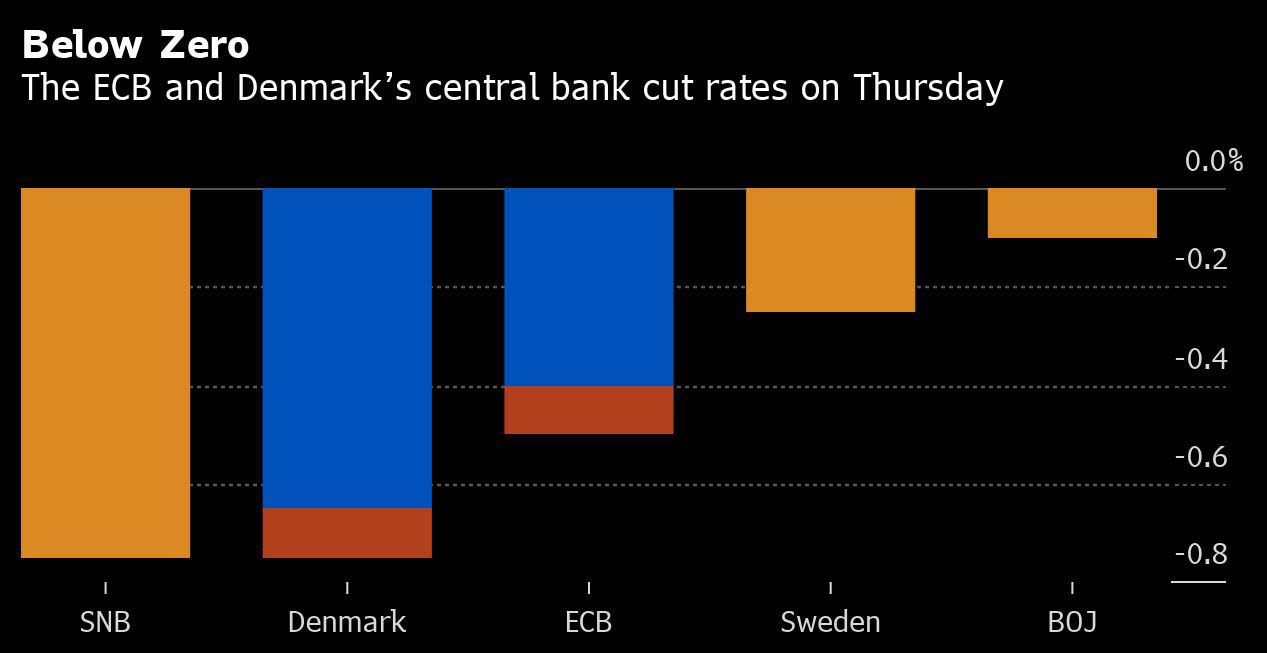

The 10 basis point cut will set an all-time new record low of -0.50%. The ECU will restructure the central banking system to accommodate the stress and pain banks will be dealing with due to negative rates.

This breaking news was announced on Thursday, September 12th, 2019. This announcement came one day after President Trump announced that the Feds should lower rates to zero or lower. The ECB went aggressive to make this plan work. They cut the cost of long-term loans to banks and lenders. Lenders will be exempt on negative rates on their deposits. This went into effect after lenders complained about profitability.

Proactive Approach By Central Banks

Every country is worried about their economy and inflation. Many fear another Great Recession coming its way. What this news means is the following:

- The deposit rate will be cut from -0.40% to -0.50%

- This is the first deposit rate cut since March 2016

- The main refinancing rate will remain at 0% which is unchanged from what the rate is currently

- The TLTRO pricing will be aligned and linked to the deposit rate for banks that conform to the lending guidelines and criteria

- The bond purchasing will be set to begin in November 2019

- The expected purchase amount will be initially set at a rate of 20 billion euros ($22 billion U.S. Dollars) per month

- There is no expiration or term deadline

- It will run as long as necessary until its inflation goal has been met

- This is going to run “for as long as necessary”

- The negative interest rates have been the talk recently

- President Trump sharply criticized Fed Chairman Jerome Powell is not being aggressive enough with the Fed monetary policy and playing footsie by delaying interest rate cuts

The European Central Bank cut in interest rates further below zero into negative territory and restarting the purchasing of bonds is exactly what Trump has in mind for the U.S. President Trump is so aggravated that he went on by calling Fed Chairman Jay Powell and the members of the Feds “Boneheads.”

What Experts Are Saying

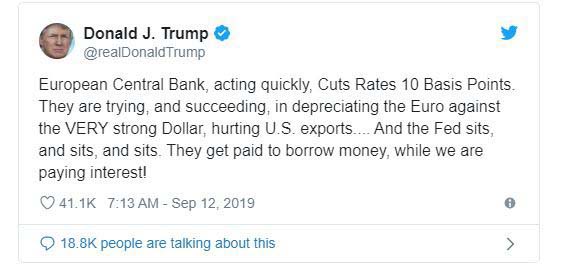

President Trump did not waste any time in making a comment after the news hit the newswires.

Trump Comments After The Breaking News on ECB Cuts Rates

President Donald Trump commended the ECU. He said the ECB is acting very quickly while the Federal Reserve Board is just sitting. He went on and said the Feds just “sits, and sits, and sits.”

Draghi commented they do not target exchange rates after the Tweet by President Trump.

ECB Cuts Rates: Is Below Zero Interest Rates Going To Be The Norm Of The Future?

The ECB’s actions of a new stimulus package are considered a positive event. This is a developing story. Gustan Cho Associates Mortgage News is on top of this story. Our mortgage experts will keep you posted as news develops in the coming days and weeks on this subject matter. Stay tuned.