Warehouse Line of Credit Used By Mortgage Bankers

In this blog, we will discuss and cover the warehouse line of credit used by mortgage bankers and correspondent lenders….

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will discuss and cover the warehouse line of credit used by mortgage bankers and correspondent lenders….

This guide covers home mortgage case scenarios for homebuyers. Many borrowers have trouble qualifying for conventional and FHA mortgage financing….

In this blog, we will cover and discuss how do mortgage underwriters qualify borrowers. Credit scores and income is what…

This ARTICLE On 15 Year Versus 30 Year Fixed Rate Mortgages On Loan Programs. All residential mortgage loan programs have…

This blog post will explore and elaborate on the Texas Cash-Out Refinance Guidelines in home mortgages. Gustan Cho Associates, a…

In this blog, we will cover and discuss qualifying and getting a mortgage approval for home purchase on acreage in…

If you’re married and you buy a home in a community property state, you’ll face different rules for qualifying. Most of these rules come into play if you finance your home with a government-backed home loan like the FHA, VA or USDA programs.

This guide covers understanding the basics on what is a mortgage. We will cover and discuss the meaning of what…

This guide covers the difference between FHA and Conventional mortgage guidelines. Many homebuyers, especially first-time buyers shopping for homes often…

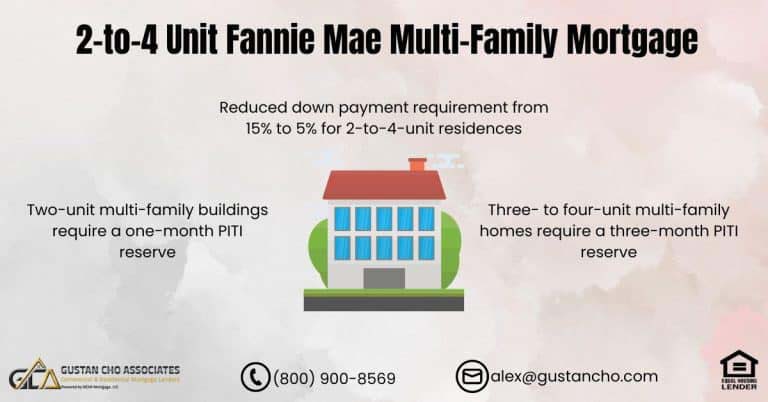

This manual addresses the modifications in down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by the…

This guide covers the truth in lending disclosure during the mortgage process. Mortgage disclosures are required to be disclosed to…

This article covers escrow account mortgage guidelines and requirements. Lenders conduct periodic escrow analyses to ensure that the account balance…

In this blog, we will cover what a 3-2-1 buydown mortgage is. We will also discuss the differences between a…

In this blog, we will cover and discuss buying house near airport. Homebuyers need to consider the benefits and…

Gustan Cho Associates are experts when analyzing consumer credit reports. Since we do not have lender overlays, we see all…

The FHA W-2 Income Only Mortgage Lending Guidelines provide a pathway for borrowers to qualify for an FHA loan based…

In this article, we will cover and discuss how credit disputes affect mortgage process and cause loan denial. The pre-approval…

This guide offers insights into Fannie Mae Guidelines on Community Property States, catering to individuals searching for mortgage-related information. An…

Every mortgage borrower is different. Your income, debts, credit rating, savings, and goals are unlike anyone else’s. The best mortgage for your neighbor might be the worst home loan for you.

This guide covers the benefits of paying mortgage balance early before end of loan term. Paying mortgage balance early before…

In this blog, we will cover and discuss buying and moving to another owner-occupied home without selling their first home….

The primary emphasis of this blog centers around the waiting period obligations that individuals face after foreclosure, specifically those on…