HUD Guidelines versus Lender Overlays on FHA Loans

This guide covers HUD guidelines versus lender overlays on FHA loans. There have been notable changes for HUD guidelines versus…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers HUD guidelines versus lender overlays on FHA loans. There have been notable changes for HUD guidelines versus…

This guide covers the difference between FHA and Conventional mortgage guidelines. Many homebuyers, especially first-time buyers shopping for homes often…

FHA mortgage loans stand out as the leading choice among borrowers in the United States. The Federal Housing Administration (FHA)…

In this blog, we will discuss and cover the FHA appraisal transfer from your old lender to a new mortgage…

This guide provides clear information about Fannie Mae’s rules for Community Property States, helping people looking for mortgage information. It…

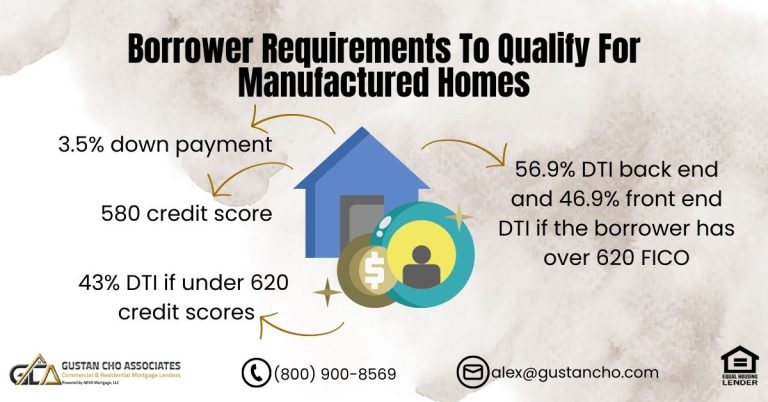

This guide covers FHA Guidelines on Manufactured Home Loans. FHA Guidelines on manufactured home loans are released. HUD, the parent…

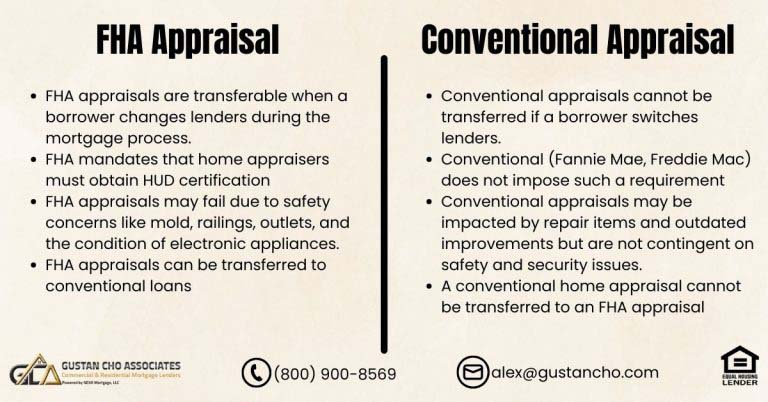

This article examines and clarifies the criteria for FHA Appraisals Versus Conventional Appraisals. There are significant differences in the guidelines…

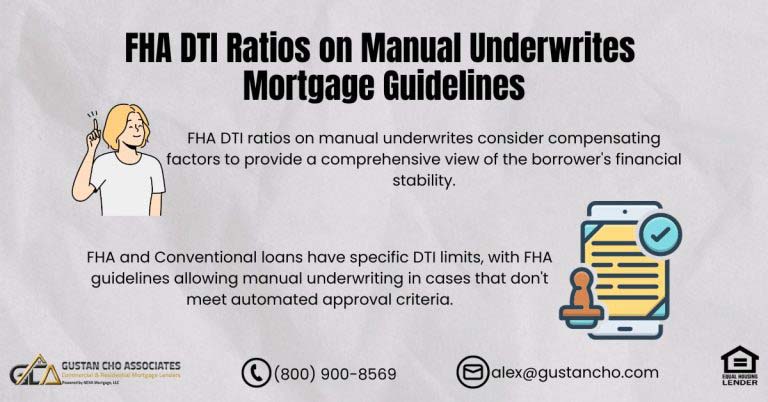

This article will delve into the mortgage guidelines for FHA DTI ratios on manual underwrites. The key distinction between manual…

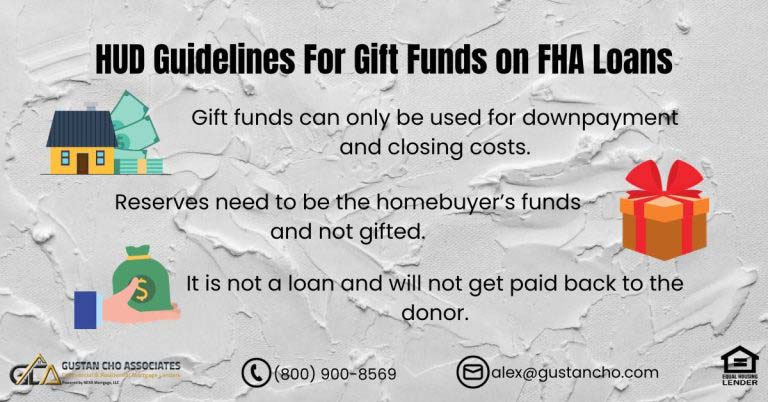

This article will delve into the HUD guidelines for gift funds in the context of home purchase transactions involving Federal…

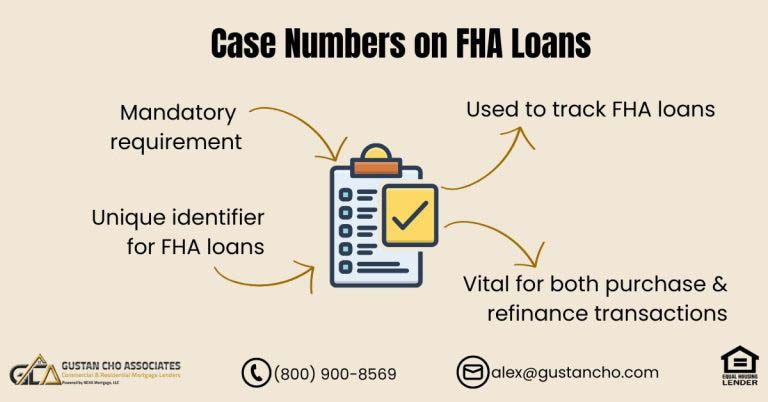

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers…

In this article, we will cover and discuss the comparison between jumbo loan vs conventional loan programs and the…

This guide covers overlays on debt-to-income ratio on FHA loans. Homebuyers who got issued pre-approval from a mortgage loan originator…

This guide covers eliminating FHA mortgage insurance premium by refinancing FNMA. Borrowers taking out an FHA insurance mortgage loan, besides…

This guide covers Fannie Mae and HUD Guidelines on conventional versus FHA loans. Fannie Mae and HUD guidelines on conventional…

This article covers Conforming versus government-backed loans. FHA, VA, and USDA loans are called government-backed loans. This is because lenders…

This guide covers the frequently asked question can I get denied for FHA loan with good credit on home purchase….

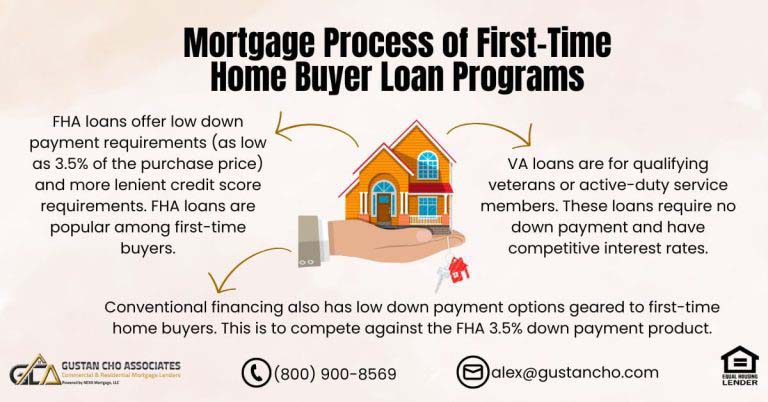

This guide covers the mortgage process of first-time home buyer loan programs. First-time home buyers have dominated the housing market…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

This guide cover FHA versus conventional mortgage after bankruptcy. There are differences in when and how you can qualify for…

This guide covers setting up written payment agreements with creditors and collection agencies so you can qualify and get pre-approved…

This guide covers the credit scores required for FHA and VA loans. Many borrowers are confused about the credit scores…

This guide covers solutions for no credit scores on mortgage loan approvals. There are cases where consumers do not have…