In this blog, we will discuss and cover FHA vs conventional cash-out refinance mortgage loans and general rate and term refinance mortgage guidelines. HUD, the parent of FHA, has changed the FHA cash-out refinance guidelines for homeowners from 85% loan to value to 80% LTV.

HUD requires FHA mortgage insurance premium on all 30-year fixed-rate FHA mortgages to have a mandatory annual FHA mortgage insurance premium for the life of a 30-year fixed-rate loan term.

In the following sections of this article, we will be covering FHA vs conventional cash-out refinance guidelines.

Should You Refinance From Conventional to FHA?

One of the common frequently asked questions often asked by homeowners. is should you refinance from conventional to FHA?

The biggest benefit of refinancing an FHA loan to a conventional loan is if you have at least a 20% equity in your home where conventional loans do not require private mortgage insurance.

FHA loans require the annual 0.55% mortgage insurance premium for the life of the loan term. This holds true no matter how low the loan to value is on the FHA loan balance. On conventional loans, the private mortgage insurance premium falls off once the conventional loan balance are below the 80% LTV.

How Can I Qualify For Cash-Out Refinance Mortgage Loans?

To qualify for conventional loans, borrowers need higher credit score requirements and lower debt-to-income ratio requirements.

The only way to eliminate FHA MIP is to pay off the FHA loan by paying off the loan balance by selling the home or refinancing it into a conventional loan.

Fannie Mae and Freddie Mac cash-out refinance caps loan to value at 80% LTV. However, private mortgage insurance (PMI) is not required on conventional loans when the loan to value is at 80% LTV or lower.

FHA vs Conventional: Which Cash-Out Works for You?

Compare credit score, equity, and loan-to-value requirements side by side.

Can FHA MIP Get Removed By Refinancing To Conventional Loans?

Eliminating private mortgage insurance is a huge reduction in the monthly housing payments. You will be better off by paying a higher mortgage rate on a conventional loan versus an FHA loan with a lower rate and not having the mortgage insurance.

Your loan officer can go over the numbers on which loan program is best for you. The ideal plan for a cash-out refinance is to do a cash-out refinance from an FHA to a conventional loan.

To refinance your FHA loan to a conventional loan and eliminate private mortgage insurance, you would need higher credit scores, lower debt to income ratio, and a stronger credit profile.

What Are The Benefits of Cash-Out Refinance Mortgage?

The skyrocketing home prices in the nation were concerning to officials at HUD. Homeowners who owned their homes for the past few years had seen their homes appreciate double digits every year. Due to concerns of a potential housing market correction, HUD has lowered the loan to value to 80% LTV on cash-out refinances on FHA loans.

What Is The Difference Between FHA vs Conventional Cash-Out Refinance

FHA cash-out refinancing benefits homeowners with less than perfect credit, borrowers with credit scores down to 500 FICO, homeowners with high debt to income ratios, borrowers with high debt to income ratio, and homeowners with less than perfect credit. The negative with an FHA cash-out refinance mortgage is that the FHA mortgage insurance premium is mandatory for the life of a 30-year fixed-rate mortgage.

Can FHA MIP Be Removed By Refinancing?

Conventional loan requirements have strict credit and income guidelines. The minimum credit score on conventional loans is 620 FICO versus 500 FICO on FHA loans.

It will be difficult to get an approve/eligible per an automated underwriting system with a lower than a 680 credit score on a conventional loan.

Private mortgage insurance is not required on conventional loans with at least an 80% LTV. Your loan officer will go over the comparison on which loan program best benefits you.

Can You Refinance With a Cash-Out With a Low Credit Score?

FHA loans remain to be the most popular home loans in the nation for first-time homebuyers, borrowers with high debt-to-income ratios, borrowers with credit scores down to 500 FICO, borrowers with large outstanding collections, and charged-off accounts, and those with other credit/income issues. As mentioned earlier, the homeowners can benefit from doing a cash-out refinance from an FHA loan to a conventional loan.

Mortgage Guidelines on FHA vs Conventional Cash-Out Refinance

In many instances, the borrower may not qualify for a cash-out refinance on a conventional loan. The housing market is booming and many homeowners who have owned their homes for a few years have seen unbelievable appreciation where they are eligible for cash-out refinance mortgage loans.

What Is The Loan To Value on FHA vs Conventional Cash-Out Refinance Loans?

The loan to value on FHA vs Conventional Cash-Out Refinance loans is both the same at 80% LTV. The housing market is booming like never before in history. Never has the demand for homes been so strong. When there is far more demand for homes and a shortage of inventory of houses, that is what is driving home prices up. Despite the coronavirus outbreak and shutdowns throughout the country, home sales were not affected.

How Can I Get Equity Out of My Home Without Selling It?

The coronavirus outbreak in February 2020 and the economic downturn have not affected the housing market. It took the opposite effect. Home sales and home prices skyrocketed like never before in history. Demand for homes made buying homes over list price the norm. Homebuyers were buying homes at over list price. This was nationwide and not confined to certain parts of the country.

What Is The Prediction of The Future of the Housing Market?

The strong housing market is expected to continue into 2022 and 2023. There is no housing correction forecasted in the near future. The strong demand for homes is what is driving home prices up. The equity of homeowners is skyrocketing as time passes. Many homeowners are eligible to do a cash-out refinance. FHA Cash-Out Refinance Guidelines require a maximum of 80% Loan To Value. In this article, we will discuss and cover FHA Cash-Out Refinance Guidelines And Requirements For Homeowners.

What Are The Different Types of FHA Refinance Loans Are There?

There are different types of FHA Refinance Mortgage Loan Programs. The first is the FHA Streamline Refinance which a current homeowner with an FHA loan can do a rate and term.

FHA refinance mortgage loans with no credit scores, no appraisal required, and no income verification. In order to qualify for an FHA Streamline Refinance Mortgage, all borrowers on the initial loan need to be on the new FHA Streamline Refinance Loan. All FHA cash-out refinance mortgage loans are full doc loans including new home appraisal.

What Documents Do I Need For Full Doc FHA Refinance Loans

The second type of FHA Refinance Mortgage Loan is the general FHA Refinance Mortgage where an appraisal is required, credit scores are required, and income verification is required. This type of FHA Refinance Mortgage Loan is common for FHA mortgage loan borrowers who want to take a non-occupant co-borrower off the original FHA mortgage loan. Maximum loan to value required on FHA Refinance Mortgage Loans that are just rate and the term is 97.75%.

What’s the difference between FHA and Conventional cash-out?

FHA is more flexible with credit, Conventional works better for higher equity borrowers.

What Is The Difference Between FHA and Conventional Loan Refinance?

One common frequently asked question among homeowners is what is the difference between FHA and conventional loan refinance? To qualify for an FHA Refinance Mortgage Loan, homeowners need to wait six months from the date of their initial mortgage loan closing. The six-month waiting period to refinance an FHA Loan only applies for a rate and term FHA Refinance Mortgage Loan and FHA Streamline Refinance Mortgages.

Waiting Period Requirements To Do FHA vs Conventional Cash-Out Refinance Mortgage

FHA Cash-Out Refinance Guidelines have a mandatory one-year waiting period after the closing of the original mortgage loan. The maximum cash out allowed with FHA Cash-Out Refinance Loans is 80% loan-to-value. FHA loans require an FHA mortgage insurance premium even with an 80% loan-to-value.

What Does Fannie Mae and Freddie Mac Consider a Cash-Out Refinance?

Conventional loans are the loan program of choice for cash-out refinance due to not requiring private mortgage insurance for borrowers with at least 80% DTI. Borrowers need higher credit scores and higher credit profiles to benefit from conventional loans.

To qualify for a Conventional cash-out refinance, homeowners are eligible six months after the closing of their initial mortgage loan.

Conventional loans do have six-month waiting periods for rate and term conventional loans as well as cash-out conventional loans.

Loan To Value Cash-Out Refinancing on Conventional Loans

The maximum loan to value on cash-out conventional mortgage loans is capped at 80% loan to value. The maximum debt to income on conventional loans is a 50% debt to income ratio. It is difficult to get an approve/eligible per automated underwriting system on conventional loans with a 50% debt to income ratio. You need to have a credit score higher than 700 FICO to get an AUS approval with a 50% debt to income ratio on a cash-out refinance conventional loan.

Mortgage Insurance Premium Guidelines on FHA vs Conventional Cash-Out Refinance

All FHA loans require annual FHA mortgage insurance premiums for the life of the 30 years FHA fixed-rate mortgage loan. This requirement is also for FHA Cash-Out Refinance Mortgage Loans.

The Annual FHA mortgage insurance premium is currently at 0.55% of the FHA loan amount and is paid monthly as part of the housing payment.

With conventional loans, private mortgage insurance is required for all loans with LTV higher than 80% LTV. Since the cap on cash-out conventional refinance mortgage loans is capped at 80% LTV, no private mortgage insurance is required on cash-out conventional refinance mortgage loans.

Mortgage Rates on FHA vs Conventional Cash-Out Refinance

There are pricing adjustments on cash-out refinance mortgages. Mortgage rates on FHA Cash-Out Refinance Mortgage Loans are slightly higher than mortgage rates and term refinance loans. Rates on cash-out conventional refinance mortgages are also higher than the standard rate and term rates.

Loan Level Pricing Adjustments on FHA vs Conventional Cash-Out Refinance Loans

Other pricing adjustments on higher mortgage rates are 2 to 4 unit properties. Two to Four unit properties have higher mortgage rates than single-family homes.

Condominiums have higher mortgage rates than single-family homes. The higher the loan to value, the higher the mortgage rates.

The higher mortgage rates are called pricing adjustments. The reason for pricing adjustments is due to the lenders considering higher risk on cash-out refinances.

Proceeds From FHA vs Conventional Cash-Out Refinance Mortgage Loans

Lenders cannot dictate what to do with the proceeds from cash-out refinance loans on both FHA and conventional loans. Homeowners can use the proceeds from FHA and Conventional loans cash-out refinance for any reason they see fit. You can use it to pay bills, renovate your home, or take a long-overdue vacation. Proceeds from cash-out refinances are tax-free. Homeowners do not have to pay a red cent from the cash proceeds from their cash-out refinancing.

What Are Cash-Out Refinance Used For?

Here are what most homeowners use their cash proceeds from their cash-out refinance mortgages:

- Pay off a second mortgage or Home Equity Line Of Credit, HELOC

- Pay outstanding credit card balances

- Pay auto loans

- Remodel their home

- Use it for college education

- Use it to pay off car loans or purchase a new vehicle

- Use it for emergencies such as medical bills or elderly care

- Use it for personal reasons such as taking vacations

- Use it to pay for high-ticket events such as weddings and anniversaries

How Long Does The Cash-Out Refinance Process Take?

To qualify for cash-out refinance mortgages with a mortgage company licensed in multiple states with no lender overlays on government and conventional loans, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Borrowers can also email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Is It Hard To Do a Cash-Out Refinance?

It is not difficult to do a cash-out refinance if you have been timely on all mortgage payments in the past 12 months. Gustan Cho Associates has a national reputation for being able to do loans other mortgage companies cannot do.

Gustan Cho Associates has a national reputation for its no lender overlays on government and conventional loans. We are mortgage bankers, correspondent lenders, and mortgage brokers.

Over 80% of our borrowers are folks who could not qualify at other mortgage companies due to their lender overlays or because the lender did not have the mortgage loan option best suited for the borrower.

Can I Do a Cash-Out Refinance on an FHA Loan?

Cash-Out Refinance Mortgage Guidelines on FHA loans were lowered from 85% LTV to 80% LTV in 2020. Housing values have been skyrocketing for the past several years. Year after year, home values throughout the nation have been rising. In many areas, home values were increasing double digits year after year.

Is It Better To Do a Cash-Out Refinance During Booming Housing Market?

Due to skyrocketing home prices, HUD and the Federal Housing Finance Agency (FHFA) have been increasing FHA and Conventional Loan Limits for the past six years. The FHA loan limit for 2025 is $524,225. 2022 Conforming Loan Limits is now capped at $805,600. Due to the skyrocketing home prices and values, HUD decided to lower the maximum loan to value on Cash-Out Refinance Mortgage on FHA loans from 85% LTV to 80% LTV.

Who helps with both FHA and Conventional refinances

Gustan Cho Associates offers both programs nationwide with no overlays.

2024 UPDATE on Cash-Out Refinance Guidelines

Many homeowners do not realize the amount of equity they have in their homes due to skyrocketing home values. HUD, the parent of FHA, allows homeowners to refinance their existing home loans and cash out additional equity. The proceeds from the cash-out refinance are tax-free. Homeowners can use the cash from the cash-out refinance mortgage for any purpose they like.

What Mortgage Experts Say About Cash-Out Refinance Mortgage Loans

Why do Homeowners Do Cash-Out Refinance?

Popular reasons to use cash proceeds from a cash-out refinance are the following:

- Home renovations and improvements

- Pay off other high-interest debts such as credit card debt, auto loans, student loans, second mortgages, and other debts

- Investments such as buying another property, buying a second home, stocks, and bonds

- Pay for a wedding

- Use the proceeds to start a business

Homeowners with equity in their homes may qualify for an FHA Cash-Out Refinance Mortgage. HUD recently lowered the loan to value of cash-out refinance mortgages on FHA loans from 85% to 80% loan to value.

Eligibility Requirements To Qualify For an FHA Cash-Out Refinance

To qualify for an FHA cash-out refinance mortgage, borrowers need to meet all the minimum HUD Agency Guidelines on FHA loans. Here are the eligibility requirements and agency mortgage lending guidelines:

- The maximum loan to value is 80% LTV

- The minimum credit score required is 500 FICO

- The two-year waiting period after Chapter 7 Bankruptcy discharged date

- Three year waiting period after a foreclosure, deed in lieu of foreclosure, short sale

- There is a six-month waiting period to qualify for a rate and term refinance on FHA loans from the closing date

- There is a twelve-month waiting period to qualify for a cash-out refinance a mortgage on FHA loans from the closing date

- Timely mortgage payments in the past 12 months

The mortgage rates are based on the borrower’s credit scores.

How Does FHA Cash-Out Refinance Works?

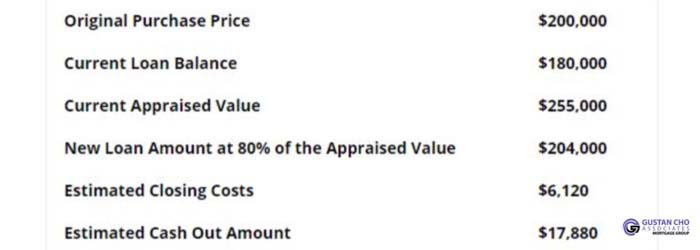

Look at a case scenario chart below on how an FHA Cash-Out Refinance Mortgage works:

There are closing costs on all home purchases and refinance transactions. All closing costs on refinances can be rolled into the loan balance or paid from the proceeds of the cash-out funds. The amount of closing costs depends on several factors. Closing costs vary depending on the location of the property, the type of property, and the loan level pricing adjustments.

Mortgage Rates on Cash-Out Refinance Mortgages

Mortgage rates are at historic lows. 30-year fixed-rate mortgages just hit 2.96% for prime borrowers. However, there are pricing adjustments on cash-out refinance mortgages.

Lenders consider cash-out refinances riskier than rate and term refinance. Therefore, there will be pricing hits on cash-out refinance mortgages.

To get the lowest possible rate, borrowers should maximize their credit scores. The team at Gustan Cho Associates are experts in helping borrowers boost their credit scores so they can get the lowest possible mortgage rates.

What Are The Closing Costs on Cash-Out Refinance?

Alex Carlucci of Gustan Cho Associates is a cash-out refinance mortgage expert. Alex said the following:

Something you need to consider before moving ahead with a cash-out refinance is the closing costs. FHA closing costs will amount to anywhere from 2%-5% of the loan amount.

However, you will not need an inspection which will save you some money and you get a pro-rated discount on the mortgage insurance when you refinance. The closing costs will be paid for out of the cash out funds or will essentially reduce the amount you can cash out.

How Can I Qualify For Cash-Out Refinance With a Lender With Lenient Guidelines

To qualify for a cash-out refinance mortgage, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Homeowners with enough equity are using cash-out refinancing to improve the terms of their current mortgage and get extra cash while they’re at it. They do this by replacing their old mortgage with a new, larger one and taking the difference in cash.

Homeowners Sitting on a Lot of Equity In Their Homes

Many homeowners who purchased homes about ten years ago bought at the bottom of the real estate market. Double-digit home appreciation rates are common in much of the country. Some California homeowners have seen 20% to 30% appreciation. These homeowners are good candidates for cash-out refinancing.

Cash Proceeds From Cash-Out Refinancing

Proceeds from cash-out refinance mortgages are tax-free because they are not income. Homeowners can take the cash proceeds for any reason. Here are some popular ones:

- Pay off higher-interest debt

- Fund home improvement projects

- Purchase additional property

- Start a business

- Pay for college

Cash-out refinancing is not the only way to pay for these things, but it could be the cheapest source of financing. Related: How to Buy a House With $0 Down

Cash-Out Refinance vs Rate and Term Refinance

There are three main types of refinancing, and they all have different guidelines. A rate and term refinance just replaces your old mortgage with a better mortgage. The amount of the new loans equals the payoff of the old loan.

A limited cash-out refinance is similar. You’re allowed to add your refinancing costs to your loan balance, so you can refinance with no out-of-pocket costs.

And a cash-out refinance replaces your old loan, adds your refinancing costs to your loan amount, and adds the amount of cash-out you want to your new loan as well.

How Does Rate and Term Refinance Work?

Rate and term and limited cash-out refinance have the least restrictive guidelines because they are safer than cash-out refinances. Cash-out refinances also have higher fees than rate and term or limited cash-out refi. For instance, Fannie Mae lenders allow rate and term refinance up to 97% of the property value, while cash-out refinances can only go up to 80%. And the fee for a cash-out refinance, if your FICO score is 700, is 1.125% more. And while purchases and rate-and-term refinancing is allowed with FICO scores down to 620, you’ll need a 680 FICO if you want a cash-out refinance.

Which cash-out loan saves me the most money?

It depends on your credit, loan size, and financial goals.

Cash-Out Loan To Value Guidelines by Loan Program

Different loan programs set varying limits on the amount of cash you can take out when you refinance. FHA cash-out refinancing is limited to 80% of the property value (It was reduced from 85% in 2019).

Conforming (Fannie Mae and Freddie Mac) programs allow cash-out to 80% loan-to-value (LTV). VA cash-out refinancing is limited to 100% LTV.

Other programs might allow you to pull more cash out when you refinance. These are “non-prime,” “non-QM” or “portfolio” loans offered by individual lenders and kept on their own books. It’s harder to find loans with creative guidelines like these but they are out there.

Related: Non-QM Cash-Out Refinance to 90%

How Property Type Affects Cash-Out Refinancing

Different property types are subject to different rules and limits for cash-out refinancing. For instance, most conventional guidelines limit cash out for 2-4 unit properties to 75% LTV.

On the other hand, the limit for single-family homes is 80%. The cash-out refinance limit for manufactured homes is 65% LTV under most conventional loan guidelines. And under conventional guidelines, co-ops don’t qualify for cash-out refinancing at all.

How Property Use Affects Cash Out

It’s not just the type of property that impacts your cash-out refinance guidelines, pricing, and LTV limit. The use — primary residence, second home, or investment property — also impacts how much cash you can take and what it takes to get approved. Government-backed loans only allow primary residences, so this section only pertains to conventional (non-government) home loans. For primary residences, you can do cash-out refinancing to 80% LTV. For second homes, that drops to 75%. With investment property like rental units, your limit is 75% for single-family homes and 70% for 2-4 unit dwellings.

What Factors Affect Refinancing?

Many refinance mortgage borrowers often ask what factors affect refinancing? Current mortgage rates and loan level pricing adjustments normally are the biggest factors affecting refinancing. Closing costs should be considered. Closing costs and the period to recoup your closing costs on the refinance needs to be taken into account.

What Are The Net Tangible Benefit To Borrowers in Refinancing

What net tangible benefit does the borrower have is what you need to consider also. Homeowners who need a cash-out refinance can prequalify by clicking APPLY NOW. A licensed loan officer from Gustan Cho Associates will go through your results with you and work together with you to choose the right program for your situation. You can also call us at Gustan Cho Associates anytime, 7 days a week, at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com.

When Can You Do a Cash-Out Refinancing on Government And Conforming Loans

Updated Cash-Out Refinance Guidelines. Cash-Out Refinance Guidelines depend on the type of mortgage loan programs the borrower selects. Loan to value is the key when it comes to cash-out refinance guidelines. FHA and Conventional loans are the most popular mortgage loan programs in the United States.

Waiting Period Guidelines on Cash-Out Refinancing

There is loan to value requirements and seasoning requirements when it comes to cash-out refinances for FHA and conventional loans. The key when it comes to cash-out refinancing is to find out what the property is worth. Housing prices in many parts of the country have been appreciating in recent years. This holds true, especially in many parts of Florida, California, Illinois, Texas, Alabama, Virginia, Georgia, Ohio, Tennessee, Kansas, Nevada, and Arizona.

When Is The Best Time To Do Cash-Out Refinancing

Many homeowners in California have seen their homes appreciate more than 30% in the past three years. Many homeowners in Florida have seen their home values appreciate equally as much if not more. Texas is a booming state. Many homes are under contract the day it is listed. In the Miami-Dade area, Palm Beach County, and Broward County, real estate demand is so high that many sellers are not offering seller concessions to home buyers anymore. Many homes in areas where the demand is higher than the inventory of homes that are listed on the market, homes are selling over the listing market price.

Demand versus Inventory of Homes

Homebuyers are willing to purchase the home over the appraised value. The increased demand for homes versus the housing inventory out there is creating an increase in home values throughout the country. This is good for homeowners who are looking for a cash-out refinance mortgage on their homes. They can use the extra cash to do home improvement, pay off credit card debt, use it for a down payment on investment property, or use it for personal and/or other reasons.

HUD Cash-Out Refinance Guidelines on FHA Loans

A home buyer who purchased a home with an FHA Loan is eligible to do a rate and term streamline refinance mortgage loan. Homeowners will qualify for an FHA Streamline Refinance after he or she has made six monthly timely mortgage payments on their FHA-insured mortgage loan. However, to be eligible to do a cash-out refinance mortgage on an FHA loan, the homeowner needs to have made at least 12 months of timely payments on their FHA loan.

HUD Waiting Period To Refinance on Cash-Out vs Rate and Term Refinancing

There is a six-month waiting period to do a rate and term refinance on an FHA loan. There is a 12 month waiting period to do a cash-out refinance mortgage loan on an FHA loan.

The maximum loan to value on an FHA Cash-Out Refinance Mortgage Loan is 80% LTV. This is possible for homeowners who purchased their home with a lot of down payment or homeowners who have had their homes appreciate substantially.

The United States Department of Housing and Urban Development, also known as HUD, is the parent of FHA. They are the governmental entity that sets FHA Guidelines On Cash-Out Refinance Mortgages as well as all other FHA lending guidelines. Refinance With 500 FICO Today!!!

Fannie Mae Cash-Out Refinance Guidelines on Conventional Loans

Fannie Mae and Freddie Mac are the two mortgage giants in the United States that set mortgage lending guidelines for Conventional loans. Conventional loans are also often called Conforming loans. This is because they need to conform to Fannie Mae and/or Freddie Mac mortgage lending standards. Fannie Mae and Freddie Mac require a six-month seasoning requirement for a Conventional mortgage loan borrower to be able to refinance their home loan into a Conventional loan.

Waiting Period For Cash-Out Refinance on Conventional Loans

Cash-Out Refinance Guidelines on Conventional loans is that borrowers need to wait six months from their home purchase in order to do a cash-out refinance mortgage. This is the same as with a rate and term refinance.

Unlike on FHA loans, the rate and term refinance waiting period is 6 months and the FHA cash-out refinance period is 12 months seasoning requirement.

The loan to value requirement is 80% LTV on a Conventional loan cash-out refinance mortgage whereas the loan to value is also capped at 80% LTV on FHA loans.

Cash-Out Refinance Guidelines on Other Mortgage Loan Programs

Homeowners can also do cash-out refinance mortgage loans on Jumbo Mortgages. Jumbo Mortgage Loans are called non-conforming loans. This is because they do not conform to Fannie Mae and/or Freddie Mac mortgage lending guidelines.

With Jumbo Mortgages, their loan limits exceed the maximum Conventional mortgage lending limit of $806,500. Most Jumbo lenders will only do a cash-out refinance of up to 75% LTV.

There may lenders that may do an 80% loan-to-value cash-out refinance mortgage loan on a Jumbo mortgage. Jumbo loans have higher credit standards and lower debt-to-income ratio requirements than Conventional loans and other mortgage loan programs. This is due to the risk lenders take on lending on a higher-end property.

Refinance Mortgage Guidelines on USDA Loans

USDA loans will only allow rate and term refinance and will not allow cash-out refinance mortgage loans. Homeowners with a current USDA loan who have substantial equity in their homes and need to do a cash-out refinance mortgage may need to do a cash-out refinance with either an FHA Loan or a Conventional loan. VA loans ( if the borrower is a veteran and meets VA mortgage lending guidelines ) allow up to 100% LTV cash-out mortgages.

Refinance Mortgage Guidelines on VA Loans

The United States Department of Veterans Affairs is the governmental agency that is in charge of VA loans. VA loans are hands down the best mortgage loan program available. However, VA loans are only limited to Veterans of the United States Armed Services who have a Certificate of Eligibility. To qualify, veterans need to have been honorably discharged from one of the branches of the United States Armed Services.

What Is The Max LTV on Cash-Out Refinance on VA Loans?

The Department of Veteran Affairs allows up to 100% loan to value on a VA loan cash-out refinance mortgage. However, there are VA mortgage lenders who will have VA mortgage lender overlays. Lenders with overlays may only lend up to 90% LTV on a VA loan even if the Department of Veterans Affairs will allow up to 100% LTV VA Loan cash-out refinancing.

FAQs: FHA vs Conventional Cash-Out Refinance Mortgage Loans

- 1. What is the difference between FHA vs conventional cash-out refinance? The credit score requirements, loan-to-value limits, and mortgage insurance differ between FHA and conventional cash-out refinance. Mortgage insurance premiums are required for FHA loans throughout the loan but not for conventional loans if the loan-to-value ratio is less than 80%.

- 2. Can I remove FHA mortgage insurance by refinancing to a conventional loan? Yes, you can remove FHA mortgage insurance by refinancing to a conventional loan, provided you have at least 20% equity in your home.

- 3. What are the credit score requirements for FHA vs conventional cash-out refinance? FHA loans usually need a minimum credit score of 500, while conventional loans typically require a minimum credit score 620. However, having a higher credit score will make getting approved for a conventional cash-out refinance easier.

- 4. How much equity do I need to qualify for an FHA vs conventional cash-out refinance? FHA and conventional cash-out refinances require at least 20% equity in your home. This means your loan-to-value ratio should be at most 80%.

- 5. Are there differences in debt-to-income ratio requirements for FHA vs conventional cash-out refinance? Yes, FHA loans are generally more lenient and have higher debt-to-income ratios. In comparison, conventional loans require lower debt-to-income ratios for approval.

- 6. Can I get a cash-out refinance with a low credit score? Borrowers can access FHA cash-out refinance options even with credit scores as low as 500. In contrast, conventional cash-out refinances usually necessitate higher credit scores.

- 7. What are the benefits of choosing an FHA vs conventional cash-out refinance? An FHA cash-out refinance can be a favorable choice for individuals with lower credit scores or higher debt-to-income ratios. Conversely, a conventional cash-out refinance is better suited for those with higher credit scores and a minimum of 20% equity to avoid mortgage insurance.

- 8. How does mortgage insurance work for FHA vs conventional cash-out refinance? Mortgage insurance premiums are necessary for the entire loan term with FHA loans, whereas conventional loans only mandate private mortgage insurance if the loan-to-value ratio exceeds 80%. Canceling this insurance is permitted when the loan-to-value ratio falls below 80%.

- 9. Can I use the proceeds from an FHA vs conventional cash-out refinance for any purpose? Yes, you can use the proceeds from FHA and conventional cash-out refinances for any purpose, such as home improvements, debt consolidation, or other personal expenses.

- 10. How long does it take to complete an FHA vs conventional cash-out refinance? The timeline for completing an FHA vs conventional cash-out refinance varies but typically takes 30 to 45 days. The process involves an appraisal, credit review, and underwriting approval.

Homebuyers looking to do a cash-out refinance the mortgage on an FHA loan, conventional loan, VA loan, or Jumbo loan, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. We are available 7 days a week to take your phone calls or email inquiries to answer any questions you may have.

Do I need more equity for Conventional cash-out?

Yes—Fannie Mae usually requires at least 20% equity, FHA allows more flexibility.