This blog will discuss whether you can qualify for a mortgage after a recent eviction. One of the most frequently asked questions daily at Gustan Cho Associates is if you can qualify for a mortgage with a recent eviction. If your landlord has not taken the eviction to the credit reporting agencies, it should not be a problem. If you rent an apartment or home from a property management company, the chances are your eviction will be reported to the three credit bureaus.

There are ways around getting a mortgage, even with a recent eviction. Recent evictions that are not reported on the credit bureaus do not matter.

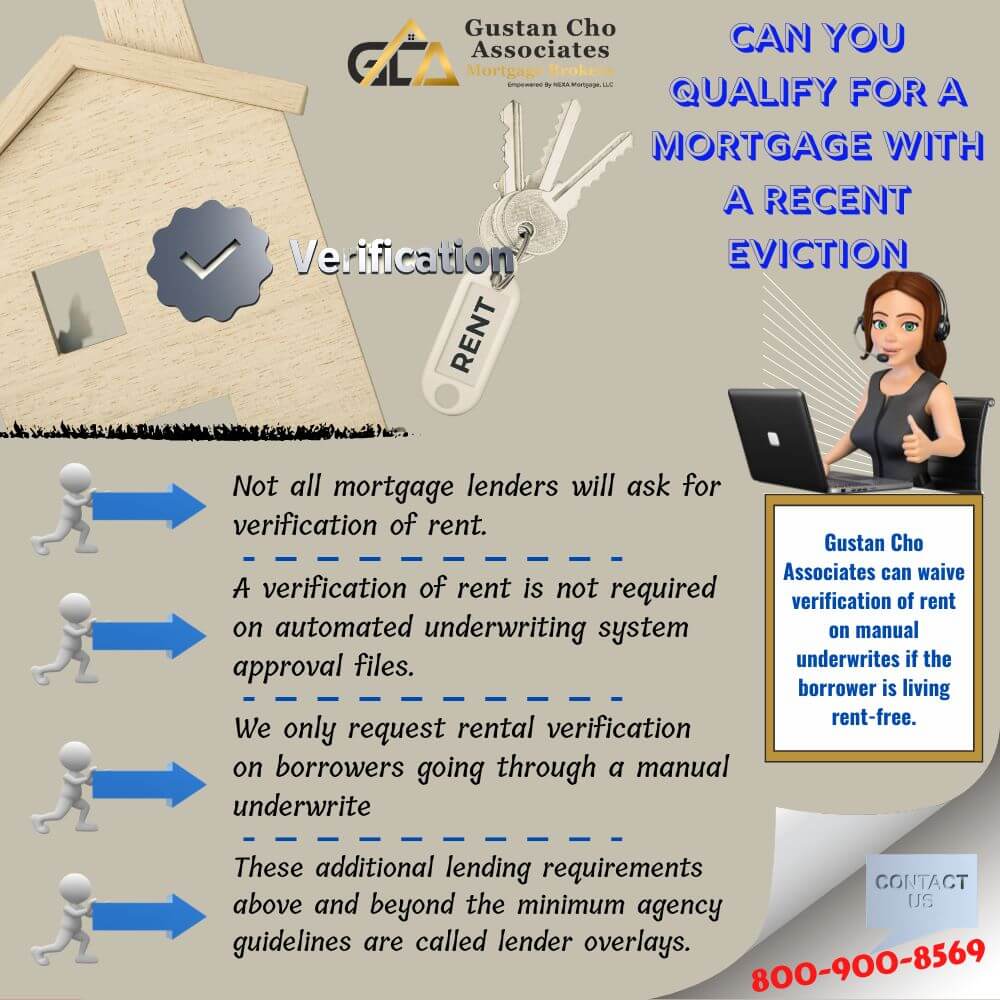

Borrowers should not volunteer for the recent eviction and not report on credit bureaus to the mortgage underwriter. Verification of rent is not required for borrowers who get an approve/eligible per the automated underwriting system (AUS). In the following paragraphs, we will discuss a frequently asked question: can you qualify for a mortgage with a recent eviction?

Should I Be Worried About Underwriting With Previous Eviction?

The automated underwriting system (AUS) normally does not condition for verification of rent. Verification of rent is not required on files with an approve/eligible per automated underwriting system (AUS). Gustan Cho Associates will waive verification of rent on manual underwrites if the borrower has been living rent-free with family members so they can save the down payment or closing costs on a home purchase.

Lenders can only discover an eviction if the tradeline is posted on the borrower’s credit reports. The mortgage process is not difficult. Understanding the overall mortgage process for borrowers.

At first, the mortgage process can become intimidating. If you understand what to expect throughout the mortgage process, it will avoid stress during the loan approval process. Most renters going through the home buying and mortgage process find this moment one of the most memorable and exciting. You are about to make the largest purchase in your lifetime. Everyone always remembers their first home purchase.

Speak With Our Loan Officer for Getting Mortgage Loans

How Rental History Impacts Mortgage Application and Approval Process

Buying your first home is a special and exciting time for renters. Many factors go into home mortgage approval. Mortgage underwriters will evaluate the borrower’s overall credit payment history on the borrower’s tri-merger credit report. Poor housing payment history from prior landlords is not normally posted on consumer credit reports. If you have had a prior rental payment history, make it a top priority the landlord does not take you to court and get a judgment on you.

Can Mortgage Lenders Find Out About Previous Eviction?

If the landlord does not take you to court and a judgment is not issued, it will not be reported on your credit bureaus. Since the courts do not order the eviction and judgment, they will not be posted on your tri-merger credit report. Nobody can find out about the bad non-payment rental history. As mentioned earlier, verification of rent is normally not required on an approve/eligible per automated underwriting system (AUS) files. Even on manual underwriting, borrowers can often skirt an untimely rental payment history record if the borrower states they have been living rent-free with family members.

Getting a Home Mortgage With a Recent Eviction

Not all lenders have the same FHA, VA, USDA, and Conventional loan requirements. Just because you may not qualify at one lender does not mean you do not qualify at a different lender. All lenders must ensure all their borrowers meet the minimum agency mortgage guidelines of the loan program.

Mortgage lenders can have higher lending requirements above and beyond the minimum agency guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac which are called overlays.

As to the frequently asked question, can I qualify for a mortgage with a recent eviction? The answer is yes. You can qualify for a mortgage with a recent eviction. Not all mortgage lenders will ask for verification of rent. You should be fine if the eviction is not on your credit report. However, if your eviction is reported on your credit reports, you can get a good letter of explanation as to why you got an eviction. The team at Gustan Cho Associates can help you write a letter of explanation as to why you got an eviction and get you qualified and approved for a mortgage loan.

Contact Us For Getting A Home Mortgage With A Recent Eviction

Can You Buy a House and Get a Mortgage After a Recent Eviction?

These additional lending requirements above and beyond the minimum agency guidelines are called lender overlays. Lenders can have lender overlays on just about anything and everything. Verification of rent is not required on borrowers who get an approve/eligible per the automated underwriting system (AUS). VOR is required for manual underwriting.

Gustan Cho Associates exempts verification of rent for borrowers who are being manually underwritten but are living rent-free with family members.

The underwriter shouldn’t know that you are getting evicted. No agency guidelines say that a borrower with a recent eviction cannot qualify for a home mortgage. If you plan to qualify for a new mortgage, a timely housing payment in the past 12 months is required. A housing payment is either 12 12-month timely home mortgage or a rental payment. You should be fine if you can settle the eviction before the eviction verbiage reports on the tri-merger credit report. Remember that not all lenders ask for rent verification. This blog on Can you qualify for a mortgage with a recent eviction was updated on November 25th, 2023.

Contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Hello Gustan Cho Associates:

My name is Javier Rodriguez. My wife and I are looking to get a prequalification for a mortgage loan. We are hoping to living in Hammond, IN and are looking for a house between 100,000 – $150,000. Background financial information: We are first time home buyers. In addition, we previously worked overseas and our work history in the US is limited to the last 10 months. Currently, I am working full-time at Greenhouse in Mokena which is a medical cannabis dispensary. We have been denied loans by two companies this week because they don’t feel safe loaning based on income from marijuana. My wife works full-time as a partner in an LLC (self-employment). She has only been a partner for one year, so we are aware that we can’t use her income for qualification for the loan. I look forward to hearing back from your office soon.

Cordially,

Javier Rodriguez

My name is Mike Wilson I have steady job 3 years salary position, my credit is good our monthly debt is 1950 per month have 2019 Montana 5th wheel and two vehicles financed.

My problem is I have not filed taxes in a few years.

what would be my options.

Thank You

Michael Wilson