Overages of Seller Concessions To Pay For Closing Costs

Homebuyers should ask for seller concessions from the home seller to pay closing costs. There are two types of costs…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Homebuyers should ask for seller concessions from the home seller to pay closing costs. There are two types of costs…

This guide covers the frequently asked question can I get denied for FHA loan with good credit on home purchase….

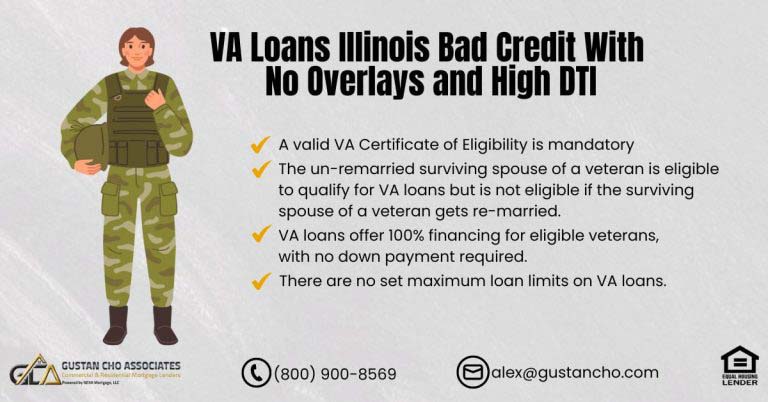

This article Is about qualifying for VA loans Illinois bad credit with no overlays and high debt-to-income ratio. VA loans…

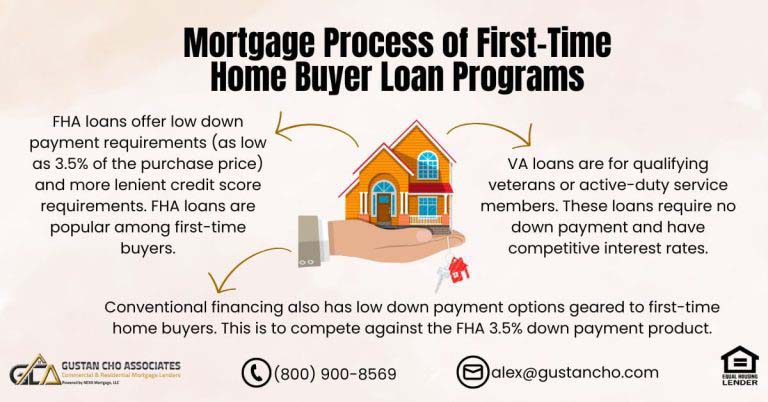

This guide covers the mortgage process of first-time home buyer loan programs. First-time home buyers have dominated the housing market…

The initial loan approval from the mortgage loan approval lists a set of conditions from the mortgage loan underwriter. Once the loan conditions are satisfied, the mortgage underwriter will issue will issue a clear to close.

In this article, we will cover and discuss when am I committed to mortgage lender for a home loan. Mortgage…

This guide covers how to get the best mortgage rates on a home loan. How to get the best mortgage…

This guide covers buying home with real estate purchase land contracts or seller financing. Real estate purchase land contracts is…

This guide covers buying a second home and renting the exiting home. Many hard-working folks plan on retiring and moving…

This guide covers home buyer concerns buying their first-home. A home purchase is most people’s single largest investment in their…

This guide covers about the third-party search by mortgage lenders during the underwriting process. Mortgage lenders will pull three credit…

In this blog, we will cover why lenders need credit reports and credit scores to get borrowers a mortgage loan…

When saving money buying a house, remember one key thing, low rates with FICO credit scores. This article will cover…

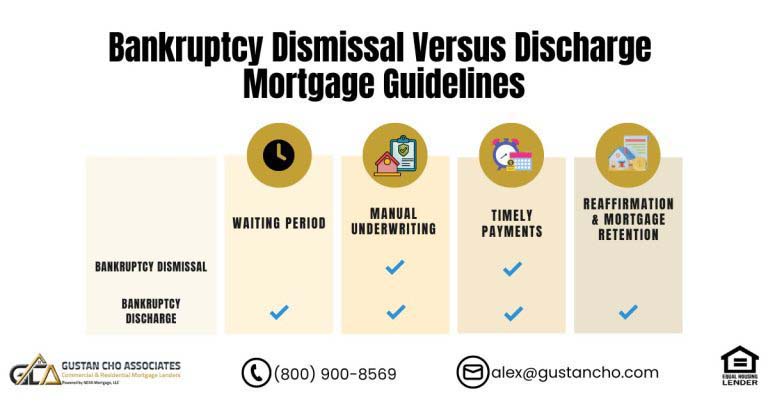

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy…

This guide covers how solid is your pre-approval for a home purchase mortgage. A mortgage pre-approval letter means that a…

Lenders can cover borrowers’ mortgage refinance costs with a lender, credit in lieu of a higher mortgage rate to the…

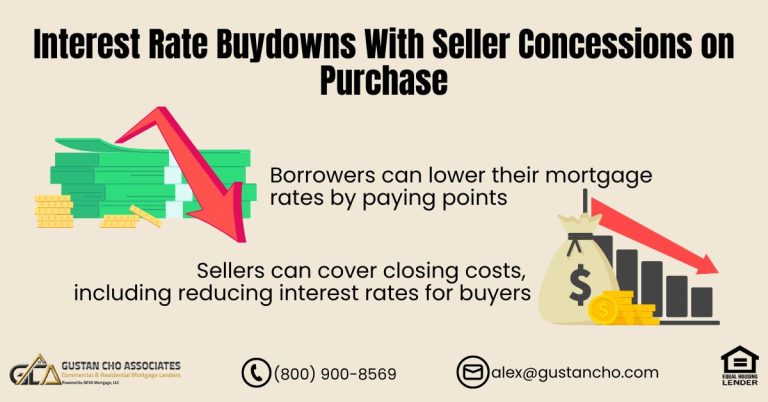

This guide covers interest rate buydowns with seller concessions on purchases. Interest Rate Buydowns are when borrowers pay DISCOUNT POINTSto…

This guide covers government and conventional loans after bankruptcy and foreclosure. There are mandatory waiting period requirements on government and…

This guide covers tips and advice selling home fast by real estate professionals. Many homebuyers have an existing home and…

This guide covers qualifying and getting approved for a home mortgage moving to new home. Moving to new home is…

This guide covers subprime loans and non-QM mortgages. Borrowers who have bad credit or not enough income due to self-employment…

In this blog, we will cover and discuss the mortgage guidelines Chapter 13 versus Chapter 7 Bankruptcy. Homebuyers qualifying for…