Mortgage For College Graduates Lending Guidelines

This article delves into Mortgage For College Graduates Lending Guidelines, shedding light on established norms and recent changes that may…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This article delves into Mortgage For College Graduates Lending Guidelines, shedding light on established norms and recent changes that may…

In this blog, we will discuss and cover the FHA appraisal transfer from your old lender to a new mortgage…

Gustan Cho Associates are experts when analyzing consumer credit reports. Since we do not have lender overlays, we see all…

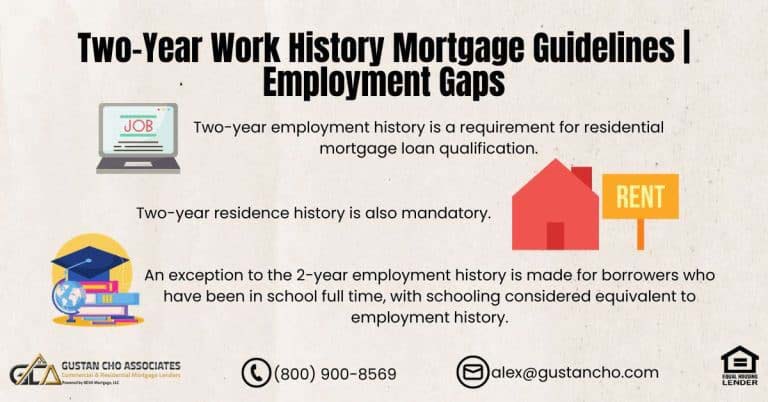

This blog post delves into the crucial aspects of the Two-Year Work History Mortgage Guidelines. It explores the significance of…

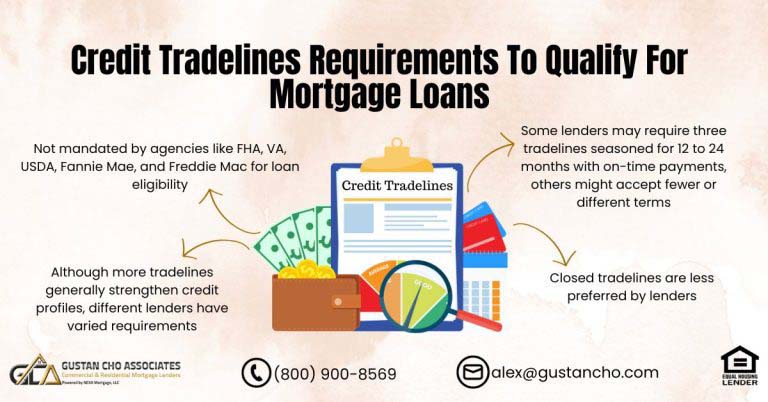

In this article, we will delve into the credit tradelines requirements essential for mortgage loan application eligibility. The credit tradelines…

This guide covers low appraisal on home purchase and solutions for mortgage borrowers. We will discuss solutions to low appraisal…

This guide covers avoiding home loan denial during the mortgage process. We will go deeply in giving our viewers tips…

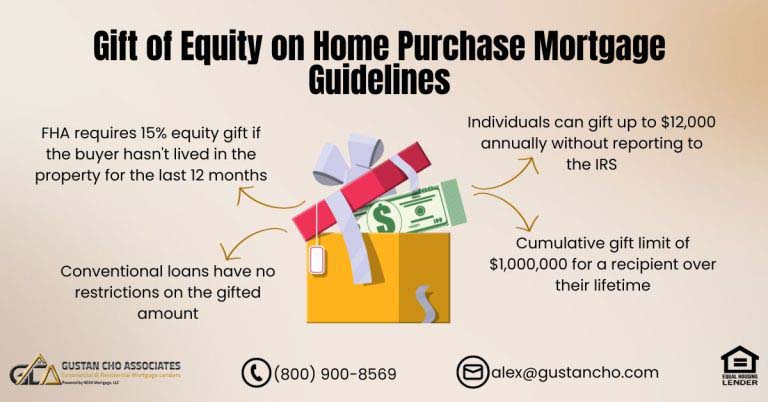

In this blog, we will cover and discuss the gift of equity on home purchase mortgage guidelines. Many people want…

How To Get Refer To Approve-Eligible Per AUS To Qualify For Mortgage: There are ways of trying to get a refer/eligible findings to an approve/eligible per automated underwriting system.

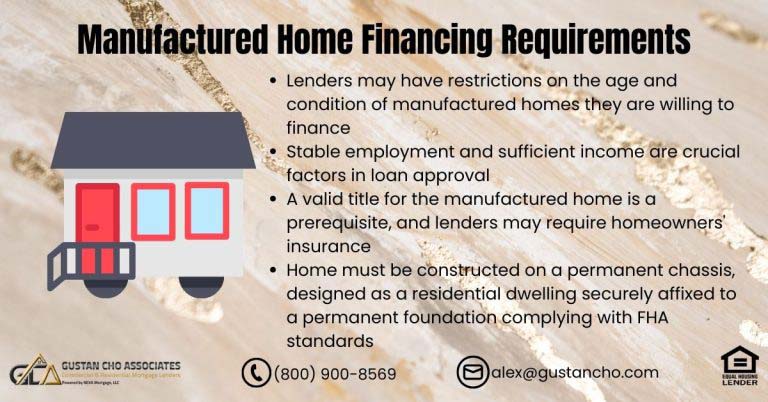

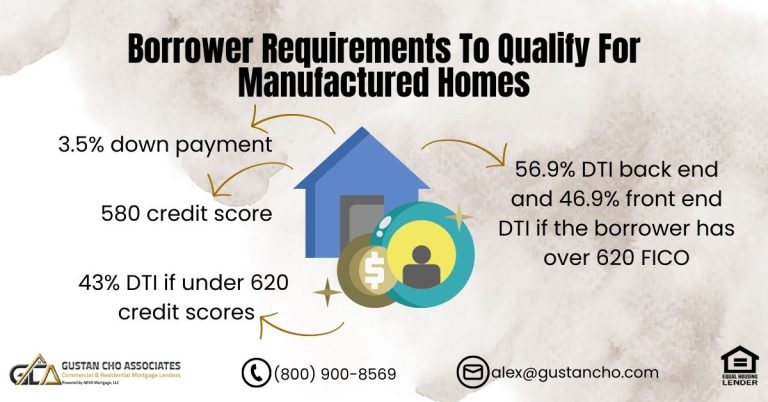

This guide covers manufactured home financing requirements. Many home buyers of manufactured home financing have a difficult time getting it….

In this article, we will cover and discuss how credit disputes affect mortgage process and cause loan denial. The pre-approval…

This guide provides clear information about Fannie Mae’s rules for Community Property States, helping people looking for mortgage information. It…

Every mortgage borrower is different. Your income, debts, credit rating, savings, and goals are unlike anyone else’s. The best mortgage for your neighbor might be the worst home loan for you.

This guide covers VA credit agency guidelines versus lender overlays on VA loans. Understanding VA Credit Score Agency Guidelines is…

This guide covers the benefits of paying mortgage balance early before end of loan term. Paying mortgage balance early before…

This guide explains Fannie Mae second home guidelines, especially vacation properties. As of 2025, a minimum down payment of 10%…

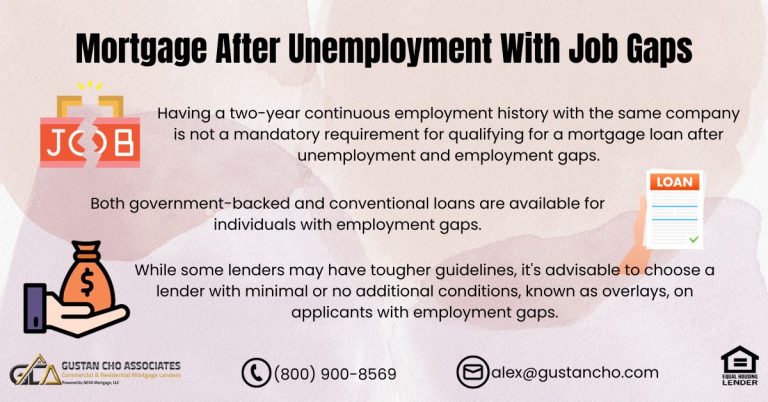

This article will discuss and cover qualifying for a mortgage after unemployment. Homebuyers do not need a two-year employment history…

In this blog, we will cover and discuss buying and moving to another owner-occupied home without selling their first home….

This guide covers FHA Guidelines on Manufactured Home Loans. FHA Guidelines on manufactured home loans are released. HUD, the parent…

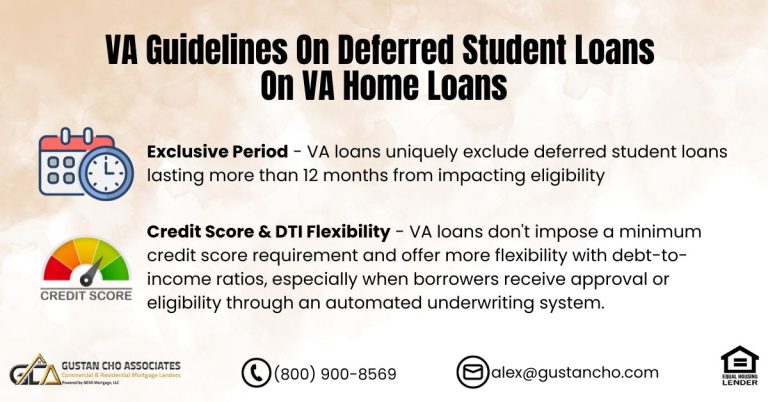

This article explores the VA Guidelines on Deferred Student Loans and their influence on the debt-to-income ratio in the context…

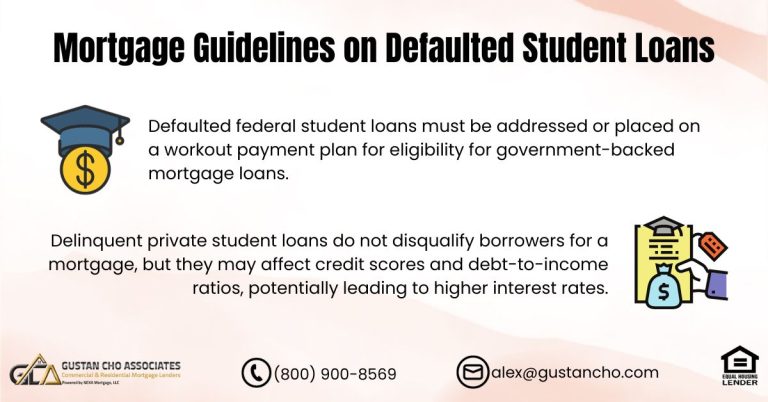

Borrowers cannot qualify for a mortgage with defaulted federal student loans until the student loans are out of default.

The primary emphasis of this blog centers around the waiting period obligations that individuals face after foreclosure, specifically those on…