Credit and DTI Guidelines on Conventional Loans vs FHA Loans

This guide covers credit and DTI guidelines on conventional loans vs FHA loans. Credit and DTI guidelines on conventional loans…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers credit and DTI guidelines on conventional loans vs FHA loans. Credit and DTI guidelines on conventional loans…

This BLOG covers FHA insured mortgage loans vs other loan programs. FHA insured mortgage loans are government residential home loans…

This guide covers borrowers cost out of pocket in the mortgage process. There are two types of costs involved when…

This article covers everything you need to know about how to choose the right internet lawyer. How do you go…

Loss of Employment During Mortgage Process: What You Need to Know Losing your job while trying to buy a home…

This guide covers property tax appeal for homeowners with high property taxes. Property Taxes are one of the highest expenses…

This guide covers how do mortgage lenders view periods of unemployment. Qualified income is extremely important when qualifying for a…

This guide covers how loan officers prepare borrowers for mortgage underwriters. How loan officers prepare borrowers for mortgage underwriters depends…

This guide covers the future of Texas homeowners living near border wall. The state of Texas is the second largest…

This guide covers homeowners who should refinance now to save money. Par mortgage rates are hovering around 5.0% for prime…

This guide covers things to consider if you want to rent a room in your house. When you’re getting ready…

This guide cover learn how to use money and not let money use you. There’s more to managing your finances…

Buying a Home in States With Exceptional Campgrounds: Your Guide to Outdoor Living Are you dreaming of a home where…

This guide covers how to find a good realtor for veterans when buying a house. When you separate from the…

In this guide, we will cover Feds start land seizures along the Texas border to clear path for new wall. …

Waiting Period After Loan Modification: What You Need to Know Before You Apply for a Mortgage If you’ve gone through…

In this guide, we will cover what to do if borrowers get mortgage denial from bank. First and foremost, find…

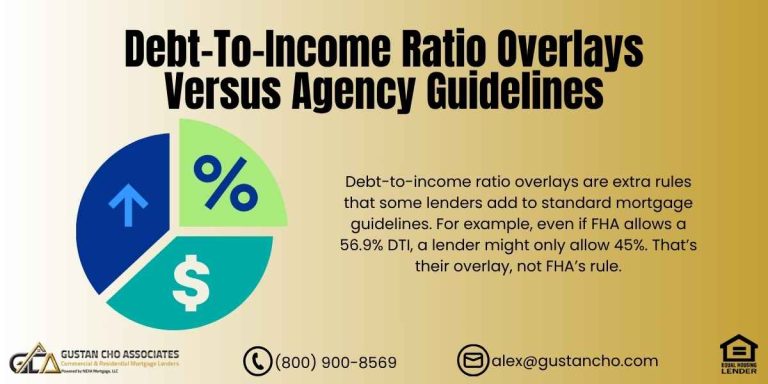

Debt-to-Income Ratio Overlays: What Homebuyers Need to Know Your debt-to-income ratio (DTI) matters to lenders when getting a mortgage. But…

Buying a House With Tenants: Everything You Need to Know Buying a house with tenants already living there can be…

Buying a House in Iowa: Everything You Need to Know in 2025 If you are considering buying a house in…

In this guide, we will cover getting 15-year vs 30-year FHA loans. We will compare and contrast 15-year vs 30-year…

Can you buy a house with bad credit? One of the most frequently asked questions we get is can you…