How Does A Mortgage Payment Structure Work On Home Loans

Mortgage Payment Structure Explained: What Every Homebuyer Needs to Know Are you considering buying a home but unsure what a…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Mortgage Payment Structure Explained: What Every Homebuyer Needs to Know Are you considering buying a home but unsure what a…

This guide covers factors influencing credit scores when applying for a mortgage. There are five Factors Influencing credit scores. The…

This guide covers the importance of credit reports in the mortgage application process. Our society is credit-driven. Almost every aspect…

FHA Debt-To-Income Ratio Requirements: What You Need to Know If you’re applying for an FHA loan, one of the most…

The Role of the Loan Officer Assistant: How They Help You Get a Mortgage Buying a home or refinancing can…

How Holidays Affect the Mortgage Process: What Every Homebuyer Should Know Buying a home is one of the most significant…

Closing Mortgage Under LLC: How Real Estate Investors Can Use an LLC to Get a Mortgage Are you a real…

Most mortgage lenders really don’t like seeing overdrafts in bank statements. If they spot an overdraft, it can make them…

Steps in the Underwriting Process: What Borrowers Need to Know in 2025 If you’re buying a home or refinancing your…

Buying a house can be exciting, but feeling a bit nervous about the mortgage process is normal. One big question…

Buying a home is exciting. But when you’re applying for a mortgage, your bank statements can suddenly become a big…

The Mortgage Process After the Conditional Approval: What Happens Next? The mortgage process after the conditional approval is one of…

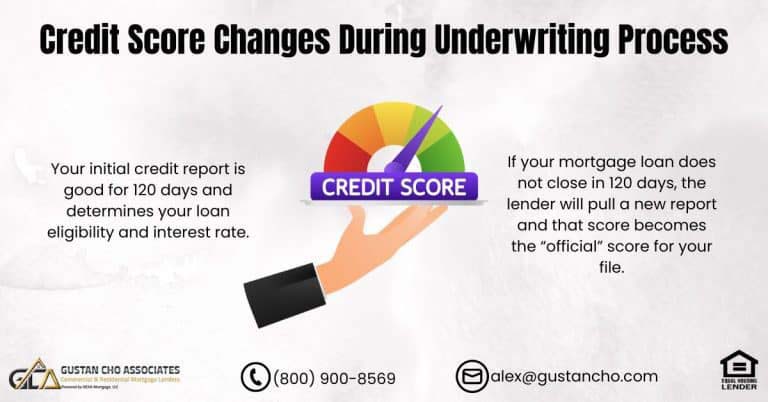

Your mortgage lender checks your credit when you apply for a home loan. Your credit score determines your mortgage rate and also if you qualify for a loan.

Understanding the Mortgage Process Timeline: Your Step-by-Step Guide to Getting a Mortgage in 2025 Buying or refinancing your mortgage can…

Avoiding Delays in Getting Conditional Mortgage Approval: A Step-by-Step Guide Getting a mortgage is a big milestone, but it can…

The Complete Guide to the Mortgage Closing Process in Illinois: Everything You Need to Know Buying a home is one…

This guide covers changes in credit report during mortgage process. Credit scores and debt-to-income ratios determine whether borrowers qualify for…

Mortgage Approval Can Be Revoked: What Every Borrower Needs to Know in 2024 Getting your mortgage approval feels like crossing…

How fast can you close a mortgage? Americans love instant gratification! Gustan Cho Associates has a fast-track, 15-day mortgage process.

Why Do Lenders Request Bank Statements? A 2024 Guide for Borrowers If you plan to buy a home or refinance…

How Underwriters Calculate Debt-to-Income Ratio (DTI) – 2024 Guide When it comes to buying a home, there are a few…

Clear to Close in 2 Weeks or Less: Here’s How to Fast-Track Your Mortgage Approval At Gustan Cho Associates, we…