Fannie Mae Mortgage Included in Chapter 7 Bankruptcy

In this article, we will cover and discuss getting approved for a new home loan after having a prior mortgage…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this article, we will cover and discuss getting approved for a new home loan after having a prior mortgage…

In this article, we’ll talk about reaffirming home loan after bankruptcy, a frequently inquired topic. Milwaukee-based Attorney James Miller of…

As per the Fannie Mae Bankruptcy Guidelines for conventional loans, borrowers must follow a mandatory waiting period after filing for…

After experiencing financial difficulties, it can be overwhelming to navigate the intricacies of mortgage lending. The process can be complex…

This guide covers rebuilding credit during Chapter 13 Bankruptcy repayment plan. Rebuilding credit during Chapter 13 Bankruptcy is highly recommended…

This article will discuss the FHA Waiting Period After Bankruptcy and Foreclosure. The FHA mandates waiting periods after bankruptcy, foreclosure,…

This guide covers how bankruptcy affects mortgage approval and the waiting period after discharge date. Bankruptcy is a great tool…

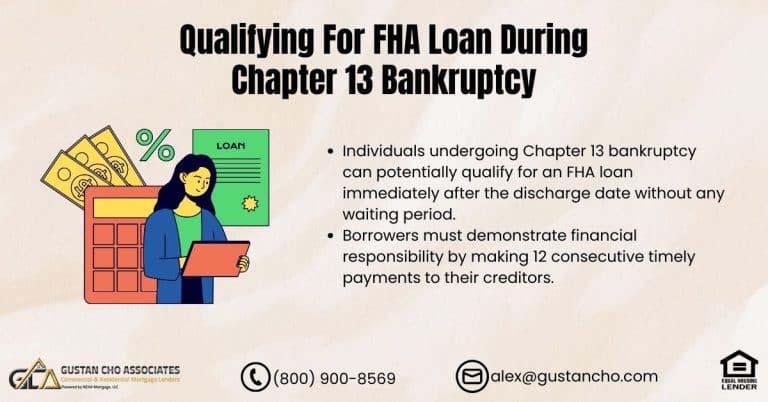

In this article, we’ll explore the process of Qualifying For FHA Loan During Chapter 13 Bankruptcy. Homebuyers can secure an…

This article will discuss HUD bankruptcy guidelines following Chapter 7 and Chapter 13 bankruptcy, particularly about FHA loans. HUD Bankruptcy…

This guide cover the things to know before filing bankruptcy for future homebuyers. There are things to know before filing…

In this blog, we will cover the Fannie Mae Chapter 13 dismissal guidelines on conventional loans. One of the most…

In this article, we will cover and discuss when you can get a mortgage approval after bankruptcy dismissal. There are…

In this blog, we will cover and discuss the mortgage guidelines after bankruptcy on home purchases and refinance transactions. There…

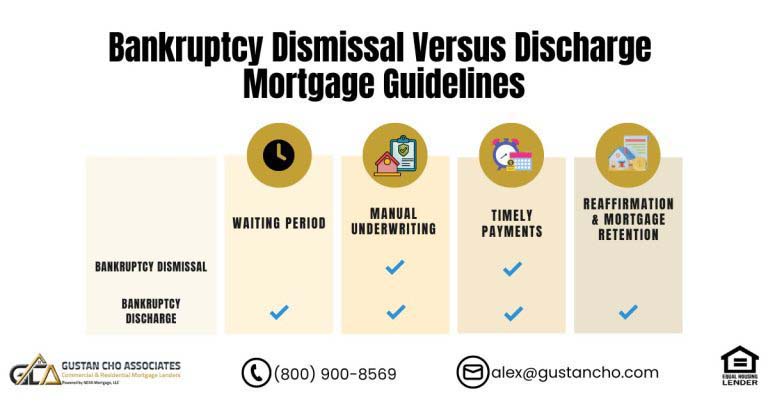

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy…

In this blog, we will cover and discuss the mortgage guidelines Chapter 13 versus Chapter 7 Bankruptcy. Homebuyers qualifying for…

This article is about FHA Bankruptcy waiting periods after Chapters 7 and 13. FHA Bankruptcy wqiting period requirements were release…

This guide cover FHA versus conventional mortgage after bankruptcy. There are differences in when and how you can qualify for…

This guide covers mortgage rates after bankruptcy on government and conventional loans. There are loan level pricing adjustments (LLPA) charged…

In this blog, we will cover and discuss the agency mortgage guidelines from the U.S. Department of Veterans Affairs for…

This guide covers buying a house after bankruptcy discharge date. Buying a house after bankruptcy is possible. Many homebuyers think…

This guide covers the mortgage process experience after Chapter 13 Bankruptcy. The experience does not have to be stressful. I…

This article will cover the mortgage guidelines for the types of bankruptcies—James Miller of Miller explains how you can qualify…