Mortgage Approval Without Retracting Credit Disputes: A Complete Guide for 2024 and Beyond

If you’re worried about how credit disputes might affect your mortgage approval, you’re not alone. Many borrowers are caught off guard when their lender tells them to retract disputes to move forward. But here’s the good news: under certain conditions, you can get mortgage approval without retracting credit disputes. Let’s dive into what you need to know for 2025.

Understanding Credit Disputes and Their Impact on Mortgages

A credit dispute occurs when you challenge an error or negative information on your credit report. While disputes can temporarily boost your credit score by removing derogatory items from scoring calculations, they can also complicate the mortgage approval process.

Why? When underwriters look at your credit, they need to assess how much of a risk you are as a borrower. If there are disputes on your report, it “hides” those negative items, and they can’t make a fully informed decision. This can lead to delays or even a denial of your loan application, which can be frustrating. It’s important to keep your credit report clear and accurate to improve your chances of getting the loan you need.

Start Your Process Towards Buying A Home

Apply Online And Get recommendations From Loan Experts

HUD’s Guidelines on Credit Disputes

The Department of Housing and Urban Development (HUD), which oversees FHA loans, has strict rules about credit disputes:

- Credit disputes on derogatory accounts like late payments, charge-offs, and repossessions must typically be removed.

- Exemptions include:

- Medical collections

- Non-medical collections with a zero balance

- Non-medical collections with a total balance under $1,000

If your disputed accounts don’t fall under these exemptions, your lender will likely require you to retract the disputes before approving your loan.

Exemptions That Allow Mortgage Approval Without Retracting Credit Disputes

While HUD’s guidelines seem rigid, there are key exemptions that can work in your favor:

- Medical Collections: When it comes to medical debt, disputes are always treated differently. This means that if there’s a disagreement about medical bills, it doesn’t have to be taken off your credit report. So, if you’ve got issues with medical charges, those disputes won’t get counted against you as other types of debt might.

- Zero Balance Non-Medical Accounts: You can keep the dispute open if you’ve already paid off a non-medical collection account. This means you can continue challenging any mistakes or issues related to that account, even though you’ve settled it. It’s a way to ensure everything is correct and protect your credit report.

- Balances Under $1,000: You don’t need to worry too much if you have a disputed balance that’s less than $1,000. You’re in a good spot, and it should be easier to handle. Just keep track of everything and make sure you know what you’re dealing with.

- Older Derogatory Accounts: If there are disagreements about accounts that haven’t had any activity lately, especially those older than two years, they are usually accepted or allowed.

These exemptions can save time and prevent the stress of retracted disputes, lowering your credit score.

How to Navigate FHA Guidelines for 2025

To secure mortgage approval without retracting credit disputes, you need a plan. Here’s how to do it:

Step 1: Understand Your Credit Report

Before applying for a mortgage, pull a copy of your credit report and identify any disputed accounts. Check:

- The type of account (medical or non-medical)

- The balance on each account

- The date of the last activity

Step 2: Work With an Experienced Lender

Not all lenders handle credit disputes the same way. At Gustan Cho Associates, we specialize in helping borrowers with complex credit situations. Our team can guide you through the process without unnecessary delays.

Step 3: Pay Down Balances

If you’re close to the $1,000 limit, consider paying down your balances to qualify for an exemption. For example:

- A $1,200 balance on a collection account can be reduced to $999 to avoid retracting the dispute.

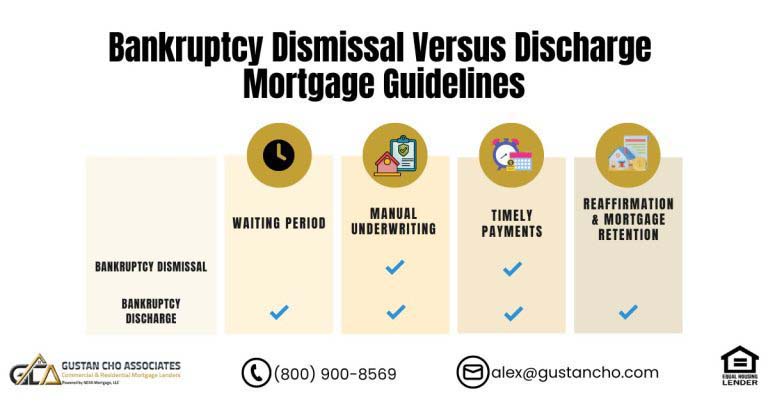

Step 4: Consider Manual Underwriting

If disputes disqualify you from automated underwriting systems (AUS), manual underwriting could be an option. While manual underwriting has stricter requirements, it allows lenders to evaluate your file based on compensating factors.

Step 5: Explore Alternative Loan Programs

Non-QM, DSCR, and portfolio loans may offer greater flexibility for borrowers with active credit disputes. These programs don’t follow HUD guidelines and may provide a path forward.

Manual Underwriting: A Path to Approval

If your mortgage application is downgraded to manual underwriting, here’s what you need to know:

- Timely Payments: You must show 12 months of on-time payments for all accounts.

- Debt-to-Income (DTI) Ratios: Manual underwriting allows a maximum back-end DTI ratio of 50% with compensating factors.

- Compensating Factors: Examples include:

- Two months of cash reserves

- A strong history of rental payments

- High residual income

- Verification of Rent: Lenders will verify your rental payment history to ensure stability.

At Gustan Cho Associates, our team has extensive experience with manual underwriting and can help you navigate these requirements.

Get Approvable Without Retracting Disputes

Apply Online And Get recommendations From Loan Experts

Case Study: How John Got Approved Without Retracting Disputes

Background: John had a credit score of 580 and was dealing with two unpaid collections totaling $900. He was hoping to get mortgage approval for an FHA loan. However, he was concerned that his credit score might drop even more if he took back his disputes.

Solution: John teamed up with Gustan Cho Associates to get help with his loan. He could avoid some extra fees because his total unpaid bills were less than $1,000. His loan application was quickly checked and approved, and he got a loan with only a 3.5% down payment without any issues.

Key Considerations for Non-FHA Loans

While this guide focuses on FHA loans, it’s worth noting that other loan programs have different rules:

1. Conventional Loans

When applying for mortgage approval, it’s important to know that conventional loans from Fannie Mae and Freddie Mac usually need any credit disputes you have to be cleared up. However, there might be some exceptions where they could overlook these disputes.

If you’ve had some issues with your credit, it’s best to address them, but don’t lose hope entirely, as there could be chances for approval even if you have a dispute.

2. VA Loans

Both FHA and VA loans offer the option of manual underwriting, which means they can look at your whole financial picture instead of just your credit score. This can be helpful if you have credit disputes or issues in your history. If you’re looking for mortgage approval and have some disagreements on your credit report, these types of loans might still work for you under certain conditions.

3. Non-QM Loans

These loans could be a great option if you’re dealing with credit disputes. These options offer greater flexibility and come with fewer restrictions than standard loans. This allows borrowers to secure mortgage approval more easily, even if they face credit challenges. This means you can find the help you need without having your credit problems hold you back.

The Role of Credit Repair in Mortgage Approval

Many borrowers seek the assistance of credit repair companies to enhance their scores before applying for a mortgage. Although this approach can be beneficial, it’s important to approach it wisely:

- Avoid Disputing Recent Accounts: Disputing recent derogatory tradelines can backfire if you plan to apply for a mortgage.

- Focus on Paying Off Balances: Instead of disputing accounts, focus on paying them down to qualify for exemptions.

- Consult Your Lender: Before making changes to your credit report, talk to your lender about the potential impact on your application.

Common Mistakes to Avoid

- Disputing All Negative Accounts:

- Blanket disputes can trigger red flags during underwriting.

- Ignoring Balances Over $1,000:

- Even a single account over this threshold can halt the process.

- Failing to Communicate With Your Lender:

- Keep your lender informed about your credit repair efforts to avoid surprises.

Why Choose Gustan Cho Associates?

At Gustan Cho Associates, we understand that life happens. Whether you’re dealing with disputes, low credit scores, or other challenges, we specialize in finding solutions. Here’s why borrowers choose us:

- No Overlays: We follow agency guidelines without additional requirements.

- Expertise in Manual Underwriting: Our team excels in manual underwriting for FHA and VA loans.

- Flexible Loan Programs: We offer options for every borrower from FHA to Non-QM loans.

- 24/7 Availability: We’re here to help evenings, weekends, and holidays.

How to Get Started

If you’re ready to explore your options for mortgage approval without retracting credit disputes, contact us today. Here’s how to reach us:

- Call or Text: 800-900-8569

- Email: gcho@gustancho.com

- Visit: www.gustancho.com

Our dedicated team is here to support you throughout your journey and is available 7 days a week, even on holidays!

In Closing

Getting a mortgage with active credit disputes might seem challenging, but it’s not impossible. By understanding the guidelines, working with an experienced lender, and exploring alternative loan programs, you can achieve your dream of homeownership without retracting disputes. Contact Gustan Cho Associates today to learn how we can help you!

Frequently Asked Questions About Mortgage Approval Without Retracting Credit Disputes:

Q: What is a Credit Dispute?

A: A credit dispute is when you challenge an error or negative information on your credit report. It temporarily hides the negative item while the dispute is being investigated.

Q: Can I Get Mortgage Approval Without Retracting Credit Disputes?

A: Yes, it’s possible if your disputes meet specific exemptions, like medical collections or non-medical disputes with zero balances or under $1,000.

Q: Why do Lenders Want Credit Disputes Removed?

A: Lenders need to see a full and accurate picture of your credit history. Disputes can hide negative items, making it harder for them to assess your risk as a borrower.

Q: What Types of Credit Disputes are Exempt from Being Retracted?

A: Medical collections, non-medical collections with a zero balance, and disputes on accounts with balances under $1,000 are typically exempt.

Q: What Happens if I Don’t Remove a Credit Dispute that Doesn’t Meet an Exemption?

A: Your mortgage application may be delayed or denied until the dispute is retracted and your credit report is updated.

Q: What is Manual Underwriting, and How Can it Help with Disputes?

A: Manual underwriting is when a lender reviews your financial details without relying solely on automated systems. It’s a great option for borrowers with credit disputes or unique financial situations.

Q: Can I Qualify for a Non-QM Loan with Active Credit Disputes?

A: Yes, non-QM loans are more flexible and may allow you to secure mortgage approval even with active credit disputes.

Q: Should I Use a Credit Repair Company to Resolve Disputes Before Applying for a Mortgage?

A: Be cautious. Instead of disputing all accounts, focus on paying down balances or resolving issues directly. Always consult your lender first.

Q: How Can I Lower my Balances to Meet the $1,000 Exemption Rule?

A: You can pay down collection accounts or negotiate settlements to reduce balances under $1,000, which might exempt you from retracting disputes.

Q: How Can Gustan Cho Associates Help me with Mortgage Approval Without Retracting Credit Disputes?

A: Gustan Cho Associates specializes in helping borrowers with complex credit situations. They offer flexible loan programs, manual underwriting expertise, and personalized guidance to help you secure a mortgage.

This blog about “Mortgage Approval Without Retracting Credit Disputes” was updated on January 13th, 2025.

Hi do you do mortgages in NY?

Unfortunately, we are not licensed in New York.