Quick Answer

To get approved for a mortgage, you usually need to know how to remove credit disputes (the “consumer disputes this account” flag) before underwriting—unless they’re exempt (often medical disputes, zero-balance non-medical, older disputes, or small total balances). The fastest fix is to request that the bureau/creditor remove the dispute notation, then confirm it has been updated on your report.

What You’ll Learn About How To Remove Credit Disputes

- What a “credit dispute” flag is and why underwriters stop files for it

- Which dispute types are typically exempt (and which are not)

- How to remove disputes the fast way vs the standard way

- What to say when you call a credit bureau or creditor to retract a dispute

- How long dispute removal usually take and how to verify it’s gone

- Common underwriting conditions tied to disputes and how to avoid delays

Simple Decision Flow: How to Remove Credit Disputes (Fast)

1) Are you in underwriting (or submitting the file) right now?

Yes → Do this today

- Step 1: Pull your most recent credit report and look for any wording like “consumer disputes this account” or accounts marked “in dispute.”

- Step 2: Stop any active disputes immediately (credit repair company, online bureau, mailed).

- Step 3: Call the bureau(s) showing the dispute flag and request: “Please remove the dispute notation/flag from this account. I am retracting the dispute.”

- Step 4: If the bureau says the creditor/furnisher placed the dispute, call the creditor and request that they remove the dispute status and send an update to the bureaus.

- Step 5: Tell your loan officer you retracted the dispute and ask if they need a credit supplement / rapid update (if available) to keep closing on track.

- Step 6: Verify it cleared (your LO/processor can confirm on the refreshed report or supplement). Don’t assume it’s gone until you see the dispute comment removed.

No → You still want to clean it up before pre-approval

- If you’re 2–6+ weeks out from underwriting, use the standard retraction method (written request), so you’re not rushed later.

- Avoid starting new disputes while mortgage shopping unless your LO advises you to do so.

2) Are your disputes exempt?

Maybe/Yes → You’re likely fine, but confirm with your loan officer

Disputes are commonly treated as exempt when they involve:

- Medical collections

- Non-medical collections with $0 balance

- Older non-medical disputes (often 2+ years since last activity)

- Small total unpaid non-medical collection balances (often under a threshold)

✅ Action: Send your LO the account list and ask:

“Are these disputes exempt from my loan type and AUS findings, or do you want them removed anyway?”

No/Not sure → Assume you must retract

If you have disputes on:

- Charge-offs, or

- Non-medical collections with balances above a typical threshold, or

- Multiple disputed accounts, and you’re close to underwriting

✅ Action: Retract now to prevent an underwriter suspension.

Credit Disputes That Are Exempt From Disputes Being Removed

Non-medical disputes with a total aggregate outstanding unpaid collection account balance of over $1,000 and/or charge-off accounts need to be removed prior to the mortgage process. Mortgage processors cannot submit files with outstanding credit disputes to underwriting. The mortgage underwriter will suspend the file and kick it back to processing.

Not checking for credit disputes by both the loan officer and/or mortgage processor is one of the biggest reasons there are delays in the mortgage process and can delay the closing.

Medical disputes, non-medical disputes that are older than two years old, and non-medical disputes with zero balances are all exempt from retraction. If the total aggregate outstanding unpaid collection account balance is under $1,000, they are exempt from retraction and do not have to be retracted. Gustan Cho Associates has written this step-by-step guide on How To Remove Credit Disputes.

Need to Remove Credit Disputes from Your Report? Let Us Help!

Contact us today to learn how we can assist you in removing disputes and improving your credit score.

Credit Repair Companies Can Do More Damage Than Good

Credit repair is not required nor recommended for homebuyers with bad credit. Do not spend hundreds or thousands of dollars on credit repair if you are planning on doing so just for the sake of qualifying for a mortgage. You can qualify for a mortgage with outstanding late payments and charged-off accounts without having to pay them off at Gustan Cho Associates.

Credit repair can often do more damage for mortgage loan applicants than good. Whatever a credit repair agency can you, you can do it yourself at no cost with the proper guidance of Gustan Cho Associates.

Remember that you can qualify for a home mortgage with bad credit, outstanding collections and charged-off accounts, repossessions, late payments, and other prior derogatory credit, BUT lenders want to see rebuilt and reestablished credit with timely payments in the past 12 months.

How To Remove Credit Disputes During The Mortgage Loan Process

There are thousands of credit repair companies in this country. There are also countless books and online courses teaching consumers how to repair their credit. The most common method with credit repair is by disputing derogatory credit items to the three giant credit bureaus; Experian, Equifax, and TransUnion.

Consumers try to get their derogatory item deleted by writing a letter disputing the validity of the derogatory credit item to either the creditor or credit bureaus or both.

Once the creditor or credit bureaus receive the credit dispute letter, they have 30 days to contact the creditor and request the validity of the consumer’s dispute and send proof to the credit bureau. The credit bureau will examine the response of the creditor. They will check to see if the credit dispute is valid or not. Then make a decision of whether to either delete the derogatory credit item from the consumer’s credit report. Or let the derogatory credit item remain on the consumer’s credit report because the creditor has confirmed that the credit has justified their bad credit reporting.

Dispute Letter Instructions:

|

Attention: _______________________

Address: _____________________

City, State, ZIP: _______________

The following accounts are being listed on my credit report as being in dispute. I no longer wish to dispute this account and consider it resolved for now. Please remove this statement from the following accounts:

{{{List Account Name and Number}}}

Thank you for your help regarding this issue.

Sincerely,

Name: ______________________________________________

Social: _______________________

DOB: _______________________

Address: _______________________

City State, ZIP: _______________________

How Do Derogatory Credit Tradelines Get Removed From Credit Disputes

Reasons Consumers Dispute Derogatory Credit Tradelines

Again, millions of consumers will go through credit repair in hopes of removing the derogatory credit items from their credit reports and improving their credit scores.

Credit disputes will backfire on borrowers. This is because there are specific mortgage guidelines when it comes to how to remove credit disputes and the mortgage process.

You cannot have credit disputes during the mortgage process unless the retraction is exempt. Medical collections, non-medical collections that are older than two years since the date of last activity, and non-medical collections with zero balances are exempt from retraction. If the total aggregate balance of your collections is less than $1,000, they are exempt from retraction. Do not dispute any derogatory credit tradelines unless you have solid facts on paper prior to or during the mortgage process.

HUD/FHA Credit Dispute Guidelines (Allowed/Not allowed/Underwriter Action)

Allowed (generally OK for FHA)

- Disputed medical collection accounts (medical disputes are typically allowed under FHA guidance).

- Disputed non-medical collection accounts with a $0 balance (no unpaid balance showing).

- Disputed non-medical collections that meet common FHA exemption thresholds (for example, when the total unpaid non-medical collection balances are under a typical limit).

- Older non-medical disputes (often treated as exempt when they’re beyond a certain age, depending on how the account is reported).

Borrower tip: Even if something is “allowed,” some underwriters may still ask for clarification if the dispute wording is present—so always be ready to document why it’s exempt.

Not allowed (will typically stop FHA underwriting)

- Any disputed charge-off accounts (FHA files are commonly not eligible to move forward with disputed charge-offs).

- Disputed non-medical collection accounts with unpaid balances when the total unpaid non-medical collection balances exceed a common FHA threshold (often referenced as $1,000 in many lender workflows).

- Any dispute that prevents the underwriter from accurately evaluating the borrower’s true credit risk (example: multiple disputed derogatories where the pattern of repayment is unclear).

Underwriter action (what usually happens)

- Suspends or conditions the file until disputes are removed (or proven exempt).

- Requests one or more of the following:

- A credit report update/supplement showing the dispute notation has been removed

- A written explanation and/or documentation that the dispute is exempt

- Proof that the dispute was retracted with the bureau/creditor (when needed)

Bottom line: If the dispute is not clearly exempt, the file often cannot proceed to final approval until the dispute comments/flags are cleared.

Most Common Underwriting Conditions Related to Credit Disputes

When an underwriter sees any account marked “in dispute” or “consumer disputes this account”, they’ll usually pause the file until the dispute issue is cleared or proven exempt. Here are the most common conditions borrowers get:

1) Remove the dispute notation (required condition)

Condition: Provide an updated credit report showing the dispute flag/comment removed.

What satisfies it:

- Updated tri-merge report or a bureau credit supplement confirming the account is no longer in dispute.

2) Confirm whether the dispute is exempt (documentation condition)

Condition: Identify each disputed account and confirm it meets the program’s exemption rules.

What satisfies it:

- A list of disputed accounts + balances + type (medical vs non-medical)

- LO/processor notes showing why it’s exempt (and, if needed, supporting documentation)

3) Retract disputes directly with the creditor/furnisher (when the bureau can’t remove)

Condition: If the creditor placed the dispute, the underwriter requires proof that the furnisher removed the dispute status and updated the bureaus.

What satisfies it:

- Creditor confirmation (letter/email/statement) and an updated credit report/supplement reflecting the change.

4) Letter of explanation (LOE) for dispute history or credit repair involvement

Condition: Explain why disputes were filed and confirm no active disputes remain during underwriting.

What satisfies it:

- Short LOE: what was disputed, why, and confirmation that the dispute is retracted/removed (or exempt).

5) Re-run AUS / rescore after dispute removal (system finding condition)

Condition: Automated underwriting (AUS) must be re-run once disputes are removed because scores and findings can change.

What satisfies it:

- Updated AUS findings based on the new credit report.

6) Verify collection/charge-off treatment after dispute changes (DTI condition)

Condition: If removing disputes reveals balances or changes account status, the underwriter may reassess DTI and required monthly payments.

What satisfies it:

- Updated liabilities on the credit report + any required payment calculations (if applicable).

7) No new disputes during the mortgage process (compliance condition)

Condition: Underwriter requires confirmation that the borrower will not initiate new disputes while the loan is in process.

What satisfies it:

- Borrower acknowledgment (often in LOE) and no new dispute remarks on the updated report.

Ready to Remove Credit Disputes and Improve Your Credit Score?

Disputes on your credit report can delay your loan approval. Reach out now to see how we can help you remove credit disputes and boost your credit score.

Consequences and Risks on How To Remove Credit Disputes

HUD does not require you to pay off outstanding collection accounts to qualify for an FHA loan. Medical collection accounts and charge-off accounts are exempt from debt-to-income ratio calculations. However, if you have outstanding non-medical collection accounts that have outstanding unpaid balances of $2,000 or greater, then HUD Guidelines on collection accounts require that 5% of the outstanding unpaid balance needs to be used as a hypothetical monthly debt. This holds true even though the borrower does not have to make any payments.

Removing the outstanding collection accounts of the borrower’s credit report will solve the lender not counting the debt-to-income ratios.

This is because deleting collection accounts cannot be found since they are not public records. Many borrowers with larger outstanding collection accounts and higher debt-to-income ratios try to dispute derogatory credit accounts by settling with the creditor via pay-for-delete. There are times when the creditor and/or credit bureaus will give you a very difficult time when you try to retract a credit dispute. We will explain in this step-by-step guide how to remove credit disputes from your credit reports and how you can do it yourself.

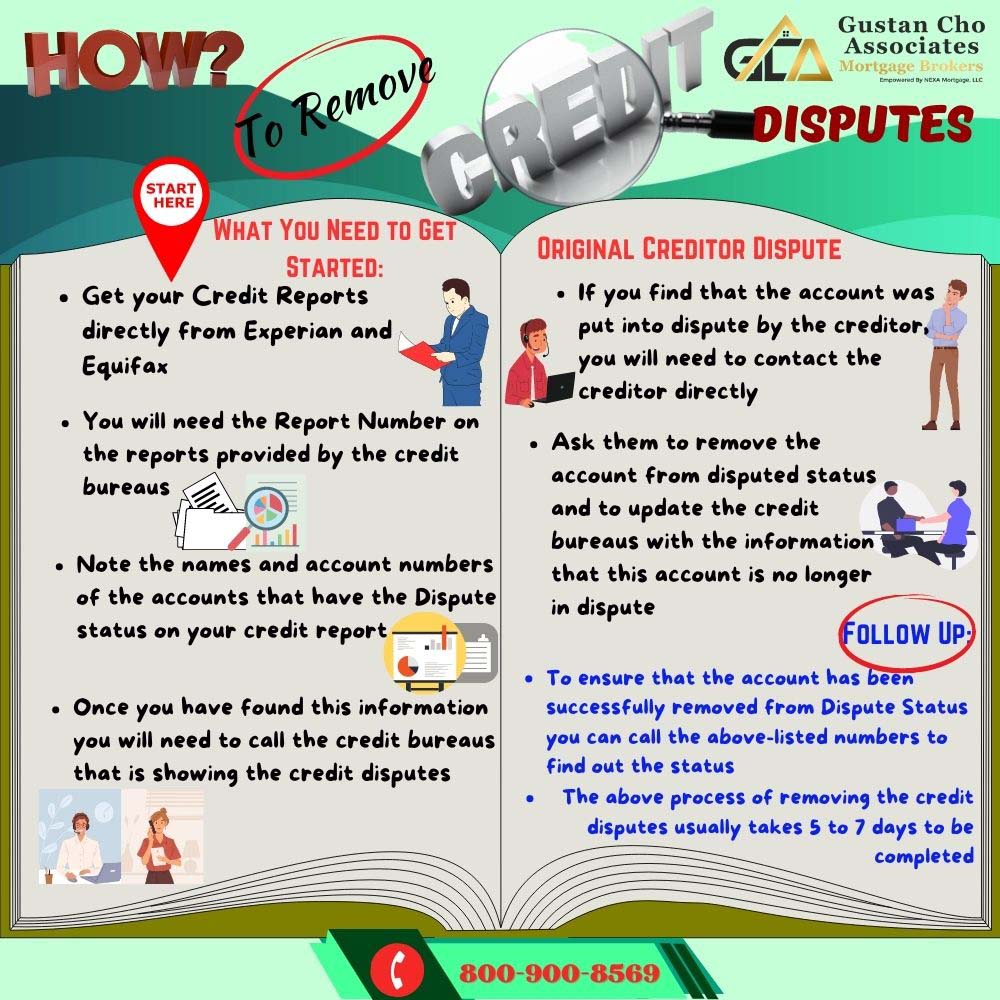

How To Remove Credit Disputes Off Credit Report: Fast Track

This rapid correction method on how to remove credit disputes can help consumers who need to get the verbiage of “Consumer Disputes This Account” statements that are showing on their credit reports removed from an account quickly This can take anywhere from 30 minutes up to 2 hours to accomplish.

What You Need to Get Started:

Get your Credit Reports directly from Experian and Equifax (this has been discontinued in 31 states) (TransUnion does not require this). You will need the Report Number on the reports provided by the credit bureaus from Experian.com and www.Equifax.com. Note the names and account numbers of the accounts that have the Dispute status on your credit report

Make The Calls

Once you have found this information you will need to call the credit bureaus that is showing the credit disputes. The telephone numbers provided are for the dispute department that you will need to contact to speak with to accomplish this task.

During the conversation, you will give the representative of the credit bureau the account number that is being disputed. You will also need to ask if the dispute has been placed by the credit bureaus or the creditor or company.

WARNING:

Reaching a human at each of the credit bureaus will be next to impossible. Gustan Cho Associates has a step-by-step guide on how to reach a human credit bureau representative. Please take a few minutes to read this popular step-by-step guide on reaching a human representative. Click This Link HOW TO REACH A HUMAN AT THE CREDIT BUREAUS

ASK THEM TO REMOVE THE DISPUTE!

Original Creditor Dispute:

- If you find that the account was put into dispute by the creditor, you will need to contact the creditor directly

- Ask them to remove the account from disputed status and to update the credit bureaus with the information that this account is no longer in dispute

Follow Up:

To ensure that the account has been successfully removed from Dispute Status you can call the above-listed numbers to find out the status. The above process of removing the credit disputes usually takes 5 to 7 days to be completed. Sign up for Credit Karma. There is no fee for this. You can check your credit scores and credit report on Credit Karma at no cost. Credit Karma will also send you an email alert if there are any changes to your credit report.

Conventional Method on How to Remove Credit Disputes

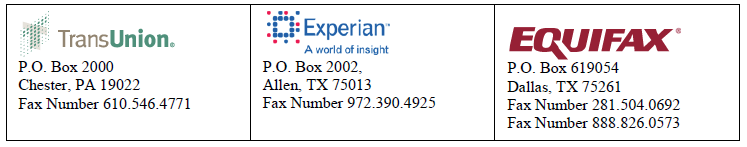

The second way how to remove credit disputes is by completing the form that is listed below and faxing it to the credit bureaus and the creditors and requesting that they remove the credit disputes.

Credit repair experts recommend that you send this to both the credit bureaus and the creditors. The fax numbers listed may not be active, we recommend that you still mail a copy to the burea us via certified mail as well.

The credit dispute process for removing derogatory credit tradelines can take anywhere between 30 to 45 days to complete but works well if the issue needs to be addressed but is not an urgent matter yet.

How To Remove Credit Disputes for Gustan Cho Associates

Learn how to remove credit disputes in a comprehensive but straightforward manner with Gustan Cho Associates. We have designed a credit dispute removal checklist to boost your FICO score to mortgage approval levels by correcting erroneous negative credit items, such as payment lates and credit inquiries. Engage knowledgeable mortgage lenders offering credit scores down to 500 to get individual assistance in mortgage financing– begin your charge-off dispute removal today to improve your financial situation in 2025.

Understanding Credit Disputes And What Impact They Have on Your Credit Score

Credit Disputes are considered formal challenges you make about inaccuracies or incompleteness in different information found in your credit history files with one of the big three bureaus: Equifax, Experian, and TransUnion. These inaccuracies can cause your FICO score to drop, making it challenging to obtain new loans, especially mortgages.

With U.S. consumer debt soaring to $17.68 trillion, as Equifax reported in February, it is crucial to keep the credit report as up to date as possible.

Gustan Cho Associates, one of the leading mortgage brokers, licensed in all 48 states, has mortgage clients with a credit score as low as 500 FICO and helps how to remove credit disputes. Disputes should be resolved immediately, and in some instances, within 30 to 60 days. They can help you add 50 to 100 points to your score, based on data from the CFPB about report resolution successes.

Credit Disputes: What Are They and Their Importance

A credit dispute allows individuals to challenge any item in their credit report that they consider incorrectly done, obsolete, or unsubstantiated. This might be incorrect personal information, erroneous credit account pairs, or disputed debts.

For mortgage seekers working with Gustan Cho Associates, unresolved disputes can flag your account as “in dispute,” which will send a warning to the lenders regarding potential risks and can delay the approval. That’s why it’s important to know how to remove credit disputes.

We all know credit companies have underestimated and mistreated consumers. Based on the recent actions taken by the FTC in 2025 against certain companies, over 19.8 million dollars worth of reimbursement checks to consumers with credit dispute violations were documented. Wrongful credit dispute removal could ultimately lead to the borrower being charged thousands of dollars for borrowing. For instance, a 100-point drop can lead to an additional $200 to $300,000 mortgage.

2026 Common Types of Credit Report Errors

Much like 2025, the year 2026 has also seen 50% of survey participants having some issue with their credit report inaccuracy, an increasing tendency with the rising identity theft issue. Along with fully unauthorized inquiries, 20% of users and filers alike have issues with negative accounts holding on to obsolete accounts even after the 7-year holding limit imposed by the FCRA.

Medical debts with overstated payment obligations- more than $ 1000- constitute a major portion of the substantial upsurge in the FCRA grievances, 4542 in 2025 alone.

With the year 2025’s data in mind, the CFPB’s report analyzing the year-over-year increase of complaints of an FCRA nature was a shocking 23%. Non-composite financing policies greatly restrict the Gustan Cho Associates’ clients, even with 30 days of targeted credit dispute removals employed.

Reason For Choosing Gustan Cho Associates on How to Remove Credit Disputes

Gustan Cho Associates is a known national mortgage expert with no overlays on credit guidelines. They will integrate credit repair seamlessly into your home loan process. Unlike credit repair companies, Gustan Cho Associates has a no-cost, no-obligation credit analysis that no one else offers to borrowers. Gustan Cho Associates will help remove credit disputes that stop borrowers from getting a mortgage underwritten.

Sift reported that in 2026 there will be a 78% year-over-year surge in chargeback disputes, which is more than enough reason to be skeptical as to whether your firm will be ready.

Based on internal case studies, 80% of clients after dispute show a score improvement—these figures are impressive. Additionally, Gustan Cho Associates is a BBB mortgage broker with a central office in Chandler, Arizona, and various locations throughout the US. They combine dispute loan techniques with mortgage lending to make homeownership more accessible for their clients.

The Impact of Professional Support on Effective Credit Repair

Hiring professionals like those at Gustan Cho Associates increases dispute success rates for verified claims to nearly 60-70% per FTC follow-up studies.

DIY efforts report success only about 40% of the time due to incomplete documentation and other rookie mistakes, such as lacking dispute letters and bureau manipulation.

Licensed advisors save you 20-30 hours per case of time and dispute letters. This is critical in 2026, as CFPB complaints on credit reporting soared 182% from 2023 levels, drowning self-filers.

Take First Step Toward Making Your Dream A Reality

Apply Now And Get recommendations From Loan Experts

Step-By-Step Instructions on How to Remove Credit Disputes

Removing credit disputes is a methodical process. Gustan Cho Associates recommends starting with a clean and complete review before any filings are done.

Follow these proven steps, and you might dispute and delete errors that, in your favor, might save you from issues during the compulsory 30-day investigation period from the bureau.

In 2025, over 1.2 million credit-related complaints will be lodged with the CFPB, which is extremely important. Act quickly on how to remove credit disputes to avoid long-term damage to your score.

Step 1: Get Your Free Annual Credit Reports from All 3 Bureaus

You may obtain free credit reports from AnnualCreditReport.com, as it is authorized by law and available for weekly access.

Reports obtained from Equifax, Experian, and TransUnion are different from each other, and according to the FTC, 5% of those reports may contain errors.

Gustan Cho Associates recommends looking for the “account in dispute” indicator, part of a resolved dispute. This indicator is usually appended to a file, and its presence, ‘unreconstructed’, lowers a lender’s confidence in the report. Based on surveys, 11% of consumers are unaware of the inaccuracies in the reports.

Step 2: Find Errors on Your Credit Report and Get Proof

Locate falsely attributed late payments, part of 25% of disputes. Some errors include collections over $100 that you might owe. Allude to and obtain proof, which may include bank statements and payments.

According to Gustan Cho Associates, for mortgage clients, failing to document that errors result in scores below 620, the score that is usually deemed a threshold for several conventional loans, is inexcusable.

According to the FTC, identity fraud claims in the year 2026 peaked, and considering the records, robust documents are fundamental to 75% of successful removals.

Step 3: Disputes Can Be Filed Electronically, By Post, Over The Phone, through the bureaus, or with the appropriate creditors

You can send disputes through the portals of each bureau and TransUnion. They report that 70% of disputes are resolved online. Alternatively, you can send them certified letters with the documentation.

Just make sure that the instructions are clear. For example, you can say, “This $500 debt is inaccurate. I paid it off on [date].” Send or notify the furnisher (creditor) directly.

Gustan Cho Associates carefully manages this under the FCRA right of 623. Gustan Cho Associates expedites this under templates, which are processed 90% faster. Expect 30-day timelines, but escalations to the CFPB can resolve 50% of stalled cases, and 50% of escalated CFPB cases are resolved within 15 days.

Step 4: Certify That You Are The Originating Party To That Transaction

Monitor the investigation closely and pursue all avenues available. Track these submissions and the outcomes that come with them. If there are disputes to which no response is given, these can be refiled or appealed.

Since new consumer advocacy data suggests that success rates easily surpass 65% with enough persistence, this case is no different.

Gustan Cho Associates clients are directly affected by this. They are on loan as underwriters. Over the underwriters, proactive monitoring can avoid blocks that prevent loan access for the 90-day periods common in 2026.

Step 5: Once Resolved, Remove the In Dispute Notation

When the dispute was recognized, the bureau was requested to remove the flag, either in letter format or over the telephone. Deleting the dispute flag has almost always been forgotten in one’s credit report. Gustan Cho Associates verifies that this has been done at the point of examination to keep the mortgage flowing. This is critical as 31% of disputed items are only recognized as correct ‘post full review,’ per FTC studies.

Step 6: After Disputed Items Are Removed, Repair And Sustain Your Credit Score

In rebuilding credit, focus on maintaining a full payment history and a low balance to credit limit (30% or under). Gustan Cho Associates incorporates this into the loan consultation process and how to remove credit disputes, enabling clients to improve their credit score by 85 points on average over a 6-month period, as noted in 2025 client reports.

Removing Difficult Credit Disputes in 2026

Goodwill letters to the creditor on a case-by-case basis are particularly useful and should be used to tackle the more difficult issues. These payments are always made after the due date.

In 2026, Gustan Cho Associates suggests freezes, which have been available since 2018. These tackle the more drastic cases of fraud.

With 28.1 billion dollars lost to fraud, it’s more crucial than ever. The regulations that state that automatic deletions apply to medical debts under $500 will resolve 15% of disputes automatically.

Handling Simultaneous Disputes Across Multiple Bureaus

File disputes with all three bureaus at once for maximum efficiency. They resolve at the same rate 80% of the time. Gustan Cho Associates manages this for multi-state borrowers, cutting the average time to resolve disputes by 25%.

The Financial Gains of Removing Credit Disputes for Mortgage Approval

For lenders, the major benefit of how to remove credit disputes is the instant improvement to your score and the lift in mortgage interest rates, which over 30 years is an average of $50,000 for every 100 points gained. Due to the no-overlay programs, they are also able to offer jumbo loans of up to $3 million to clients with disputes. In the context of $17.68 trillion of debt in 2026, this is incredibly useful.

Frequently Asked Questions on How to Remove Credit Disputes

What Does “Consumer Disputes This Account Information” Mean?

It’s a remark on your credit report showing an account is (or was recently) in an active dispute. Mortgage underwriters often require that dispute remarks be removed (or confirmed exempt) before they can use the credit report for final approval.

Can I Get a Mortgage With Disputes on My Credit Report?

Sometimes—but it depends on loan type, the account type (medical vs non-medical), balances, and the lender’s underwriting findings. If you’re close to underwriting, assume disputes can delay approval and ask your loan officer which ones must be cleared.

Are Medical Disputes Allowed During Mortgage Underwriting?

Many lenders treat medical-related dispute remarks differently from non-medical disputes, but the safest move is: list the disputed accounts and confirm with your loan officer whether they’re exempt from your specific program.

How to Remove Credit Disputes From My Credit Report Fast?

The fastest path to remove credit disputes is usually:

- Identify which bureau(s) show the dispute remark,

- Request the bureau remove the dispute notation (retract the dispute),

- If the bureau says the creditor/furnisher placed it, contact the creditor to remove dispute status and update the bureaus,

- Get an updated report/supplement for your lender.

How Long Does it Take to Remove a Dispute Remark?

Timelines can be different. Credit bureaus usually have about 30 days to investigate a dispute, and it might take even longer for any updates to appear on your reports.

Will Removing a Dispute Lower My Credit Score?

It can. If a dispute was “masking” a negative item from scoring, retracting it may cause the score to change once the account is fully included again. Experian notes disputes can affect what appears on your report. They may impact scores depending on what changes after the dispute is completed.

Can I Retract a Dispute Online, or Do I Have to Call/Mail?

Each bureau offers different options (online, mail, phone) for dispute-related requests. Online is often the easiest for standard disputes, but removing a dispute remark may require a call or a written request, depending on the situation.

Do I Retract the Dispute with the Credit Bureau or the Creditor?

Either can be involved:

- If the bureau placed the dispute remark from your filing, start with the bureau.

- If the creditor/furnisher placed the dispute status, you’ll likely need the creditor to remove it and push an update to the bureaus.

What if a Credit Repair Company Filed Disputes While I’m Buying a Home?

Tell them to stop all disputes immediately and notify your loan officer. New disputes during underwriting commonly trigger delays because the underwriter must re-check credit and may need updated findings.

How Can I Prove to My Lender That the Disputes are Removed?

Ask your loan officer/processor what they prefer, but common proof includes:

- an updated tri-merge credit report, or

- a credit supplement showing the dispute remark/flag is gone, plus any creditor confirmation if the furnisher had to remove it.

The above are the steps on How To Remove Credit Disputes on your own. If you are in the middle of the mortgage process, your loan officer can help you with retracting your credit disputes.

This article about “How to Remove Credit Disputes Fast for Mortgage Approval” was updated on January 29th, 2026.

Looking to Remove Credit Disputes and Secure a Loan?

Get in touch today to learn how to clear your credit report and move forward with your mortgage or loan application.