DTI Manual Underwriting Guidelines on FHA and VA Loans

TL;DR: DTI Manual Underwriting Guidelines (2026 Update) If a computer system says “no” to your mortgage because your debt-to-income ratio…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

TL;DR: DTI Manual Underwriting Guidelines (2026 Update) If a computer system says “no” to your mortgage because your debt-to-income ratio…

Mortgage With High Student Loan Debts: How to Qualify in 2025 Buying a home when you’ve got a lot of…

How Property Taxes Can Determine Buying Power in 2025 When people are looking to buy a home, they usually pay…

This guide covers how credit scores impact DTI on FHA and Conventional loans. A person’s credit score will determine whether…

Debt-to-Income Ratio Overlays: What Homebuyers Need to Know Your debt-to-income ratio (DTI) matters to lenders when getting a mortgage. But…

In this guide, we will cover front-end debt-to-income ratios mortgage guidelines. There are two different types of debt-to- income ratios:…

FHA Debt-To-Income Ratio Requirements: What You Need to Know If you’re applying for an FHA loan, one of the most…

Getting approved for a mortgage isn’t just about your income and credit score. A huge factor lenders look at is…

How Underwriters View Liabilities in Mortgage Qualification (Updated for 2024) When applying for a mortgage, understanding how underwriters evaluate liabilities…

Mortgage with High DTI: Your Guide to Home Loans in 2024 In 2024, the world of home loans is changing….

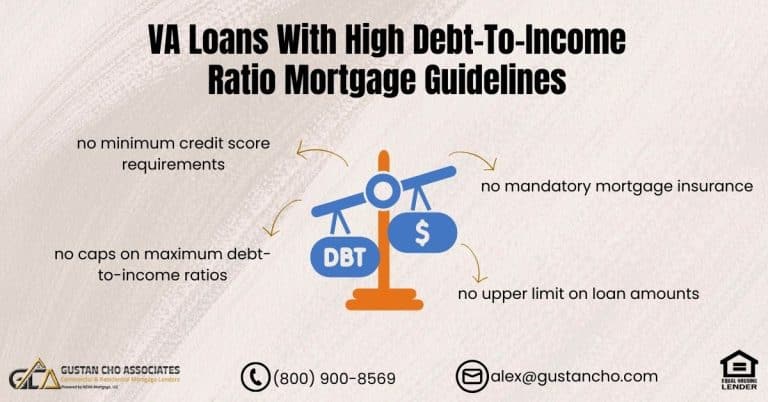

VA Loans with High Debt-to-Income Ratio: A 2024 Guide for Veterans Are you a Veteran worried about your high debt-to-income…

How Underwriters Calculate Debt-to-Income Ratio (DTI) – 2024 Guide When it comes to buying a home, there are a few…

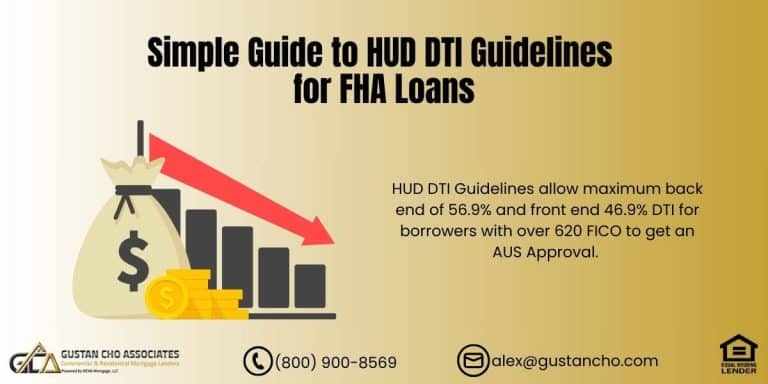

Understanding HUD DTI Guidelines for FHA Loans in 2024: How to Qualify for a Purchase or Refinance When you’re considering…

Excluding Debts from DTI Calculations in 2024: How You Can Qualify for a Mortgage with High Debt-to-Income Ratios One of…

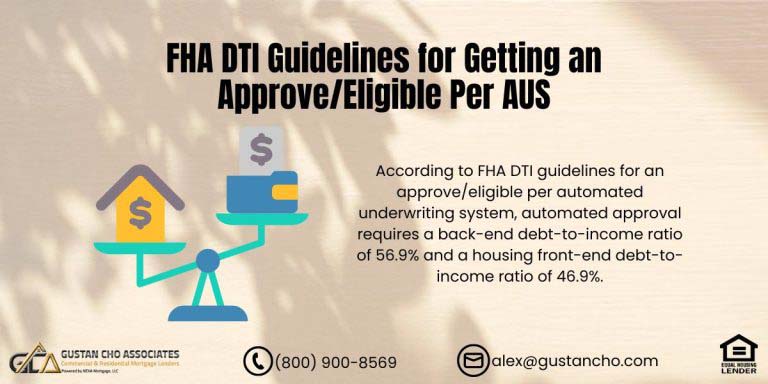

Maximum Debt-To-Income Ratios for AUS Approval: What You Need to Know in 2024 When applying for a mortgage, your debt-to-income…

This guide covers all about Debt-To-Income Ratio for Conventional Loan: Your 2024 Guide to Homeownership with conventional loans: Are you…

Understanding Exempt Debts of Co-Signed Loans in 2024: A Guide for Homebuyers Co-signing a loan can feel like helping a…

FHA Guidelines on Student Loans: Your Path to Homeownership Student loans are a significant part of life for many Americans,…

First-time homebuyers, especially, may be easily overwhelmed by the complexities of purchasing a home. One of the most critical aspects…

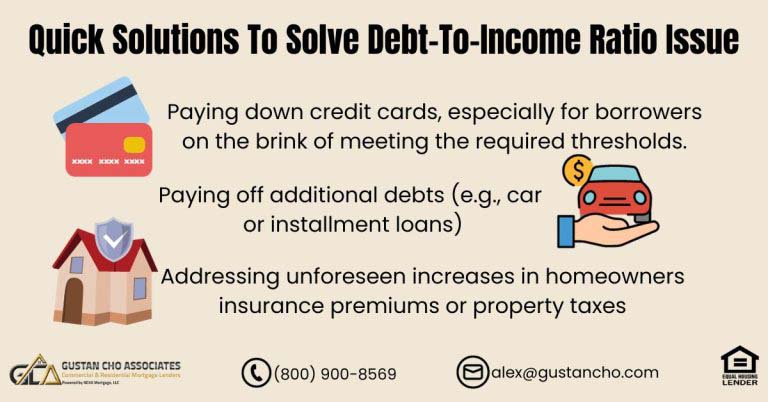

This guide covers paying down credit cards during mortgage process due to high debt-to-income ratios. Debt-to-income ratios are one of…

In this blog, we will discuss and cover bad credit mortgage lenders in Rhode Island for borrowers with bad credit…

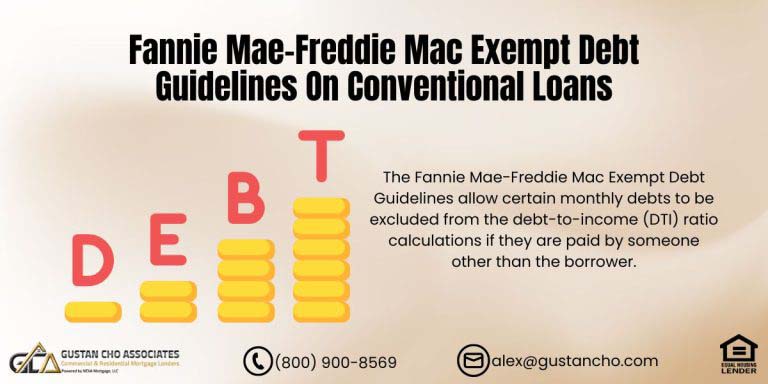

There are certain debts that can be exempt from debt to income ratio calculations on conventional loans.