Qualifying For a Home Mortgage Moving To New Home

This guide covers qualifying and getting approved for a home mortgage moving to new home. Moving to new home is…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers qualifying and getting approved for a home mortgage moving to new home. Moving to new home is…

This guide covers subprime loans and non-QM mortgages. Borrowers who have bad credit or not enough income due to self-employment…

In this blog, we will cover and discuss the mortgage guidelines Chapter 13 versus Chapter 7 Bankruptcy. Homebuyers qualifying for…

This GUIDE covers the experience with homeowners associations. Have you ever wondered where your HOA fee goes every month or…

In this blog, we will cover and discuss mortgage loan programs with no overlays and closing in 30 days. The…

This guide covers mortgage for second primary residence lending guidelines. Many Americans have a current primary residence and are looking…

This article is about FHA Bankruptcy waiting periods after Chapters 7 and 13. FHA Bankruptcy wqiting period requirements were release…

Data Show More Homebuyers Buying Homes In The Suburbs And Fleeing City Life. More city dwellers are fleeing the city and buying homes in the suburbs due to the high crime rate in the city due to the Black Lives Matter Movement and incompetent politicians.

This guide covers how credit card balance affect debt-to-income ratio for mortgage borrowers. We will discuss the negative impact how…

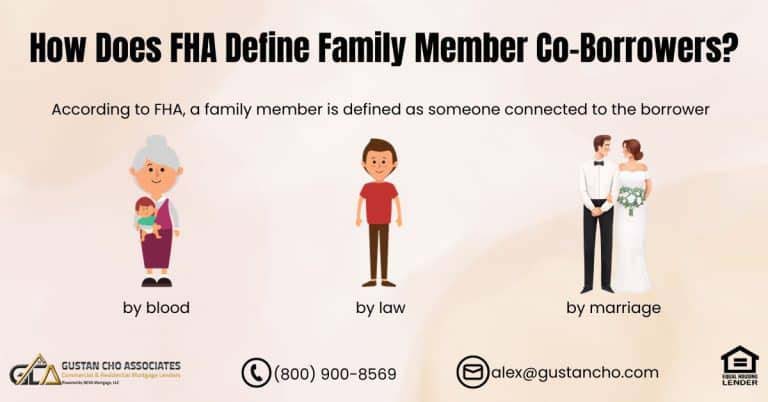

This guide covers how does FHA define family member. In this blog post, we’ll explore FHA’s criteria for defining a…

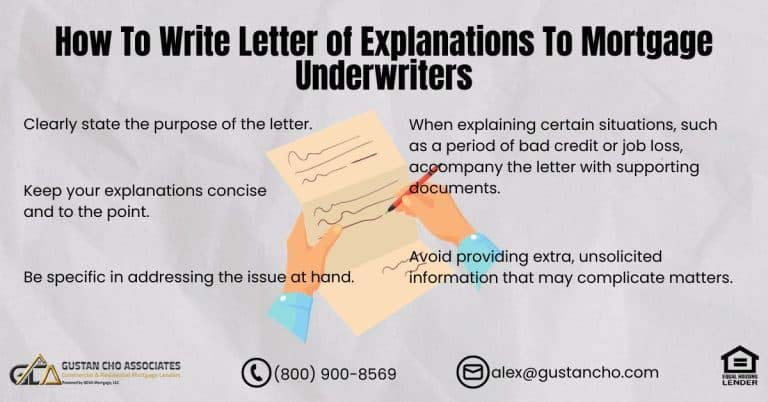

In this blog, we will cover how to write a letter of explanation to mortgage underwriters. Borrowers planning on applying…

In this blog, we will discuss and extensively cover everything you need to know about the loan estimate. The Loan…

This guide covers manual underwriting versus automated approval. There are two types of Automated Underwriting Systems (AUS): Fannie Mae’s Automated…

In this blog, we will cover and discuss getting a fully underwritten TBD mortgage approval as pre-approvals. Fully Underwritten TBD…

This guide covers the mortgage process leading to closing for borrowers. The home buying and mortgage process leading to closing…

This guide covers buying house next to power lines. Some home buyers will run into their dream home when…

This article covers Freddie Mac foreclosure guidelines on Conventional loans. Fannie Mae and Freddie Mac is the nations largest buyers…

Unlock Your Dream Home with Doctor and Medical Professional Mortgage Loans Are you a medical professional dreaming of buying your…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

This guide covers getting a mortgage with student loans with high debt-to-income ratio. Getting a mortgage with student loans can…

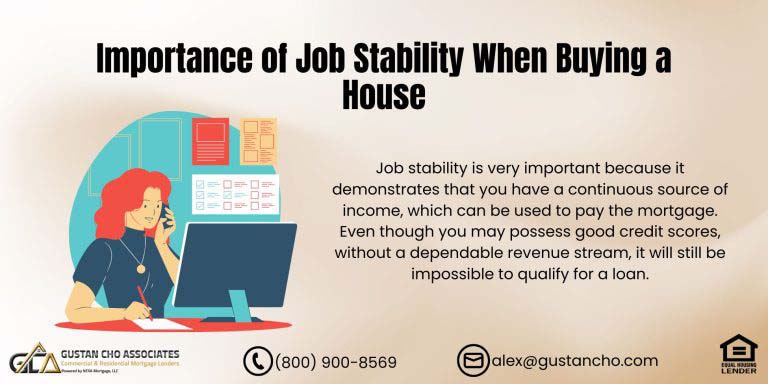

This guide covers the importance of job stability when buying a house with a mortgage. Income is the most important…

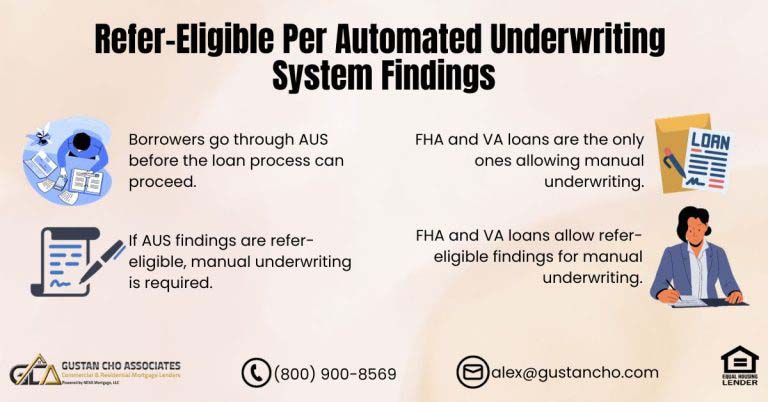

This article will cover and discuss refer-eligible per automated underwriting system findings. All mortgage loan applicants need to go through…