Eviction Moratorium: Is Your State Offering Protection?

Eviction Moratorium Updates: What Renters and Homeowners Need to Know in 2024 The eviction moratorium became a lifeline for millions…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Eviction Moratorium Updates: What Renters and Homeowners Need to Know in 2024 The eviction moratorium became a lifeline for millions…

Homebuyers do not need great credit and high credit scores to qualify for a mortgage. You can have outstanding collections and charged-off accounts and qualify for a mortgage as long

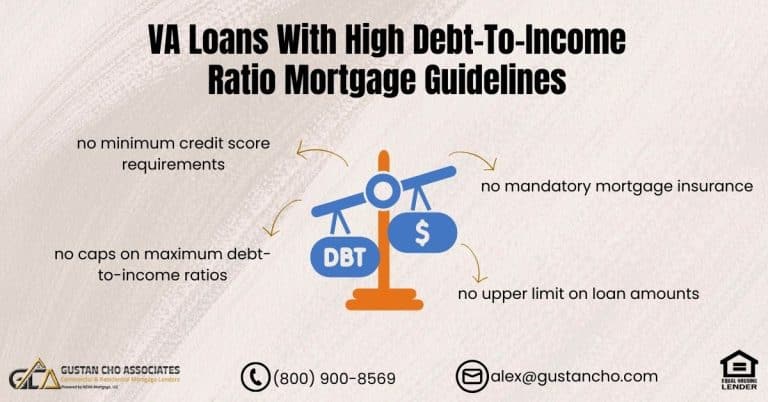

VA Loans with High Debt-to-Income Ratio: A 2024 Guide for Veterans Are you a Veteran worried about your high debt-to-income…

FHA Loans Chicago: Your 2024 Guide to Affordable Homeownership Buying a home in Chicago can be daunting, especially with rising…

In this guide, we will cover a comprehensive look at 100% unsecured business loans for small business owners and entrepreneurs….

How To Get a Mortgage in Puerto Rico: Your Guide Are you ready to trade chilly winters and high federal…

In 2024, is it possible to secure a mortgage with collection accounts? Yes, find out how it can be done!…

Changing Lenders After Locking Rates: What You Need to Know in 2024 Locking in a mortgage rate is a critical…

Re-Establishing Credit to Qualify for FHA Loan: Your 2024 Guide to Homeownership Are you dreaming of buying a home but…

FHA Approved Condos Versus Single-Family Homes: What’s the Best Choice for You? Are you torn between buying an FHA-approved condo…

Are you worried that medical collections on your credit report might stop you from getting an FHA loan? FHA medical…

In this detailed guide, we’re going to dive into everything you need to know about getting an FHA loan in…

Kentucky is becoming popular for people looking for affordable housing and a lower cost of living. Kentucky offers a more…

Many people reestablish themselves sooner than others after bankruptcy and foreclosure. These folks can qualify for a mortgage sooner than the mandatory waiting period on government and conventional loans. Gustan Cho Associates has non-QM loans one day out of bankruptcy and foreclosure with a 30% down payment.

Is it possible to get a mortgage with a recent eviction? It’s a common worry – can someone get a…

Looking for the best Minnesota mortgage lenders for bad credit might seem daunting, but it doesn’t have to be. If…

Are you trying to buy a house but find out you have unpaid court fees on your credit? It feels…

Understanding FHA 203k Rehab Loans After Bankruptcy Securing a home loan after experiencing bankruptcy can be challenging. Still, the FHA…

An auto loan can be a deal killer when it comes to getting qualified for a mortgage. The average monthly auto loan on a new car is $500 per month. $500 per month is equivalent to a $100,000 mortgage payment.

Qualifying for FHA loan after foreclosure is now possible for homebuyers who meet the mandatory waiting period after foreclosure. Fannie…

This article concerns securing a home loan with bad credit in Indiana with no overlays. Indiana home values are skyrocketing…

In this article, we will cover and discuss home loans in South Carolina for homebuyers with bad credit and low…