In this article, we will cover and discuss home loans in South Carolina for homebuyers with bad credit and low credit scores. Not all South Carolina mortgage lenders have the same lending requirements on government and conventional loans. Most lenders in South Carolina will have higher lending requirements called lender overlays on FHA, VA, USDA, and conventional loans.

While securing a mortgage with poor credit may be more challenging, some programs and lenders cater to individuals with less-than-perfect credit scores.

Homebuyers with bad credit who are looking to purchase a home in South Carolina have several options. In the following sectiions, we will cover an overview of the options available: In the following paragraphs, we will cover getting approved for home loan in South Carolina for homebuyers with bad credit.

Non-QM and Non-Prime Lenders in South Carolina

Not all mortgage lenders in South Carolina offer non-QM and non-prime loans. Gustan Cho Associates are mortgage brokers licensed in 48 states with a large presence in South Carolina. Over 80% of our borrowers are folks who could not qualify at other mortgage companies due to lender overlays, last-minute mortgage loan denials, or because other lenders did not have the mortgage loan product the borrower needed. Credit Score Requirement: Lenders may offer loans to borrowers with credit scores below 600, but terms can be less favorable. Down Payment: Higher down payment requirements. Interest Rates: Higher interest rates due to increased risk. Benefits: This option is available for those who don’t qualify for traditional loans but have higher costs.

Bad Credit? No Problem! We Offer Home Loans for South Carolina Homebuyers Like You!

Contact us today to see how we can help you find the right loan for your situation.

What Are The Best Home Loans in South Carolina For Bad Credit?

Gustan Cho Associates has a wide variety of mortgage options for bad credit borrowers. We have no lender overlays on government and conventional loans and offer non-QM loans. A large percentage of our borrowers are folks we qualify and approve for FHA, VA, and non-QM loans with credit scores down to 500 FICO scores.

South Carolina Mortgage Lenders For Bad Credit

Outstanding collections and charged-off accounts do not have to qualify for primary home loans. The best home loans in South Carolina for bad credit are FHA loans. The team at Gustan Cho Associates are experts in helping borrowers get approved for a mortgage after bankruptcy in South Carolina. Gustan Cho Associates has a reputation for being able to do loans other lenders cannot do.

Can I Get Approved With a Different Lender After Being Denied?

Mortgage Lenders in South Carolina have different lending requirements on FHA, VA, USDA, and Conventional loans. One lender may deny a borrower with a 600 credit score because that lender requires a 620 credit score but a different lender will approve a borrower with a 580 credit score all day long.

Many mortgage borrowers and real estate professionals are under the assumption that all government and conforming loan requirements in South Carolina are uniform.

Many are under the assumption that FHA, VA, and USDA loans are government-backed mortgages so all lenders should have the same lending requirements. This is not true. Lenders can have different lending guidelines for the same loan program. The best home loans in South Carolina for homebuyers with low credit scores are FHA, VA, and non-QM loans

FHA Loans (Federal Housing Administration)

Credit Score Requirement on FHA loans: Typically, a minimum credit score of 580 is required to qualify for a 3.5% down payment. Borrowers with scores between 500 and 579 may still qualify for a 10% down payment. Down Payment: on FHA loans is as low as 3.5%. Benefits of FHA loans is easier qualification requirements and lower down payments. FHA loans are backed by the government, reducing the risk for lenders. FHA loans requires an upfront mortgage insurance premium (UFMIP) and an annual mortgage insurance premium (MIP).

VA Loans (Veterans Affairs)

Eligibility: Available to veterans, active-duty service members, and certain National Guard and Reserves members. Credit Score Requirement on VA loans: There is no official minimum credit score, but lenders typically require a score of at least 580-620. Down Payment on VA loans: No down payment is required. Benefits of VA loans: No mortgage insurance and competitive interest rates.

USDA Loans (United States Department of Agriculture)

Eligibility of USDA Loans: Available for rural and suburban homebuyers who meet income eligibility requirements. Credit Score Requirement: A minimum credit score of 640 is generally preferred, but lower scores can be considered with compensating factors. Down Payment: No down payment is required. Benefits: Low mortgage insurance costs and favorable terms for eligible borrowers.

South Carolina State Housing Finance and Development Authority (SC Housing)

Programs: Offers programs for homebuyers, including down payment assistance and special mortgage products. Credit Score Requirement: Varies by program, but some programs cater to borrowers with lower credit scores. Benefits: Access to down payment assistance, favorable loan terms, and support for first-time homebuyers.

Private Lenders and Hard Money Loans

Eligibility: Available to individuals who may not qualify for conventional financing. Credit Score Requirement: More flexible, but terms can vary widely. Interest Rates and Fees: Higher interest rates and fees than traditional mortgages. Benefits: Faster approval process and more flexible qualification criteria.

Credit Unions

Eligibility: Often have more lenient lending criteria and offer personalized services. Credit Score Requirement: This varies by institution, but some may be more willing to work with borrowers with lower credit scores. Benefits: Lower fees and competitive rates compared to traditional banks.

Tips for Improving Chances of Approval:

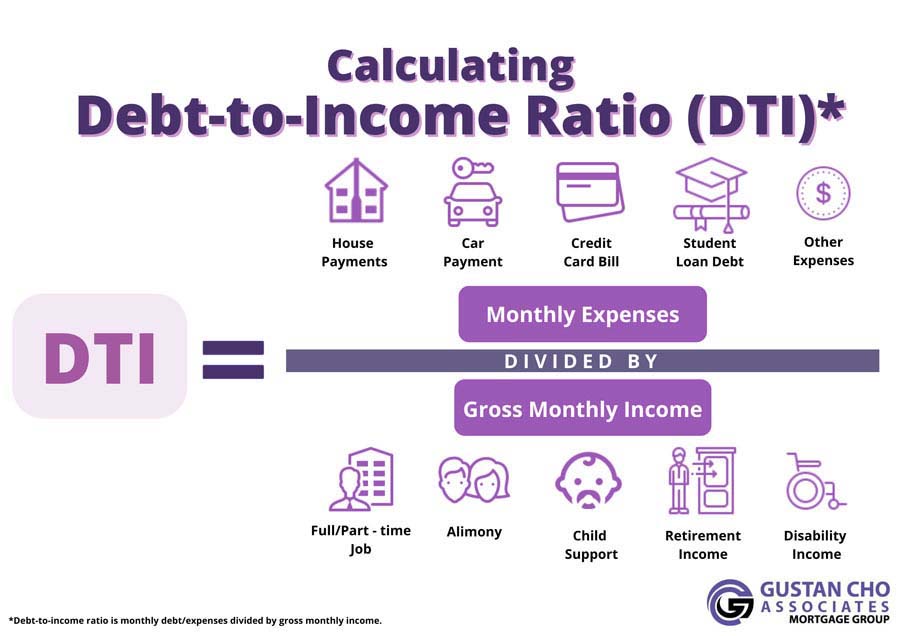

Improve Credit Score: Take steps to improve your credit score before applying, such as paying down debt, disputing errors on your credit report, and making timely payments. Save for a Larger Down Payment: A larger down payment can improve your chances of approval and may secure better loan terms. Reduce Debt-to-Income Ratio: Pay down existing debts to improve your debt-to-income ratio. Provide Proof of Stable Income: Lenders look for stable employment and consistent income.

W2 Income Wage Earner Consider a Co-Signer: A co-signer with good credit can improve your chances of approval. Different lenders have different criteria, so shopping around and comparing offers is beneficial.

While having bad credit can make securing a home loan more challenging, several options are available for homebuyers in South Carolina. Government-backed loans like FHA, VA, and USDA loans and state-specific programs like those offered by SC Housing can provide pathways to homeownership. Additionally, exploring options with credit unions and private lenders and improving your credit score can enhance your chances of getting approved for a mortgage.

Take First Step Toward Making Your Dream A Reality

Reach out now to learn how we can help you secure the financing you need and get you into your new home.

What Are The Requirements For FHA Loans in South Carolina?

The best home loans in South Carolina for bad credit are FHA loans. You can get an FHA loan with credit scores down to 500 FICO. All lenders in South Carolina require borrowers to meet the minimum HUD agency mortgage guidelines on FHA loans. Lenders need to meet the minimum agency mortgage guidelines of HUD in order for the FHA loans they originate and fund to be insured by HUD in the event the borrower defaults. Individual lenders can have higher lending requirements that surpass the minimum agency HUD guidelines called lender overlays. Gustan Cho Associates has zero lender overlays on FHA loans.

Do Lenders Have Different Requirements For The Same Mortgage Program?

Individual lenders can have higher lending requirements that are above and beyond the minimum HUD agency mortgage guidelines. These higher lending requirements that surpass the minimum agency HUD guidelines are called lender overlays. Lenders can have lender overlays on just about anything. Lender overlays on credit scores, debt-to-income ratio, gift funds, collections, and charged-off accounts are very typical lender overlays by mortgage companies.

Home Loans in South Carolina For 500 FICO Borrowers

HUD allows borrowers with credit scores as low as 500 FICO to be eligible for an FHA loan. Lenders do not have to accept borrowers with under 580 credit scores as part of their lender overlays. Understanding the difference between agency guidelines versus lender overlays is very important for borrowers with less-than-perfect credit. If one lender says you do not qualify for an FHA loan does not mean that another lender will not approve you. We will cover the difference between agency guidelines versus lender overlays in the next paragraph.

Home Loans in South Carolina For High Debt-To-Income Ratio Homebuyers

The only income that has been verified and documented can be used as qualified income for home loans in South Carolina. You cannot use cash or undocumented cash. Many home buyers in South Carolina have issues with a high debt-to-income ratio. The best home loans in South Carolina for a high debt-to-income ratio are FHA and VA loans.

Can I Get Denied For a Mortgage After Being Pre-Approved?

This happens all the time. Over 80% of our borrowers at Gustan Cho Associates are folks who got denied by other lenders and get qualified, approved and close on their home loans with us. Not all South Carolina lenders have the same lending requirements on FHA loans. Most lenders have lender overlays on FHA loans in South Carolina. Lender overlays are lending requirements that are higher lending guidelines above and beyond the minimum agency HUD mortgage guidelines. Not all mortgage lenders have the same lender overlays. Each lender can have its own lender overlays. The minimum credit score requirement to qualify for a 3.5% down payment home purchase FHA loan is 580 FICO.

Best South Carolina Mortgage Lenders For Bad Credit

One lender may require a 620 FICO, while another lender may require a 640 credit score These higher credit score requirements by mortgage lenders are called overlays. The maximum debt to income ratio allowed to get an approve/eligible per automated underwriting system in South Carolina is 46.9% front-end and 56.9% back-end.

Lender Overlays on Debt-To-Income Ratio

Most lenders require lower debt-to-income ratio caps. Some require a 31% front-end and 40% back-end debt-to-income ratio or lower than the maximum DTI allowed by HUD. Again, these stricter lending requirements are lender overlays imposed by individual lenders.

Buying a Home with Bad Credit in South Carolina? We’ve Got You Covered!

Contact us today to discuss your mortgage options and find a solution that works for you.

Reason For Last-Minute Denial on Home Loans in South Carolina

The main reason for last-minute denials in home loans in South Carolina is that the loan officer issued a pre-approval based on agency guidelines on the automated underwriting system and ignored the lender overlays. Lender overlays are mortgage guidelines imposed by the lender that is higher than the agency guidelines.

Mortgage Companies With Lender Overlays in South Carolina

Mortgage companies can implement any type of lender overlay. Each lender can have its own type of lender overlay. Some lenders may have lender overlays on gift funds while other lenders may not. Some lenders may require a borrower cannot to use gift funds for the down payment and/or closing costs unless they have a 640 credit score while other lenders may not care about gift funds.

Overlays on Home Loans in South Carolina by Mortgage Lenders

Below is a list of typical lender overlays imposed by mortgage companies:

- Credit score requirements

- Not accept borrowers with a certain credit score such as not accepting borrowers with under 580 credit scores

- Not accept manual underwriting on FHA loans

- HUD allows borrowers with outstanding collections and/or charged-off accounts to qualify for FHA loans but lenders can require collections and/or charged-off accounts need to be paid off

- Have a certain credit score requirement for borrowers who are getting gift funds for the down payment and closing costs

- There are no waiting period requirements after the Chapter 13 Bankruptcy discharged date but lenders can require a one year or two-year waiting period requirement

- HUD allows employment gaps in the past two years but lenders can have lender overlays requiring two years of employment with the same employer

- Not accepting employment offer letter mortgages

- Requiring verification of rent

In the next paragraph, we will discuss and cover the minimum agency HUD mortgage guidelines.

HUD Agency Mortgage Guidelines On FHA Loans In South Carolina

Lenders need to make sure all borrowers meet the minimum HUD agency mortgage guidelines if they want to get insured on all of their FHA loans. Here are the minimum agency mortgage guidelines on FHA loans. The minimum credit score of 580 FICO for a 3.5% down payment home purchase FHA loan. Borrowers with credit scores between 500 to 579 FICO are eligible for FHA loans but need a 10% down payment versus a 3.5% down payment.

Mortgage Guidelines on Late Payments in Past 12 Months

Need timely payments for the past 12 months to get an approve/eligible per automated underwriting system on FHA loans. Borrowers with no credit scores are eligible to qualify for an FHA loan with non-traditional credit. Non-traditional credit is alternative credit such as utilities, cell phones, insurance, educational payments, or other creditors that do not report to the three credit reporting agencies. One to four-unit residentially zoned owner-occupant primary homes.

HUD Property Standards For FHA Loans

Property needs to meet the minimum HUD property standards and be safe, secure, and habitable. One time 1.75% upfront FHA mortgage insurance premium that can be rolled into the loan balance and a 0.85% annual mortgage insurance premium for the life of a 30-year fixed-rate FHA mortgage. The above are the basic HUD agency mortgage guidelines in South Carolina. Again, if you meet the above agency HUD mortgage guidelines and are told you do not qualify for a loan by one lender, then you should realize that you can qualify for an FHA loan with a different lender with no lender overlays. Gustan Cho Associates has no lender overlays on FHA loans in South Carolina.

The Best Mortgage Lenders For FHA Loans After Bankruptcy

HUD guidelines require a two-year waiting period after Chapter 7 Bankruptcy to be eligible for an FHA loan. Borrowers should have rebuilt and re-established credit after the Chapter 7 Bankruptcy discharged date with no late payments. Borrowers who are in a Chapter 13 Bankruptcy repayment plan are eligible to qualify for an FHA loan after they have been in the repayment plan for at least 12 months and bankruptcy trustee approval.

Home Loans in South Carolina During and After Chapter 13 Bankruptcy

It needs to be a manual underwrite. Most trustees will approve a home loan during the Chapter 13 Bankruptcy repayment plan. You do not need to have the Chapter 13 Bankruptcy discharged but you do need timely payments during your repayment plan. There is no waiting period after the Chapter 13 Bankruptcy discharged date. However, if your Chapter 13 Bankruptcy discharge has not been discharged for at least 24 months, it needs to be a manual underwrite. Gustan Cho Associates are experts in helping borrowers qualify and get approved for an FHA loan during and after bankruptcy.

Struggling with Bad Credit? South Carolina Home Loans Are Still Within Reach!

Reach out now to learn about the options available and get pre-approved for your home purchase.

Home Loans in South Carolina After Foreclosure, Deed In Lieu Of Foreclosure, Short-Sale

You can qualify for home loans in South Carolina after foreclosure, a deed in lieu of foreclosure, and/or short sale. There are waiting period requirements after a housing event. Here are the waiting period requirements after a housing event in South Carolina. There is a three-year waiting period after foreclosure, a deed in lieu of foreclosure, and a short sale to qualify for an FHA loan in South Carolina.

VA Guidelines After a Housing Event

There is a two-year waiting period after foreclosure, a deed in lieu of foreclosure, and a short sale on VA loans. There is a four-year waiting period after a deed in lieu of foreclosure, and/or a short sale to qualify for a conventional loan. There is a seven-year waiting period after a foreclosure to qualify for conventional loans. There is a three-year waiting period requirement after foreclosure, a deed in lieu of foreclosure, and a short sale to qualify for USDA loans.

Re-Establishing Credit After Bankruptcy and Foreclosure

Borrowers should rebuild and re-establish their credit after a housing event. Under no circumstances should a borrower have a late payment after a foreclosure, deed-in-lieu of foreclosure, or short-sale if they want to qualify for a mortgage after a housing event. If the borrower cannot wait until passing the waiting period after foreclosure, deed in lieu of foreclosure, or short-sale, Gustan Cho Associates has non-QM mortgages one day out of bankruptcy and/or foreclosure for homebuyers with a 30% down payment.

Best Mortgage Lenders For First-Time Homebuyers With Bad Credit

The team at Gustan Cho Associates are experts in helping homebuyers qualify for a mortgage after foreclosure, deed in lieu of foreclosure, and short-sale in South Carolina. FHA loans are the most popular home mortgage loan program in South Carolina for first-time homebuyers, borrowers with prior bad credit, and borrowers with lower credit scores.

Over 80% of Our Borrowers Could Not Qualify at Other Lenders

Over 80% of our borrowers at Gustan Cho Associates are folks who could not qualify at other lenders due to those lenders having overlays on government and conventional loans. We help thousands of first-time homebuyers, borrowers with credit scores down to 500 FICO, and homebuyers who are in an active Chapter 13 Bankruptcy repayment plan.

FAQs: Home Loans in South Carolina For Homebuyers With Bad Credit

- 1. What options are available for homebuyers with bad credit in South Carolina? Homebuyers with bad credit in South Carolina have several options, including FHA, VA, USDA, and non-QM loans. Each program has different requirements and benefits that can accommodate individuals with less-than-perfect credit scores.

- 2. What is a non-QM or non-prime loan, and who offers it in South Carolina? Non-QM loans, also known as Non-Qualified Mortgages or non-prime loans, are designed for individuals who fall outside the usual lending standards. Gustan Cho Associates, a prominent mortgage broker in South Carolina, offers these loans to help borrowers who may have been denied by other lenders due to strict overlays.

- 3. What are the typical requirements for an FHA loan in South Carolina? FHA loans typically require a minimum credit score 580 for a 3.5% down payment. You’re still eligible for FHA loans if your credit score is in the 500-579 range. With a 10% down payment, you can make your homeownership dreams a reality. It’s important to note that FHA loans come with upfront and annual mortgage insurance premiums.

- 4. Can veterans in South Carolina get a home loan with bad credit? VA loans can be accessed by veterans, active-duty service members, and certain National Guard and Reserve members. Although there is no set minimum credit score, most lenders usually mandate a credit score of at least 580-620. VA loans provide advantages such as no down payment and no need for mortgage insurance.

- 5. What are the benefits of USDA loans for homebuyers in South Carolina? The USDA loans cater to homebuyers in rural and suburban areas who fulfill certain income criteria. These loans do not necessitate a down payment and come with economical mortgage insurance expenses. It is generally preferred to have a credit score of at least 640.

- 6. Are there state-specific programs for homebuyers with bad credit in South Carolina? SC Housing offers down payment assistance and specialized mortgage options for individuals looking to purchase a home, even with lower credit scores.

- 7. Can I get a home loan in South Carolina after being denied by another lender? Yes, different lenders have different requirements, and being denied by one does not mean all lenders will deny you. Comparing the loan options provided by different lenders is essential to improve the probability of getting approved. Be sure to look around to enhance your chances of approval.

- 8. What steps can I take to improve my chances of getting approved for a home loan in South Carolina? Working to increase your credit score, saving up for a larger down payment, lowering your debt-to-income ratio, showing evidence of steady income, and considering a co-signer all boost the likelihood of being approved.

- 9. What should I do if denied a home loan in South Carolina due to lender overlays? If denied due to lender overlays, try other lenders who may not have those specific overlays. Gustan Cho Associates, for example, has no lender overlays on FHA loans, making them a good option for borrowers with bad credit.

- 10. What are the waiting period requirements for home loans in South Carolina after bankruptcy or foreclosure? For FHA loans, a two-year waiting period is required after Chapter 7 bankruptcy, and borrowers in Chapter 13 repayment plans are eligible after 12 months with trustee approval. After experiencing foreclosure, a deed in lieu of foreclosure, or a short sale, FHA loans mandate a waiting period of three years.

If you have any questions about the content in this article or need to qualify for an FHA loan in South Carolina, please contact us at 800-900-8569 or email us at gcho@gustancho.com. Text us for a faster response. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about Home Loans in South Carolina For Homebuyers With Bad Credit was updated on June 23rd, 2024.

Bad Credit in South Carolina? You Can Still Qualify for a Home Loan!

Contact us today to explore flexible loan options and get the guidance you need to secure financing.