FHA Investor Overlays: What They Are and How to Avoid Them

Are you trying to get an FHA loan but keep getting turned down—even though you meet the basic requirements? The problem might not be you—it might be the FHA investor overlays added by your lender.

In this post, we’ll explain exactly what FHA investor overlays are, how they affect your ability to get approved, and what you can do to finally get your mortgage with no hassle. We’ll also show you why Gustan Cho Associates is one of the few lenders offering FHA loans with no investor overlays.

What Are FHA Investor Overlays?

FHA loans are one of three government-backed home loans. The three government loans are FHA, VA, USDA loans. Government-backed home mortgages are for primary owner-occupant loans. Private lenders originate and fund government loans. Government agencies backing the government home loans will insure and/or partially guarantee lenders in the event homeowners default and/or foreclosure on the government-backed loan.

FHA loans are mortgage options supported by the Federal Housing Administration. These loans are a great choice for first-time homebuyers or those with lower credit scores because they provide flexible lending options.

The FHA has set basic guidelines that all lenders must follow, which dictate things like the minimum credit scores, borrowing limits, the amount of debt a borrower can have, and the types of homes that can be purchased.

However, lenders can impose their own additional rules beyond what the FHA requires, which are known as FHA investor overlays. These overlays can complicate the process for borrowers trying to fulfill the criteria for an FHA loan, even when they meet the FHA’s fundamental standards.

FHA Investor Overlays vs. HUD Guidelines: Know the Difference

Understand how investor overlays affect your mortgage options compared to HUD agency guidelines.

Government Versus Conventional Loans

Conventional loans are also known as conforming loans because they must meet the guidelines set by Fannie Mae and Freddie Mac. If a loan doesn’t follow these guidelines, Fannie Mae and Freddie Mac won’t buy it.

Lenders use a special line of credit to fund these conventional loans. They need to sell these loans in the secondary mortgage market to get the money required to keep making new loans. Fannie Mae and Freddie Mac help make sure there is enough money in the mortgage market, which helps lenders create and fund loans and keeps the housing market stable.

All mortgage companies require that borrowers meet the minimum guidelines set by the agencies for government and conventional loans. Some lenders, however, have stricter requirements than these minimum guidelines. These stricter requirements are commonly referred to as lender overlays. Lenders can impose overlays on various aspects of the loan process.

It is legal for lenders to have requirements that exceed the standard agency guidelines. Many lenders do this, which is why not all lenders have the same rules for FHA loans. A borrower might meet the minimum HUD guidelines but still find they don’t qualify with a specific lender.

Some lenders have no additional overlays for FHA loans. If a lender tells you that you don’t qualify for an FHA loan, it’s a good idea to try another lender that doesn’t have overlays. Gustan Cho Associates is one of the rare lenders that doesn’t add extra rules to government and conventional loans. We rely on the automated results from the underwriting system and do not add additional requirements for FHA loans.

Why Do Lenders Use FHA Investor Overlays?

Lenders don’t want to take too much risk. So even though the FHA says one thing, the lender may say:

- “We need a higher credit score.”

- “Your debt-to-income ratio is too high.”

- “You need more time since your last bankruptcy.”

These extra rules don’t come from FHA. They’re from the lender’s investors or internal risk policies.

That’s why you might qualify for an FHA loan on paper—but still get denied by the lender.

If this sounds like what you’re dealing with, you’re definitely not alone. Many folks who come to Gustan Cho Associates have already been turned down by other lenders because of investor overlays.

FHA Investor Overlays vs. FHA Guidelines

Let’s break it down.

| FHA Guidelines (from HUD) | FHA Investor Overlays (from lenders) |

| Minimum 580 credit score with 3.5% down | Some lenders require 620 or even 640 FICO |

| Debt-to-income ratio up to 56.9% | Some lenders cap DTI at 45% or 50% |

| No waiting period | Some lenders want a 1- or 2-year waiting period |

| Manual underwriting allowed | Some lenders won’t do manual underwriting |

At Gustan Cho Associates, we don’t add extra overlays. If you meet FHA guidelines, you’re approved. Period.

This no-overlay approach is why we can help so many borrowers who’ve been told “no” elsewhere.

FHA Investor Overlays: How They Differ from HUD Agency Guidelines

Find out how overlays impact your loan approval and what to expect when working with FHA loans.

Most Common FHA Investor Overlays (2025 Update)

In 2025, many lenders will still add overlays that block good borrowers from getting approved. Let’s look at the most common ones.

1. Credit Score Overlays

The Federal Housing Administration (FHA) has some clear rules when it comes to credit scores for people looking to borrow money. If your credit score is 580 or above, a down payment of just 3.5% will suffice. For 500 to 579 credit scores, you need a down payment of 10%. The catch is that many lenders have their own stricter rules and want scores of 620 or 640, leaving a lot of buyers out in the cold even if they fit the FHA criteria.

At Gustan Cho Associates, we stick to the FHA guidelines without adding extra demands on credit scores, so more people can get the financing they need for a home.

2. Debt-to-Income Ratio (DTI) Overlays

FHA guidelines permit a back-end debt-to-income (DTI) ratio of up to 56.9% for borrowers with strong credit. However, if your credit score is below 620, the maximum DTI allowed drops to 43%. It’s important to note that many lenders impose their own limits, often capping DTI at either 45% or 50%, regardless of what FHA allows. This means that even if the FHA guideline approves your DTI, your lender may still decline your application based on their own criteria.

Ultimately, we adhere strictly to FHA standards. If the automated underwriting system (AUS) indicates “Approve/Eligible,” we will move forward based on that outcome.

3. Manual Underwriting Overlays

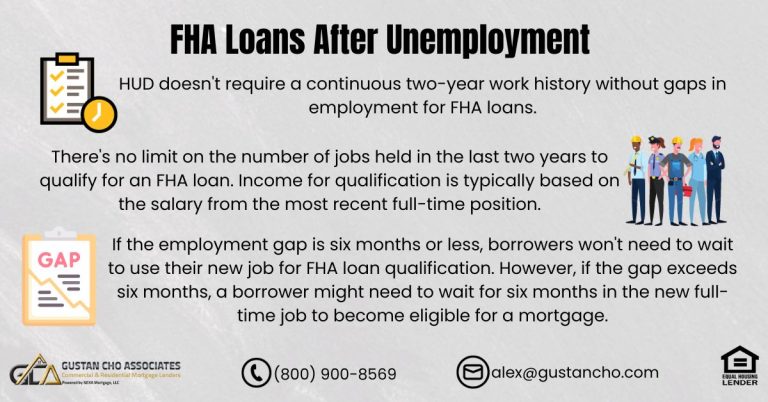

Manual underwriting overlays are super important, especially for FHA loans. The Department of Housing and Urban Development (HUD) says manual underwriting is an option when the Automated Underwriting System (AUS) can’t give a green light. This process comes with certain factors to balance things out, such as having a steady job, some extra savings, and not experiencing a major increase in payments.

However, some lenders completely avoid manual underwriting and impose additional requirements, known as overlays. On the bright side, Gustan Cho Associates focuses on manual underwriting, keeping things simple without adding any overlays, which gives borrowers more flexibility.

Real-Life Example: How Overlays Hurt Good Borrowers

Meet Sarah. She had a 610 credit score and was buying her first home. She got pre-approved with a big lender but was denied during underwriting. Why?

Her DTI was 52%, and the lender capped it at 45%.

Sarah was confused. She met FHA’s rules, had steady income, and a clean rental history.

She came to us, and we approved her in 24 hours. There were no overlays. She closed on her home in 3 weeks.

This happens all the time. Borrowers get turned away—not because of FHA—but because of FHA investor overlays.

Why Choose a No-Overlay Lender?

If you’re tired of hearing “no,” it’s time to choose a lender who only follows FHA guidelines—not what its investors want.

Here’s what you get with Gustan Cho Associates:

- No minimum credit score overlays

- No DTI cap overlays

- Manual underwriting available

- No waiting period overlays after Chapter 13 discharge

- No overlays on collections or charge-offs

- Fast closings—even with tricky files

We don’t add rules—we follow HUD’s rules. That means more approvals, less stress, and faster closings.

What If You Were Denied Due to FHA Investor Overlays?

If a lender tells you:

- Your credit is too low

- Your debts are too high

- You need more time after a bankruptcy or foreclosure

Ask them: Is that FHA’s rule—or your investor’s overlay?

Then call us.

We’ll review your file for free and let you know if you truly qualify under FHA guidelines. Chances are—you do.

FHA Investor Overlays and the Automated Underwriting System (AUS)

FHA loans go through an AUS, which gives a result like:

- Approve/Eligible (green light to close)

- Refer/Eligible (needs manual underwriting)

Most lenders still apply overlays even when the AUS gives the green light.

At Gustan Cho Associates, we honor the AUS findings. If it says “Approve,” you’re good. If it says “Refer,” we’ll do manual underwriting.

This is how we close loans other lenders won’t touch.

FHA Investor Overlays and HUD Guidelines Explained

Explore the differences in eligibility, credit requirements, and DTI limits for FHA loans.

Who We Help

We help all kinds of borrowers get FHA loans with no overlays:

- First-time homebuyers with low credit

- Borrowers with a recent Chapter 13 discharge

- Homebuyers with high DTI ratios

- Self-employed borrowers with non-traditional income

- People who were denied by other lenders

If you meet FHA’s guidelines, we’ll get you to the closing table.

FHA Investor Overlays Are Costing You Time and Money

Every time you get denied by a lender with overlays, you’re losing time, money, and energy. You may even lose the home you love.

Stop the cycle. Get a second opinion from Gustan Cho Associates.

We close FHA loans that other lenders can’t—because we don’t play games with overlays.

Ready to Get Approved?

You don’t need to be perfect to qualify for an FHA loan. You need to meet FHA guidelines—not extra investor rules.

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on FHA investor overlays, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com.

Let’s get you approved today.

Final Thoughts on FHA Investor Overlays

FHA investor overlays are one of the top reasons borrowers are denied mortgages, even when they technically qualify.

Don’t give up if another lender tells you no. It might not be you—it might just be their overlays.

At Gustan Cho Associates, we say yes when others say no because we follow FHA guidelines exactly as written—no overlays, no excuses.

Frequently Asked Questions About FHA Investor Overlays:

What are FHA Investor Overlays?

FHA investor overlays are extra rules some lenders add on top of the standard FHA guidelines. Even if you meet FHA’s rules, a lender with overlays might still deny you.

Why was I Denied an FHA Loan Even Though I Met All the Requirements?

You may have been denied because of FHA investor overlays. These are stricter rules added by the lender, not by the FHA.

Can FHA Investor Overlays Stop Me From Getting a Loan with a Low Credit Score?

Yes. FHA allows credit scores as low as 580 with 3.5% down, but some lenders add FHA investor overlays that require 620 or 640 instead.

Do All Lenders Use FHA Investor Overlays?

No, not all lenders use overlays. Some, like Gustan Cho Associates, follow FHA guidelines with no overlays at all.

What’s the Difference Between FHA Guidelines and FHA Investor Overlays?

FHA guidelines are the official rules set by HUD. FHA investor overlays are added rules made up by the lender or their investors.

How do FHA Investor Overlays Affect My Debt-to-Income Ratio (DTI)?

FHA may allow a DTI up to 56.9%, but a lender with overlays might cap it at 45% or 50%, which could result in a denial.

Can I Still Get a Loan After a Recent Bankruptcy?

FHA allows you to get a loan right after a Chapter 13 discharge, but lenders with FHA investor overlays might make you wait 1–2 years.

What if My Loan is Denied Because of Overlays?

If you’re denied, ask the lender if it’s due to FHA investor overlays. Then, contact a no-overlay lender like Gustan Cho Associates for a second opinion.

What is Manual Underwriting, and Do Overlays Affect it?

Manual underwriting is a backup method when automated systems don’t approve your loan. Many lenders with FHA investor overlays won’t allow it, but Gustan Cho Associates does.

How Can I Avoid FHA Investor Overlays?

Work with a lender that follows FHA guidelines without overlays. Gustan Cho Associates is one of the few that offers FHA loans with no FHA investor overlays, making it easier for you to get approved.

This blog about “FHA Investor Overlays Versus HUD Agency Mortgage Guidelines” was updated on December 15th, 2025.

FHA Investor Overlays and HUD Guidelines: Understand Your Loan Options

Make the right choice by understanding overlays and how they influence FHA loan approvals.