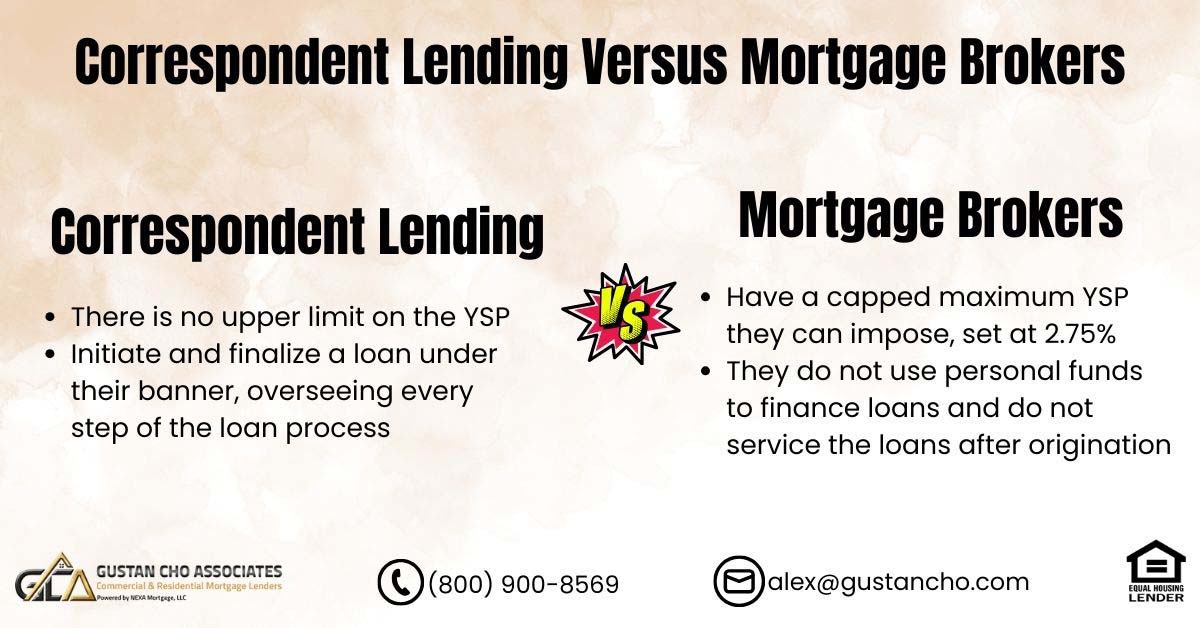

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains to the lender type offering the most favorable rates. The response is straightforward: correspondent lenders aren’t mandated to reveal the yield spread premium in the closing disclosure, and there’s no upper limit on this premium in correspondent lending. In contrast, mortgage brokers have a capped maximum yield spread premium they can impose, set at 2.75%.

Correspondent lending involves a mortgage lender utilizing their in-house warehouse credit line to originate and finalize a loan under their banner.

These lenders, known as correspondent lenders, essentially function as mortgage bankers, overseeing every step of the loan process from origination, processing, underwriting, closing, and funding, to eventually selling the loan in the secondary market. Because of the expenses involved, the majority of correspondent lenders cannot sustain operations with a maximum yield spread premium of 2.75%. Instead, they typically charge a yield spread premium exceeding 5% on the back end. As the yield spread premium increases, so does the rate for borrowers. Comparatively, mortgage brokers tend to offer borrowers superior mortgage rates and terms compared to mortgage bankers and correspondent lending mortgage companies.

What Is Correspondent Lending In Mortgage

There are various types of mortgage companies for borrowers to choose from. Many have heard the term correspondent lending or correspondent lenders. Correspondent lenders are smaller mortgage lenders that normally piggyback off larger mortgage bankers. Correspondent lenders and mortgage bankers both operate within the banking realm. Correspondent lenders leverage funds from their warehouse line of credit to initiate loans under their banner.

Akey distinction exists: mortgage bankers typically act as lenders, managing loans even after selling them in the secondary market. Correspondent lenders primarily focus on loan origination without servicing the loans afterward.

In essence, correspondent lenders fall under the category of mortgage bankers. Smaller ones are commonly known as mini-correspondent lenders. They utilize their funds via a warehouse line of credit to initiate and finance loans for their clients. These lenders handle the closing and funding of loans under their name and using their warehouse line of credit.

Confused About Correspondent Lending vs. Mortgage Brokers? Let Us Help You Make the Right Choice!

Contact us today to learn more and find the solution that works best for you.

Direct Versus Correspondent Lending

Direct and correspondent lenders originate and fund the mortgage loans they originate under their company names. The difference between direct and correspondent lending is direct lenders will service the loans they fund. Once the correspondent lender funds the loans, they sell them to the direct lender. Correspondent lenders do not service the loans they fund.

Direct lenders sell mortgage loans on the secondary market. The largest purchase of mortgages on the secondary market is Fannie Mae and Freddie Mac.

However, direct lenders will service loans after the loans are funded and sold on the secondary market. Once they fund and close the loans, the correspondent lender will sell the loans they fund to the larger mortgage banker they associate with correspondent lending. Direct lenders normally service the loans they purchase from correspondent lenders. The larger mortgage banker will then purchase funded loans from several correspondent lenders and sell these loans to institutions or Fannie Mae and Freddie Mac. Fannie Mae and Freddie Mac are the two mortgage giants in the United States.

What Is The Role of Fannie Mae and Freddie Mac in the Mortgage Industry?

Fannie Mae and Freddie Mac play a crucial role in maintaining liquidity in the mortgage markets by acquiring loans from mortgage bankers on the secondary market. Mortgage bankers rely on selling the loans they originate in the secondary market to cover expenses such as their warehouse line of credit and to finance additional loans. This process is essential for mortgage lenders to offer home mortgages at competitive and affordable rates.

The Correspondent Lending Process Explained

Correspondent lending is when a mortgage company piggybacks off a larger mortgage banker and sells the loans they originated and fund to the larger mortgage banker after the loan closes and funds. Correspondent lenders will team up with larger mortgage bankers to sell their loans once they fund them. The larger mortgage bankers will buy loans from several correspondent or mini-correspondent lenders.

How Correspondent Lenders Sell Loans To Larger Mortgage Bankers

After acquiring sufficient loans from their correspondent lenders, they sell these loans to a larger institutional lender, such as Fannie Mae and Freddie Mac, in the secondary market. It’s essential to distinguish correspondent lenders from mortgage brokers. Correspondent lenders employ their warehouse line of credit to initiate and fund loans under their name. Correspondent lending encompasses two distinct types of underwriting—delegated and non-delegated.

Delegated Versus Non-Delegated Correspondent Lending

Delegated underwriting occurs when the correspondent lender utilizes its mortgage underwriters. On the other hand, non-delegated underwriting takes place when a correspondent lender relies on a larger mortgage banker to underwrite the loan. In delegated underwriting, the correspondent lender instructs its mortgage underwriter to adhere to the guidelines of an investor who intends to sell the loan after it is funded.

Selling Loans To The Larger Mortgage Banker

After the mortgage loan is sold to the investor, it is typical for the investor to acquire the loan while retaining the servicing rights. The mortgage servicer is responsible for issuing statements, gathering monthly principal and interest payments, and collecting escrow payments from borrowers. Correspondent lenders may vary in size, ranging from small entities with only a handful of employees, licensed in a limited number of states, to larger mortgage companies employing hundreds or thousands of individuals and licensed in numerous states.

Correspondent Lending Mortgage Process

Becoming a mini-correspondent or correspondent lender offers numerous advantages for mortgage brokers. It’s important to note that to transition into a correspondent lender, one doesn’t necessarily need to operate as a large mortgage company. Several correspondent lenders successfully operate with just a handful of employees and hold licenses in only one or a few states.

The Role of Mortgage Brokers

Mortgage brokers are authorized experts with indirect lending affiliations with wholesale lenders. They do not utilize personal funds to finance the loans they initiate. On the other hand, correspondent lenders possess a warehouse line of credit for loan initiation and funding, closing loans under their company name. Mortgage brokers have the flexibility to establish connections with numerous wholesale mortgage lenders. In the subsequent discussion, we will delve deeper into the reasons behind choosing a mortgage broker over mortgage bankers or correspondent lenders.

How The Correspondent Lending Cycle Works

After closing and securing loans through their warehouse line of credit, correspondent lenders proceed to sell the loans to a larger mortgage investor. The underwriting of these loans is carried out by correspondent lenders per the investor’s guidelines. John Strange, from Gustan Cho Associates, provides insights into the functioning of the secondary mortgage markets in correspondent lending: The correspondent lender plans on selling the loan after it is funded.

Mortgage brokers are limited to earning a yield spread premium of no more than 2.75%. In contrast, mortgage bankers and correspondent lenders have the potential to surpass the 2.75% cap imposed on mortgage brokers.

Once the larger mortgage investor buys the loan from the correspondent lender, the lender will pay down the banking warehouse line of credit so they can originate and fund more loans. The wholesale mortgage investor will buy more loans from other correspondent lenders, package them, and sell them to institutional investors like Fannie Mae or Freddie Mac.

Mortgage Brokers vs. Correspondent Lending: Which is Right for You? Let Us Guide You!

Reach out today to discuss the differences between correspondent lending and mortgage brokers, and get expert advice on what’s best for you.

Advantages Of Being A Correspondent Lender Versus A Mortgage Broker

The 2.75% limit challenges mortgage companies to cover commissions for loan officers and overhead expenses. Angie Torres, the National Operations Director at Gustan Cho Associates, provides insights into how regulations operate in correspondent lending compared to mortgage brokers: If you are a mortgage banker or correspondent lender, you do not have to disclose the yield spread premium on the Closing Disclosure (CD).

Mortgage regulators exempt lenders from disclosing how much they make on each loan transaction because lenders use their names and own funds to close their loans.

As a correspondent lender, you enjoy complete operational control, in contrast to the role of a mortgage broker. One drawback of working with correspondent lenders is the potential for higher rates compared to those offered by mortgage brokers. The correlation lies in the fact that the more profit a lender earns on the back end, the greater the likelihood of elevated mortgage rates. Nevertheless, certain correspondent lenders prioritize competitive rates and operate with a lower back-end compensation plan. Consequently, their rates and terms can rival those of mortgage brokers.

Difference Between Wholesale Versus Retail Lending

What is the difference between mortgage brokers versus mortgage bankers? Mortgage brokers and bankers originate home mortgages for clients needing a home purchase or refinance mortgage. Dale Elenteny, a senior loan officer at Gustan Cho Associates, Inc., explains the difference between wholesale versus retail lending: The difference between wholesale and retail lending is retail lenders originate loans directly with borrowers.

Wholesale lenders partner up with mortgage brokers and do not have a retail staff of licensed loan officers. Wholesale lenders depend on third party licensed mortgage loan originators for production.

They both have the same type of licensing. Borrowers can get a mortgage from a mortgage broker or a mortgage banker. There is no difference between getting a home mortgage from a mortgage broker or a mortgage banker for a borrower. They both lend home loans to consumers. They both need to be licensed and regulated. However, understanding the differences between a mortgage banker and a broker can save borrowers time and money when shopping for a mortgage.

What Are The Advantages of Wholesale Versus Retail Lenders

Numerous individuals seeking to purchase homes, particularly those venturing into the real estate market for the first time, typically approach their nearby banks to request a mortgage loan. It’s important to note that banks operate as mortgage bankers, not mortgage brokers. They provide loans using their funds. Individuals with less-than-ideal credit may discover that obtaining a mortgage loan from a bank is challenging, as banks generally impose more stringent lending criteria compared to other mortgage companies.

Wholesale lenders do not have high marketing costs like correspondent lenders. Marketing is every companies biggest expense and overhead.

Lenders vary in their lending requirements for government and conventional loans. While all lenders are obligated to ensure that their borrowers adhere to the minimum agency guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac, some may impose additional requirements beyond these standards. These extra lending criteria, exceeding the minimum agency guidelines, are commonly referred to as overlays.

Why Mortgage Brokers Have Access To More Loan Options

Lenders have lender overlays to lower their risk tolerance on government and conventional loans. Some lenders have no lender overlays. Understanding agency mortgage guidelines are important for borrowers. FHA, VA, USDA, Fannie Mae, and Freddie Mac have their agency guidelines. Correspondent lenders need to pay loan officers, benefits, brick and mortar, advertising costs, and other overhead. They need to charge much higher than the 2.75% mortgage brokers charge. The higher the compensation to lenders, the higher the rates to the consumer.

The Importance of Understanding Agency Mortgage Guidelines Versus Overlays

Individuals with less-than-ideal credit must understand agency guidelines. Even if a borrower has less-than-perfect credit, a history of bad credit, outstanding collections, charged-off accounts, or other derogatory credit tradelines, they may still be eligible for a mortgage by meeting the minimum agency guidelines.

However, it’s important to note that being deemed ineligible for a mortgage by one lender doesn’t necessarily mean they cannot qualify with another lender. In such cases, if a borrower is informed that they do not meet the qualifications at one lender due to specific overlays, they should seek out a lender without such overlays that adhere to the minimum agency guidelines.

What Are Government-Backed Mortgages?

Government and conventional loans have their agency guidelines lenders need to meet. There are three types of government loans.

- FHA Loans

- VA Loans

- USDA Loans

How Do Government Mortgages Work in the Mortgage Process?

Government-backed loans are originated and funded by lenders. Government loans are partially guaranteed and insured by a government agency (FHA, VA, USDA) if the borrower defaults or foreclosure on the government-backed loan. The government agency has nothing to do with the origination, process, underwriting, and funding of government-backed mortgages.

Why Government Loans Have Lenient and Low Down Payment Requirements

Lenders are keen to initiate and finance government loans with minimal or no down payment and attractive mortgage rates, thanks to the assurance provided by government guarantees. FHA, VA, and USDA play a role in partially guaranteeing and insuring lenders against losses incurred in case borrowers default or face foreclosure on government loans.

Nevertheless, to secure this guarantee for the government loan, lenders must adhere to the specific guidelines set by the respective government agencies. Any government loan not meeting these guidelines will not be insured by FHA, VA, or USDA.

Fannie Mae And Freddie Mac Guidelines on Conventional Loans

Fannie Mae and Freddie Mac are the two that is the two largest purchasers of mortgages in the United States. Both Fannie Mae and Freddie Mac are government-sponsored enterprises (GSE). The role of Fannie Mae and Freddie Mac is to provide liquidity to lenders by purchasing mortgages they originate and fund.

Ready to Understand Correspondent Lending vs. Mortgage Brokers? Let’s Break It Down!

Reach out now for a personalized consultation and learn which option will help you secure the best mortgage.

Does any Government Agency back Conventional Loans?

Conventional loans are not government-backed mortgages. Lenders originate and fund conventional loans. But why do conventional loans need to meet Fannie Mae and Freddie Mac Agency Guidelines if they are not government-backed mortgages?

Fannie Mae and Freddie Mac only purchase mortgages that conform to their agency lending guidelines. Lenders use their warehouse line of credit to originate and fund conventional loans.

Once the loan is funded, they must sell it on the secondary market. The mortgage purchaser on the secondary mortgage market can be a larger mortgage lender, or it can be Fannie/Freddie directly. Fannie Mae and Freddie Mac refrain from acquiring conventional loans that fail to meet their specified lending criteria, leading to the common designation of such loans as conforming loans. Secondary market buyers also abstain from acquiring mortgages that do not adhere to the guidelines set by Fannie and Freddie agencies. Upon the sale of a loan, lenders utilize the proceeds to reduce their warehouse line of credit, enabling them to initiate and finance additional loans.

Why It Makes Sense to Go with Mortgage Brokers Versus Mortgage Bankers

Lender Overlays are additional mortgage guidelines that exceed the minimum agency lending guidelines by FHA, VA, USDA, Fannie Mae, and Freddie Mac. HUD, the parent of FHA, requires a 580 credit score for a 3.5% down payment home purchase FHA loan (mortgage lending guidelines).

However, most banks, credit unions, and mortgage bankers will require a higher credit requirement from their clients. Most lenders will require a 620 credit score or higher on FHA loans. This holds even though HUD Agency Guidelines require a 580 FICO.

Why One Lender Have Different Requirements than Another Lender

Lenders’ higher credit score requirement on FHA loans is called lender overlays. It is perfectly legal for mortgage bankers to have a higher credit score requirement and other lender overlays. Most lenders will have lender overlays on government and conventional loans.

Mortgage Companies With No Lender Overlays

Gustan Cho Associates has a national reputation for not having any mortgage lender overlays on government and conventional loans. As long as borrowers can get an approved eligible per Automated Underwriting System and can provide the documents verifying whatever stated mortgage application, we will close on the home loan.

Difference Between Mortgage Brokers Versus Correspondent Lenders

The distinction between mortgage brokers and mortgage bankers lies in the fact that brokers do not utilize their funds to finance home loans. Instead, mortgage brokers establish connections with wholesale lending partners. They may be affiliated with various third-party wholesale mortgage lenders, potentially maintaining associations with numerous lenders, and in some cases, dozens of them. The question arises: how do mortgage brokers receive compensation for their services?

Rate Comparison Between Mortgage Brokers and Mortgage Bankers?

Mortgage brokers typically establish compensation plans ranging from 2.5% to 2.75%. The borrower’s mortgage rates tend to increase with higher compensation plans negotiated with wholesale mortgage lenders. Brokers focused on securing the most favorable mortgage rates for their clients, particularly those specializing in refinancing mortgage loans, might opt for a borrower-paid compensation plan of 2% or less.

Lender Compensation Plan is What Determines Rates For Consumers

The mortgage rates are directly influenced by the compensation plan (comp plan) – the lower the comp plan, the lower the mortgage rates. Mortgage bankers typically impose fees ranging from 4% to 10% on the back end. Mortgage bankers and correspondent lenders, utilizing their warehouse line of credit for loan funding, are not obligated to disclose their compensation plan. According to legal regulations, mortgage brokers are limited to charging a maximum of 2.75%. This 2.75% is referred to as the yield spread premium (YSP), and it is mandatory to disclose it on the Closing Disclosure.

Correspondent Lending Compensation Versus Mortgage Brokers

The maximum a mortgage broker can charge a borrower by law is 2.75%. The higher the lender’s comp plan, the higher the rate to the borrower. At 2.75%, borrowers will get a very low mortgage rate compared to mortgage bankers. Comp plan on mortgage bankers does not have to be disclosed to borrowers.

Correspondent Lenders Use Their Warehouse Line of Credit To Fund Loans

Mortgage bankers utilize their funds to finance loans. According to federal regulations, there is no obligation to reveal the compensation earned on the loan when using personal funds for a mortgage loan. Typically, mortgage bankers receive significantly higher compensation than mortgage brokers. When working with a mortgage banker as opposed to a broker, mortgage rates are noticeably elevated.

Role Of Mortgage Bankers and Correspondent Lenders Versus Mortgage Brokers

Mortgage bankers, much like mortgage brokers, initiate home loans. Nevertheless, they finance the loans under their names through their warehouse line of credit. Mortgage bankers collaborate with wholesale lending partners, who are the investors responsible for acquiring the mortgages they fund using their warehouse line of credit.

Delegated Versus Nondelegated Underwriting

The lender can have a delegated or nondelegated underwriting relationship with the wholesale lending partner. Delegated mortgage underwriting means the lender has its in-house mortgage underwriter. The in-house mortgage underwriter will underwrite the loan under the wholesale lending partner’s strict guidelines.

How Mortgage Bankers Sell Loans on The Secondary Market To Pay Down the Warehouse Line of Credit

After the loan is funded, the primary goal of the lender is to promptly sell the financed loan on the secondary mortgage market. The lender aims to avoid being burdened with holding onto the loan for an extended period. Mortgage bankers and correspondent lenders are proactive in selling the loan to a larger mortgage banker, allowing them to recycle the warehouse line of credit efficiently.

Delegated Versus Non-Delegated Mortgage Bankers and Correspondent Lenders

Correspondent lenders who do not delegate authority will transfer the funded loan to the mortgage banker responsible for the underwriting process. These nondelegated lenders do not personally underwrite the loans they originate. Instead, the in-house underwriter of the lending partner, following their guidelines, undertakes the underwriting.

Upon purchasing the loan from the wholesale lending entity, the lender will utilize the funds to reduce their warehouse line of credit and facilitate additional loan transactions. This cyclical process repeats continuously.

Not Sure Whether to Choose a Correspondent Lender or a Mortgage Broker? We Can Help!

Contact us today to explore the benefits of correspondent lending and mortgage brokers, and let us guide you to the best option for your needs.

How Mortgage Bankers Operate

Mortgage bankers normally sell loans to wholesale lending partners and larger mortgage companies. They may also sell loans to banks, insurance companies, financial institutions, and Fannie or Freddie Mac. Mortgage Bankers are lenders who normally do not broker out mortgage loans to third-party wholesale lenders.

How Direct and Correspondent Lending Works

Mortgage bankers or direct lenders use their funds or warehouse line of credit to fund their borrower’s mortgage loans. Once the mortgage banker funds the borrower’s mortgage loans, they package the mortgage loans they have funded. They resell them to the secondary market. This is so they can relieve their warehouse lines of credit so they can fund more mortgage loans for new borrowers. Mortgage bankers do not have to disclose yield spread premiums but mortgage brokers do. Yield Spread Premium is the money mortgage brokers make as compensation.

Who Should I Choose?

Mortgage Bankers typically promote their loan programs and establish lending guidelines. Due to having higher overhead costs compared to brokers, mortgage bankers tend to have higher mortgage rates and fees. Mortgage brokers frequently provide lower mortgage rates compared to bankers. Mortgage bankers usually have the capability to offer government and conventional loans. In contrast, mortgage brokers can cultivate numerous relationships with wholesale lending partners who specialize in alternative financing mortgages, including non-QM loans, bank statement mortgages, asset depletion, fix and flip loans, and various other mortgage programs.

Comparison of Correspondent Lenders Versus Mortgage Brokers

Other aspects of mortgage banker versus broker are the following:

- For example, mortgage bankers may have lending overlays on credit scores

- Mortgage bankers set their lender overlays

- They may not accept mortgage borrowers with credit scores under 620 FICO

- However, mortgage brokers may have access to a lender where the lender may accept borrowers with credit scores of under 620 FICO.

- The advantage of mortgage brokers is that if a borrower gets denied by one lender, they can submit the file to a different lender.

- With mortgage bankers, if the borrower gets denied by one lender, the broker has the luxury of resubmitting the borrower’s loan application to a different lender with fewer overlays.

Many mortgage bankers do have the ability to be able to broker mortgage loans. These mortgage bankers can be mortgage bankers and mortgage brokers simultaneously. If you have any questions on correspondent lending, please get in touch with us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Frequently Asked Questions about the Article on Correspondent Lending Versus Mortgage Brokers:

- What is the main difference between correspondent lending and mortgage brokers? Correspondent lenders utilize their in-house warehouse credit line to originate and finalize loans under their banner, overseeing the entire loan process from origination to selling in the secondary market. On the other hand, mortgage brokers act as intermediaries between borrowers and wholesale lenders, offering various loan options from different lending partners.

- Why do correspondent lenders often charge higher yield spread premiums than mortgage brokers? Correspondent lenders may charge yield spread premiums exceeding 5% on the back end due to the expenses involved in their operations. Mortgage brokers, in contrast, have a capped maximum yield spread premium of 2.75%, making them potentially more cost-effective for borrowers.

- What is the role of Fannie Mae and Freddie Mac in the mortgage industry? Fannie Mae and Freddie Mac are crucial in maintaining liquidity in the mortgage markets by acquiring loans from mortgage bankers on the secondary market, allowing lenders to offer competitive and affordable rates.

- What is the difference between direct and correspondent lending? Direct lenders both originate and service the loans they fund, while correspondent lenders focus primarily on loan origination and sell the loans to larger mortgage bankers after funding.

- What are lender overlays, and how do they affect borrowers? Lender overlays are additional lending guidelines some lenders impose beyond the minimum agency guidelines. They can affect borrowers by requiring higher credit scores or other criteria to qualify for a loan.

- How are mortgage brokers compensated, and what is the maximum compensation they can charge? Mortgage brokers receive compensation through yield spread premiums paid by lenders, with the maximum allowable compensation capped at 2.75% as regulations require. Yes, mortgage brokers may have access to lenders who can accept borrowers with lower credit scores, providing more flexibility in finding suitable loan options.

- What is the advantage of using a mortgage broker over a mortgage banker with regard to lender overlays? Mortgage brokers can submit loan applications to different lenders if a borrower is denied by one, potentially finding a lender with fewer overlays to meet the borrower’s needs.

- Why do mortgage bankers often have higher mortgage rates compared to mortgage brokers? Mortgage bankers typically have higher overhead costs, leading to potentially higher mortgage rates and fees for borrowers than mortgage brokers.

- What types of loans do mortgage brokers typically offer? Mortgage brokers can offer various loan options, including government and conventional loans and specialized financing programs like non-QM loans, bank statement mortgages, and fix and flip loans.

- Can borrowers with lower credit scores benefit from working with mortgage brokers? Yes, mortgage brokers may have access to lenders who can accept borrowers with lower credit scores, providing more flexibility in finding suitable loan options.

- Can a mortgage banker also act as a mortgage broker? Yes, some mortgage bankers have the ability to act as both mortgage bankers and mortgage brokers, offering a wider range of loan options to borrowers.

This blog on Correspondent Lending Versus Mortgage Brokers was updated on , April 28th, 2024.

Correspondent Lender or Mortgage Broker? Let Us Help You Navigate Your Options!

Contact us today to explore your options between correspondent lending and mortgage brokers, and get the expert guidance you need.

I am now the Loan Program Specialist here at Compass Mortgage and we would like to look at a possible Correspondent relationship with you. Can you let me know if you can help us with any of the following types of loans:

Jumbo Product 90% LTV @680 fico up to $1M

2nd Lien product 90% LTV with less than $50k minimum that will pay us

Interest only Jumbo ARMs

Construction to Perm programs

Pretty! This has been a really wonderful article. Many thanks for providing these details. Corresponding lending is when lenders use their own money to originate and fund the loan. Correspondent lenders do not show the commission where mortgage brokers need to disclose the yield spread. Is Gustan Cho Associates correspondent lenders or mortgage brokers?

Gustan Cho Associates is a dba of NEXA Mortgage and AXEN Mortgage. NEXA Mortgage are mortgage brokers and AXEN Mortgage are correspondent lenders. Therefore, we are both mortgage brokers and correspondent lenders.