Manual Underwriting With Late Payments Mortgage Guidelines

Can You Qualify For Manual Underwriting With Late Payments? VA and FHA allow manual underwriting for borrowers who cannot get an approve/eligible per automated underwriting system.

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Can You Qualify For Manual Underwriting With Late Payments? VA and FHA allow manual underwriting for borrowers who cannot get an approve/eligible per automated underwriting system.

The Role of the Loan Officer Assistant: How They Help You Get a Mortgage Buying a home or refinancing can…

Mortgage Guidelines on Late Payments: How to Qualify for a Home Loan Despite Credit Challenges Life happens. Unexpected events like…

Credit Requirements: What You Need to Know to Get a Mortgage If you’re planning to buy a home, one of…

Understanding the VA Funding Fee: Your Ultimate Guide for 2025 Navigating a VA loan can seem complicated at first. Understanding…

Why You Should Not Get a 15-Year Fixed-Rate Mortgage: Think Twice Before Choosing a 15-year Fixed-Rate Mortgage. If you’re considering…

Mortgage Charge Offs Lending Guidelines: Your Guide to Homeownership in 2025 Have you experienced a mortgage charge off and need…

This blog covers how to build relationships by reading peoples body language. Reading peoples body language provides an amazing amount…

With mortgage payments often being one of the largest monthly expenses, owning a home comes with big financial responsibilities. Life’s…

This article is about the story of a veteran who served in the U.S. military. A decorated Vietnam veteran and…

This guide covers the 27-second effect research data and effects on driving. If you’re like most people, you probably need…

Gustan Cho Associates and Great Community Authority Forums News are updating a new updated guide on the Southern California Gas…

Housing Economic Outlook and how it impacts Homebuyers (Updated January 26, 2025) Introduction Housing Economic Outlook: Market activity at the…

This guide covers growing up in the inter-city of Chicago as a homeowner: The Story of John Strange. Escaping and…

This guide covers what happens when the Federal Reserve Board increases interest rates. This guide is an update of an…

This guide covers lenders for best rates. We have seen high interest rates and skyrocketing mortgage rates. Still to this…

Qualifying for Jumbo Loans in 2025: Your Complete Guide If you dream of purchasing a high-value home and need a…

In this blog, we will cover and discuss IHDA mortgage guidelines on Illinois home purchases. The Illinois Housing Development Authority…

This guide covers the role of the property manager and their responsibilities to landlords. The role of the property manager…

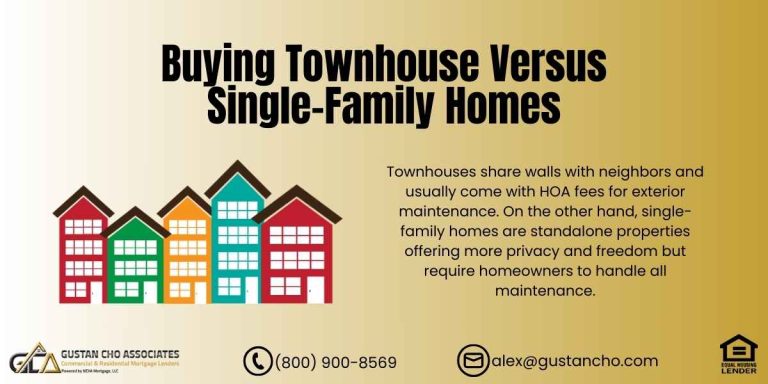

More and more homebuyers are gravitating towards a townhome purchase versus a single-family home during today’s booming housing market

This guide covers the Sarasota housing market. Purchasing a Property in Sarasota and Picking Your Real Estate Agent The Sarasota…

This guide covers the ill-fated HUD’s FHA Back to Work Mortgage. The FHA Back to Work Mortgage no longer exists….