Bounce Back Fast With Non-QM Loan Waiting Period Guidelines

Non-QM Loan Waiting Period Guidelines: Buy a Home Sooner After Bankruptcy or Foreclosure Life happens. Job loss, medical bills, divorce,…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Non-QM Loan Waiting Period Guidelines: Buy a Home Sooner After Bankruptcy or Foreclosure Life happens. Job loss, medical bills, divorce,…

In this article, we will discuss and cover refinance mortgage rates pricing adjustments, and volatility. Refinance Mortgage Rates hit a…

In this blog, we will cover and discuss VA loan limits on how much home you can buy with a…

The Impact of the Coronavirus Outbreak on Non-QM Lenders The Coronavirus outbreak hit non-QM lenders hard and fast. In early…

In this blog, we will discuss and cover buying home near schools for first-time homebuyers. There are pros and cons…

Conditional Mortgage Approval Versus Pre-Approval: What Borrowers Need to Know in 2025 Buying a home is super exciting, but the…

How Property Taxes Can Determine Buying Power in 2025 When people are looking to buy a home, they usually pay…

Cash-out refinance mortgage rates are higher than rate and term refinance rates. Cash-out mortgage rates are substantially higher for homeowners…

This guide covers how to prepare for mortgage for first-time homebuyers. The best way on how to prepare for mortgage…

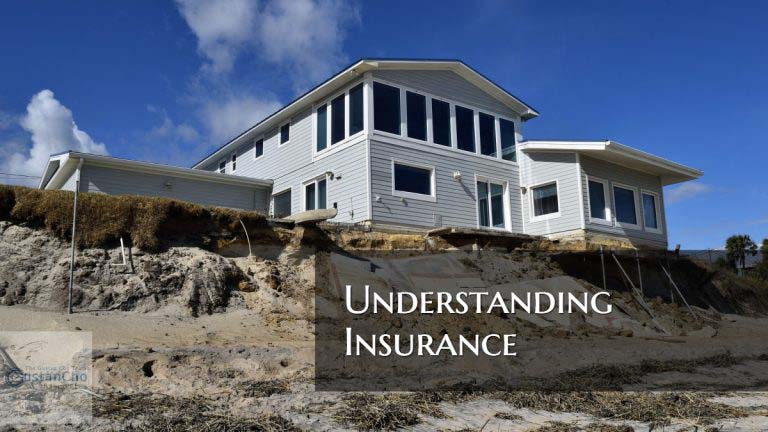

This guide covers understanding insurance protection for consumers and homeowners. Good morning open enrollment blog for day 1 of the…

This guide covers limited review versus full review condo purchase. Due to the real estate and mortgage meltdown of 2008…

Starting New Career as MLO in 2025: Step-by-Step Guide to Success If you’ve been thinking about starting a new career…

This ARTICLE covers the CFPB Eliminating TRID to help mortgage borrowers. Breaking News on CFPB Eliminating TRID: The mortgage industry…

HomeReady Versus Home Possible in 2025: Which Loan Is Best for You? If you’re looking for a mortgage and don’t…

Chicago Mortgage Loans for Self-Employed Individuals: 2025 Guide to Getting Approved Being self-employed in the Chicago area can be super…

This guide covers President Donald Trump to privatize Fannie Mae and Freddie Mac later in 2025. Fannie Mae and Freddie…

This guide covers the housing market outlook after the Federal Reserve Board cut interest rates. Housing prices have been increasing…

In this guide, we will cover 7 ways to defend a debt collection lawsuit. Jobs come with various offerings which…

Manual Underwriting With Extenuating Circumstances: 2025 Guide to Mortgage Approval Buying a home can feel impossible when you’ve had tough…

One of the most frequently asked questions is how much income do I need to buy a house in 2025….

How to Avoid Customer Complaints as a Loan Officer: Proven Tips That Work The mortgage business is full of moving…

This guide covers Chicago area property taxes soaring to record high levels. Chicago area property taxes soar to record levels….