Colorado VA Lenders For Bad Credit With No Lender Overlays

Quick Answer: Colorado VA Lenders for Bad Credit If you’re a veteran or active-duty borrower in Colorado and you’ve been…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Quick Answer: Colorado VA Lenders for Bad Credit If you’re a veteran or active-duty borrower in Colorado and you’ve been…

VA New Construction to Permanent One-Time Close Mortgages: 2026 Guide for Veterans Buying a house is hard in today’s market….

Buying a Home With a VA Loan in 2026: The Clear, No-Nonsense Guide You served. You earned this benefit. If…

TL;DR: DTI Manual Underwriting Guidelines (2026 Update) If a computer system says “no” to your mortgage because your debt-to-income ratio…

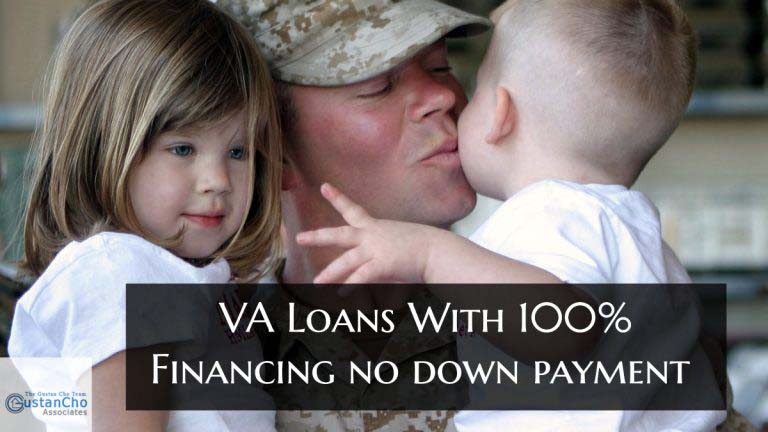

Veteran administration loans are one of the most powerful mortgage options available to the men and women who served our…

Active and/or retired members of the United States Armed Services and eligible surviving spouses of eligible veterans in Kentucky can…

VA Loan Eligibility Requirements in Vermont (2025 Update) Buying a home in Vermont is more than just owning property—it’s about…

Your All-Inclusive Manual to Getting an Illinois Mortgage with Bad Credit Mortgage Options. Do you fear poor credit could dash…

In this blog, we will cover and discuss government mortgages for owner-occupant homebuyers. We will go in-depth about what government…

In this article, we will cover and discuss FHA streamline refinance Utah mortgage guidelines. Gustan Cho Associates, Empowered by NEXA…

In this blog, we will cover and discuss VA loan limits on how much home you can buy with a…

In this blog, we will discuss and cover VA loans for first-time home buyers with no lender overlays. The United…

Virginia VA loan requirements has the most lenient mortgage guidelines versus any other loan program in the nation. VA loans…

This guide covers VA lender overlays- What Veterans need to know in 2025. Veteran homebuyers who are looking for lenders…

This guide covers VA employment history guidelines on VA loans. VA loans is the best loan program in the U.S….

Manual Underwriting With Extenuating Circumstances: 2025 Guide to Mortgage Approval Buying a home can feel impossible when you’ve had tough…

This guide covers how to find a good realtor for veterans when buying a house. When you separate from the…

Mortgage Guidelines After High School: How to Qualify for a Home Loan Buying a home is a big dream for…

Appraisal Transfer Policy: How to Transfer a Home Appraisal to a New Lender If you’re changing mortgage lenders and have…

Do All Lenders Have the Same Guidelines on VA Loans? One of the most frustrating experiences for VA homebuyers is…

How to Improve Credit to Qualify for VA Loans (2025 Update) Buying a home with a VA loan is an…

Understanding the VA Funding Fee: Your Ultimate Guide for 2025 Navigating a VA loan can seem complicated at first. Understanding…