Loan Officer Document Checklist To Start Mortgage Process

This guide covers the loan officer document checklist. This article on the Loan Officer Document Checklist is a series of…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers the loan officer document checklist. This article on the Loan Officer Document Checklist is a series of…

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

This guide covers how underwriters qualify income to approve mortgage loans. Many mortgage loan applicants do not have the role…

This guide covers qualifying for a home loan downsizing to a smaller home. It makes no sense in having a…

This guide covers things that can delay your mortgage loan closing. A mortgage loan should be able to close in…

Borrowers should not stress during the mortgage process. . There is no reason why there should be stress during the mortgage process.

This guide covers the steps in mortgage process for closing home loan on time. Homebuyers looking to purchase a new…

This guide covers mortgage underwriter errors causing borrowers a loan denial. Mortgage underwriter errors do happen. Underwriters are human and…

In this blog post, we will explore a tackle problem many borrowers face – Mortgage Denied After Pre-Approval. The landscape…

In this guide, we address underwriters conditions to pave the way for a clear-to-close submission. Whether individuals seek approval for…

This blog delves into the significance of non-traditional credit in mortgage qualification process, particularly focusing on scenarios where borrowers lack…

This guide covers avoiding home loan denial during the mortgage process. We will go deeply in giving our viewers tips…

In this article, we will cover and discuss how credit disputes affect mortgage process and cause loan denial. The pre-approval…

This article delves into how underwriters analyze bank statements of borrowers. When individuals seek a mortgage loan, underwriters deem 60…

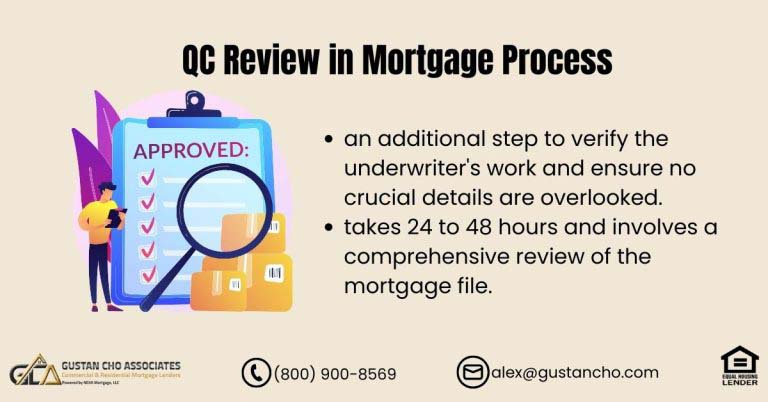

In this blog, we will be covering the QC Review Prior Clear To Close During Mortgage Process by some mortgage…

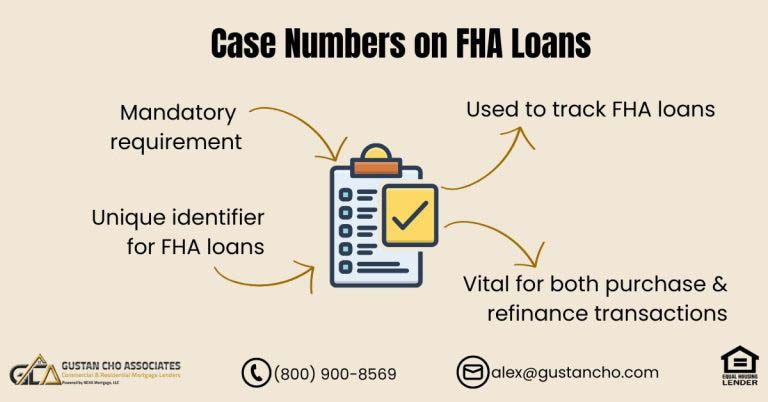

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers…

This guide covers overlays on debt-to-income ratio on FHA loans. Homebuyers who got issued pre-approval from a mortgage loan originator…

This guide covers non-QM down payment guidelines on home purchase. Non-QM down payment guidelines on home purchase for homebuyers on…

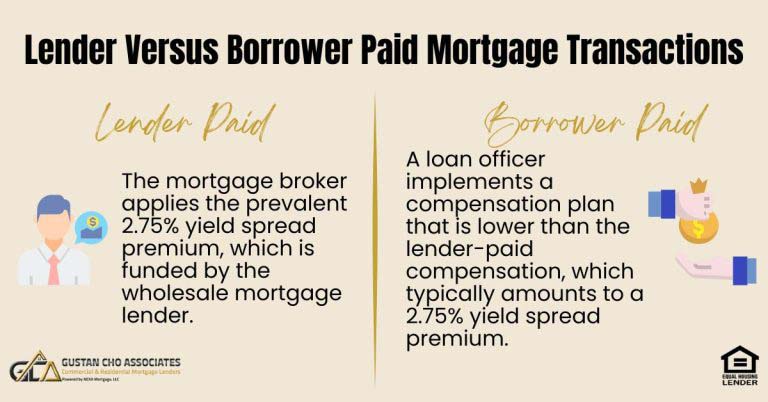

In this blog, we will discuss lender versus borrower paid mortgage transactions. Mortgage brokers can often opt to go with…

This guide covers the importance of mortgage qualification and pre-approval. A pre-approval is when a home buyer or homeowner has…

This guide covers things to avoid when repairing your credit for a mortgage approval. There are things to avoid when…

This guide covers the five C’s of mortgage underwriting leading to clear-to-close. With mortgage loans, the risk analysis is critically…