Rate and Term Refinance Mortgage Loans versus Streamlines

Rate and Term Refinance Mortgage Loans: Which Refinance Is Better? Refinancing can lower your payment, lock in a fixed rate,…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Rate and Term Refinance Mortgage Loans: Which Refinance Is Better? Refinancing can lower your payment, lock in a fixed rate,…

In this guide, we will cover self-employed mortgage borrowers with no income tax returns required on a home purchase. Many…

In this blog, we will cover and discuss on ways on how can you get a mortgage after retirement. Seniors…

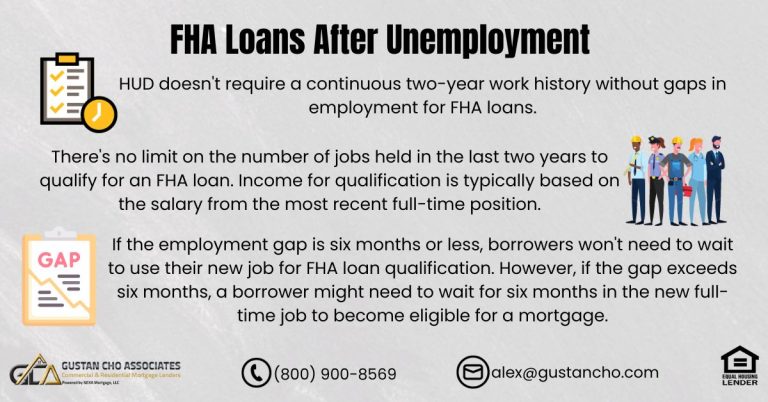

Mortgage Guidelines After Unemployment in 2025: How to Get Approved Losing your job can feel like pausing your dream of…

Mortgage With Disability Income: How to Qualify in 2025 Buying a home when most or all of your income comes…

This guide covers negative income with co-borrowers mortgage guidelines. HUD, the parent of FHA, allows non-occupant co-borrowers to be added…

This guide covers VA employment history guidelines on VA loans. VA loans is the best loan program in the U.S….

This guide covers how recent increase in income is viewed by mortgage underwriters. Depending on mortgage underwriters, W-2 income is…

Chicago Mortgage Loans for Self-Employed Individuals: 2025 Guide to Getting Approved Being self-employed in the Chicago area can be super…

Loss of Employment During Mortgage Process: What You Need to Know Losing your job while trying to buy a home…

This guide covers things to consider if you want to rent a room in your house. When you’re getting ready…

This blog examines the eligibility requirements for FHA loans after unemployment or employment gaps. Prospective FHA loan applicants now have…

Mortgage Guidelines After High School: How to Qualify for a Home Loan Buying a home is a big dream for…

Social Security Income for Mortgage: How to Use It to Buy a Home If you’re living on Social Security income…

Qualifying for Mortgage With Irregular Income: 2025 Guide for Homebuyers Are you worried that your irregular income might stop you…

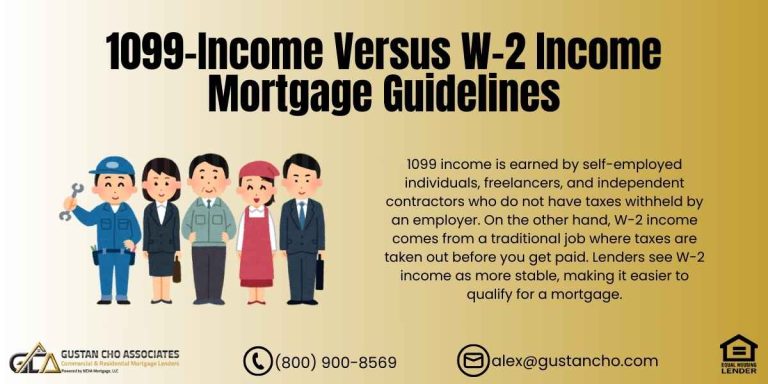

1099-Income Versus W-2 Income: How It Affects Your Mortgage Approval When applying for a mortgage, the type of income you…

A two-year employment history does not necessarily mean two consecutive years at the same job. You can have gaps in employment and/or multiple jobs in the most recent two years and still qualify for mortgage approval. In some cases, you can qualify for a mortgage with 12 months employment history.

Gustan Cho Associates has mortgage with no income documentation, no tax returns, and low credit scores. Many folks who have…

How Unreimbursed Business Expenses Affect Your Ability to Get a Mortgage in 2024 If you plan to buy a home…

Employment Offer Letter Mortgage Programs and Guidelines for 2024 Are you a recent graduate or someone starting a new job…

Changing Jobs During Mortgage Approval Process: What You Need to Know in 2024 Changing jobs during the mortgage approval process…

Mortgage for Self-Employed Versus W-2 Borrowers: 2024 Guide to Getting Approved Are you a self-employed worker or a W-2 employee…