Steps To Buying a House in Washington DC

In this blog, we will cover the frequently asked question of what are the steps to buying a house in…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will cover the frequently asked question of what are the steps to buying a house in…

This guide covers the process of qualifying borrowers for mortgage on home purchases and refinances. From the application stage to…

This guide covers realtors marketing package for home buyers, real estate agents and referral partners. Home buyers rely on their…

This guide covers how mortgage brokers get paid on closed home loans. Mortgage brokers, loan originators, or loan officers are…

This article is about Why Mortgage Process Is Biggest Home Buying Stress The process of buying a home can be…

This Article Is About Verification Of Mortgage Guidelines And Requirements By Lenders. A Verification of Mortgage, commonly known as VOM,…

This guide covers how prenuptial agreements affect mortgage loans. You may have heard of prenuptial agreements if you plan to…

This guide covers buying a home from a family member with no down payment or closing costs with a gift…

Understanding Sellers Concessions and Tax Prorations in Illinois Home Purchases Illinois home buyers benefit from a unique financial advantage that…

This Article On Fannie Mae HomePath Mortgage Was PUBLISHED On May 10, 2024. Fannie Mae is now offering the Fannie…

Home loans are still available to borrowers with collections, charged-off accounts, or late payments. Lenders are generally willing to approve…

In this blog, we’ll explain the qualifying credit score that lenders use for mortgages. Mortgage underwriters determine this score by…

This guide covers qualifying for a home loan without spouse mortgage guidelines. There are many reasons why home buyers want…

This guide covers comparison of mortgage rates on purchase and refinance loans. Mortgage rates have been steadily going up to…

In this blog, we’ll explore the process of working with a loan officer during your mortgage application. Choosing a loan…

Many homebuyers have substantial value on their 401k. They can use up to 60% of the value of their 401k for their down payment and/or closing costs on their home purchase. The amount used from their 401k is not used for their debt to income ratio calculations.

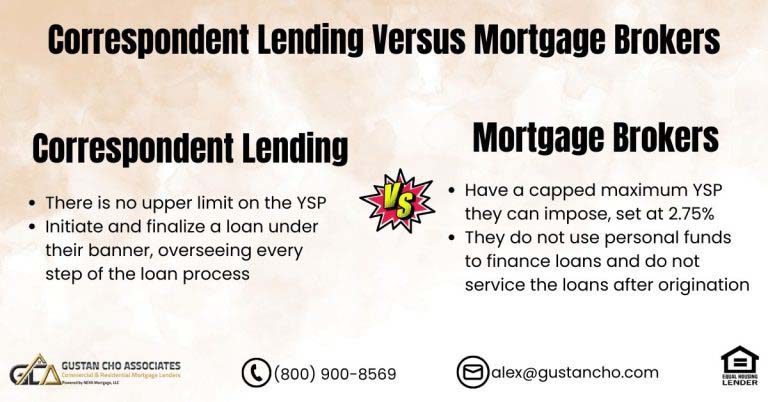

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains…

All mortgage loan programs require a maximum front debt-income ratio and back debt to income ratio. However, conventional loans do not require a front debt to income ratio. VA loans do not have a debt to income ratio requirements. Lenders can have lender over lender overlays on debt to income ratios.

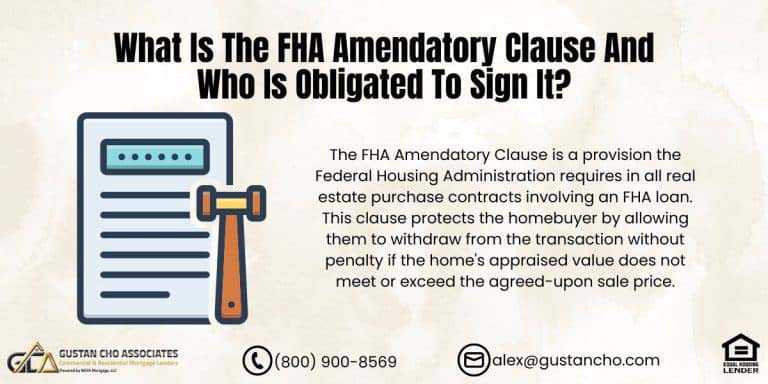

The Federal Housing Administration (FHA), a segment of the United States Department of Housing and Urban Development, was established in…

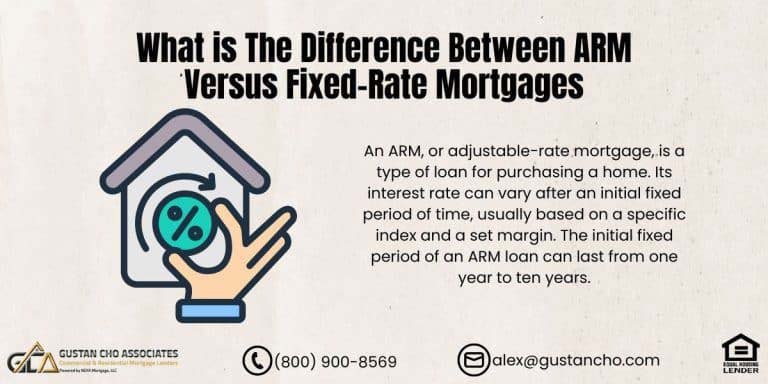

In this blog, we will cover ARM versus fixed-rate mortgages. ARM stands for an adjustable-rate mortgage. Adjustable-Rate Mortgage is when…

California FHA loans are a preferred mortgage solution for various borrowers, including first-time homebuyers, individuals with poor credit, and those…

Lenders can offer 100% with no mortgage insurance at competitive low mortgage rates on VA loans due to the government guarantee against loss or foreclosure on VA loans. VA loans have no maximum debt-to-income ratio cap on VA loans.