Conventional Versus Government-Backed Mortgages: Which Loan Fits You Best?

When you’re buying a home, one of the first big decisions is choosing between conventional versus government-backed mortgages. These two loan categories dominate the U.S. housing market and affect your down payment, credit score requirements, and even what type of property you can buy.

At Gustan Cho Associates, we specialize in helping borrowers—especially those turned down by other lenders—find the right loan with no lender overlays. In this guide, we’ll walk you through everything you need to know about conventional versus government-backed mortgages in 2025 so you can make a confident choice.

What Are Government-Backed Mortgages?

Government-backed mortgages are loans insured by a federal agency. The guarantee helps lenders offer lower down payments and flexible credit requirements. There are three main types:

- FHA loans – backed by the U.S. Department of Housing and Urban Development (HUD).

- VA loans – backed by the U.S. Department of Veterans Affairs, available to eligible veterans, active-duty service members, and surviving spouses.

- USDA loans – backed by the U.S. Department of Agriculture, for homes in eligible rural and suburban areas.

The key rule is that government-backed loans are for primary residences only. You cannot use them for second homes or investment properties.

Make an Informed Mortgage Decision

See the pros and cons of conventional versus government-backed loans.

What Are Conventional Loans?

Conventional loans are mortgages not insured by the government. Instead, they must meet the standards of Fannie Mae and Freddie Mac, two government-sponsored enterprises (GSEs). Because of this, conventional loans are also called conforming loans.

Conventional loans have stricter income and credit requirements. However, they provide more options for borrowers. You can use these loans to buy different properties, such as primary homes, vacation homes, and small investment properties with one to four units. This flexibility helps borrowers meet their housing needs while following conventional financing rules.

In the debate of conventional versus government-backed mortgages, conventional loans often win when you want flexibility and higher loan limits.

Conventional Versus Government-Backed Mortgages: Key Differences

Let’s break down the main differences borrowers care about most.

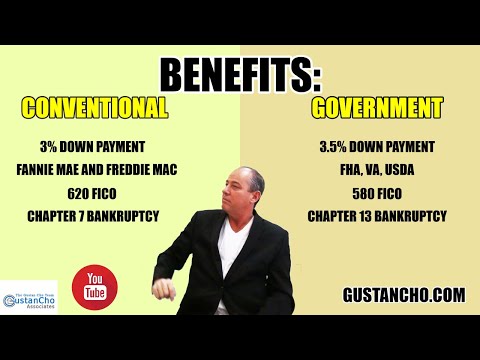

1. Down Payment Requirements

- FHA loans: 3.5% minimum down payment with a 580+ credit score.

- VA loans: No down payment required.

- USDA loans: You don’t need to make a down payment in certain areas.

- Conventional loans: 3% down for first-time homebuyers, 5% for repeat buyers.

2. Credit Score Requirements

- FHA: 580 for 3.5% down; 500–579 requires 10% down.

- VA: No official minimum score, but most lenders want at least 580–620.

- USDA: Typically 580–640 minimum.

- Conventional: Minimum 620 FICO score.

3. Mortgage Insurance

- FHA: Requires upfront and annual mortgage insurance for the life of the loan.

- VA: No monthly mortgage insurance; one-time funding fee (can be waived for disabled vets).

- USDA: Upfront guarantee fee and annual fee.

- Conventional: If you put down less than 20% for your mortgage, you’ll need to get private mortgage insurance (PMI). But good news—you can ditch the PMI once you hit 20% equity.

4. Property Eligibility

- Government loans: Only for owner-occupied primary homes.

- Conventional loans: Can finance primary, second homes, and investment properties.

Why Are Conventional Loans Called Conforming Loans?

Borrowers often wonder why conventional loans must follow Fannie Mae and Freddie Mac rules if they aren’t government loans. The answer: lenders want to sell these loans on the secondary mortgage market, where Fannie and Freddie are the largest buyers. If the loans don’t meet their standards, lenders can’t sell them—and won’t make them in the first place.

This is why conventional versus government-backed mortgages aren’t just about who insures the loan—they’re also about how the mortgage market operates.

Benefits of Government-Backed Mortgages

Government-backed mortgages can be particularly beneficial in certain circumstances. They are often the best option for individuals with lower credit scores or limited savings and those looking to take advantage of programs like VA or USDA that allow for zero down payment. Additionally, these mortgages are ideal for first-time homebuyers purchasing their primary residence.

These programs help open the door to homeownership for millions of Americans who might not qualify for conventional financing.

Conventional vs Government Loans: Know Your Options

Get expert guidance on rates, down payments, and eligibility.

Benefits of Conventional Mortgages

On the flip side, conventional loans are ideal if you:

- Have strong credit and a stable income.

- Plan to buy a second home or rental property.

- Want higher loan limits, especially in high-cost areas.

- Prefer a mortgage without lifetime insurance (PMI can be removed).

When weighing conventional versus government-backed mortgages, conventional loans often provide the best long-term value for borrowers with strong financial profiles.

Conventional Versus Government-Backed Mortgages and Student Loans

Student loans significantly impact borrowers’ choices. Here’s how they influence decisions:

- FHA loans: If the loans are deferred or in income-driven repayment (IBR), HUD requires 0.5% of the balance as a monthly payment.

- VA loans: Student loans deferred for more than 12 months are ignored. Otherwise, underwriters use 5% of the balance divided by 12.

- USDA loans: Typically require 0.5% of the balance unless documentation supports a different payment.

- Conventional loans: Fannie Mae and Freddie Mac allow actual IBR payments—even $0—to be used in debt-to-income (DTI) calculations.

This makes conventional loans a huge advantage for borrowers with large student loan balances.

Conventional Versus Government-Backed Mortgages After Bankruptcy or Foreclosure

Waiting periods are another big difference.

- FHA loans: 2 years after Chapter 7 discharge, 1 year into a Chapter 13 plan.

- VA loans: 2 years after bankruptcy or foreclosure.

- USDA loans: 3 years after bankruptcy or foreclosure.

- Conventional loans: 4 years after Chapter 7, 2 years after Chapter 13 discharge, 7 years after foreclosure.

Borrowers with recent credit issues may benefit more from FHA, VA, or USDA. Those further out from bankruptcy or foreclosure might prefer conventional.

Loan Limits in 2025

- Conventional loans: The 2025 baseline conforming loan limit is $766,550 for one-unit properties, with high-cost areas up to $1,149,825.

- FHA loans: 2025 FHA loan limits vary by county, typically capped lower than conventional.

- VA loans: No loan limits for eligible veterans with full entitlement.

- USDA loans: No set loan limits, but household income restrictions apply.

This is another factor where conventional versus government-backed mortgages show considerable differences.

Which Loan Is Right for You?

When trying to figure out the best loan for your needs, consider government-backed loans if you’re a first-time homebuyer and don’t have much savings. These loans can be easier to get if you qualify for benefits like VA or USDA, making them a solid choice if you need more flexible credit requirements. They help folks who might struggle to get funding from traditional lenders.

On the other hand, if you have a steady income and good credit, a conventional loan might be a good choice for you.

This option is handy for buying a second home or an investment property. Conventional loans often don’t require permanent mortgage insurance, which can save you money if you meet specific criteria. Considering these factors, you can pick the loan that best fits your financial situation and goals.

Choosing the Right Mortgage Made Easy

Understand the differences between conventional and FHA/VA/USDA loans.

Why Work With Gustan Cho Associates

At Gustan Cho Associates, we offer conventional and government-backed loans with no lender overlay. That means we follow only the agency guidelines—no extra rules that make it harder for you to qualify.

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on conventional versus government-backed mortgages, please contact us 800-900-8569, text us for a faster response, or email us at alex@gustancho.com. Our team is available 7 days a week, evenings, weekends, and holidays to guide you through the process.

Whether you’re leaning toward conventional versus government-backed mortgages, our goal is simple: get you approved and into your home as smoothly as possible.

Final Thoughts

Choosing between conventional versus government-backed mortgages doesn’t have to be stressful. Both loan types exist to help different kinds of borrowers reach the dream of homeownership. The best choice depends on your credit, income, savings, and long-term goals.

With the proper guidance—and the right lender—you can feel confident that you’re picking the loan that truly works for you.

Frequently Asked Questions About Conventional Versus Government-Backed Mortgages:

Q: What Does Conventional Versus Government-Backed Mortgages Mean?

A: It means comparing home loans insured by the government (FHA, VA, USDA) with loans not insured by the government (conventional loans).

Q: Which is Easier to Get Approved for, Conventional Versus Government-Backed Mortgages?

A: Government-backed mortgages are usually easier if you have lower credit scores or less money saved. Conventional loans work best if you have strong credit and a steady income.

Q: Can I Buy an Investment Property with Conventional Versus Government-Backed Mortgages?

A: You can buy investment properties with conventional loans. Government-backed mortgages are for primary homes only.

Q: What is the Main Difference in Down Payment for Conventional Versus Government-Backed Mortgages?

A: First-time buyers need at least 3% down on conventional loans, while FHA requires 3.5%. VA and USDA loans can require no down payment.

Q: Who Pays Mortgage Insurance with Conventional Versus Government-Backed Mortgages?

A: If you go for a conventional loan and put down less than 20%, you’ll have to pay for private mortgage insurance (PMI), but the good news is you can get rid of it later on. On the other hand, FHA loans always have mortgage insurance, and VA loans don’t require you to pay for monthly mortgage insurance.

Q: Do Credit Score Rules Change Between Conventional and Government-Backed Mortgages?

A: Conventional loans typically require a 620 credit score or above. But if you’re looking at FHA, VA, or USDA loans, you can get by with a lower score, depending on the specific program.

Q: Which Loan Type has Higher Limits, Conventional Versus Government-Backed Mortgages?

A: Conventional loans usually have higher loan limits than FHA or USDA. VA loans do not have loan limits for eligible veterans with full entitlement.

Q: Can Student Loans Affect Me Differently with Conventional Versus Government-Backed Mortgages?

A: Yes. Conventional loans let you use your actual income-based repayment amount, even if it’s $0. FHA, VA, and USDA calculate student loans differently, which may raise your debt ratio.

Q: What Waiting Periods Apply After Bankruptcy or Foreclosure with Conventional Versus Government-Backed Mortgages?

A: Government-backed loans usually have shorter waiting periods, such as 2–3 years. Conventional loans often require 4–7 years, depending on the situation.

Q: How do I Decide Between Conventional Versus Government-Backed Mortgages?

A: It depends on your credit, savings, income, and goals. A government loan may fit if you want flexible rules. A conventional loan may be better if you want higher limits, a second home, or rental options.

This article about “Conventional Versus Government-Backed Mortgages ” was updated on August 20th, 2025.

Conventional or Government-Backed Mortgage?

Learn which loan fits your needs and saves you money.