TL;DR: DTI Manual Underwriting Guidelines (2026 Update)

If a computer system says “no” to your mortgage because your debt-to-income ratio (DTI) is high, your income is hard to document, or your credit history is unique, you may still qualify through manual underwriting. DTI Manual underwriting guidelines is when a real underwriter reviews your whole situation—not just a score. FHA and VA are common options, and some non-QM programs can also be considered.

What is Manual Underwriting?

Manual underwriting is when a real person (an underwriter) reviews your loan file instead of relying on an automated approval system. They look at your income, debts, credit history, and payment habits to decide if you can comfortably handle the new mortgage payment—even if the computer didn’t approve you.

Who Usually Needs Manual Underwriting?

You may be a good fit for manual underwriting if any of these sound like you:

- The automated system (AUS) didn’t approve your loan

- Your DTI is high because of car payments, credit cards, student loans, or personal loans

- You’re self-employed, or your income doesn’t look “normal” on tax returns

- You have limited credit (not many tradelines) or no traditional credit

- You recently had a credit event (like bankruptcy) and are rebuilding

- Your income is stable, but your file needs a human review to explain the story

DTI Limits by Loan Program (Jump to the One You Need)

DTI is usually shown as two numbers: front-end/back-end (housing payment / total monthly debts)

- FHA Manual Underwriting DTI Limits (common ranges): 31/43, 37/47, up to 40/50 with strong “compensating factors”

- Jump to: FHA Loans and DTI Manual Underwriting Guidelines

- VA Manual Underwriting DTI Limits: The VA doesn’t have a hard maximum DTI, unlike FHA. Many files use 41% as a guideline, but approvals often depend more on residual income (the money left over after bills are paid).

- Jump to: VA Loans and DTI Manual Underwriting Guidelines

- Non-QM / Alternative Loans: DTI rules vary by lender and program. Some allow higher DTIs if the rest of the file is strong and income is documented in different ways (like bank statements).

- Jump to: Non-QM Loans and DTI Manual Underwriting Guidelines

Manual Underwriting Can Help You Qualify with Higher DTI

If you’ve been denied by AUS, don’t give up—manual underwriting gives you a second chance.

FHA Loans and DTI Manual Underwriting Guidelines

When it comes to loans backed by the government, FHA loans are a top choice for people who need manual underwriting. This means that the loan guidelines can be a bit more flexible. FHA loans are great for borrowers with low credit scores, high DTI (debt-to-income) ratios, or even no credit history. The DTI manual underwriting guidelines let lenders consider more than just numbers, making it easier for some folks to get approved.

Home buyers may be eligible for an FHA Loan immediately following the discharge of a Chapter 13 Bankruptcy through manual underwriting.

Maximum DTI Ratios for FHA Manual Underwriting (2025):

- 31/43%: No compensating factors.

- 37/47%: One compensating factor (e.g., reserves or job stability).

- 40/50%: Two or more compensating factors.

Compensating Factors That Can Boost Approval:

- Three months of reserves for 1-2 unit properties.

- Low payment shock (less than a 5% increase in housing costs).

- Residual income exceeding guideline thresholds.

- A stable, long-term employment history.

- Income from a spouse who is not listed on the mortgage loan

Case Example: Sarah, with a credit score of 580, has a DTI of 39/48%. She didn’t qualify through the automated underwriting system (AUS), but her $10,000 in reserves and 10-year job history helped her secure manual underwriting approval for an FHA loan.

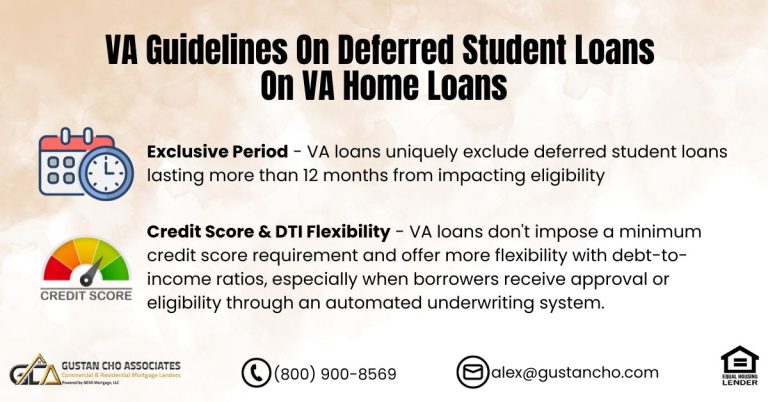

VA Loans and DTI Manual Underwriting Guidelines

VA loans provide great advantages for veterans and active-duty military personnel. One key difference from FHA loans is that VA loans don’t have strict requirements for your debt-to-income (DTI) ratio. Instead of just looking at how much you owe compared to how much you earn, they pay more attention to your residual income—the money you have left after paying all your bills. This approach can make qualifying borrowers easier, especially under DTI manual underwriting guidelines.

VA Manual Underwriting Guidelines (2025):

- Residual Income: Borrowers must meet regional residual income standards.

- DTI Threshold: While there is no official maximum, 41% is generally considered the benchmark. Exceptions can be made with strong compensating factors.

Common Compensating Factors for VA Loans:

- High residual income.

- Significant cash reserves.

- A proven track record of timely housing payments.

Case Example: John, a veteran, had a back-end DTI of 55%. Despite being above the recommended 41%, his $20,000 in residual income and history of on-time rent payments helped him secure approval for a VA loan under the DTI manual underwriting guidelines.

Manual Underwriting for FHA and VA Loans Made Simple

We specialize in manual underwriting approvals for high DTI borrowers with stable income and solid credit.

Non-QM Loans and DTI Manual Underwriting Guidelines

Non-QM loans (non-qualified mortgages) cater to borrowers who don’t fit traditional lending criteria. These loans are ideal for self-employed individuals, investors, or those with complex income structures. While non-QM loans typically don’t require manual underwriting, some lenders may review applications manually for borrowers with high DTIs or unconventional financial profiles.

Non-QM Manual Underwriting Features:

- Flexible DTI limits (up to 50-55% in many cases).

- Alternative forms of income verification include documents like bank statements or profit-and-loss reports.

- Minimal credit score requirements in some cases.

Common Non-QM Loan Programs:

- Bank Statement Loans: Evaluate deposits instead of tax returns.

- Debt-Service Coverage Ratio (DSCR) Loans: Focus on rental income to qualify.

- Asset-Based Loans: Rely on liquid assets rather than income.

Case Example: Mary, a self-employed borrower, had a DTI of 50% and inconsistent tax returns. Using 12 months of bank statements to document her income, she qualified for a non-QM loan through DTI manual underwriting guidelines.

Alternative Loan Programs for Unique Borrowers

In addition to FHA, VA, and non-QM loans, several alternative loan programs cater to borrowers needing manual underwriting:

ITIN Loans: These loans are for individuals who may not have a Social Security number but have an Individual Taxpayer Identification Number (ITIN). For example, a Mexican immigrant living in the U.S. for work can use an ITIN loan to buy their first home, even though they don’t have a Social Security number.

Foreign National Loans: These loans cater to non-residents who want to invest in U.S. real estate. For instance, a Canadian investor looking to purchase a vacation home in Florida can apply for a foreign national loan, even though they don’t live in the U.S. full-time.

Hard Money Loans: These loans are great for real estate investors who may not have all the regular paperwork needed for a mortgage. A house flipper who wants to quickly buy a rundown property might use a hard money loan. This loan lets them get financing based on the property’s value, not their income or credit score.

These loans offer alternatives for individuals who face difficulties obtaining funding through conventional means.

How Mortgage Underwriters Calculate Debt-to-Income Ratios

For DTI manual underwriting guidelines, lenders check two different ratios:

- Front-End Ratio: Housing expenses divided by gross monthly income.

- Back-End Ratio: Housing expenses + all other monthly debts divided by gross monthly income.

Example: If you earn $5,000/month, have $1,800 in housing expenses, and $700 in other debts:

- Front-End DTI: $1,800 / $5,000 = 36%

- Back-End DTI: ($1,800 + $700) / $5,000 = 50%

Advantages of Manual Underwriting

- Human Discretion: Unlike automated systems, DTI manual underwriting guidelines allow underwriters to evaluate your financial story holistically.

- Compensating Factors: Strong reserves, job stability, or residual income can help offset high DTIs or credit challenges.

- Flexibility: Manual underwriting accommodates unique borrowers, such as those with non-traditional income or credit profiles.

Challenges of Manual Underwriting

- Stricter Guidelines: Higher standards for DTI ratios and documentation.

- Lengthier Process: Manual underwriting requires more time for evaluation.

- Increased Scrutiny: Borrowers must provide extensive documentation, such as proof of income, reserves, and payment history.

Common Reasons Manual Underwriting is Denied

Manual underwriting gives you another chance when the computer system can’t approve you, but it’s still strict. Here are the most common reasons a manually underwritten loan gets denied, and what you can do about it:

1) Recent late payments (especially housing payments)

- Underwriters pay close attention to your last 12 months. Late rent or mortgage payments are one of the biggest red flags.

- What helps: A clean 12-month payment history and proof of on-time rent (like canceled checks, bank statements, or a verification of rent if allowed).

2) Not enough income to support the new payment

- Even if you’ve been paying bills fine, the underwriter must show on paper that your income supports the new mortgage payment plus your other debts.

- What helps: Stable job history, consistent overtime/bonus (if allowed), and accurate income documentation.

3) DTI is too high without strong compensating factors

- High DTI can be approved, but manual underwriting often requires additional strengths—such as cash reserves or a very low “payment shock.”

- What helps: Paying down debts, lowering the target house payment, bringing more money to closing, or showing reserves.

4) Unstable job or income history

- Frequent job changes, recent gaps in employment, or income that varies significantly can make manual underwriting more challenging.

- What helps: A steady work history, clear explanations for job changes, and income that can be documented and averaged correctly.

5) Credit history is too thin or has major recent issues

- Manual underwriting can help with lower scores, but a pattern of late payments, new collections, or recent major derogatory credit can still stop an approval.

- What helps: Re-established credit, fewer new accounts right before applying, and time since the last major credit event.

6) Undisclosed debts or new debt during the process

- If a new car loan, credit card, Buy Now Pay Later account, or personal loan is discovered during underwriting, it can push the DTI over the limit.

- What helps: Don’t open new accounts, don’t co-sign, and avoid big new monthly payments until after closing.

7) Large deposits or bank activity that can’t be explained

- Underwriters may require a paper trail for unusual deposits to confirm that the funds are from acceptable sources.

- What helps: Document the source of deposits (e.g., payroll, sale of an asset, gift funds with proper paperwork, etc.).

8) Not enough cash reserves after closing

- Manual underwriting often favors borrowers who still have money left after closing—especially if DTI is high.

- What helps: Keeping some savings, using allowable reserve funds (like retirement accounts if permitted), or choosing a lower payment.

9) Payment shock is too high

- If your new mortgage payment is much higher than what you pay now, the underwriter may see a higher risk.

- What helps: Showing you’ve managed similar payments before, increasing the down payment, or picking a home with a payment closer to your current housing cost.

10) Missing documents or inconsistent paperwork

- Manual underwriting is paperwork-heavy. If documents are missing or numbers don’t match, approvals can stall or be denied.

- What helps: Respond quickly to conditions, keep paperwork consistent, and work with a lender experienced in manual underwriting.

Quick tip: If you were denied, it doesn’t always mean you can’t qualify—it often means you need a better strategy (lower debts, stronger reserves, cleaner housing history, or a different program).

How to Improve Your Chances of Approval

- Lower Your DTI Ratio:

- Pay down existing debts.

- Increase your income by taking on additional work or securing a raise.

- Build Reserves:

- Save at least three months of mortgage payments as reserves.

- Use retirement or investment accounts if necessary.

- Establish a Strong Payment History:

- Choose a Flexible Lender:

- Work with lenders specializing in DTI manual underwriting guidelines, like Gustan Cho Associates.

Why Choose Gustan Cho Associates for Manual Underwriting?

At Gustan Cho Associates, we excel in helping borrowers navigate DTI manual underwriting guidelines. Unlike many lenders, we impose no lender overlays. We adhere strictly to agency guidelines for FHA, VA, and other loan programs.

What Sets Us Apart:

- Expertise in FHA and VA DTI manual underwriting guidelines.

- Access to flexible non-QM and alternative loan programs.

- A team dedicated to finding solutions for borrowers turned down by other lenders.

Ready to take the first step toward homeownership? Contact Gustan Cho Associates today for expert guidance on DTI manual underwriting guidelines and customized mortgage solutions. Let’s make your dream home a reality!

Denied for High DTI? FHA and VA May Still Work

Our no-overlay lending team can help you qualify with manual underwriting

Frequently Asked Questions About DTI Manual Underwriting Guidelines:

Does FHA Allow Manual Underwriting?

Yes. FHA loans can be manually underwritten when an automated system can’t approve the file or when a lender needs a closer human review. Manual underwriting is common for borrowers with higher DTI, limited credit history, or recent credit challenges.

What is the DTI for Manual Underwriting on FHA?

FHA manual underwriting often follows ratio “tiers,” such as 31/43, 37/47, and up to 40/50 when you have strong compensating factors (like reserves and low payment shock). The exact max depends on your credit profile and what compensating factors you can document.

What’s the Difference Between Manual Underwriting and Automated Underwriting?

Automated underwriting uses a computer decision system to approve or refer your loan. Manual underwriting means a real underwriter reviews your full file (income, debts, credit history, assets) to make a decision, and it usually requires more documentation.

What Triggers Manual Underwriting?

Manual underwriting is often triggered when the automated system can’t approve your loan—common reasons include high DTI, limited credit, self-employed income, or a file that needs a closer look. In short, if the computer says “refer,” a lender may move the file to a human review.

Is Manual Underwriting Harder to Get Approved?

It can be. Manual underwriting is usually stricter and more detail-focused because the lender needs to verify that the loan remains safe to approve. The upside is that it gives you a second chance when the automated system can’t.

How Long Does Manual Underwriting Take?

Manual underwriting usually takes longer than automated underwriting because the underwriter reviews more documents and may ask more questions. Timelines vary by lender and the speed at which you provide paperwork, but expect more back-and-forth communication compared to an AUS.

Can I Get Approved for a VA Loan with a High DTI?

Often, yes—VA puts heavy emphasis on residual income (money left over each month after major expenses) instead of using a strict DTI cap. Many lenders treat 41% as a benchmark, but higher DTIs can be approved when residual income is substantial, and the overall file makes sense.

What are “Compensating Factors” in Manual Underwriting?

Compensating factors are strengths that help offset higher risks, such as a higher DTI. Examples often include verified cash reserves, minimal payment shock, and a strong, consistent payment history. FHA specifically outlines how compensating factors support higher ratios for manual underwrites.

Can I Get an FHA Loan with No Credit Score or a Thin Credit File?

Yes, in many cases. FHA allows lenders to use manual underwriting with alternative credit (like rent, utilities, phone, insurance payments) if you don’t have a traditional credit score or your file is very thin.

Why Would a Manual Underwrite Get Denied?

Common denial reasons include late payments, income that can’t be clearly documented, a DTI that is too high without compensating factors, new debt incurred during the process, or missing/inconsistent paperwork. Manual underwriting is detail-heavy, so small documentation issues can matter more than in AUS approvals.

This blog about “DTI Manual Underwriting Guidelines on FHA and VA Loans” was updated on January 2nd, 2026.

High DTI? You May Still Qualify Through Manual Underwriting

FHA and VA allow flexible debt-to-income ratios when strong compensating factors are present.