Conventional Loan With Non-Occupant Co-Borrower

This blog will cover Fannie Mae and Freddie Mac guidelines on qualifying for a conventional loan with non-occupant co-borrower. Non-Occupant…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This blog will cover Fannie Mae and Freddie Mac guidelines on qualifying for a conventional loan with non-occupant co-borrower. Non-Occupant…

This blog will cover Fannie Mae Collection Guidelines on Conventional loans. Fannie Mae and Freddie Mac are the two mortgage…

This guide covers modular homes mortgage guidelines on purchase and refinance transactions. Modular homes are becoming more and more popular…

In this blog, we will cover the Fannie Mae Chapter 13 dismissal guidelines on conventional loans. One of the most…

This guide covers FHA MIP versus conventional PMI for mortgage borrowers. Mortgage Insurance is mandatory on all FHA loans and…

This guide covers the difference between FHA and Conventional mortgage guidelines. Many homebuyers, especially first-time buyers shopping for homes often…

This guide provides clear information about Fannie Mae’s rules for Community Property States, helping people looking for mortgage information. It…

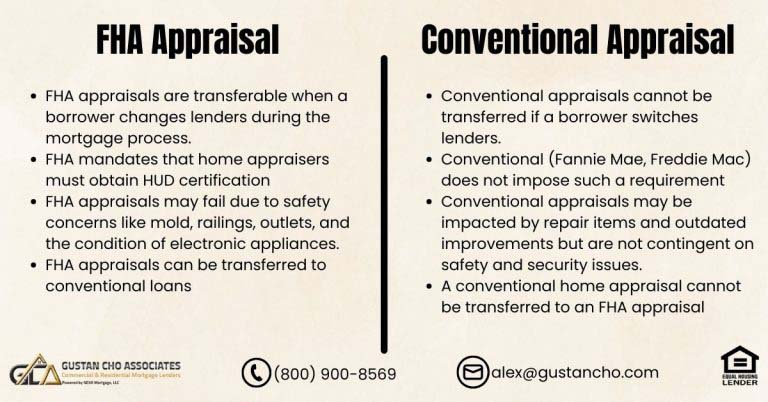

This article examines and clarifies the criteria for FHA Appraisals Versus Conventional Appraisals. There are significant differences in the guidelines…

In this article, we will cover and discuss the comparison between jumbo loan vs conventional loan programs and the…

This guide covers eliminating FHA mortgage insurance premium by refinancing FNMA. Borrowers taking out an FHA insurance mortgage loan, besides…

Homeowners With FHA Loans Should Consider A Conventional Refinance Loan While Mortgage Rates Are At Historic Lows And Avoid Paying FHA MIP. Mortgage rates are at historic lows and many home values have skyrocketed in the past several years. Many homeowners with FHA loans can benefit by refinancing to a conventional mortgage and avoid paying LPMI.

This guide covers Fannie Mae and HUD Guidelines on conventional versus FHA loans. Fannie Mae and HUD guidelines on conventional…

This article covers Conforming versus government-backed loans. FHA, VA, and USDA loans are called government-backed loans. This is because lenders…

This article covers Freddie Mac foreclosure guidelines on Conventional loans. Fannie Mae and Freddie Mac is the nations largest buyers…

This guide cover FHA versus conventional mortgage after bankruptcy. There are differences in when and how you can qualify for…

This guide covers buying home with no private mortgage insurance with 80-10-10 mortgage loans. Any conventional mortgage loan with less…

This guide covers the FHFA FNMA Guidelines updates on Conventional loans. There are FNMA guidelines changes for mortgage loan borrowers…

In this guide, we will cover what is lender-paid mortgage insurance on conventional loans. Lender-paid mortgage insurance is also referred…

Conventional Loans also referred to as Conforming Loans are not guaranteed and/or insured by the federal government. Conventional Loans need to …..

This guide will cover finding the best mortgage lenders for the best rates. Buying a home is a significant milestone,…

This article will cover the conventional loan guidelines for mortgage borrowers on primary, second, and investment homes. Borrowers needing Conventional…

In this blog, we will cover and discuss Fannie Mae Conventional loan limits on one to four-unit properties. The FHFA…