In guide covers buying house with new job and gaps in employment. Many homebuyers are concerned about qualifying for a mortgage and buying house with new Job and gaps in employment in the past two years. Many are under the impression that you need to be on the same job for the past two years to qualify for a mortgage. This is not the case.

If you’ve recently started a new job, lenders may prefer to see a stable employment history. Having a job in the same industry or a related field can be viewed more favorably.

Borrowers can qualify for a new mortgage with multiple jobs in the past two years, gaps in employment, and just out of school. Being in a job for a long period is definitely a positive factor. It offers stability and the likelihood of being secured in their jobs for years to come. However, being on your job for the past 2 years is not required to qualify for mortgage loans

Importance of Income and Employment When Qualifying for a Mortgage

Income and employment are very important when it comes to qualifying for a mortgage. Income and employment are what determine the ability to repay by borrowers. First-time home buyers buying house with new job can qualify for a mortgage if they meet certain requirements.

Get pre-approved for a mortgage. This can give you a better understanding of how much you can afford and demonstrates to sellers that you are a serious buyer.

Borrowers do not have to have a past two-year employment history with the same employer. Lenders will require a two-year past employment history by all borrowers. There are certain incomes that may or may not qualify as qualified income. We will further discuss this topic and buying house with new job.

Got a New Job and Wondering About Buying a Home? Let Us Help You Navigate Employment Gaps!

Contact us today to explore mortgage options and learn how you can qualify for a home loan.Is Buying House With New Job Possible

Buying a house with a new job and employment gaps can present some challenges, but it’s not impossible. Lenders typically look at various factors when considering mortgage applications, including your income stability, credit history, and overall financial situation.

Provide proof of your income. Lenders will ask for recent pay stubs and W-2 forms. If you’re self-employed or have irregular income, you may need to provide additional documentation.

We will cover some tips to improve your chances. Longer periods of unemployment may raise concerns, so be prepared to explain any employment gaps. Maintain a good credit score. A higher credit score can help you qualify for a better interest rate and improve your overall mortgage terms.

Buying House With New Job After Full-Time Schooling

In general, lenders consider full-time education the same as employment history. All lenders will require the past two years of employment history. Be prepared to explain any employment gaps. If they were due to personal reasons or pursuing further education, providing context can be helpful.

Consult with a mortgage broker or financial advisor. They can provide guidance based on your specific situation and help you understand the options available to you.

High School, trade school, and college graduates right out of school can qualify in buying house with new job with no prior work history. This holds true as long as they can document they have been a full-time student for the past two years. Transcripts will be required. With an employment offer letter, recent graduates can qualify for a mortgage if they are buying house with new job.

Buying House With New Job Offer Employment Letter

In order for recent graduates to qualify for a mortgage, the job offer employment letter needs to be a full-time position. The lender needs to feel confident that the job offers stability. Keep your debt-to-income ratio in check. Lenders often have specific limits on the ratio of your debt payments to your income.

The new job offer needs to look promising in the borrower being likely to be employed for the next three years.

Part-time income or 1099 wage earners cannot qualify. All part-time, bonus, overtime, commission, or other income need to be seasoned for two years in order to be used in mortgage qualification by underwriters. All income needs to show promising outlooks in being able to continue for the next three years.

How Do Underwriters Calculate The Ability To Repay New Mortgage Payments?

Mortgage Underwriters always have the borrower’s ability to repay their new mortgage payments on time when they are calculating income. This is why the likelihood of the borrower’s income to continue for the next three years is very important.

Consumer credit payment history shows the ability and the past history of the borrower’s payment patterns. It shows the borrower’s willingness to pay.

Income and employment show mortgage underwriters the borrower’s ability to repay. With no income or loss of a job, the borrower will not be able to meet their debt obligations, especially their mortgage debt. Due to this very reason why employment and income are very important factors when qualifying for a mortgage.

What Happens if You Have a Gap in Employment in the Past 2 Years?

You do not need to be in the same field in the past two years of employment. For example, a borrower can be an attorney but have changed careers to be a teacher in the past two years. This would be acceptable. Or if a borrower majored in biology but got a full-time job at the post office. This would be acceptable under general mortgage lending guidelines.

How do You Handle Gaps in Employment?

Handling gaps in employment when buying a house involves proactive steps to ensure your mortgage application remains strong. Here’s how to approach it:

- Prepare an Explanation: Write a concise explanation of the employment gap. Please include relevant details that provide context (e.g., medical leave, family responsibilities, education, career change) to show it was necessary or beneficial.

- Show Stability in Your Current Job: Lenders want to see that your current employment is stable. If possible, aim to be in your current job for at least six months before applying.

- Provide Documentation: If the gap was due to legitimate reasons like illness or education, providing supporting documents can help. For instance, a letter from a physician, school records, or previous employer verification can bolster your case.

- Highlight Positive Work History: Emphasize your work history before and after the gap. If your current job is in the same field as previous positions, it demonstrates a consistent career path.

- Maintain Strong Financials: A strong credit score and a healthy down payment can offset concerns over employment gaps. Save aggressively and keep your finances in good shape.

- Diversify Your Income: If you have secondary sources of income, like freelance work or rental properties, include them in your application to present a more comprehensive financial picture.

- Consult a Mortgage Broker or Specialist: A broker can find lenders more willing to accommodate applicants with gaps in employment. They can help you structure your application for the best chance of approval.

- Consider Pre-Approval: Getting pre-approved can give you an early indication of how lenders will assess your application and identify potential issues to address.

New Job? Employment Gaps? We Can Help You Buy a Home!

Reach out now to discuss how we can help you secure financing for your new home.How Long Must You Be on Your Job Buying House With New Job

Save for a larger down payment. A higher down payment can compensate for a less-than-ideal employment history and improve your loan-to-value ratio. Buying house with new job with no prior employment experience is possible right after graduation with a solid offer employment letter by the employer.

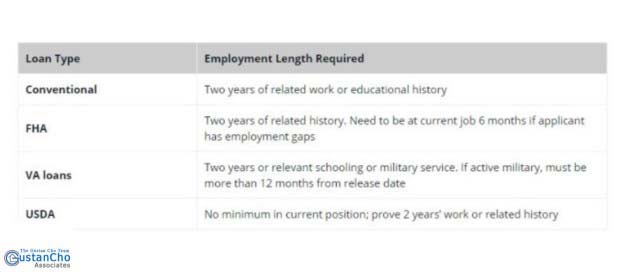

Below is a Chart on the Type of Loan Program and Employment Guidelines:

Buying House With New Job Guidelines on Conventional Loans

Fannie Mae And Freddie Mac require two years of prior employment history by borrowers on conventional loans. Full-time education can be used to meet prior employment history requirements. Gaps in employment are the same as all mortgage guidelines. With conventional loans, borrowers can qualify for conventional loans with an offer letter of employment without starting the new job. This comes as a major benefit if the borrower is relocating to another state.

HUD Guidelines With Less Than Two Years of Employment

FHA is different than conventional loans when it comes to qualifying for a mortgage with a job offer employment letter. The borrower needs to start work at their new place of employment and get 30 days of paycheck stubs before the mortgage underwriter can issue a clear to close. This often creates a problem if the home buyers have accepted a job in a different state. Some may need to relocate twice.

VA Guidelines on Buying House With New Job

The veterans administration allows full-time schooling to be used as part of the previous two years of work history requirements. Home buyers with VA loans can purchase a new home with a job offer letter without starting the new job and/or without providing 30 days’ paycheck stubs. It is the same as conventional mortgage guidelines. VA Loans do not have a minimum credit score requirement or a maximum debt to income ratio requirement. Gustan Cho Associates is a national mortgage company with no overlays on VA Loans.

Buying House With New Job USDA Guidelines

USDA loans offers homebuyers to purchase a home with 100% financing and no down payment required. Both the borrower and the property need to meet USDA mortgage guidelines. USDA loans allow prior full-time education as work history. Job offer letters are allowed with USDA loans. USDA is different than other loan programs because there are two different mortgage underwriters underwriting the loan. The lender’s internal underwriter and the USDA agency mortgage underwriter. The property needs to be located in a USDA-designated eligible area.

Importance of Sourced Qualified Income

Consider having a co-signer with a stable income and good credit. This can strengthen your application.If you have a new job, provide a copy of your job offer letter to demonstrate your employment status and income expectations. Cash undocumented cannot be used in qualifying for a mortgage. Only documented sourced qualified income can be used.

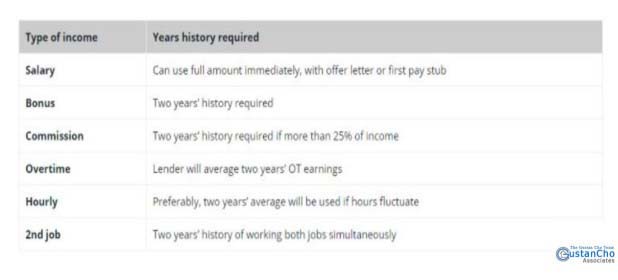

Study The Income Chart Below:

How Is Salary Income Calculated By Mortgage Underwriters?

Salary income is calculated as follows: The gross income is used. Mortgage underwriters calculate the monthly gross income by taking the annual salary and dividing it by 12 months. The resulting figure is the monthly gross income used to qualify borrowers.

Ready to Buy a Home with a New Job? Let’s Make It Happen, Even with Employment Gaps!

Reach out today to explore loan programs that can help you qualify for a mortgage.Can You Qualify For Mortgage With Bonus Income?

Bonus and other Income can be used as qualified income only if the borrower has a two-year history of earning the income. Bonus income cannot be declining. Other income that can be used are the following:

- Bonus Income

- Overtime Income

- Part-Time Income

- Commission Income

How do Lenders Calculate Income of Hourly Wage Earners?

Remember that each lender may have different criteria, so it’s a good idea to shop around and compare mortgage options. Additionally, consider seeking the advice of a financial professional to help navigate the process and make informed decisions based on your unique circumstances. Hourly wage earners’ income is averaged. Here is the chart that explains hourly wage earners’ income calculations:

How Do Mortgage Lenders Calculate Overtime Income?

Overtime income can be used as qualified income if and only if the borrower had a two-year history of earning overtime income. Overtime income cannot be declining. Verification of employment is done to determine the actual overtime income that can be used.

How Do Mortgage Lenders Calculate Commission Income?

Alex Carlucci is a senior vice president at Gustan Cho Associates that is an expert in helping 1099 wage earners and self-employed borrowers. If you have less than 24 months of commissioned income, your lender probably can’t use it for qualifying. There are exceptions. Here is what Alex Carlucci says about commission income borrowers:

Borrowers who earn at least 25 percent of their income from commissions, the base income is the monthly average of your last 24 months of income.

If you work for the same company, doing the same job, and earning the same or better income, a change in your pay structure from salary to fully or partially commissioned might not hurt you. You have to make the argument, however, and get your employer to confirm this.

How Do Mortgage Underwriters Calculate Self-Employment Income?

Self-employed borrowers need two years of self-employment history. Lenders will average the past two years of the borrower’s income tax returns. The figure they will go by will be the adjusted gross income. This means that the net income after deductions will be used. Self-employed borrowers have the advantage and benefits of deducting expenses.

If the adjusted gross income is too low and they do not qualify, they should explore qualifying with non-QM bank statement loans for self-employed borrowers.

No income tax returns are required. The way this loan program works is by taking 12 months of bank statement deposits and averaging them. The resulting average monthly deposit is the borrower’s monthly income.

How To Start The Mortgage Loan Application Process

For more information about the content in this blog or other mortgage topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans. We also offer W-2 income only mortgages and bank statement mortgage for self-employed borrowers with no income tax returns required.

FAQ: Buying House With New Job and Employment Gaps

- Can I buy a house with a new job and gaps in my employment history? Yes, purchasing a home is possible even if you’ve recently started a new job or have employment gaps. Lenders consider various factors beyond just employment history when assessing mortgage applications.

- Do I need to have been in the same job for the past two years to qualify for a mortgage? Although lenders prefer a stable employment history, it is not mandatory. Multiple jobs or employment gaps only qualify you if you meet other requirements.

- How important are income and employment when qualifying for a mortgage? Income and employment are crucial factors determining your ability to repay the mortgage. To determine eligibility, lenders assess your income stability, credit history, and overall financial situation.

- What documents do I need to provide to prove my income? You’ll typically need to provide recent pay stubs, W-2 forms, and additional documentation if you’re self-employed or have irregular income.

- How can I improve my chances of getting approved for a mortgage with a new job or employment gaps? Maintain good credit, explain employment gaps, show job stability, and consult an advisor for guidance.

- How long do I need to be in my current job before buying a house with a new job? While longer job tenure is viewed favorably, buying a house with a new job offer letter is possible, especially if you’re a recent graduate or have prior full-time education.

- What are the guidelines for different types of loan programs regarding employment history? Each loan program (Conventional, FHA, VA, USDA) has specific requirements regarding employment history, but generally, full-time education can count towards prior employment history, and job offer letters may be accepted.

- How is income calculated for different types of earners (hourly, salaried, commission, self-employed)? Income calculation methods vary based on the type of employment. For example, income is typically calculated by dividing the annual salary by 12 months, while self-employed borrowers may need to provide two years of tax returns for income verification.

- Can I qualify for a mortgage with a bonus, overtime, or commission income? Yes, bonus, overtime, and commission income can be used for qualification purposes. Still, lenders typically require a two-year history of earning such income.

- What if I have gaps in my employment history? How do I handle them? It’s important to be ready to explain any employment gaps, including relevant details such as medical leave, family responsibilities, or education. Showing stability in your current job and maintaining strong financials can also help offset concerns over employment gaps.

For further assistance or inquiries about mortgage options, contact Gustan Cho Associates at 800-900-8569 or email gcho@gustancho.com. Our team specializes in various loan programs and can provide personalized guidance based on your needs.

This blog about Buying House With New Job and Employment Gaps was updated on May 9th, 2024.