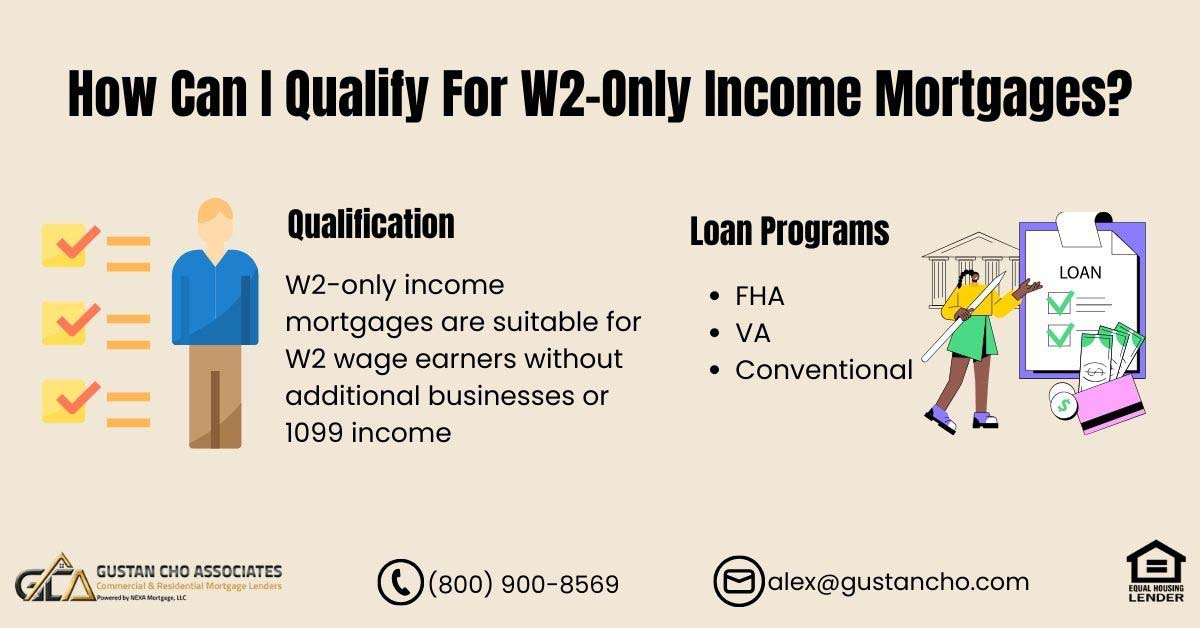

Homebuyers with pending income tax returns or significant unreimbursed business expenses may be eligible for W2-only income mortgages. Gustan Cho Associates doesn’t mandate income tax returns from borrowers unless the Automated Underwriting System specifically demands a two-year tax return for qualification. We offer W2-Only Income Mortgages on the following loan programs:

- FHA loans

- VA loans

- Conventional loans (Fannie Mae Only)

Borrowers do not have to turn in their income tax returns. Loan officers cannot submit income tax returns for W2-only income mortgages. We only need two years of W-2s. We will only do a W-2 income verification with the Internal Revenue Service. In the following paragraphs, we will discuss W2-only income mortgages.

Loan Programs Offering W2-Only Income Mortgages

Borrowers are eligible for W2-Only Income Mortgages through Gustan Cho Associates. These mortgages don’t require federal income tax returns specifically for W2-only income. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about W2-only income mortgages:

For individuals whose sole income source is W2 and who have unreimbursed business expenses, there’s no need to factor these expenses into their income tax returns. Strictly, W2 income will be considered.

However, if there are rental properties, side businesses, or part-time 1099 income, these won’t qualify for W2-Only Income Mortgages. Those applying for FHA, VA, and Conventional loans as W2 Income Employees won’t need income tax transcripts (the 1040s).

Qualify With Just Your W-2s

No tax returns required—your W-2s and pay stubs may be enough.

Can I Qualify For W2-Only Income Mortgages?

If you’re a W2 wage earner without additional businesses or 1099 income, you’re eligible for W2-only income mortgages. The lending criteria for these mortgages entail specific requirements and guidelines. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about W2-income mortgages:

For FHA, VA, and Conventional loans, there’s no necessity for tax transcripts (1040s) if applicants are W2 employees and the automated underwriting system (AUS) doesn’t mandate it.

Moreover, FHA, VA, and Conventional loans no longer mandate complete income tax transcripts (4506-T) for W2 employees. However, this exemption doesn’t apply if borrowers are self-employed or over 25% of their income comes from commissions or self-employment. Additionally, individuals with rental income from multiple properties aren’t eligible for W2-only income mortgages.

How Long Do You Need W2-Income To Be Eligible For W2-Only Income Mortgages?

Mortgages that consider W2-only income benefit individuals buying a new home or refinancing their current one when their tax returns reflect losses from unreimbursed employee expenses listed on IRS TAX FORM 2106. These mortgage options offer advantages to borrowers facing self-employment losses detailed on Schedule C of their tax returns, particularly when this loss doesn’t constitute their main income source.

Mortgage Lenders That Do Not Require Tax Returns For W2 Income Wage Earners

Gustan Cho Associates does not require federal income tax returns for W-2 income earners. It does not matter whether or not you filed taxes or declared substantial unreimbursed business expenses. Borrowers who have unreimbursed employee expenses on their income tax returns are workers who need to purchase their work uniforms. Examples of such employees are the following:

- Police Officers

- Fire Fighters

- Mechanics

- Tradesman

- Nurses

- Doctors

- Dentists

- Pharmacists

- Bus drivers

- Truck drivers

- Other workers who need to purchase their uniforms for work

No Tax Returns Required For W2 Income Wage Earners on FHA, VA, Conventional Loans

W2 Income Mortgages don’t necessitate income tax returns. For this loan program, it’s acceptable if borrowers haven’t filed their income taxes. The Internal Revenue Service will only verify the W-2 income transcripts. Borrowers who typically need to buy tools and equipment for their jobs often have unreimbursed employee expenses.

Typical Jobs For W2-Only Income Mortgages On FHA, VA, Conforming Loans

Take police officers, for instance—they must buy firearms, ammunition, and work gear. Similarly, plumbers and electricians must invest in tools and equipment for their jobs. Mechanics also need specific tools and equipment for their work.

Discover how to qualify for W2-only income mortgages with our comprehensive guide. Learn eligibility criteria, required documents, and tips to boost approval chances for W2-only income mortgages.

Additionally, this provision benefits borrowers who generate part-time self-employment income, enabling them to demonstrate losses. Under this updated tax mortgage rule, lenders are solely responsible for verifying and confirming your W-2 information with the IRS.

W2-Only Income Mortgages Loan Options

Here’s how you might be eligible for W2-only income mortgages: HUD, VA, and Fannie Mae permit W2-only income mortgages, while Freddie Mac does not. These mortgages cater to borrowers with significant unreimbursed expenses, enabling them to qualify for a loan.

Specific regulations govern eligibility for W2-only income mortgages. Individuals cannot operate a full-time self-employed business, own 25% or more of a business employed as a W2 earner, or generate rental income.

For comprehensive guidance on W2-only mortgages across FHA, VA, and Conventional loans, Gustan Cho Associates specializes in this area.

Qualifying For W2-Only Income Mortgages With a Lender With No Overlays

Borrowers wanting to know more about our W2-only income mortgages and see if they qualify, please contact Gustan Cho Associates at 800-900-8569 or text for a faster response. Borrowers can also email us at alex@gustancho.com.

The team at Gustan Cho Associates is available evenings, weekends, and holidays seven days a week. We are licensed in 48 states (NY and MA pending) including Washington, DC, Puerto Rico, and the U.S. Virgin Islands.

Gustan Cho Associates is a 5-star national mortgage lender with no mortgage overlays on government and conventional loans. We offer non-QM loans with no waiting period after foreclosure, short sale, or deed-in-lieu of foreclosure. Gustan Cho Associates also offers bank statement mortgage loans for self-employed borrowers.

How Do The W2-Only Income Mortgages With No Tax Returns Work?

Qualified income is a crucial determinant for lenders when assessing borrower eligibility. All income considered as qualified must undergo a verification process. Lenders aim to ensure that borrowers possess the capacity to meet their new mortgage obligations.

Learn how to qualify for W2-only income mortgages in 2025. Find out requirements, guidelines, and how Gustan Cho Associates can help borrowers get approved without tax returns.

The track record of qualified income is significant as it is a reliable indicator of future earnings. Each lender employs its own approach in calculating qualified income. Typically, lenders mandate the submission of two years’ worth of income tax returns, two years of W2 forms, and the most recent 30 days’ paycheck stubs.

We Approve Loans Other Lenders Deny

With no overlays, we follow true agency guidelines.

The Mortgage Process For W2-Only Income Mortgages

At Gustan Cho Associates, we do things differently. We streamline documents and make the mortgage process easier. You do not need to provide two years of income tax returns for all W2 wage earners with a base salary and overtime income.

W2-only income mortgages are a powerful option for wage-earners who want a simple, streamlined path to homeownership. With fewer documents, faster approvals, and flexible program options, these loans make qualifying easier than ever.

The only income document we go by is the W-2 transcript processing. This holds only if you are a W2 salaried employee. If you have a commission or bonus income of less than 25% of your base salaried income, it can only be used, and no income tax returns will be required.

How Do Mortgage Underwriters Process W2-Only Income Mortgages

One crucial element in qualifying for residential mortgage loans is income. Historically, government and conventional loan programs mandated submitting two years’ worth of tax returns. Nevertheless, individuals with W2 income jobs seeking qualification for FHA, VA, USDA, and Conventional loans typically find that income tax returns are not obligatory.

There are many instances where the Automated Underwriting System Approval (AUS) does not require income tax returns from W-2 wage Earners.

Mortgage Lenders with no mortgage overlays only go off Automated Underwriting System Approval (AUS). If the automated findings do not require two years of income tax returns, Gustan Cho Associates will not require them. W2 income wage earners can now qualify for W2-only income mortgages with no tax returns required on FHA, VA, USDA, and Conventional loans. Only two years of W-2s are required.

How Do I Start The W2-Only Income Mortgages With No Tax Returns Loan Process?

The era of no-income and no-documentation loans is over. In the mortgage lending industry, cash income is no longer considered.

At least 2 years of consistent W2 employment (sometimes one year with strong compensating factors). Gaps in employment may require explanations, but short breaks aren’t always disqualifying.

All income must be traced and properly documented. Self-employed mortgage loan applicants or 1099 wage earners must provide two years of tax returns. W2 income wage earners typically need to submit the most recent 30 days of paycheck stubs, and most mortgage lenders prefer to review two years of W2s and tax returns.

Mortgage Loans With No Income Tax Returns

We have just launched a new residential mortgage loan product for W2 wage earners. It is called W2-only income mortgages, where only two years of W2s are required, and the past two years’ tax returns are no longer required. W2-only income mortgages are available on government-backed and conventional loans:

W2-only income mortgages are available for FHA, VA, and Conventional loans. At Gustan Cho Associates, our team specializes in W2-only mortgage approvals nationwide. Whether you’re buying your first home or refinancing, we’ll help you navigate every step.

Not all lenders offer this. Gustan Cho Associates offers W2-only income mortgages for FHA, VA, and Conventional loans. To qualify for W2-Only Income Mortgages With No Tax Returns with FHA, VA, and Conventional Loans, borrowers must be W2 income wage earners. 1099 or self-employed borrowers do not qualify.

Why are 2 2-year tax Returns Required?

While borrowers may be W2 income wage earners, and the Automated Underwriting System doesn’t require two years of income tax returns, numerous lenders still request this documentation. This is primarily attributed to the impact of tax deductions on income taxes. Borrowers with substantial unreimbursed business expenses frequently encounter challenges with debt-to-income ratios because of adjustments to their gross income.

Write-offs on tax returns offset monthly gross income. This gross income reduction often hurts borrowers in debt-to-income ratio calculations.

Due to the income tax deductions, many cannot qualify for FHA, VA, or Conventional loans. Many police officers and firefighters get uniform allowances. Many write off expenses for uniforms, weapons, equipment, and other job-related expenses on their income tax returns. Unfortunately, these write-offs will bite them in the rear end when qualifying for home loans because some of these write-offs can add up to several thousand dollars.

The Impact of Unreimbursed Business Expenses on Qualified Income For a Mortgage

Numerous entrepreneurs, freelancers, real estate investors, and individuals earning income through 1099 wages find advantages in utilizing significant unreimbursed business expenses.

By deducting these expenses from their gross income on tax returns, they effectively minimize their tax liabilities. While unreimbursed business expenses serve as a valuable tool for tax reduction among self-employed individuals, they frequently pose a challenge when seeking mortgage qualification.

Mortgage Loan Options With No Income Tax Returns Required

The deductions are deducted from the total monthly income, frequently surpassing the permissible debt-to-income ratios. Numerous borrowers attempt to modify their tax returns to undo these deductions.

Nonetheless, amending tax returns involves six months before the revised returns can be utilized to meet the criteria for a mortgage.

Thanks to the innovative W2-only income mortgages, no tax returns are necessary, enabling W2 wage earners to qualify for home loans. It’s important to note that W2 income earners with rental properties do not meet the eligibility criteria for W2-only income mortgages.

Can I qualify for a mortgage with just W-2s?

Yes—many programs allow approval without income tax returns.

How Can I Qualify for W2-Only Income Mortgages?

Discover how to qualify for W2-only income mortgages. Get step-by-step eligibility rules, documents to prepare, and simple tips to boost your chances of approval.

Buying your first home should be exciting, not stressful. A W2-only income mortgage might be the simplest path if you earn wages shown on a W-2.

These mortgages are made for people with a steady income, like a salary or an hourly position. This guide covers the basic rules you must meet, the papers you must submit, and smart moves to take before applying.

What Are W2-Only Income Mortgages?

A W2-only income mortgage is a home loan for folks whose pay comes only from W2 forms. You’re a good fit if you get a paycheck with taxes already taken out.

Unlike other loans that count side income from self-employment, rentals, or stocks, these loans stick with one steady paycheck.

Lenders like these loans because W2 pay is steady and easy to prove, letting them offer quicker decisions to borrowers who meet the basic rules.

Why Choose a W2-Only Income Mortgage?

A W2-only income mortgage is perfect for anyone who works a steady job and gets a paycheck every week. Since the bank looks mainly at the salary shown on your W2, the paperwork is usually a lot simpler than it is for folks with income from side gigs, investments, or self-employment. Because W2 income is predictable, lenders often offer better interest rates and favorable loan terms. Salespeople, teachers, nurses, and anyone with a salaried job should consider this loan type.

Eligibility Criteria for W2-Only Income Mortgages

Even the easiest mortgage has a few checkboxes. To get a W2-only income mortgage, here’s what lenders usually want to see.

Stable Employment History

Most lenders ask for at least two years of steady employment with the same company or field. Jumping from job to job or taking several months off can make mortgage officers nervous.

Because of that, showing a clear job pattern is essential. Did you switch jobs six months ago? Be ready to explain how it fits your long-term career plan and share any promotions, extra training, or salary bumps you received. Keeping a steady job is one of the quickest ways to improve your chances of landing that home loan.

Sufficient Income and Debt-to-Income Ratio

Your W-2 income must be enough to pay the mortgage while keeping a reasonable debt-to-income (DTI) ratio. Most mortgage lenders want a DTI ratio of 43% or less. This means all your monthly debt payments, including the mortgage, cannot be more than 43% of your gross income. For example, if you earn $5,000 a month, all your debts must total $2,150 or less.

Good Credit Score

A solid credit score is crucial for mortgages based solely on W-2 income. While each lender has its rules, you’ll usually need a score of at least 620 for conventional loans. However, scores of 700 or above give you a much better shot at lower interest rates and better loan terms. A strong score equals less risk for the lender.

Down Payment Requirements

W-2-only income loans almost always have a down payment requirement. Expect to pay between 3% and 20% of the home price. For a $300,000 home, you could be looking at a down payment between $9,000 and $60,000, depending on the lender and the loan program you choose. If that sounds too steep, look into FHA loans, which may let some borrowers put down even less.

Documentation Needed for W2-Only Income Mortgages

Suppose you’re applying for a W2-only income mortgage. In that case, you’ll need to gather specific documents to help your lender verify your employment and financial situation. Organizing this paperwork early can make your loan application smoother and faster.

W2 Forms and Pay Stubs

Start by collecting your W-2 forms from the last two years. These are your key income documents. Then, the lender will want your most recent pay stubs, usually covering the last 30 to 60 days, to keep your income steady. Double-check that all the figures match to avoid any hiccups later.

Tax Returns

Even for W2-only loans, lenders often ask for your two most recent federal income tax returns. These help confirm that your W2 data is complete and that no hidden income sources exist. Review your returns carefully for any mistakes before you hand them over.

Bank Statements

You’ll also need to provide two to three months of bank statements. Lenders use these to verify your savings and to confirm the funds you’ll use for the down payment. If you’ve made any large deposits, be ready to explain them with additional documents, as these may lead to extra questions.

Identification and Other Documents

Finally, you’ll need a government-issued photo ID, like a driver’s license or passport, to verify your identity. After you’ve selected a property, be ready to show other paperwork, such as a signed purchase agreement or proof of homeowners’ insurance, depending on the lender. Pull all these documents together, and you’ll be set to apply with confidence.

Tips to Boost Your Approval Chances

A little planning goes a long way if you rely only on W-2 income for your mortgage. Here’s how to strengthen your application before you apply.

Improve Your Credit Score

Take a close look at your credit report a few months before applying—correct any mistakes and tackle areas that drag down your score, like missed payments or high credit card balances. Focus on paying down debts, making all payments on time, and holding off on applying for new credit cards or loans.

Reduce Your Debt-to-Income Ratio

One of the best ways to tip the scales in your favor is to lower your DTI ratio. Start by paying off debts that carry high interest, like credit cards and personal loans, so that a larger share of your monthly income is available for future mortgage payments. Resist opening new loans or charging new balances until you close on your home.

Save for a Larger Down Payment

Putting down a larger deposit lowers the risk to lenders and could snag you a lower interest rate. Aim to save 10% to 20% of the home’s asking price. If that target feels out of reach, don’t overlook down payment assistance programs that could help you leap.

Work with an Experienced Lender

Partner with a mortgage lender who specializes in W-2-only income borrowers. An experienced professional will walk you through the right loan options, catch mistakes on your paperwork early, and help you sidestep the typical roadblocks that could delay your approval.

Common Challenges and How to Overcome Them

Mortgage approval can be straight-up when you only have W2 income. Still, some bumps in the road can trip you up. Here’s a quick roadmap to the most likely roadblocks and how to get past them.

Short Job Record

Jobs last less than 24 months? That could make the lender hesitate. The easiest fix is to wait and get past the two-year mark. If you’d rather not wait, talk with your lender about an FHA loan—they often let you slide on job time. You could also ask your boss for a letter saying you’ve got a solid job and plan to stay.

High Debt Load

Is the debt-to-income ratio too high? The lender might stop the process, and nobody wants that. Start by trimming monthly payments now. Throw your next paycheck at a small debt first, or ask your employer about a bonus or raise the lender can count on. If you have older loans, refinancing them could also cut what comes out of your wallet each month.

Low Credit Score

When your score is below the lender’s line, you’ll need to boost it before you even turn in an application. That can be pregnant with rain sites, a counselor, or getting free help from a financial advisor you trust. If debt is the problem, pay off a card or two, and don’t wait to fix any errors on your credit report.

Pinching just the right number can make a score have a bigger positive impact. If you plan carefully, getting a mortgage based only on your W-2 income is within reach.

You can boost the odds of getting approved by keeping your job steady, budgeting wisely, and prepping the right paperwork. Start by checking your credit score, paying down debt, and stashing away a down payment. Working with a skilled lender can make everything smoother, guiding you to the house you’ve always wanted on a W-2-only income mortgage.

Who helps with W-2 income only mortgages?

Gustan Cho Associates specializes in W-2 only programs nationwide.

W2-Only Income Mortgages With No Overlays

Gustan Cho Associates is a national mortgage company with no overlays on government and conventional loans. Gustan Cho Associates offers W2-only income mortgages with no income tax returns required on FHA, VA, USDA, and Conventional loans.

Are you ready to move forward? Contact a trusted lender now to review your choices and start your journey to owning your own home with confidence.

Borrowers who need to qualify for FHA, VA, USDA, or Conventional loans with no income tax returns, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

FAQ – How Can I Qualify For W2-Only Income Mortgages

What are W2-Only Income Mortgages?

- W2-Only income mortgages allow borrowers with W2 income, pending income tax returns, or significant unreimbursed business expenses to qualify for home loans without submitting income tax returns. Gustan Cho Associates offers this mortgage option on FHA, VA, and Conventional loans.

Who is Eligible For W2-Only Income Mortgages?

- W2 wage earners without additional businesses or 1099 income are eligible for W2-only income mortgages.

- The mortgage suits those with W2 income as their sole income source and who have unreimbursed business expenses.

- However, individuals with rental properties, side businesses, or part-time 1099 income do not qualify for this mortgage.

Which Loan Programs Offer W2-Only Income Mortgages With Gustan Cho Associates?

Gustan Cho Associates offers W2-Only Income Mortgages on the following loan programs:

- FHA loans

- VA loans

- Conventional loans (Fannie Mae Only)

Do Borrowers Need To Submit Income Tax Returns For W2-Only Income Mortgages?

- No, borrowers must not submit income tax returns for W2-only income mortgages.

- Gustan Cho Associates only requires two years of W-2s, and income verification is done directly with the Internal Revenue Service (IRS).

How Long Do You Need W2 Income To Qualify For W2-Only Income Mortgages?

- W2-only income mortgages benefit individuals buying a new home or refinancing when their tax returns reflect losses from unreimbursed employee expenses.

- These mortgages benefit those facing self-employment losses, as detailed in IRS Tax Form 2106.

Can W2-Only Income Mortgages Be Obtained Without Providing Two Years of Income Tax Returns?

- Gustan Cho Associates offers W2-only income mortgages without requiring two years of income tax returns.

- Only two years of W-2s are needed, and the Internal Revenue Service will verify W-2 income transcripts.

What Types of Jobs Are Eligible for W2-Only Income Mortgages?

- Jobs such as police officers, firefighters, mechanics, tradespeople, nurses, doctors, dentists, pharmacists, bus drivers, truck drivers, and other workers who must purchase work uniforms are eligible for W2-only income mortgages.

Why Are Two Years of Tax Returns Usually Required for Mortgage Applications?

- While the Automated Underwriting System (AUS) may not require two years of income tax returns for W2 wage earners, many lenders still request them due to the impact of tax deductions on income taxes.

- Write-offs on tax returns can affect debt-to-income ratios, making it challenging for some borrowers to qualify for loans.

Can Self-Employed Individuals or 1099 Income Earners Qualify For W2-Only Income Mortgages?

- No, W2-only income mortgages are specifically designed for W2 income wage earners.

- Self-employed individuals or those with 1099 income do not qualify for this mortgage option.

This blog about How Can I Qualify For W2-Only Income Mortgages was updated on September 12th, 2025.

Why did another lender ask for tax returns?

They likely added overlays—we follow true FHA, VA, and Conventional rules.