How To Fix Bad Credit To Qualify For a Home Mortgage

This guide covers how to fix bad credit to qualify for a mortgage. How to fix bad credit to qualify…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers how to fix bad credit to qualify for a mortgage. How to fix bad credit to qualify…

This guide covers the frequently asked question can I get denied for FHA loan with good credit on home purchase….

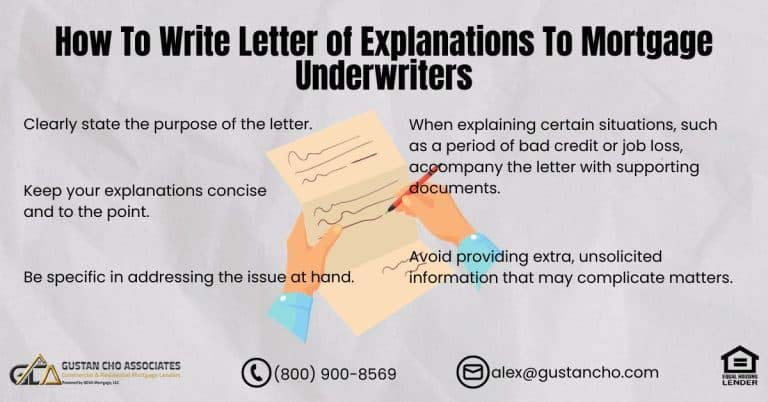

In this blog, we will cover how to write a letter of explanation to mortgage underwriters. Borrowers planning on applying…

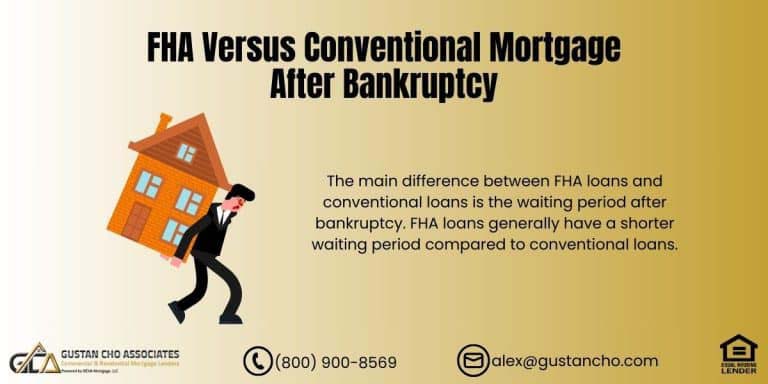

This guide cover FHA versus conventional mortgage after bankruptcy. There are differences in when and how you can qualify for…

This guide covers mortgage rates after bankruptcy on government and conventional loans. There are loan level pricing adjustments (LLPA) charged…

This guide covers mortgage approval with bad credit and late payments. Many consumers have had a period in their lives….

This guide covers the credit scores required for FHA and VA loans. Many borrowers are confused about the credit scores…

In this blog, we will cover and explain home equity. Home values have skyrocketed over the past few years. Many…

This guide covers the benefits of moving to cities with diverse Farmers Markets. We will discuss exploring local flavors: The…

This guide covers a comprehensive guide of the top beaches of Florida. We will discuss the top beaches of Florida…

The homebuying and mortgage process in a seller market with historically high rates and soaring inflation can be challenging. The…

In this article, we will discuss and cover the borrower review of Gustan Cho Associates. Just this past June 2,…

In this guide, we will cover how much house can I afford versus qualify. First-time and seasoned home buyers…

Borrowers with prior outstanding collections, charged-off accounts, and other bad credit can qualify for a mortgage without paying them off. The key to qualifying for a mortgage is not prior bad credit but timely payments.

This guide covers what is the lowest credit score allowed for mortgage approvals. The team at Gustan Cho Associates gets…

In this article, we will discuss why More Homeowners Fleeing Illinois Than Any Other State in the nation. Illinois is…

This article will cover buying a home in Alaska with bad credit. Buying a home in Alaska with bad credit…

In this blog, we will cover choosing the right lender for a mortgage loan approval. Choosing The Right Lender with…

In this blog, we will be comparing the skyrocketing mortgage rates versus housing prices. We will cover the forecast of…

In this article, we will cover and discuss qualifying for FHA loans with under 620 FICO in Utah with outstanding…

In this blog, we will cover and discuss necessary ending giving loan officers strength. Good Morning and Happy Saturday World,…

In this blog, we will discuss and cover qualifying and getting approved on FHA loans with not paying off collections…