This article Is about qualifying for VA loans Illinois bad credit with no overlays and high debt-to-income ratio. VA loans are owner-occupant residential mortgage loans originated by private lenders but guaranteed by the U.S. Department of Veteran Affairs (VA). The Department of Veteran Affairs does not originate nor fund VA loans. VA insures private lenders who follow VA Mortgage Guidelines. In the event the veteran borrower defaults on their VA loans and the lender takes a loss, the Veterans Affairs will partially insure the loss to the lender.

Not everyone qualifies for VA loans. Only members of the United States Armed Services, veterans of the U.S. Military, and eligible surviving spouses of veterans qualify for VA mortgage loans.

VA loans is the best mortgage loan program in this country but is not for everyone ( Veterans and spouses of veterans only). VA offers 100% financing where veteran homebuyers can purchase a one to four-unit primary residence with no money out of pocket. Closing costs can be covered by sellers’ concessions of up to 4.0% or lender credit.

Who Can Qualify For VA Loans Illinois?

Veteran’s eligibility is determined by the length the veteran served and the type of service. In this section, we will cover the VA loans Illinois eligibility requirements. Veterans of the U.S. Military who had two years of active duty continuous service with an honorable discharge. Honorably discharged veterans of the U.S. Armed Services with at least six years of service in the National Guard and/or in the Selected Reserves. Soldiers who had served at least 90 days of active duty service during wartime and has an honorable discharge. Dishonorably discharged veterans of the U.S. Military who served 181 continuous days of active duty service during peacetime as stated below

- July 26, 1947 – June 26,- 1950

- February 1, 1955 – August 4,- 1964

- May 8, 1975 – August 1, 1990

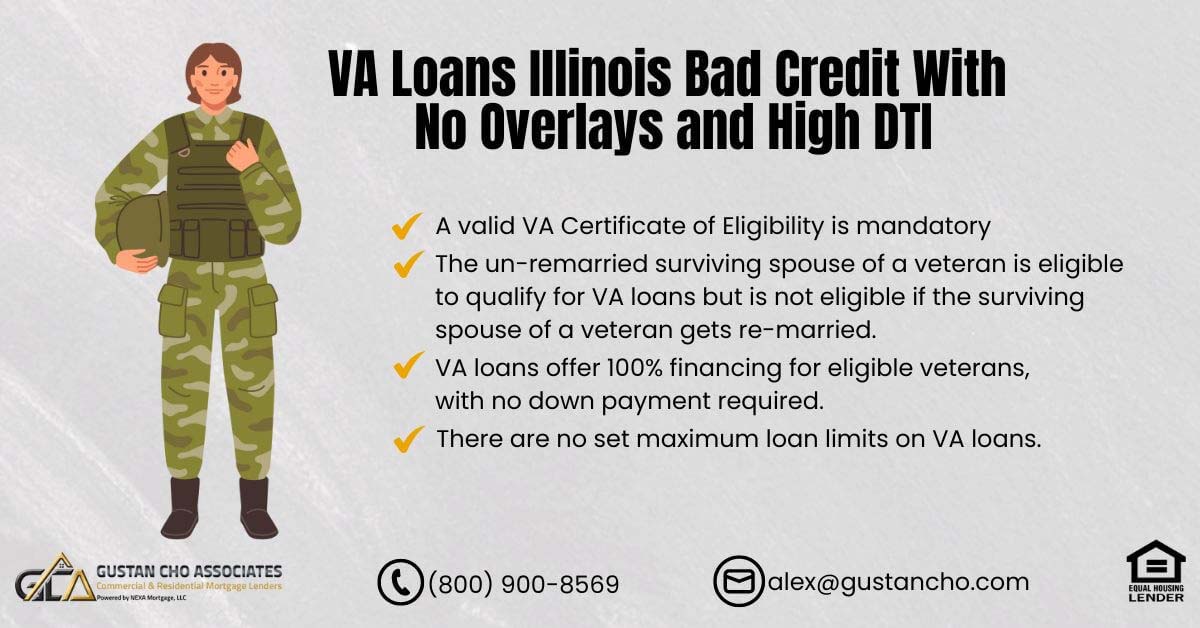

The un-remarried surviving spouse of a veteran is eligible to qualify for VA loans but is not eligible if the surviving spouse of a veteran gets re-married. Eligibility requirements are determined by the U.S. Veterans Administration (VA). The veteran must have died on active duty or as a result of service-connected injuries or illness for surviving spouses of a veteran to be eligible for VA loans.

Speak With Our Loan Officer For Get Free VA Loan Quote

Only Veterans With Certificate Of Eligibility Can Qualify For VA Loans Illinois

A valid VA Certificate of Eligibility is mandatory on VA loans for a home purchase. Certificate of Eligibility is obtained by going to the U.S. Department of Veteran Affairs website http://vip.vba.va.gov or by contacting the Veterans Affairs eligibility offices at

- 1700 Clairmont Road, Decatur, GA 30031

- Phone: 888-768-2132

Most regional loan centers also prepare certificates of eligibility for walk-in veterans. A Certificate of Eligibility (COE) is an important document for individuals seeking VA (Veterans Affairs) home loan eligibility requirements for a VA loan. Here are some key points about the Certificate of Eligibility for VA loans.

Eligibility Requriements on VA Loans Illinois

To qualify for a VA loan, you must meet certain eligibility criteria. These criteria are typically related to your military service. Eligible individuals include

- veterans,

- active-duty service members,

- members of the National Guard and Reserves, and

- Some surviving spouses of veterans.

How to Obtain a COE

You can apply for a Certificate of Eligibility from the Department of Veterans Affairs (VA) or through a VA-approved lender. The easiest and fastest way to obtain your COE is usually through a lender, as they can often request it on your behalf using their online systems.

To apply for a COE, you will need to provide certain documents, such as your DD Form 214 (Certificate of Release or Discharge from Active Duty), proof of current military service (for active-duty members), and other documentation depending on your specific eligibility category.

The VA or your lender will guide you on the required documents. The COE is essential because it verifies your eligibility for a VA loan program. Lenders require the COE as part of the loan application process to ensure you meet the eligibility criteria. It’s a crucial step in securing a VA loan. If you want to know more about mortgage loan, Speak With Our Loan Officer For Get Free VA Loan Quote

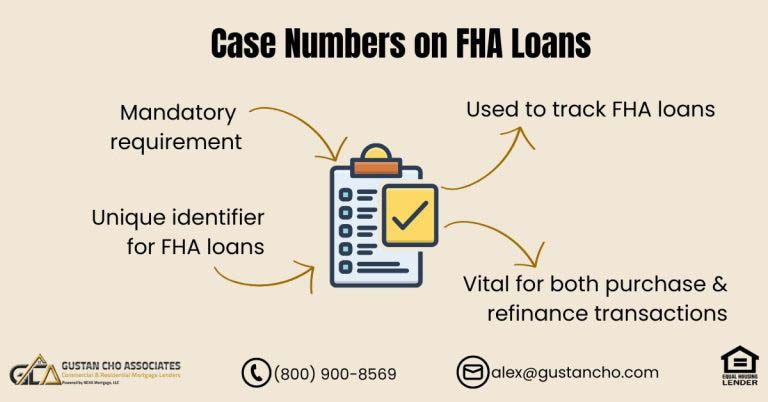

Types of VA Loans

VA loans offer various financing options, including purchase loans, cash-out refinance loans, and interest rate reduction refinance loans (IRL). The COE is typically required for all of these loan types. The VA provides an online application process for obtaining your COE. You can visit the VA’s eBenefits website or contact your lender to help you with the application.

In some cases, lenders can use the Automated Certificate of Eligibility (ACE) system to instantly verify your eligibility, eliminating the need for you to provide certain documents manually.

It’s important to note that the specific requirements and processes for obtaining a Certificate of Eligibility may evolve, so it’s recommended to check the VA’s official website or consult a VA-approved lender for the most up-to-date information and assistance in obtaining your COE for a VA loan.

Down Payment and Closing Costs Requirements on VA Loans

One of the greatest rewards our government rewards our veterans is with VA loans. Veterans who are eligible for VA home purchase loans can borrow 100% financing. Do not have to worry about closing costs and own a home with zero money out of pocket. Closing costs can be covered with the seller’s concessions or lender credit. VA allows sellers to contribute up to 4% in seller’s concessions for veteran home buyers.

Speak With Our Loan Officer for Getting Mortgage Loans

Other Perks With VA Loans

If veteran home buyers are short on closing costs, lenders can give a lender credit and cover the closing costs. VA does not require an annual mortgage insurance premium. VA does require a funding fee but the funding fee can be rolled into the VA mortgage loan balance. No down payment and 100% financing of the purchase price and/or appraised value (whichever is lower). Down payment is only required if the veteran’s available entitlement is less than 25% of the mortgage loan amount. This includes the funding fee or in the event if there is a co-borrower on the mortgage loan who is not a veteran or is the spouse of the veteran borrower.

VA Loan Limits

There is no set maximum loan amount that the Department of Veteran Affairs sets for veteran borrowers in high-cost areas. There is no maximum VA loan limit. Most VA loans limits used to similar to Conventional loans where the maximum loan limit in most counties in the U.S. is $548,250 until the maximum VA loan limit got elimitated. Former President Trump signed into law a bill where the VA exempts VA loan limits. There are no longer maximum loan limits on VA loans. Click here to check VA loan limits on all counties in the United States.

General VA Loans Illinois Requirements

In this section, we will cover the general VA lending requirements. Gustan Cho Associates has no overlays on VA loans. There are no minimum credit score requirements on VA loans on AUS approved and manually underwritten VA loans Illinois. There is no maximum debt-to-income ratio caps on VA loans Illinois as long as the borrower can get an approve/eligible per AUS.

VA loans are for one to four-unit residential owner occupant properties. Veteran homeowners need to either occupy home purchase at the time of closing their VA Loan or occupy the home within 60 days of closing on their VA Loan.

The spouse of the veteran home buyer can occupy the home of the veteran. Will satisfy the occupancy requirement if the spouse occupies the home in the event if the veteran cannot occupy the property due to deployment overseas. Qualify for VA loan , fill up the form and get free quote

Credit Score Requirements on VA Loans Illinois

There are no credit score requirements on VA loans. However, it is preferred that veteran borrowers have at least a 580 FICO. There are no set debt-to-income ratio requirements on VA loans. Debt-to-income ratios are determined by AUS FINDINGS and residual income on VA Loans. Veterans can qualify for VA Loans two years after Chapter 7 Bankruptcy discharge.

Borrowers can qualify for VA Loans one year into Chapter 13 Bankruptcy Repayment Plan. Borrowers can qualify for VA Loans with no waiting period after the Chapter 13 Bankruptcy discharged date.

Veteran borrowers can qualify for VA Loans two years after the recorded date of foreclosure, deed in lieu of foreclosure, short sale. Deferred student loans that are deferred more than 12 months are exempt from debt to income ratio calculations.

VA Funding Fees

There is a one-time funding fee on all VA loans. Funding Fees on VA loans can be rolled into the balance of the loan. The VA Funding Fee is a fee charged to borrowers who take out a VA home loan. It is a one-time fee that helps offset the cost of the VA loan program, which allows veterans and eligible service members to obtain mortgages with favorable terms, such as no down payment requirement and competitive interest rates.

The VA Funding Fee amount can vary depending on the VA loan, the down payment amount (if any), and whether the borrower has used their VA loan benefit.

The VA fee is a percentage of the loan amount and can be rolled into the overall loan balance or paid upfront at closing.

The VA Funding Fee is a way to make the VA loan program self-sustaining, so it does not require taxpayer funding. The specific fee rates can change periodically based on legislation and VA policies, so it’s essential to check with the VA or a VA-approved lender for the most up-to-date information on VA Funding Fees.

Here is the chart on VA Funding Fees

Condominium Purchase With VA Loans Illinois

Veteran home buyers can purchase warrantable condominiums with VA Loans. However, the condominium complex needs to be VA Approved. Here is the link to see whether or not the condominium complex is VA Approved: http://vip.vba.va.gov/portal/VBAH/VBAHome/condopudsearch

How To Start The VA Loans Illinois Mortgage Process

VA loans do not require annual mortgage insurance premiums like FHA loans and Conventional loans with under 20% equity. VA offers extremely low mortgage rates. Lower than FHA and Conventional mortgage interest rates. In this guide, we covered and discussed qualifying for VA loans with bad credit and low credit scores and hope you now understand the basics of VA loans Illinois. Veteran homebuyers can contact us at Gustan Cho Associates at 800-900-8569 to qualify for VA loans with no lender overlays. Or text Gustan on his cell at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.

This BLOG on VA loans Illinois Was UPDATED on January 16th, 2024.