VA Loans with High Debt-to-Income Ratio: A 2024 Guide for Veterans

Are you a Veteran worried about your high debt-to-income ratio holding you back from a VA loan? Here’s the good news: VA loans offer some of the most flexible options, even if your debt-to-income ratio (DTI) is on the high side. In this guide, we’ll break down how VA loans work for borrowers with high DTIs, explain why some lenders have stricter requirements than others, and show you how to boost your chances of getting approved—without compromising on the benefits you’ve earned.

What Is a Debt-to-Income Ratio, and Why Does It Matter?

Your DTI ratio represents the portion of your monthly earnings allocated to paying off debts. Lenders calculate DTI to assess how much you can afford monthly mortgage payments. While many loan programs set strict debt-to-income (DTI) guidelines, it’s encouraging to note that VA loans, which the Department of Veteran Affairs supports, offer greater flexibility.

In fact, the VA doesn’t set a maximum DTI for loans—they focus on residual income, which measures your ability to cover living expenses after your mortgage and debt payments.

If you’ve got a high DTI but a stable income and meet other guidelines, a VA loan may still be within reach. Let’s dive into how you can qualify and what to expect in 2024.

Struggling with a High Debt-to-Income Ratio? You May Still Qualify for a VA Loan!

Contact us today to explore how you can qualify for a VA loan despite a high debt-to-income ratio.

Why Do Some Lenders Have Different DTI Caps on VA Loans?

You might have heard that VA loans are government-backed, so you may wonder why some lenders say you need a 41% DTI or lower while others might accept 50% or more. The answer? Lender overlays.

Lender overlays are additional requirements that some lenders add to the VA’s standard guidelines. While the VA has no DTI cap and doesn’t require a minimum credit score, lenders often set their own rules to manage risk. This means some lenders might turn you down for a high DTI, even if the VA guidelines would technically allow it.

At Gustan Cho Associates, we specialize in VA loans without lender overlays, which means we rely on the VA’s core guidelines. Our team has a national reputation for closing challenging VA loans, including loans for borrowers with high DTIs and credit scores as low as 500.

Qualifying for a VA Loan with a High Debt-to-Income Ratio

If you’re wondering whether you can qualify for a VA loan with a high DTI, here’s the short answer: yes, you can. But there are a few important things to know:

- Focus on Residual Income – The VA’s residual income guidelines are the real key to approval. Residual income is what’s left after paying debts and living expenses, and it’s a top factor for VA loan eligibility. With strong residual income, high DTIs can be approved.

- No Minimum Credit Score Requirement—The Department of Veterans Affairs doesn’t establish a minimum credit score, but specific lenders may have their requirements. At Gustan Cho Associates, we assist Veterans whose credit scores begin at 500.

- Automated Underwriting System (AUS) – Most lenders use an AUS to analyze your application quickly. If your residual income meets VA’s requirements, the AUS will likely approve you, even with a high DTI.

- Manual Underwriting – Lenders can manually review your application if AUS isn’t an option due to credit or other factors. Manual underwriting for VA loans is available and allows high DTI ratios when residual income is sufficient.

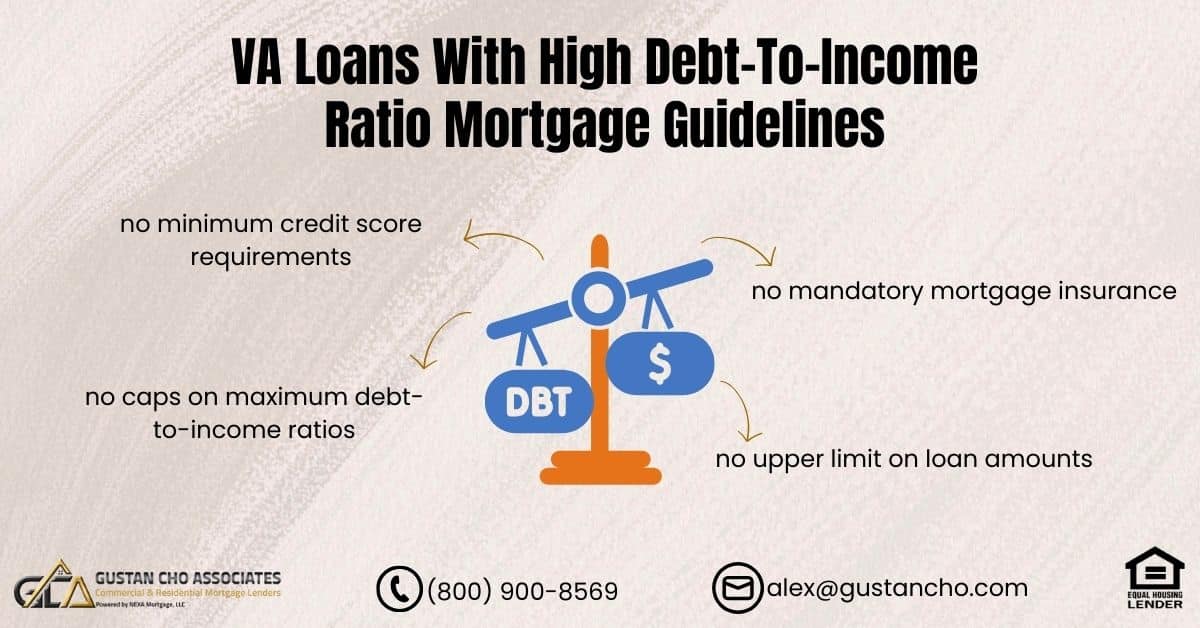

What Are the Benefits of VA Loans for Borrowers with High DTI?

VA loans come with several borrower-friendly features that make homeownership possible, even for Veterans with high debt-to-income ratios:

- No Down Payment Required – Unlike most loans, VA loans let you buy a home with zero down, which can help you avoid dipping into savings.

- No Mortgage Insurance – With VA loans, there’s no monthly mortgage insurance (MI), which means lower monthly payments.

- Flexible DTI and Credit Standards – The VA’s guidelines allow higher DTI ratios than most other loan types.

- Competitive Rates—VA loans frequently have reduced interest rates, which can simplify the management of monthly payments, even when dealing with a high DTI.

Real-Life Success: A VA Loan Approval with a 65% DTI Ratio

Several lenders turned away one of our clients, a U.S. Army Veteran, due to their 65% DTI ratio and a 580 credit score. Despite these challenges, our team reviewed their application using the VA’s residual income guidelines. They were approved for their VA loan with a stable job, good income, and no recent late payments. Today, they’re proud homeowners and didn’t have to compromise on the house or the benefits they earned.

Tips to Boost Your Chances of Approval

To maximize your chances of approval for a VA loan with a high DTI, consider these tips:

- Increase Residual Income – The higher your residual income, the better your chances. If possible, pay off smaller debts or negotiate lower monthly payments to improve your residual income.

- Show a History of On-Time Payments – Timely payments on your debts, especially over the last 12 months, can show lenders that you’re managing your finances responsibly.

- Avoid New Debt – Taking on new debt right before or during the loan application process can raise red flags and lower your DTI score.

- Choose a Lender with No Overlays – Work with a VA lender with no overlays and follow the VA’s core guidelines, like Gustan Cho Associates. This way, your high DTI won’t be an automatic barrier to approval.

Understanding the Role of the Automated Underwriting System (AUS) in VA Loan Approval

The AUS is an automated system most lenders use to streamline the approval process. It considers various factors, including your credit score, income, and residual income, and determines your eligibility based on VA guidelines.

For example, if you have a high DTI but your residual income meets VA standards, the AUS may still issue an “approve/eligible” decision. At Gustan Cho Associates, we run all applications through AUS. If manual underwriting is necessary, we’re equipped to handle that, too.

Worried About Your High DTI and VA Loan Approval? We’ve Got You Covered!

Contact us now to find out how we can help you navigate the approval process and secure your home loan.

VA Loans with High DTI and Collections

VA loans are more forgiving regarding past credit issues, including collections and charge-offs. Unlike conventional loans, which often require paying off collections before approval, VA loans don’t automatically require payment of collections—this is left to the lender’s discretion.

Don’t be discouraged if you’re a Veteran with collections on your credit report and a high DTI. Our team has helped Veterans secure VA loans despite credit challenges, including collections, with our no-overlay approach.

Conclusion: Start Your Path to Homeownership Today

Whether you’re ready to buy a home or want to refinance your current mortgage, a VA loan with a high debt-to-income ratio is possible. At Gustan Cho Associates, we specialize in VA loans with no overlays. We follow VA’s core guidelines and focus on your residual income, credit history, and commitment to on-time payments.

If you’re a Veteran or active-duty service member and want to explore your options, call us at 800-900-8569 or email alex@gustancho.com. Our team is here to make your homeownership journey as smooth as possible, even if you have a high debt-to-income ratio. Remember, your service to our country has earned you the right to access these benefits—don’t let lender overlays stand in your way.

Frequently Asked Questions About VA Loans with High Debt-to-Income Ratio:

Q: What is a Debt-to-Income Ratio, and Why Does it Matter for VA Loans?

A: Your DTI ratio shows what part of your monthly income goes towards paying debts. This ratio helps lenders decide if you can afford a mortgage for VA loans if you have a high DTI.

Q: Can I Get a VA Loan With a High Debt-to-Income Ratio?

A: Yes! VA loans are known for flexibility with high DTIs, especially if you have good residual income, which is the income left over after paying your bills.

Q: Why Do Some Lenders Have Different DTI Limits for VA Loans?

A: Some lenders have “overlays,” which are extra rules beyond VA’s guidelines. These overlays can set stricter DTI limits. Finding a lender like Gustan Cho Associates with no overlays can increase your chances with high DTI.

Q: Do VA Loans Have a Maximum DTI Limit?

A: No, the VA doesn’t set a maximum DTI for VA loans. Lenders often look at your residual income to determine eligibility, even if you have a high debt-to-income ratio.

Q: How Does the Automated Underwriting System (AUS) Affect My VA Loan Application?

A: AUS is a tool lenders use to assess your application. AUS may approve you if you meet the VA’s residual income requirements, even with a high DTI.

Q: Can I Qualify for VA Loans With High Debt-to-Income Ratio if I Have Collections?

A: VA loans are more forgiving with past credit issues, including collections. It depends on the lender, but some won’t require you to pay off collections.

Q: What is Residual Income, and Why is it Important for VA Loans?

A: Residual income is what’s left after you pay bills and debts. For VA loans with high debt-to-income ratio, having a strong residual income can increase your chances of approval.

Q: Do VA Loans Have a Minimum Credit Score Requirement?

A: The VA itself does not set a minimum credit score requirement; however, certain lenders might impose their own criteria. At Gustan Cho Associates, assistance is provided for Veterans, even if their credit scores are as low as 500. Our goal is to empower those who have served by helping them navigate their options effectively.

Q: Why Might a Lender Suggest an FHA Loan Instead of a VA loan if I Have a High DTI?

A: Some lenders have strict overlays for VA loans with high DTI, so they may suggest FHA loans, which often have fewer restrictions. Working with a VA lender that has no overlays can help you stay with a VA loan.

Q: How Can I Up My Chances of Getting a VA Loan if I Have a High Debt-to-Income Ratio?

A: To improve your chances, focus on increasing your residual income, avoid new debt, and keep a history of on-time payments. Also, choose a lender with no overlays, like Gustan Cho Associates, who follow VA’s guidelines directly.

This blog about “VA Loans With High Debt-To-Income Ratio Mortgage Guidelines” was updated on November 13th, 2024.

Looking for a VA Loan but Have a High Debt-to-Income Ratio? Let’s Make It Work!

Contact us today to learn how we can help you get approved for a VA loan with a high debt-to-income ratio.