If you are in the market for a mortgage loan, you know the importance of credit scores for home loans during periods of high inflation and increasing rates. Having low credit scores can be incredibly frustrating. You can wreck them in one night and can take years to rebuild. In this blog, we will detail the importance of credit scores for home loans post-COVID-19 coronavirus outbreak when rates are skyrocketing and inflation is out of control.

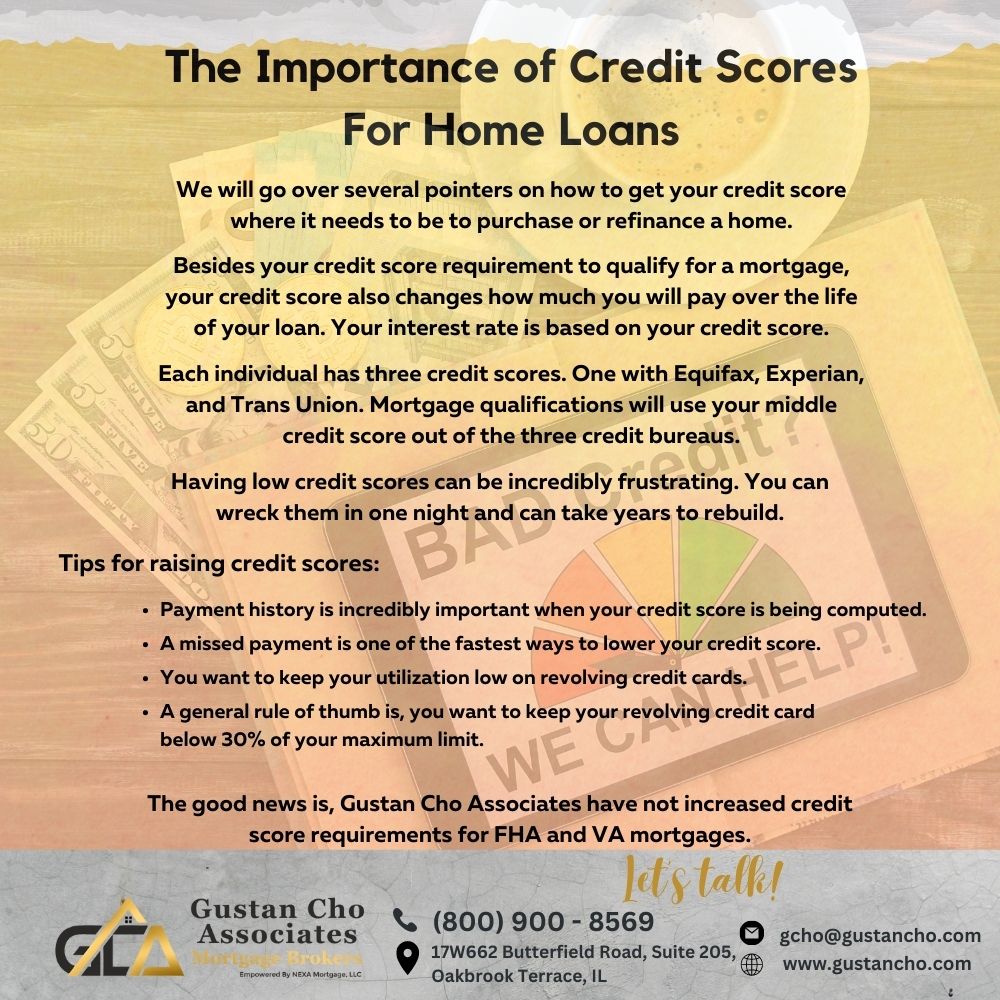

We will also detail the importance of credit scores for home loans in not just getting approved for a mortgage but getting the lowest possible credit scores. We will go over several pointers on how to get your credit score where it needs to be to purchase or refinance a home. In the following paragraphs, we will discuss and cover the importance o for home loans during periods of high inflation, rising home prices, and skyrocketing mortgage rates. In the following paragraphs, we will cover and discuss the importance of credit scores for home loans.

The Importance of Credit Scores For Home Loans During Mortgage Process

Your credit score is as important as ever during the COVID-19 coronavirus outbreak. As you may already know, the majority of mortgage lending institutions have raised their minimum credit score requirements, making it more difficult to obtain a mortgage. Most lending institutions have raised their credit score requirements to 640 and some even to 660.

The good news is, Gustan Cho Associates have not increased credit score requirements for FHA and VA mortgages. We go down to 500 on FHA mortgages with a 10% down payment, 580 with a 3.5% down payment, and no minimum credit score for VA mortgages. Our conventional loan programs have always stayed at a minimum credit score of 620.

The Importance of Credit Scores For Home Loans During Credit Score Change

Besides your credit score requirement to qualify for a mortgage, your credit score also changes how much you will pay over the life of your loan. Your interest rate is based on your credit score. Each individual has three credit scores. One with Equifax, Experian, and Trans Union. Mortgage qualifications will use your middle credit score out of the three credit bureaus.

If for some reason you only have two credit scores, the lower of the two scores will be used. Each credit bureau also has numerous different scoring models. Below are the models used for mortgage scoring.

-

- Trans Union – FICO CLASSIC (04)

- Equifax – FICO CLASSIC V5 FACTA

- Experian – FAIR, ISAAC (VER. 2)

Discount Points For Mortgage Pricing Adjustments

Discount points: In today’s crazy rate environment, discount points are becoming more prevalent for all mortgage products. Discount points can be defined as a prepaid interest that lowers your overall interest burden over the life of the loan. Also referred to as a rate buydown. Discount points can be a great tool to save money over the life of the loan. You want to discuss these options with your loan officer if you have additional funds available at the time of purchase.

How Much Is a Discount Point To Lower Mortgage Rates?

If you are completing your refinance transaction, many times it is to your benefit to utilize the equity in your property to buy down the interest rate. It is important to discuss your short and long-term mortgage goals with your loan officer. Mainly, how long do you plan on staying on the property?

We know that everybody’s life goes through changes and this can be a hard number to predict. If you plan on being in the house for a long time, discount points can help you quite a bit. If this home is a short-term investment, usually paying discount points will cost you money. Make sure to discuss your specific scenario with your loan officer.

How To Boost Your Credit Scores To Qualify For A Mortgage

Tips for raising credit scores: On-time payments go a long way. If you have missed payments in the past, do you want to get a streak going of all on-time payments as soon as possible? Payment history is incredibly important when your credit score is being computed.

Paying your creditors on time shows you fulfill your commitment when borrowing money. A missed payment is one of the fastest ways to lower your credit score.

The Importance of Credit Scores For Home Loans on Credit Utilization on Revolving Accounts

Besides payment history, you want to keep your utilization low on revolving credit cards. A general rule of thumb is, you want to keep your revolving credit card below 30% of your maximum limit. For example, if your credit card has a $1000 limit, you do not want to charge more than $300 to the account. The closer you get to the $1000 limit, the more negative impact it will have on your credit score.

How Long Does It Take To Increase Your Credit Scores For Mortgage?

Keeping all credit cards as low as possible will help boost your credit score. If you pay your credit card down to zero at the end of every month, but shop, you may want to pay close to zero every week. This week, when your loan officer pulls your credit report, the balance will be low.

Each creditor sends information to the credit bureaus on a different date. You do not want your balance to be high on the day of the report, or it could lower your score for the next 30 days.

How To Optimize Your Credit Scores To Qualify For a Mortgage

Many Americans do not have revolving credit cards reporting to the credit bureaus. This actually hurts your credit score. You are missing part of the algorithm for revolving credit card debt used to compute your overall credit score. Assuming you use your credit cards responsibly, it is a great tool to boost your credit.

If you’re having trouble obtaining a credit card, you may want to contact your bank and get a secured credit card. A secured credit card requires an initial investment but does help your credit score quickly. A secured credit card will still help you with the credit scoring algorithm.

The Negative Impacts of Late Payments

In these times of uncertainty, millions of Americans are off work. Being laid off is going to lead to late payments reported to the credit bureaus. I received a letter in the mail from my auto loan company stating they will not report any late payments for the next two months.

Not every American is in a position to stay up to date on their payments. And in two months, who knows where they will be financial. Wrecking your credit score can happen immediately and it will take years to recover. For any credit-related questions or for tips to raise your score, call Mike Gracz at (800) 900-8569.

The COVID-19 coronavirus outbreak is affecting every major industry across the world. Please stay tuned to our YouTube channel for important updates in the mortgage industry. 75% of our clients have been turned down by their current lender and are usually running into a lender overlay. To discuss your mortgage qualifications please reach out today. We are available seven days a week. We hope to hear from you soon.

This blog on the importance of credit scores for home loans was updated on November 6th, 2022.