FHA Continuation Income Requirements on Other Income

This guide covers FHA continuation income requirements on second job and other income. FHA continuation income requirements state borrower’s income…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers FHA continuation income requirements on second job and other income. FHA continuation income requirements state borrower’s income…

This guide covers no tax returns mortgages. We will discuss W2 income mortgages and no-doc mortgage loans for self-employed borrowers….

This Article Is About Home Loan With Declining And Irregular Income Mortgage Guidelines. There are ways on how mortgage underwriters…

This guide explores the updated Freddie Mac part-time income mortgage guidelines for 2024. The new year has introduced significant changes…

In guide covers buying house with new job and gaps in employment. Many homebuyers are concerned about qualifying for a…

More and more people are choosing self-employment or contract work as their source of income. This trend means that mortgage…

This blog will cover and discuss how to calculate income for mortgage with multiple jobs. Homebuyers can qualify for a…

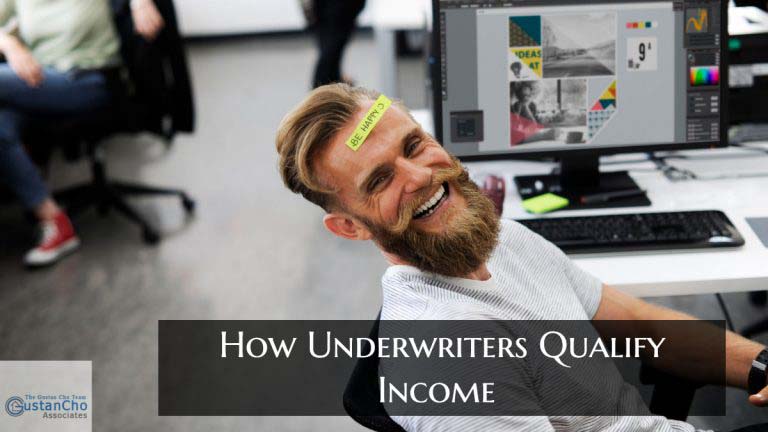

In this blog, we will cover and discuss how mortgage underwriters view the declining and irregular income of borrowers. There…

This guide covers Indiana police hiring fired Chicago cops. This breaking news was updated on March 23rd, 2024. Breaking News:…

This guide coverss temporary unemployment mortgage guidelines on home purchases. The coronavirus pandemic that hit the United States sent millions…

This guide covers how do mortgage underwriters calculate income of borrowers. Income is the most important aspect of qualifying for…

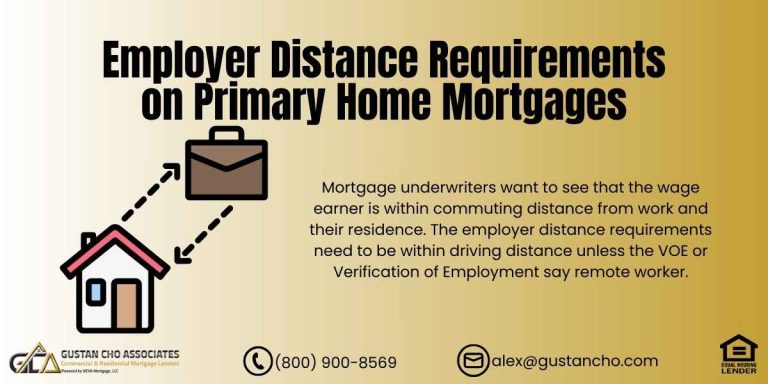

This guide covers remote wage-earner mortgage guidelines on home loans. Remote Wage-Earner Mortgage Guidelines On Home Loans allow borrowers who…

FHA Work History Guidelines: Can You Qualify with Gaps in Employment? If you’ve been dreaming of owning a home but…

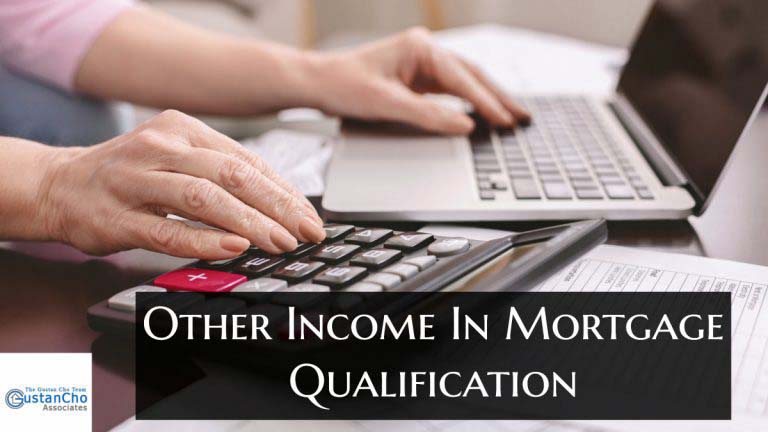

This guide covers continuation of income guidelines of mortgage lenders. The ability to repay is one of the most important…

This guide covers the types of income that mortgage lenders consider qualifying income can use for mortgage loans. Not all…

This guide covers how to buy a house with bad credit. Many folks assume you cannot get a mortgage loan…

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

This guide covers how underwriters qualify income to approve mortgage loans. Many mortgage loan applicants do not have the role…

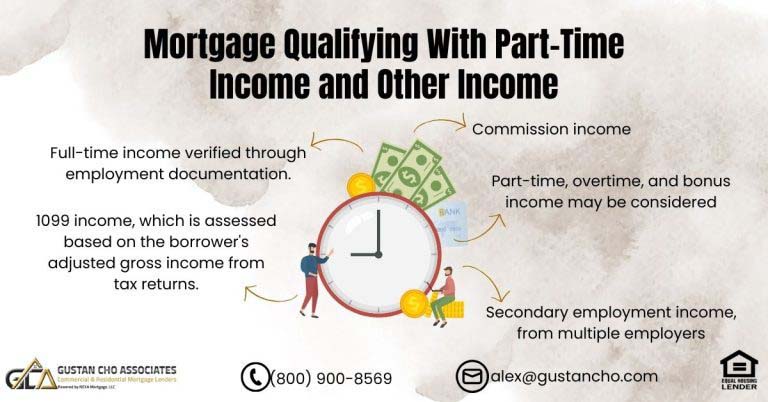

In this blog post, we’ll delve into Mortgage Qualifying With Part-Time Income and Other Income and explore lending guidelines regarding…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…

This guide covers using realtor commission for home purchase down payment. This article delves into using realtor commission for a…

This article delves into the lending prerequisites and regulations concerning mortgage with new job. It addresses the misconception that one…