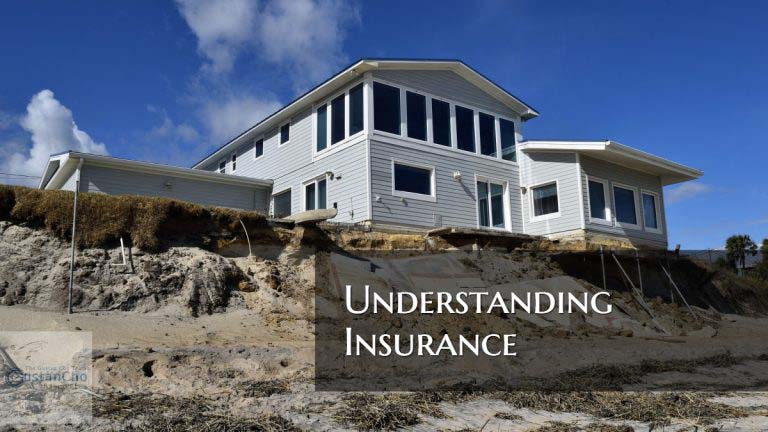

Everything You Need to Know About Understanding Insurance

This guide covers understanding insurance protection for consumers and homeowners. Good morning open enrollment blog for day 1 of the…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers understanding insurance protection for consumers and homeowners. Good morning open enrollment blog for day 1 of the…

This blog covers things to keep in mind when looking at buying an older home. There are many reasons why…

One of the most frequently asked questions is how much income do I need to buy a house in 2025….

This guide covers buying home cash and refinancing afterwards to get a better deal on the home purchase. It is…

Buying a Home in States With Exceptional Campgrounds: Your Guide to Outdoor Living Are you dreaming of a home where…

How Holidays Affect the Mortgage Process: What Every Homebuyer Should Know Buying a home is one of the most significant…

In this blog, we will cover and discuss qualifying and getting a mortgage approval for home purchase on acreage in…

Buying a home with a well and septic system can feel confusing, mainly if you’ve never dealt with private utilities…

The Ultimate Guide to Buying Oceanfront Homes in Puerto Rico (2025 Update) Picture starting your day with waves breaking against…

Buying a House in a Coastal City: The Ultimate Guide to Coastal Living and Homeownership Have you ever dreamed of…

Buying a House in Small-Town America: Your 2025 Guide to Affordable Charm Have you ever felt overwhelmed by the constant…

Buying a House in Salt Lake City Utah: A 2025 Guide Getting a home in Salt Lake City, Utah, can…

This guide covers buying a house near the Great Lakes area. You can enjoy coming from city life to buying…

Buying Home on Acreage Versus Home on Lot: What You Need to Know in 2024 Buying a home is one…

Manatee County Florida: Is It a Good Place to Buy a House in 2024? Are you thinking about buying a…

Buying House in Different State: A 2024 Guide to Relocation Success Are you thinking about buying a house in a…

Your 2024 Guide to Buying and Selling a Home at the Same Time Without the Stress Buying and selling a…

Buying a house is a big deal, and there’s a lot you need to check to make sure you’re making…

Navigating a Seller’s Market When Buying a Home When you are interested in buying a home in a sellers market,…

In this article, we will cover and discuss the final walk-through prior to home closing. A Final Walk-Through Prior To…

This guide covers how to qualify for a mortgage by buying a home in another state. Buying a home in…

This guide covers buying a house near mom-and-pop shops versus big box retail stores. Are you tired of the same…