Qualifying for a mortgage with multiple jobs is possible if you’ve worked each one for at least two years. Lenders will request written verification from employers, probing about the continuity of the part-time work.Borrowers can qualify for a mortgage with multiple part-time and full-time jobs as long as they have been on each job for two years. Lenders will want written employment verification from the employer. The employer will be asked if the part-time is likely to continue for the next three years. In the following paragraphs, we will cover part-time income to full-time income mortgage guidelines.

What Determines Qualified Income Going from Part-Time Income to Full-Time Income

Your income must be consistent. Your part-time and overtime earnings should have been stable for the past two years and should continue for the next three years. Lenders prefer borrowers who have a reliable history of income.When assessing if you can pay a new mortgage, underwriters will focus on your ability to repay. Your income must not fluctuate or decrease to be counted. This also applies to overtime income. You must have earned overtime for the last two years to include overtime as part of your income. Underwriters need to be confident that you will keep earning overtime for the next three years.

Recently Switched to Full-Time? See If Your Income Qualifies for a Mortgage

Apply Online And Get recommendations From Loan ExpertsHow Do Underwriters Determine the Full-Time Income Status of Borrowers?

Borrowers working at least 30 or more hours per week are considered full-time employees. Income can be used as a full-time income. The borrower needs to be classified as a full-time wage earner. You cannot be classified as part-time if you work 40 hours a week and are considered full-time. However, a minimum of 30 hours is needed weekly to be considered full-time income.Lenders will also need written employment verification stating that the employee is a full-time employee and the likelihood of employment continuing for the next three years is very likely.Lenders want to see a continuation of income for the next three years to qualify borrowers. In this article, we will discuss and cover how mortgage borrowers can qualify for a mortgage by going from part-time to full-time and how long they need to be employed full-time. Lenders want to see the borrower’s ability to repay their new housing payments and other bills.

Part-Time Income To Full-Time Income With Two Jobs at Same Time

When applying for a mortgage, it’s important to understand how different job types affect your income eligibility. If a borrower has two part-time jobs, both must have been held for at least 24 months to qualify their income. If one of these jobs is at least 30 hours a week, it can be considered full-time, allowing the borrower to combine this part-time income to full-time income when applying.

For those with two full-time jobs, as long as both positions have been held for two years, the income from both can be counted. In all cases, confirmation of employment is required from Human Resources to verify whether the jobs are part-time or full-time.

When applying for a mortgage, it’s important to understand how different job types affect your income eligibility. If a borrower has two part-time jobs, both must have been held for at least 24 months to qualify their income. If one of these jobs is at least 30 hours a week, it can be considered full-time, allowing the borrower to combine this part-time income to full-time income when applying.

For those with two full-time jobs, as long as both positions have been held for two years, the income from both can be counted. In all cases, confirmation of employment is required from Human Resources to verify whether the jobs are part-time or full-time.

Going From Part-Time Income To Full-Time Income Earner

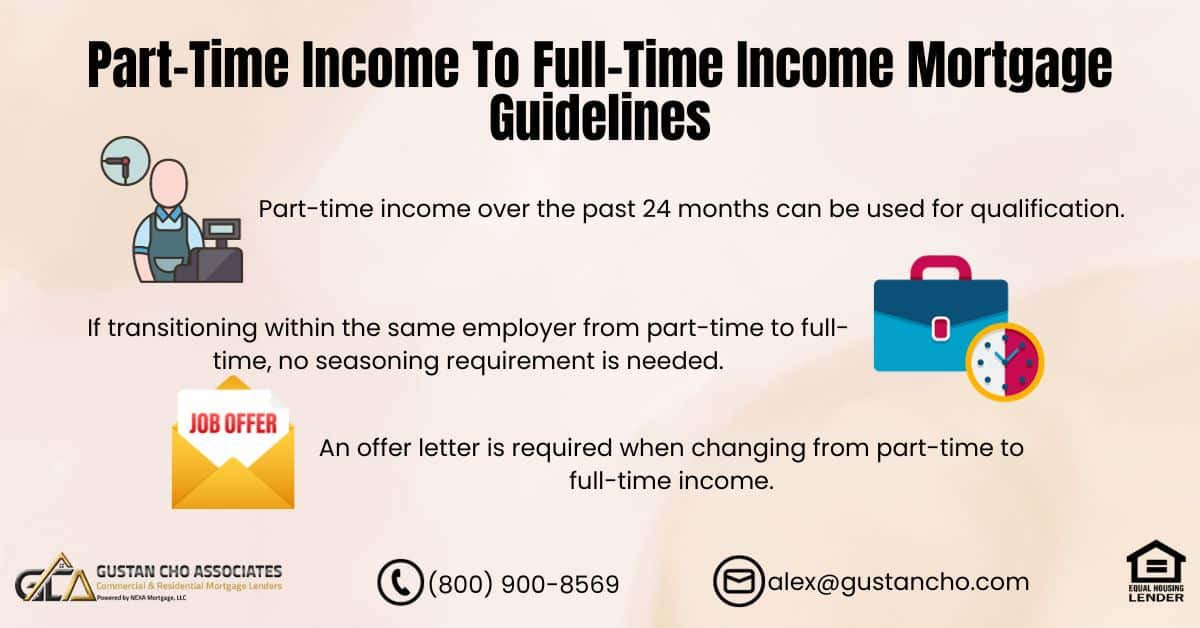

When a borrower transitions from part-time income to full-time income, the requirements vary depending on whether they stay with the same employer or move to a new one.Staying with the Same Employer

If the borrower stays with the same employer and moves to full-time work, they won’t have to wait around for any seasoning requirements for their new job. In this situation, the part-time income won’t be added to the new full-time income, and they’ll need an offer letter to show that their status has changed.Moving to a New Employer

If the borrower gets a full-time job with a new company, they can still qualify for a mortgage as long as they have proof of part-time income for the last 24 months. They’ll also need an offer letter from the new employer to show they’re officially employed full-time.How is Full-Time Employment Determined Going From Part-Time Income To Full-Time Income?

When moving from part-time to full-time work, borrowers may face a complicated income verification process for loans.What is a Verification of Employment (VOE)?

A Verification of Employment (VOE) confirms a borrower’s job status, title, and income. It typically includes:- Employer Information: The employer’s name and contact details.

- Employment Dates: The start date of the job and the end date, if applicable.

- Job Title: The borrower’s current position.

- Income Details: The borrower’s salary, hourly wage, and bonuses.

- Job Type: Whether the job is full-time or part-time.

Going From Full-Time Income To Part-Time Income or 1099

When transitioning from part-time income to full-time income, one crucial step involves obtaining verification from the employer regarding the shift in employment status. This verification confirms the commencement of a new phase where the full-time income takes precedence as the primary source. Unlike scenarios where part-time earnings are blended or averaged into the equation, the focus solely rests on this fresh full-time income, which holds weight in mortgage considerations. On the other hand, juggling both full-time and part-time roles brings its own set of requirements. For both employments to contribute as qualifying income, a steadfast commitment of two years in each role is necessary. Any gaps in employment history must be diligently addressed, demanding a consecutive six-month period of full-time engagement to ensure the inclusion of that specific tenure within the scope of qualifying income. This stipulation emphasizes the significance of consistent and continuous work in both capacities to meet mortgage eligibility standards.The Importance of Employment History to Get Mortgage Approval

Lenders often look at your employment history to assess your ability to repay the loan. If you have a solid work history, even if it includes part-time work, it can enhance your mortgage application. Your DTI ratio compares your monthly debt payments to your monthly income. A higher income from a full-time job can lower your DTI, making you a more attractive borrower. Your credit score plays a significant role in mortgage qualification. Ensure your credit score is in good shape, as a higher score can lead to better mortgage terms and higher chances of approval.Worried About Your Job History? See If You Qualify for a Mortgage

Apply Online And Get recommendations From Loan ExpertsThe Down Payment and Mortgage Types

Down payment and mortgage loan types are the two biggest factors in determining mortgage rates. The amount you can put down as a down payment also matters. A larger down payment can make you a more appealing candidate for a mortgage. Different loan programs have varying requirements. Some may be more lenient with income requirements, while others may have stricter criteria. Mortgage rates on owner-occupant primary homes are lower than investment home loans:It’s important to note that every lender may have slightly different criteria for mortgage approval, so it’s a good idea to shop around and compare offers from multiple lenders.Working with a mortgage broker or loan officer can help you navigate the process and find a mortgage that suits your financial situation. Before applying for a mortgage, it’s advisable to assess your financial situation, create a budget, and consider how the transition from part-time income to full-time income impacts your ability to afford monthly mortgage payments. Consulting with a financial advisor or mortgage professional can also provide valuable insights into your situation. If you have any questions about part-time income to full-time income mortgage guidelines and how does FHA define family member or borrowers who need to qualify for FHA loans with a lender with no overlays on government or conforming loans, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Frequently Asked Questions About Part-Time Income To Full-Time Income Mortgage Guidelines

What are the Guidelines for Using Part-Time Income to Qualify for a Mortgage?

Borrowers can use part-time income to qualify for a mortgage, but they need a two-year consistent part-time income history. Lenders also want assurance that the part-time income will likely continue for the next three years.

Can I Qualify for a Mortgage with Multiple Part-Time and Full-Time Jobs?

Yes, borrowers can qualify for a mortgage with multiple part-time and full-time jobs if they have been on each job for at least two years. Lenders will request written employment verification from each employer to assess the continuity of part-time work.

How does Moving from Part-Time Income to Full-Time Income Affect Mortgage Eligibility?

Moving from part-time income to full-time income can enhance mortgage eligibility by increasing income stability, a crucial factor for lenders. Both part-time and overtime earnings must have remained consistent for the past two years, with an expected continuation for the next three years.

What Factors do Underwriters Consider when Determining Full-Time Income Status?

Borrowers working at least 30 hours per week are considered full-time employees. Underwriters require written employment verification confirming full-time status and the likelihood of continued employment for the next three years.

Can I Use Both Incomes if I have Two Part-Time Jobs?

If a borrower has two part-time jobs, both incomes can be used if they have been employed by each job for at least 24 months. If one job has a minimum work hour of 30 per week, it is considered full-time, and both incomes can be used accordingly.

How does Transitioning from Part-Time Income to Full-Time Employment Impact Mortgage Qualification?

If a borrower has had part-time income for the past 24 months and transitions to full-time employment with the same employer, there is no seasoning requirement. The new full-time income is used for qualification, and an offer letter of employment is required.

What Happens When Going from Full-Time to Part-Time or 1099 Income?

When transitioning from part-time income to full-time income or 1099 income, verification from the employer is necessary. The new full-time income takes precedence; only the income from the new full-time job is considered for mortgage qualification.

How do Gaps in Employment Affect Mortgage Eligibility When Using Both Full-Time and Part-Time Incomes?

For borrowers juggling full-time and part-time roles, a commitment of two years is necessary for both incomes to contribute to qualifying income. Any gaps in employment history must be addressed, requiring a consecutive six-month period of full-time engagement.

How Important is Employment History in Mortgage Approval?

Lenders often consider employment history when assessing the ability to repay a mortgage. A solid work history, even if it includes part-time work, can enhance mortgage applications. A higher income from a full-time job can improve the Debt-to-Income (DTI) ratio, making the borrower more attractive to lenders.

What Factors Determine Mortgage Rates?

The two biggest factors in determining mortgage rates are the down payment amount and the type of mortgage loan. A larger down payment can make a borrower more appealing, and different loan programs have varying requirements. It’s essential to shop around and compare offers from multiple lenders, as criteria may vary.